Venture Capital Secondary Market: A Hot Investment Opportunity

Table of Contents

Understanding the Venture Capital Secondary Market

What is a Secondary Transaction?

A venture capital secondary transaction involves the buying and selling of existing venture capital stakes. Unlike primary investments where capital is directly invested into a company, secondary market transactions focus on the transfer of ownership of already-held interests. This typically occurs between Limited Partners (LPs) who want to divest from certain portfolio companies or funds, and buyers looking for exposure to established ventures. These secondary sales can take many forms, including LP divestitures, fund restructurings, and direct secondary market transactions facilitated by specialized platforms.

Why is the Secondary Market Growing?

Several factors are fueling the rapid growth of the venture capital secondary market:

- Increased demand for liquidity from Limited Partners (LPs): Institutional investors and high-net-worth individuals often require liquidity for various reasons, including portfolio rebalancing or meeting unexpected capital needs. The secondary market provides a viable avenue for them to realize their investments in illiquid venture capital assets.

- Growing number of venture capital funds seeking to rebalance their portfolios: Funds may choose to sell certain assets to concentrate investments in their most promising portfolio companies, improving overall portfolio performance and managing risk effectively.

- Rise of specialized secondary market platforms and funds: The emergence of dedicated platforms and funds specializing in secondary transactions has improved market efficiency and transparency, making it easier for both buyers and sellers to participate.

- Investor demand for improved portfolio diversification: The secondary market offers access to diversified portfolios of venture capital assets, mitigating the risk associated with concentrated investments in individual companies or funds.

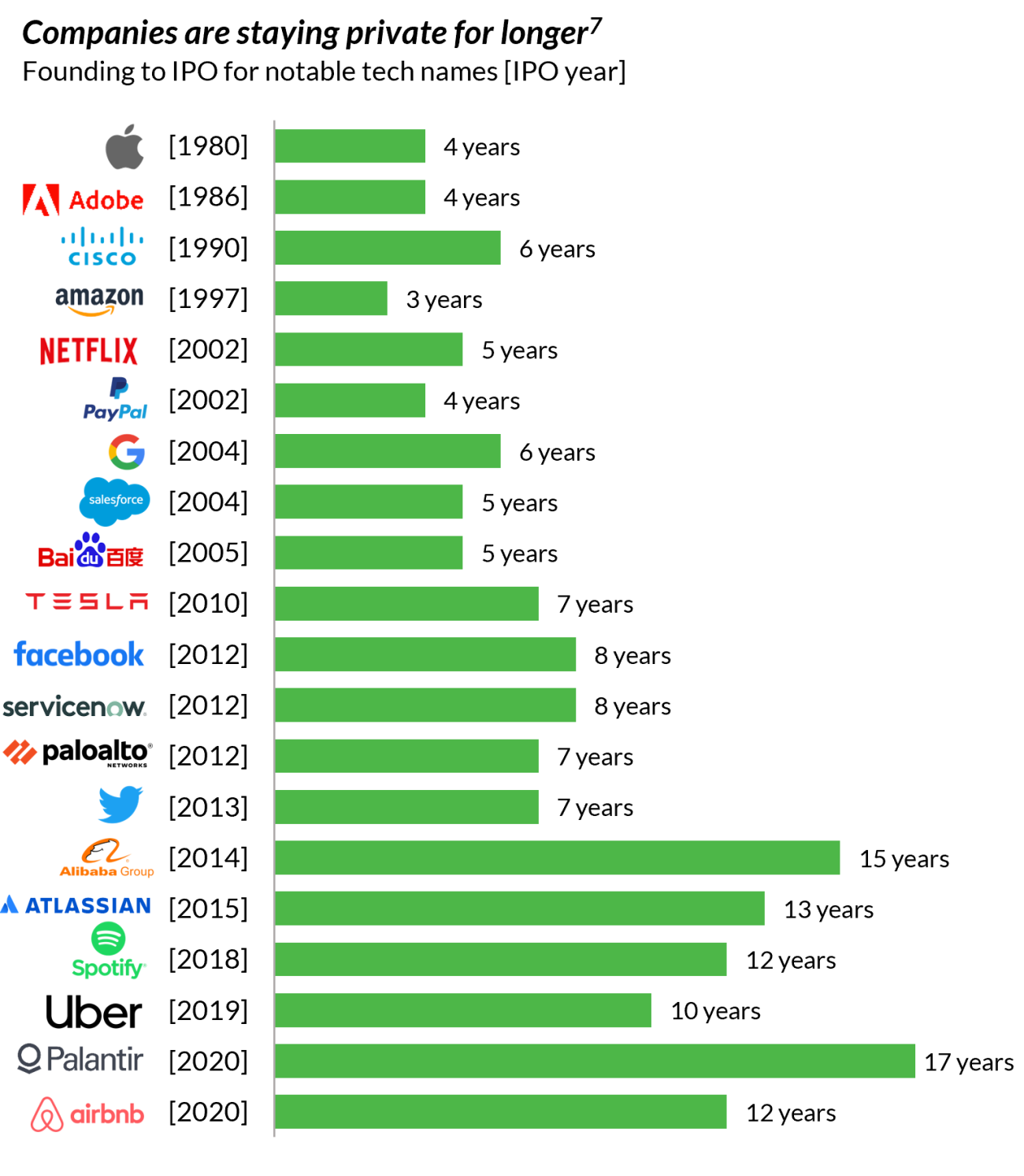

- Desire for earlier exits: The secondary market allows LPs to exit their investments earlier than the typical venture capital fund lifecycle, offering them a quicker return on their capital.

Benefits of Investing in the Venture Capital Secondary Market

Enhanced Liquidity

Investing in the secondary market significantly enhances liquidity compared to traditional venture capital. Investors can access a more liquid market, facilitating faster exits and reducing the typical long-term commitment involved in direct venture capital investments. This liquidity premium can be a significant advantage, allowing for quicker capital deployment and a greater level of control over your investment timeline.

Diversification Opportunities

The venture capital secondary market offers significant diversification benefits. By investing across multiple funds and portfolio companies, investors can effectively reduce their overall portfolio risk. This diversified exposure is crucial for mitigating the inherent volatility associated with venture capital investments, creating a more resilient portfolio.

Access to Top-Tier Assets

The secondary market provides access to high-quality, high-growth companies that may not be accessible through primary investments. Established funds often hold stakes in promising ventures that are not readily available to new investors. Secondary transactions offer an opportunity to acquire stakes in these premium assets, potentially generating substantial returns.

- Reduced holding period risk: Secondary market investments often come with shorter holding periods than direct venture capital investments.

- Potential for higher returns due to discounted valuations: Certain secondary transactions offer discounted valuations compared to primary investments, potentially leading to higher returns.

- Access to a wider range of investment opportunities: The secondary market expands the range of accessible investment opportunities beyond what is typically available in the primary market.

Potential Risks and Challenges of Secondary Investments

Due Diligence and Valuation

Thorough due diligence and accurate valuation are crucial in secondary transactions. Assessing the true value of illiquid assets presents significant challenges, demanding expertise and rigorous analysis to avoid overpaying or misjudging the underlying asset's potential. A robust due diligence process is essential for mitigating these risks.

Market Volatility and Liquidity Concerns

Market fluctuations can significantly impact secondary market transactions. Periods of market uncertainty can affect liquidity, potentially making it harder to sell assets or impacting valuations. Understanding and managing these liquidity risks is critical for successful secondary investing.

Transaction Costs

Secondary transactions involve various costs, including broker commissions, legal fees, and other transaction expenses. These costs should be carefully considered when evaluating the potential returns of a secondary investment.

- Complexity of the transaction process: Secondary transactions can be complex and time-consuming, requiring expertise to navigate the legal and financial aspects.

- Lack of transparency in some parts of the market: While transparency is improving, certain segments of the secondary market still lack complete transparency, making it essential to work with reputable partners.

- Potential for information asymmetry: Differences in information between buyers and sellers can create an uneven playing field, highlighting the need for meticulous due diligence.

Strategies for Successful Secondary Investing

Partnering with Experienced Professionals

Partnering with experienced secondary market investors or advisors is essential for navigating the complexities of this market. Their expertise in due diligence, valuation, and transaction structuring can significantly improve investment outcomes.

Building a Strong Investment Thesis

Developing a well-defined investment strategy and selection criteria is paramount. A clear investment thesis, coupled with a robust due diligence framework, will guide investment decisions and improve the likelihood of success.

Employing Robust Risk Management

Implementing robust risk management strategies is crucial. This includes diversification across investments, ongoing portfolio monitoring, and scenario planning to prepare for various market conditions.

- Focus on specific sectors or investment stages: Concentrating investments within specific sectors or investment stages can enhance expertise and improve investment outcomes.

- Utilize data and analytics to inform investment decisions: Data-driven decision-making is vital for evaluating investments and managing risk effectively.

- Develop a clear exit strategy: Having a predefined exit strategy helps maximize returns and manage potential downside risks.

Conclusion

The venture capital secondary market offers compelling opportunities for investors seeking enhanced liquidity, diversification, and access to top-tier assets. However, navigating this market requires careful due diligence, a robust investment strategy, and an understanding of the inherent risks. By partnering with experienced professionals and employing effective risk management techniques, investors can significantly increase their chances of success in this dynamic and increasingly important investment landscape. Ready to explore the lucrative world of venture capital secondary market investments? Contact us today to learn more!

Featured Posts

-

Car Drives Into Crowd At Vancouver Festival Casualties And Injuries

Apr 29, 2025

Car Drives Into Crowd At Vancouver Festival Casualties And Injuries

Apr 29, 2025 -

Navigating The Chinese Market Lessons From Bmw And Porsches Experiences

Apr 29, 2025

Navigating The Chinese Market Lessons From Bmw And Porsches Experiences

Apr 29, 2025 -

Culture Departments Annual Canoe Awakening Celebration

Apr 29, 2025

Culture Departments Annual Canoe Awakening Celebration

Apr 29, 2025 -

Minnesota Immigrant Workforce Shift Towards Higher Wage Employment

Apr 29, 2025

Minnesota Immigrant Workforce Shift Towards Higher Wage Employment

Apr 29, 2025 -

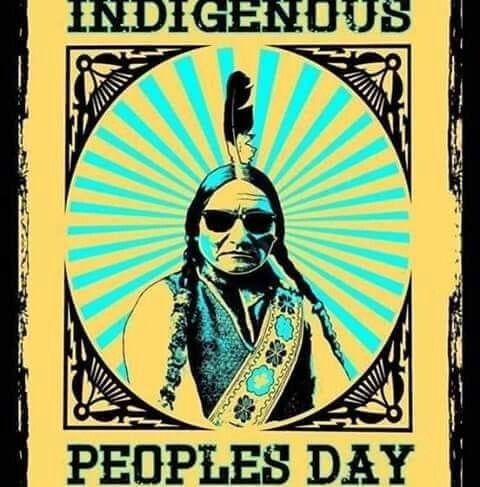

Reliance Shares Post 10 Month High Following Earnings Report

Apr 29, 2025

Reliance Shares Post 10 Month High Following Earnings Report

Apr 29, 2025

Latest Posts

-

Tik Tok And Adhd Is The Algorithm Making Us Question Our Attention Spans

Apr 29, 2025

Tik Tok And Adhd Is The Algorithm Making Us Question Our Attention Spans

Apr 29, 2025 -

Vehicle Safety Research Driving With Adhd

Apr 29, 2025

Vehicle Safety Research Driving With Adhd

Apr 29, 2025 -

Investigating The Relationship Between Brain Iron Adhd And Age Related Cognitive Changes

Apr 29, 2025

Investigating The Relationship Between Brain Iron Adhd And Age Related Cognitive Changes

Apr 29, 2025 -

Feitencheck Heeft Adhd Invloed Op De Levensverwachting Van Volwassenen

Apr 29, 2025

Feitencheck Heeft Adhd Invloed Op De Levensverwachting Van Volwassenen

Apr 29, 2025 -

Skolevansker Hos Barn Med Adhd Medisinens Rolle Og Begrensninger

Apr 29, 2025

Skolevansker Hos Barn Med Adhd Medisinens Rolle Og Begrensninger

Apr 29, 2025