Wall Street Predicts 110% Growth: Billionaire Investment In This BlackRock ETF

Table of Contents

The BlackRock ETF: A Deep Dive

This potential investment juggernaut is the iShares Global Clean Energy ETF (ICLN). You can find more information on their official page [link to ICLN official page here].

ETF Name and Ticker Symbol: iShares Global Clean Energy ETF (ICLN)

This ETF offers exposure to a broad range of global companies involved in the clean energy sector.

Investment Strategy and Holdings:

ICLN's investment strategy focuses on companies involved in renewable energy sources and energy efficiency technologies. Its holdings are diversified across various sub-sectors, including:

- Solar Energy: Companies manufacturing solar panels, developing solar farms, and providing solar-related services.

- Wind Energy: Companies involved in wind turbine manufacturing, wind farm development, and wind energy infrastructure.

- Biofuels: Companies producing and distributing biofuels.

- Energy Efficiency: Companies providing energy-efficient technologies and solutions.

Top holdings and their weightings (as of [Insert Date - This needs to be updated regularly]) would need to be inserted here, pulled from a reputable financial source. Example: "NextEra Energy (NEE) (10%), SunPower Corporation (SPWR) (8%), etc."

Past Performance:

While past performance is not indicative of future results, ICLN has demonstrated periods of significant growth aligned with increasing investor interest in renewable energy. (Include a chart showcasing past performance here. Data should be obtained from a reputable financial data provider and appropriately cited). Comparing its performance to the S&P 500 or a broader clean energy index would provide valuable context.

Expense Ratio and Fees:

ICLN’s expense ratio is [insert expense ratio here] which is [compare to industry average - is it high, low, average?]. Transparency in fees is crucial, and this ETF provides that clarity.

Billionaire Investments and Market Sentiment

The involvement of high-profile investors is significantly influencing market sentiment surrounding ICLN.

High-Profile Investors:

While specific names of billionaire investors might be difficult to publicly confirm without dedicated financial research, the overall trend of significant institutional investment in clean energy ETFs is a strong indicator. (Insert links to reputable news articles or financial reports supporting this claim here).

Market Confidence and Predictions:

The positive market sentiment reflects a growing global focus on sustainability and the transition to cleaner energy sources. Analyst predictions, often citing the increasing demand for renewable energy and supportive government policies, support the potential for significant growth in this sector. (Link to relevant analyst reports and financial news articles).

Underlying Market Trends:

Several factors contribute to the bullish outlook:

- Increasing Government Regulations: Many governments worldwide are implementing policies to promote renewable energy and reduce carbon emissions.

- Growing Consumer Demand: Consumers are increasingly choosing eco-friendly products and services.

- Technological Advancements: Continuous innovation in renewable energy technologies is driving down costs and improving efficiency.

Risk Assessment and Potential Downsides

Investing in any ETF carries inherent risks.

Market Volatility:

The clean energy sector, like any other market segment, is subject to market volatility. Price fluctuations are expected, and significant downturns are possible.

Diversification Strategies:

ICLN should be part of a diversified investment portfolio, not the sole focus. Diversification helps mitigate risk.

Alternative Investment Options:

Other clean energy ETFs or investments in individual clean energy companies offer alternative approaches with varying levels of risk and return potential.

How to Invest in This BlackRock ETF

Investing in ICLN is relatively straightforward.

Brokerage Accounts:

Major brokerage firms like Fidelity, Schwab, and Vanguard offer access to ETFs like ICLN. ([Insert links to relevant brokerage account pages]).

Investment Minimums:

Most brokerage accounts have low minimums for ETF purchases, often as low as a single share.

Investment Strategy Recommendations:

Always conduct thorough research, consult a financial advisor if needed, and create an investment plan aligned with your risk tolerance and financial goals.

Conclusion

The predicted 110% growth potential of the iShares Global Clean Energy ETF (ICLN), fueled by significant investment and positive market sentiment, is attracting considerable attention. While the potential for significant returns is enticing, remember that investing in any ETF, including ICLN, involves inherent risks. Explore this BlackRock ETF further, learn more about this potentially lucrative BlackRock ETF, and consider adding this BlackRock ETF to your portfolio only after thorough due diligence and consideration of your risk tolerance. Remember to consult with a qualified financial advisor before making any investment decisions.

Disclaimer: Investing in the stock market involves risk, including the possible loss of principal. This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and seek professional advice before making any investment decisions.

Featured Posts

-

Jatkoon Mestarien Liigassa Bayern Muenchen Inter Ja Psg

May 09, 2025

Jatkoon Mestarien Liigassa Bayern Muenchen Inter Ja Psg

May 09, 2025 -

Netflix Pravi Rimeyk Na Kultov Roman Na Stivn King

May 09, 2025

Netflix Pravi Rimeyk Na Kultov Roman Na Stivn King

May 09, 2025 -

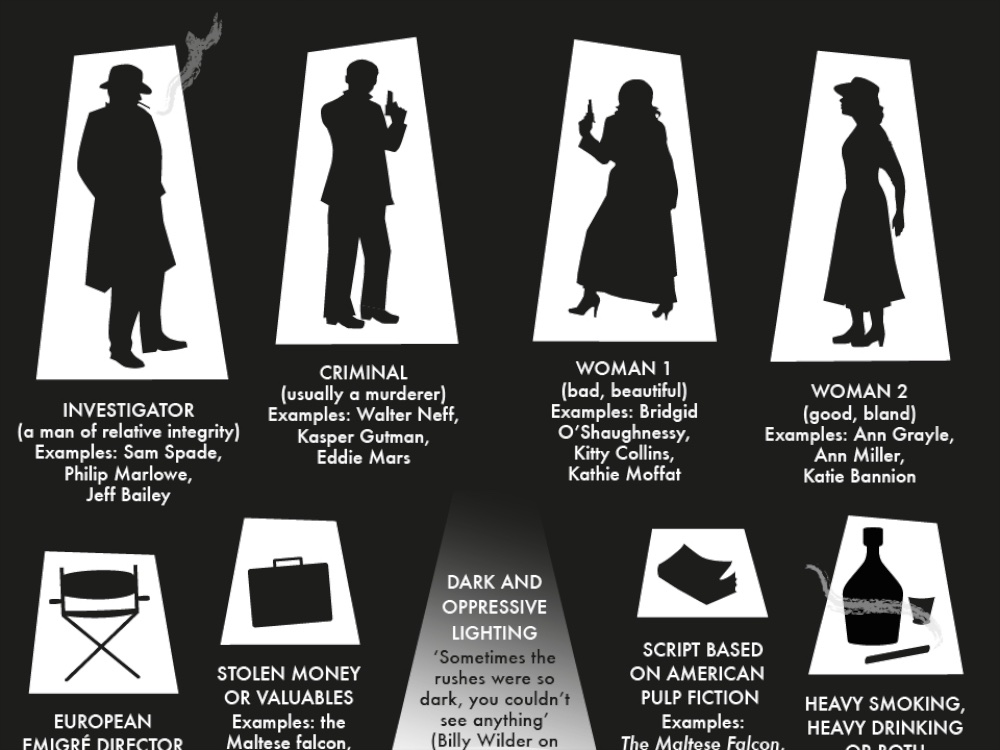

The 10 Best Film Noir Movies From Beginning To End

May 09, 2025

The 10 Best Film Noir Movies From Beginning To End

May 09, 2025 -

Dieu Tra Vu Bao Mau Bao Hanh Tre Em Tien Giang Can Bien Phap Manh Hon

May 09, 2025

Dieu Tra Vu Bao Mau Bao Hanh Tre Em Tien Giang Can Bien Phap Manh Hon

May 09, 2025 -

Melanie Griffith And Dakota Johnson At Materialists Premiere Photos

May 09, 2025

Melanie Griffith And Dakota Johnson At Materialists Premiere Photos

May 09, 2025