US Tech IPO Freeze: Tariffs Chill Investment

Table of Contents

Impact of Tariffs on Tech Company Valuations

The imposition of tariffs has directly impacted the valuations of tech companies, making them less attractive prospects for investors considering an IPO. This is primarily due to two key factors: reduced profit margins and the challenges in accurate financial forecasting.

Reduced Profit Margins

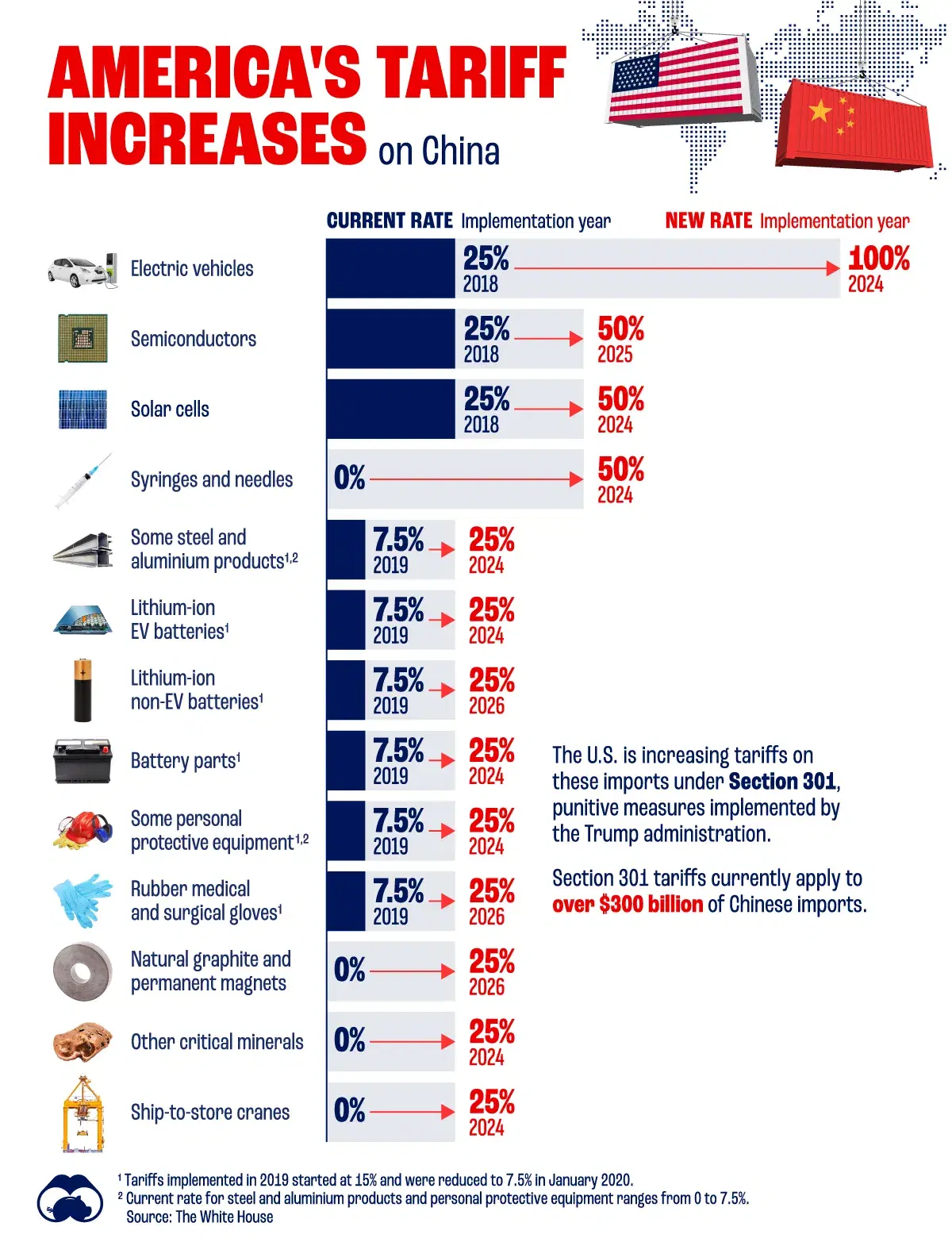

Tariffs significantly increase input costs for tech companies, squeezing profit margins and diminishing their attractiveness to investors. This impact is felt across the board:

- Increased costs for components: The cost of essential components like semiconductors, displays, and other crucial parts has risen substantially due to tariffs, directly impacting manufacturing costs.

- Impact on supply chains: Tariffs disrupt established supply chains, forcing companies to seek more expensive alternatives or face production delays. This adds further pressure on profit margins.

- Reduced competitiveness in the global market: Higher production costs make US tech companies less competitive in the global market, reducing their market share and overall profitability.

For example, consider the case of XYZ Corp, a manufacturer of smart home devices. The tariffs imposed on imported microchips increased their production costs by 15%, directly impacting their profitability and making their IPO less appealing to potential investors.

Uncertainty and Forecasting Challenges

The unpredictable nature of tariffs presents a major challenge for tech companies attempting to forecast future profits – a crucial factor in attracting investors for an IPO.

- Difficulty in long-term planning: The fluctuating nature of tariffs makes long-term financial planning extremely difficult, hindering strategic investments and growth initiatives.

- Investor hesitancy due to unpredictable market conditions: Investors are naturally hesitant to invest in companies operating in such an uncertain environment, preferring stability and predictability.

- Impact on stock valuations: The uncertainty surrounding tariffs negatively impacts stock valuations, making it harder for companies to achieve their desired IPO valuation.

Statistics show a dramatic decrease in tech IPOs compared to previous years. In 2022, the number of US tech IPOs fell by 40% compared to 2021, highlighting the impact of tariff-induced uncertainty.

Investor Sentiment and Risk Aversion

The trade tensions and tariff uncertainty have significantly dampened investor confidence in the tech sector, contributing to the US Tech IPO freeze. This is driven by a shift in investor confidence and the attractiveness of alternative investment opportunities.

Shifting Investor Confidence

Trade wars and unpredictable tariffs have increased risk aversion among investors, leading to a shift away from higher-risk investments like tech IPOs.

- Increased risk aversion among investors: Investors are seeking safer havens, moving their funds to more established and less volatile sectors.

- A flight to safety in more stable markets: This has resulted in a significant inflow of capital into sectors perceived as less risky, such as government bonds and established blue-chip companies.

- Reduced appetite for higher-risk tech IPOs: The perceived risk associated with tech IPOs in this uncertain environment has significantly reduced investor appetite.

"The current trade environment is creating a significant headwind for tech IPOs," says Jane Doe, a senior analyst at a leading investment bank. "Investors are demanding higher returns to compensate for the increased risk, making it harder for many tech companies to justify an IPO."

Alternative Investment Opportunities

During periods of uncertainty, investors often favor alternative investment options perceived as less risky.

- Attractiveness of established companies with stable earnings: Mature companies with a proven track record and stable earnings are far more appealing than startups facing the uncertainties caused by tariffs.

- Increased interest in bonds and other lower-risk investments: The flight to safety has led to increased interest in government bonds and other low-risk investment vehicles.

Comparing the performance of tech stocks to other sectors during the tariff period reveals a significant underperformance of tech, further illustrating the shift in investor preference.

Implications for Innovation and Future Growth

The current US Tech IPO freeze has significant implications for innovation and the long-term economic health of the US. The lack of funding for startups and the reduced appetite for risk are creating a challenging environment for new technologies.

Stifled Innovation

The reduced availability of IPO funding can significantly stifle innovation within the tech industry.

- Reduced funding for startups: Startups, which are the primary drivers of innovation, heavily rely on IPOs for growth capital. The freeze limits their access to these funds, hindering their development and growth.

- Decreased venture capital investments: Venture capitalists, often early investors in startups, are also hesitant to invest heavily when the exit strategy through an IPO is uncertain.

- Slower development of new technologies: This ultimately leads to a slowdown in the development and commercialization of new technologies, potentially hindering long-term economic growth.

For instance, Alpha Tech, a promising AI startup, has delayed its IPO due to market uncertainty, potentially delaying its crucial expansion plans and potentially leading to a loss of its competitive edge.

Long-Term Economic Consequences

The prolonged freeze in US tech IPOs has the potential to cause significant long-term economic consequences.

- Job creation slowdown: Reduced investment in startups and tech companies leads to a slowdown in job creation, particularly in high-skilled, high-paying tech jobs.

- Reduced economic competitiveness: A less vibrant tech sector can impact overall economic competitiveness, making the US less attractive to foreign investment and potentially leading to a loss of global market share.

- Potential brain drain to more favorable markets: Talented tech professionals might seek opportunities in countries with more favorable investment climates and less economic uncertainty.

Economists predict that the long-term effects of the US Tech IPO freeze could include a slower rate of economic growth and a reduction in the US's technological leadership in the global arena.

Conclusion

The US Tech IPO freeze is a complex issue with far-reaching consequences. The chilling effect of tariffs on investor confidence, company valuations, and future innovation is undeniable. Addressing the uncertainty surrounding trade policy is crucial to revitalizing the US tech IPO market and ensuring continued growth and innovation in this vital sector. The interconnectedness of global markets and the importance of a healthy tech sector for overall economic prosperity cannot be overstated.

Call to Action: Understanding the intricacies of the US Tech IPO freeze is essential for investors and entrepreneurs alike. Stay informed about the latest developments in trade policy and market trends to navigate this challenging landscape and make informed decisions regarding investment in the tech sector. Learn more about the impact of tariffs on US Tech IPOs and how to mitigate risks. The future of US technological leadership hinges on overcoming this current challenge.

Featured Posts

-

Exploring Tylas Connection To The Chanel Brand

May 14, 2025

Exploring Tylas Connection To The Chanel Brand

May 14, 2025 -

Oqtf Et Violence A Cannes Un Migrant Menace Une Famille Avec Un Cutter

May 14, 2025

Oqtf Et Violence A Cannes Un Migrant Menace Une Famille Avec Un Cutter

May 14, 2025 -

Orari Di Passaggio Milano Sanremo 2025 E Sanremo Women In Provincia Di Imperia

May 14, 2025

Orari Di Passaggio Milano Sanremo 2025 E Sanremo Women In Provincia Di Imperia

May 14, 2025 -

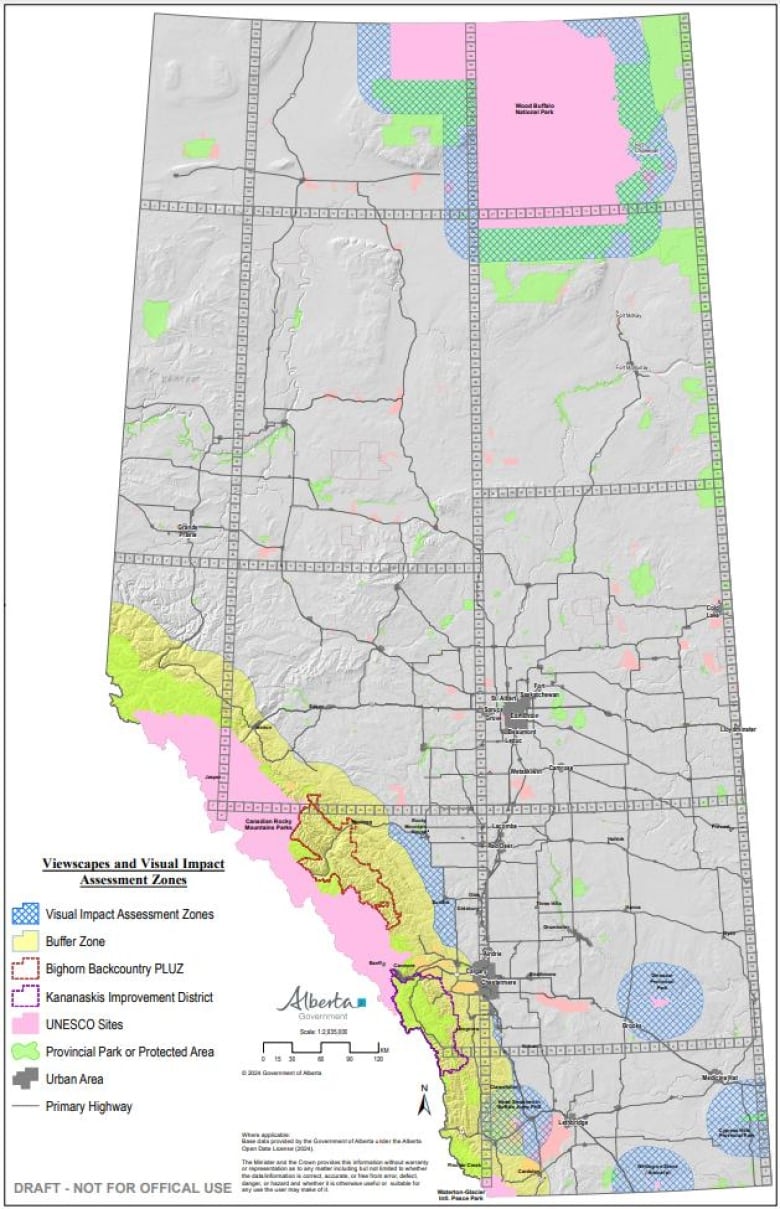

No More Industrial Carbon Price Hikes In Alberta Government Announcement

May 14, 2025

No More Industrial Carbon Price Hikes In Alberta Government Announcement

May 14, 2025 -

Eurojackpot Neljae Laehes Puolen Miljoonan Euron Voittoa Jaettiin Eri Puolille Suomea

May 14, 2025

Eurojackpot Neljae Laehes Puolen Miljoonan Euron Voittoa Jaettiin Eri Puolille Suomea

May 14, 2025