Vodacom (VOD) Announces Better-Than-Expected Payout Following Earnings Improvement

Table of Contents

Vodacom's Improved Earnings: A Detailed Look

Vodacom's strong earnings are a testament to its operational efficiency and strategic initiatives. The recent financial report showcases significant growth across several key performance indicators. Analyzing Vodacom's earnings reveals a compelling story of success.

-

Revenue Growth: Vodacom reported a [Insert Percentage]% increase in revenue compared to the same period last year. This growth can be attributed to a combination of factors, including increased data usage driven by the rising popularity of smartphones and mobile internet access across its operational areas. [Source: Cite the official Vodacom earnings report].

-

Profit Margin Expansion: The company's profit margins also saw a notable increase of [Insert Percentage]%, reflecting improved operational efficiency and effective cost management. [Source: Cite the official Vodacom earnings report]. This is a key indicator of Vodacom's ability to manage expenses while driving revenue growth.

-

Subscriber Growth: Vodacom's subscriber base experienced significant growth, particularly in [mention specific region(s) if applicable]. This expansion showcases the company’s success in attracting new customers and retaining existing ones. [Source: Cite the official Vodacom earnings report].

-

Regional Performance: While overall performance was strong, certain regions showed exceptional growth. For example, [mention a specific region and its performance highlights], while [mention another region and its performance, highlighting any differences]. This regional diversification contributes to the overall resilience of Vodacom's business.

-

Comparison to Previous Periods: Compared to the previous quarter and the same period last year, these results represent a substantial improvement, showcasing a clear upward trend in Vodacom's financial performance.

The Enhanced Dividend Payout: Implications for Investors

The improved earnings have directly translated into an enhanced dividend payout for Vodacom shareholders. This is excellent news for investors looking for reliable income streams.

-

Dividend Amount: Vodacom announced a dividend of [Insert Amount] per share, a [Insert Percentage]% increase compared to the previous payout. [Source: Cite the official Vodacom announcement]. This substantial increase reflects the company's confidence in its future prospects.

-

Dividend Yield: This translates to a dividend yield of approximately [Insert Percentage]%, making it an attractive option for income-seeking investors compared to other investments in the South Africa telecoms sector. [Source: Calculate based on current share price and dividend amount; cite source for share price].

-

Impact on Stock Price: The announcement of the increased dividend payout has had a generally positive impact on Vodacom's stock price, reflecting investor confidence. [Mention any observed stock price changes, cite source].

-

Implications for Investors: For long-term investors, this increased dividend payout reinforces the attractiveness of Vodacom as a stable and reliable investment. For potential investors, Vodacom now presents a compelling proposition with strong earnings and a healthy dividend yield.

Future Outlook and Growth Potential for Vodacom

Vodacom's future prospects look promising, driven by several key factors. The company's strategic vision and expansion plans are crucial elements in this positive outlook.

-

Strategic Growth Plans: Vodacom is actively pursuing growth opportunities through expansion into new markets, technological advancements, and strategic partnerships. Investment in 5G infrastructure and exploration of fintech solutions are expected to drive future growth.

-

Competitive Landscape: While Vodacom faces competition from other telecommunications companies in its operational areas, its strong brand recognition, wide network coverage, and commitment to innovation position it favorably to maintain its market leadership.

-

Potential Risks: Potential risks include regulatory changes, economic downturns, and intense competition. However, Vodacom's diversified business model and strong financial position mitigate these risks to a considerable extent.

-

Continued Growth Potential: Given the current trajectory and ongoing investments, there's significant potential for Vodacom to continue delivering strong earnings growth and increasing dividend payouts in the coming years.

Conclusion

Vodacom's (VOD) better-than-expected earnings and subsequent increased dividend payout signal positive momentum for the company. The improved financial performance, driven by increased data usage, operational efficiency, and successful strategic initiatives, positions Vodacom favorably for future growth. The enhanced dividend is attractive to investors seeking reliable income streams within the South Africa telecoms market.

Call to Action: Stay informed about the latest developments in Vodacom (VOD) and other leading telecommunications companies. Consider adding Vodacom to your investment portfolio to potentially benefit from its future growth and dividend payouts. Learn more about Vodacom's investment opportunities by visiting their investor relations page: [Insert Link to Vodacom Investor Relations Page].

Featured Posts

-

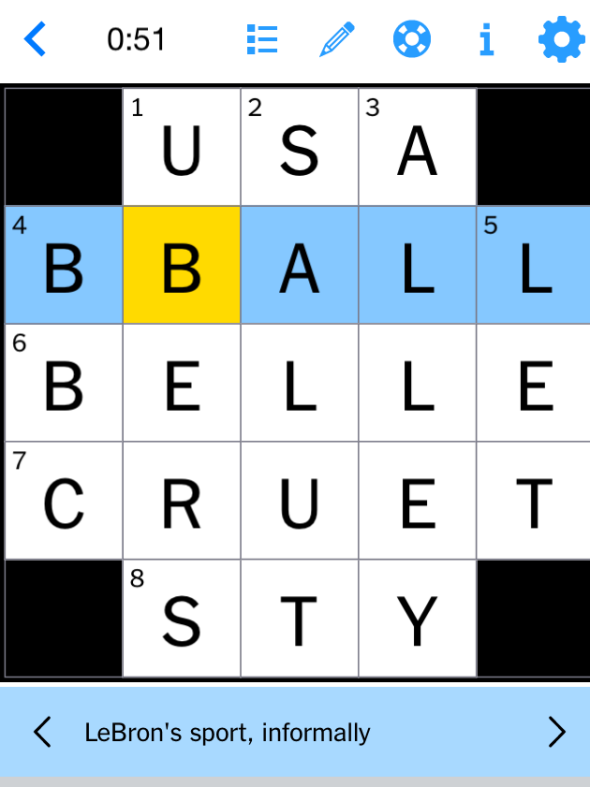

Todays Nyt Mini Crossword April 25 Answers

May 20, 2025

Todays Nyt Mini Crossword April 25 Answers

May 20, 2025 -

Uk Luxury Brands Struggle With Eu Export Growth Post Brexit

May 20, 2025

Uk Luxury Brands Struggle With Eu Export Growth Post Brexit

May 20, 2025 -

Pro D2 Saison 2023 2024 La Lutte Pour Le Maintien Focus Sur Valence Romans Et Agen

May 20, 2025

Pro D2 Saison 2023 2024 La Lutte Pour Le Maintien Focus Sur Valence Romans Et Agen

May 20, 2025 -

Is Amorims Latest Forward Signing A Success For Man Utd

May 20, 2025

Is Amorims Latest Forward Signing A Success For Man Utd

May 20, 2025 -

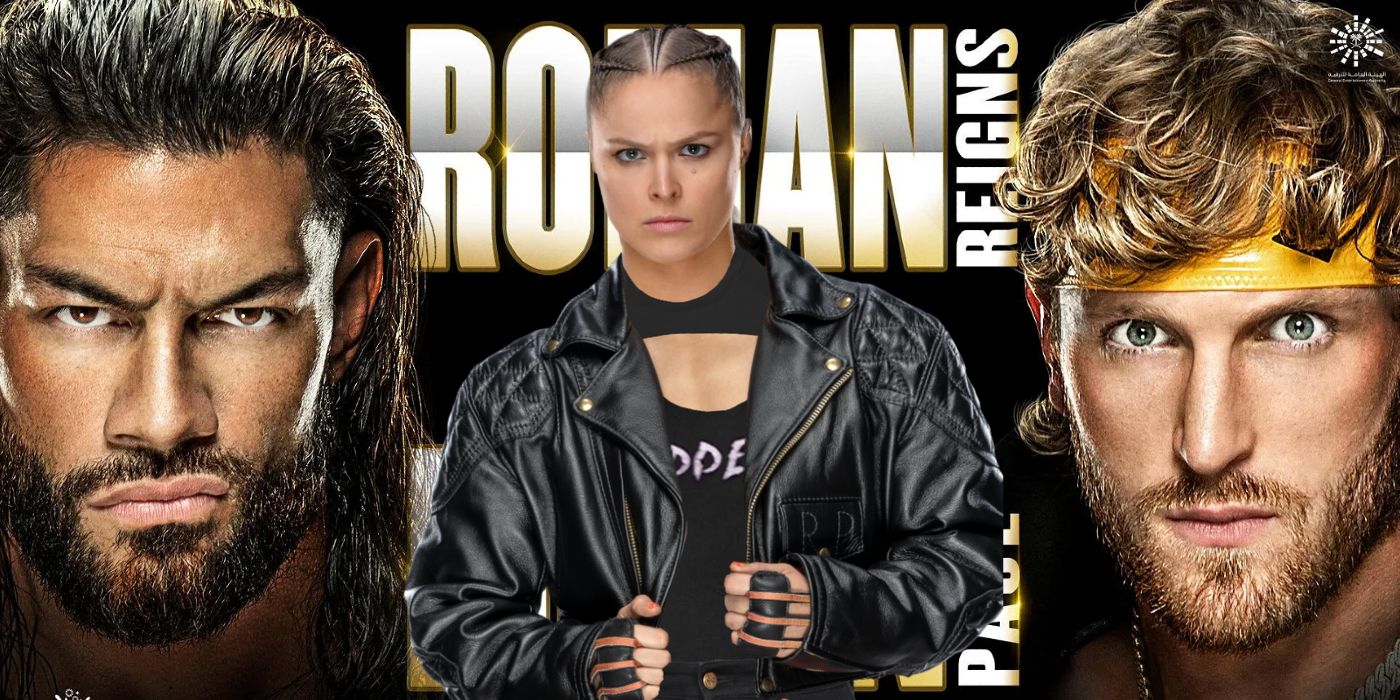

Wwe Rumors Ronda Rousey Logan Paul Jey Uso And Big Es Engagement

May 20, 2025

Wwe Rumors Ronda Rousey Logan Paul Jey Uso And Big Es Engagement

May 20, 2025