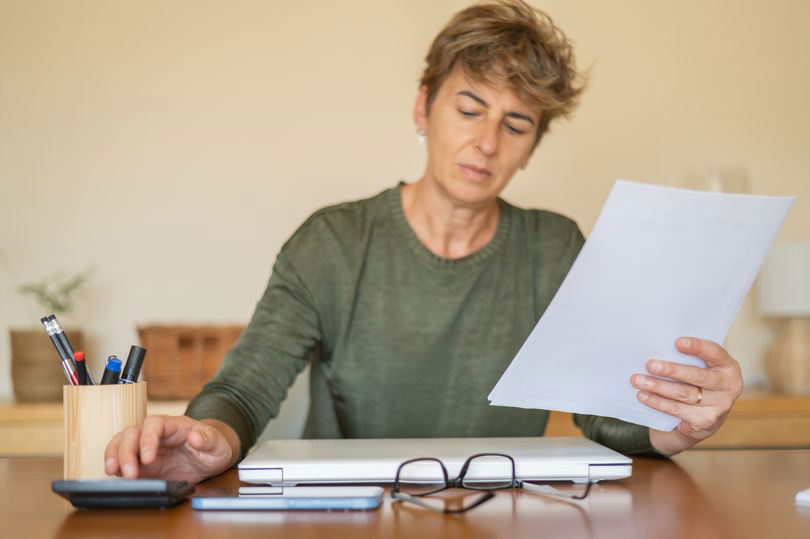

Warning: Universal Credit Overhaul Could Mean Less Money

Table of Contents

Key Changes to Universal Credit and Their Financial Implications

The recent Universal Credit overhaul introduces several key modifications that could significantly impact your monthly income. Understanding these changes is the first step towards protecting your financial wellbeing.

Reduced Work Allowances

One of the most significant alterations is the reduction in work allowances. This is the amount you can earn before your Universal Credit payments start to decrease. This reduction means that low-wage earners will see a more substantial impact on their overall income.

- Examples of specific allowance reductions: The exact amount varies depending on your circumstances (single claimant, couple, number of children, disability status etc.), but reductions can range from £100 to several hundred pounds per month. Specific figures should be checked on the government website.

- Impact on low-wage earners: Low-wage workers may find themselves effectively working longer hours for less overall income. The reduced allowance could push many below the poverty line.

- Regional variations in impact: The impact of reduced work allowances will vary across the UK due to regional differences in the cost of living and average wages. Areas with a high cost of living will feel the pinch more severely.

The changes affect different types of claimants differently. Single claimants will see a certain reduction, while couples and those with disabilities may face more substantial cuts depending on individual circumstances and existing support levels. Accurate figures should be sought from official government resources.

Changes to the Taper Rate

The taper rate, the rate at which your Universal Credit payment is reduced as your earnings increase, has also been adjusted. This increased taper rate means that for every pound earned, a larger portion of your benefit is deducted.

- Illustrative examples demonstrating the impact of the increased taper rate: For example, previously, for every £1 earned, your UC might reduce by 55p. Now, it might be reduced by 63p, leaving less disposable income. Consult official government sources for precise figures for your individual circumstances.

- Comparison to previous rates: The new rate represents a significant increase compared to previous rates, creating a much steeper reduction in benefits as earnings rise.

This increase in the taper rate creates a potential "poverty trap," disincentivizing those on low incomes from increasing their working hours due to the diminished overall financial gain.

Impact on Rent and Housing Costs

The changes to Universal Credit could have a considerable impact on housing costs, particularly in areas with high rental prices. This is especially relevant given the alterations to the system's relationship with housing benefit.

- Examples of rent increases in specific regions: Rent in major cities like London and other urban centres has been rising at a faster rate than wages, exacerbating the issue. Check local housing market data for specific information in your area.

- Potential for increased homelessness: Reduced income combined with rising rent costs could lead to increased housing insecurity and homelessness.

- Implications for different housing types (social housing, private renting): Those in private renting are particularly vulnerable, while even those in social housing may find themselves facing increased financial strain.

Universal Credit's altered relationship with housing benefit means that those relying on this support will experience the full brunt of income reductions directly impacting their ability to maintain stable housing.

Who is Most Affected by the Universal Credit Overhaul?

The Universal Credit changes disproportionately affect certain groups within the population, creating further inequalities within the welfare system.

Vulnerable Groups

Several groups are particularly vulnerable to the financial consequences of these reforms:

-

Families with children: Families with children already face significant financial pressures. The reduction in benefits will intensify these pressures, potentially leading to increased child poverty.

-

Disabled individuals: Disabled individuals often face higher living costs due to the need for assistive technology and additional care. The benefit cuts exacerbate existing financial difficulties.

-

Those with pre-existing health conditions: Individuals with pre-existing health conditions may face additional costs associated with their healthcare and medication. The reduced income significantly impacts their ability to manage these expenses.

-

Support organizations that can help: Numerous charities and organizations provide support to vulnerable groups facing financial hardship. These include [list relevant charities and their websites].

These groups often rely heavily on welfare benefits for basic living costs. The changes to Universal Credit risk pushing many further into poverty and hindering their ability to access essential resources and healthcare.

Geographical Disparities

The impact of the Universal Credit changes also varies significantly across the UK:

- Examples of regions most severely affected: Regions with lower average wages and higher living costs will feel the impact most severely. Again, official government data and local cost of living surveys can help you assess your particular region.

- Factors contributing to regional variations: Factors contributing to these variations include differences in employment opportunities, house prices, and the availability of affordable childcare.

These geographical disparities risk exacerbating existing inequalities between different regions of the UK, with some areas suffering more disproportionately than others.

Steps to Take to Mitigate the Impact of Universal Credit Changes

Despite the challenges, there are steps you can take to mitigate the negative impact of these Universal Credit changes.

Budgeting and Money Management

Effective budgeting is crucial:

- Create a budget: List all your income and expenses to identify areas where you can cut back.

- Track spending: Use budgeting apps or spreadsheets to monitor your spending habits.

- Cut unnecessary expenses: Identify areas where you can reduce spending without significantly impacting your quality of life.

- Explore free resources: Utilize free resources such as online budgeting tools and advice from charities.

Apps like [list budgeting apps] can help you manage your finances more effectively.

Seeking Additional Support

Don't hesitate to seek help:

- List relevant organizations and websites: Contact Citizens Advice, Shelter, or other local support organizations. [Provide links to their websites].

- Explain the type of support offered by each: These organizations offer financial advice, debt management support, and assistance with benefits claims.

- Emphasize the importance of seeking help early: Seeking help early can prevent the situation from escalating.

These organizations offer invaluable support and can help you navigate the complexities of the Universal Credit system.

Understanding Your Rights

Familiarize yourself with your entitlements and the appeal process:

- Outline resources to help understand entitlements: Consult the government website and seek independent advice to understand your full entitlements.

- Explain the appeal process: If you disagree with a decision, you have the right to appeal. Familiarize yourself with the appeals process and seek support if necessary.

[Link to the relevant government website providing information on appeals].

Conclusion

The Universal Credit overhaul poses significant challenges for many claimants, potentially leading to substantial financial reductions. Proactive budgeting, seeking help from relevant support services, and understanding your rights are crucial steps in mitigating the negative impact of these changes. Don't let the Universal Credit changes leave you struggling financially. Take control of your finances, explore available resources, and ensure you understand your rights to protect your income. Learn more about Universal Credit changes and how to protect your income today!

Featured Posts

-

Trumps Warning On Greenland Is The China Threat Real

May 08, 2025

Trumps Warning On Greenland Is The China Threat Real

May 08, 2025 -

Xrp Ripple Investment A Comprehensive Guide To Potential Long Term Returns

May 08, 2025

Xrp Ripple Investment A Comprehensive Guide To Potential Long Term Returns

May 08, 2025 -

Is Jayson Tatum Undervalued Colin Cowherds Criticism And The Publics Response

May 08, 2025

Is Jayson Tatum Undervalued Colin Cowherds Criticism And The Publics Response

May 08, 2025 -

Jayson Tatum Reflects On Larry Bird Honesty And The Weight Of Celtics History

May 08, 2025

Jayson Tatum Reflects On Larry Bird Honesty And The Weight Of Celtics History

May 08, 2025 -

Ella Mai And Jayson Tatums Son Confirmation In New Commercial

May 08, 2025

Ella Mai And Jayson Tatums Son Confirmation In New Commercial

May 08, 2025