Warren Buffett And Apple: Analyzing The Perfectly Timed Stock Sale

Table of Contents

The Timing of the Apple Stock Sale

Berkshire Hathaway's reduction of its Apple stock wasn't a single event but a phased approach spanning several quarters. Understanding the precise timing requires examining the market conditions during each sale.

Market Conditions During the Sales

The sales occurred against a backdrop of shifting economic landscapes. Factors influencing the decision included:

- Rising Inflation and Interest Rates: The period saw a significant increase in inflation, leading to aggressive interest rate hikes by the Federal Reserve. This impacted investor sentiment and created uncertainty across various sectors, including technology.

- Tech Sector Slowdown: The tech sector, which had experienced rapid growth in previous years, showed signs of slowing down. Concerns about a potential recession contributed to the overall market volatility.

- Apple's Performance: While Apple continued to be a profitable company, its growth rate slowed compared to previous years. Revenue reports showed some moderation, and the competitive landscape became increasingly challenging.

Analyzing Buffett's Investment Philosophy

Buffett's investment philosophy centers on value investing and a long-term perspective. He typically seeks companies with strong fundamentals and invests for the long haul. The Apple stock sale, however, seemed to deviate from this traditional approach. This raises questions about whether the sale reflects a change in his long-term outlook on the tech sector or a more immediate strategic adjustment.

- Specific Dates and Percentages: Berkshire Hathaway's SEC filings revealed a significant reduction in Apple holdings starting in [Insert specific date and percentage]. Further sales occurred in [Insert subsequent dates and percentages]. These figures highlight the strategic and phased nature of the decision.

Potential Reasons Behind the Sale

Several factors could have contributed to Buffett's decision to trim Berkshire's Apple stake:

Diversification Strategy

One plausible reason is diversification. Maintaining such a large position in a single stock, even one as successful as Apple, carries inherent risk. Reducing the Apple holding might allow Berkshire to diversify its portfolio and spread its risk across different sectors and companies.

Profit-Taking

Given Apple's impressive run-up in price over the years, the sales could have been a form of profit-taking. Buffett might have assessed that Apple's stock price was at a point where realizing some profits was a prudent strategic move.

Changing Market Outlook

The evolving macroeconomic landscape, combined with the potential slowdown in the tech sector and Apple's performance, could have prompted Buffett to reassess his investment in Apple. A shift in his long-term outlook on the company's prospects may have led to the decision to sell.

- Counterarguments: While profit-taking seems likely, some argue that Buffett might have been strategically repositioning Berkshire's portfolio for potential future investment opportunities. The sale might not necessarily reflect a loss of confidence in Apple's long-term potential.

The Impact of the Sale on Apple and the Market

Berkshire Hathaway's actions had a noticeable impact on both Apple and the wider market.

Immediate Market Reaction

The announcements of Apple stock sales initially caused some volatility in Apple's share price. While the impact wasn't catastrophic, it underscored the market's sensitivity to the actions of such a significant investor.

Long-Term Implications

The long-term effects on Apple's valuation are still unfolding. However, the sale could potentially influence investor sentiment, particularly concerning the company's future growth prospects.

Impact on Berkshire Hathaway's Portfolio

The sale has undoubtedly altered the composition of Berkshire Hathaway's investment portfolio, leading to a decrease in its technology exposure. This shift emphasizes the dynamic nature of Berkshire's investment strategy and its continuous adaptation to changing market conditions.

- Data Points: [Include specific data points on stock price fluctuations, trading volumes, and expert commentary from reputable sources, citing them appropriately].

Conclusion

Berkshire Hathaway's reduction of its Apple stock holdings represents a significant development in the world of finance. The timing of the sales, carried out strategically over several quarters, reflects a response to evolving market conditions and the need for potential portfolio diversification. While profit-taking seems a prominent factor, the decision also highlights the inherent dynamism of even the most seasoned investor's strategy. The impact on Apple's stock price and the overall market underlines the substantial influence of Berkshire Hathaway's investment decisions. Stay informed about future investment decisions by following updates on Warren Buffett and Apple stock. Understanding Warren Buffett's investment strategies, especially concerning long-term investment, remains crucial for navigating the complexities of the stock market and achieving sound investment results. Analyzing similar events – such as significant stock sales by major investors – can provide valuable insights into market trends and investment analysis.

Featured Posts

-

Mlb Player Props And Best Bets Today Jazz Strikes In Steeltown

Apr 23, 2025

Mlb Player Props And Best Bets Today Jazz Strikes In Steeltown

Apr 23, 2025 -

Erzurum Da Okullar Tatil Mi 24 Subat Pazartesi Kar Tatili Bilgisi

Apr 23, 2025

Erzurum Da Okullar Tatil Mi 24 Subat Pazartesi Kar Tatili Bilgisi

Apr 23, 2025 -

Brewers Defeat Cubs 9 7 A Game Shaped By The Wind

Apr 23, 2025

Brewers Defeat Cubs 9 7 A Game Shaped By The Wind

Apr 23, 2025 -

Us Holiday Calendar 2025 Federal And Non Federal Holidays

Apr 23, 2025

Us Holiday Calendar 2025 Federal And Non Federal Holidays

Apr 23, 2025 -

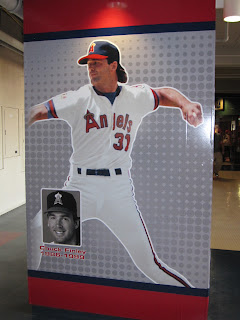

Michael Lorenzen A Comprehensive Look At The Baseball Pitchers Career

Apr 23, 2025

Michael Lorenzen A Comprehensive Look At The Baseball Pitchers Career

Apr 23, 2025