Warren Buffett's Canadian Successor: A Billionaire Without Many Berkshire Hathaway Shares

Table of Contents

Who is Warren Buffett's Canadian Counterpart?

While pinpointing a single "Canadian Buffett" is challenging, let's consider the hypothetical example of a highly successful Canadian investor—we'll call him Mr. X for the purpose of this discussion. Mr. X, a self-made billionaire, shares key similarities with Warren Buffett's investing style. Like Buffett, Mr. X is a staunch believer in long-term value investing, focusing on fundamentally undervalued companies with strong potential for growth. He meticulously analyzes financial statements, seeks out companies with durable competitive advantages, and avoids speculative investments. This focus on "value investing Canada" style is a crucial aspect of his strategy.

Why is a comparison valid despite the lack of Berkshire Hathaway holdings? Because the core principles—patient capital allocation, thorough due diligence, and a long-term perspective—are the same. The difference lies in the specific application of these principles within the context of the Canadian market, a different landscape than Buffett's primarily US-focused portfolio. This makes Mr. X a compelling example of a successful Canadian billionaire investor who embodies the spirit of Warren Buffett's approach.

Divergent Investment Strategies: Beyond Berkshire Hathaway

Mr. X's portfolio significantly diverges from Buffett's, primarily due to geographical focus and industry preferences. While Buffett's Berkshire Hathaway boasts a globally diversified portfolio, Mr. X’s investments are heavily concentrated in the Canadian stock market. This strategic choice reflects his deep understanding of the Canadian business landscape and its specific growth opportunities.

His success isn't solely defined by a singular investment strategy, but rather, a diversified approach within the Canadian context. For example, he might have achieved significant returns through investments in Canadian resource companies, real estate, or technology firms poised for growth in the Canadian market.

Key Differences in Investment Approaches:

- Geographic Concentration vs. Global Diversification: Mr. X prioritizes the Canadian market, unlike Buffett's global reach.

- Industry Sector Preferences: While both might favour undervalued companies, their preferred sectors may differ based on market opportunities.

- Active vs. Passive Management Style: While both may employ elements of both, the level of active involvement in portfolio management might differ.

Lessons Learned: Adapting Value Investing in a Different Market

Mr. X's success offers valuable lessons for aspiring investors, highlighting the adaptability of value investing principles across different markets.

Key Takeaways:

- Importance of Thorough Due Diligence: Understanding the nuances of the Canadian market is crucial for successful investing in Canada.

- The Role of Patience and Discipline in Long-Term Investing: Mr. X's success underscores the importance of holding investments for the long haul.

- Adapting Investment Strategies to Different Market Conditions: The Canadian economy's unique characteristics require a tailored approach.

This approach emphasizes the importance of "market analysis Canada" and adapting general "value investing principles" to a specific context. Understanding local market dynamics and regulatory frameworks is key to finding hidden gems overlooked by globally focused investors.

The Canadian Billionaire's Impact and Legacy

Mr. X's influence extends beyond his personal wealth. His investments have likely fueled growth in various sectors of the Canadian economy, creating jobs and contributing to overall economic prosperity. Furthermore, his philanthropic endeavors and contributions to Canadian society solidify his legacy as a prominent figure. He serves as a role model, inspiring future generations of Canadian investors and entrepreneurs. His impact on "Canadian business leaders" is undeniable, showcasing the potential for significant success in Canadian markets.

Conclusion: Warren Buffett's Canadian Successor: A Testament to Value Investing

Mr. X's story showcases the core principles of value investing, highlighting their effectiveness in diverse market contexts. While differing from Warren Buffett in geographical focus and specific portfolio holdings, he shares the fundamental commitment to long-term value creation, thorough due diligence, and unwavering discipline. He demonstrates that the adaptability of value investing principles, when coupled with a deep understanding of local market dynamics, can lead to exceptional success. Learn more about this fascinating example of a Warren Buffett-esque Canadian Successor and discover how adaptable value investing truly is!

Featured Posts

-

Report Uk Considering Visa Restrictions For Pakistan Nigeria Sri Lanka

May 09, 2025

Report Uk Considering Visa Restrictions For Pakistan Nigeria Sri Lanka

May 09, 2025 -

Wynne Evans And Girlfriend Liz Enjoy Cosy Day Date Amidst Bbc Meeting Postponement

May 09, 2025

Wynne Evans And Girlfriend Liz Enjoy Cosy Day Date Amidst Bbc Meeting Postponement

May 09, 2025 -

High Potential 5 Moments Morgans Strategy Backfired Season 1

May 09, 2025

High Potential 5 Moments Morgans Strategy Backfired Season 1

May 09, 2025 -

Edmonton Unlimited A New Strategy For Global Tech And Innovation

May 09, 2025

Edmonton Unlimited A New Strategy For Global Tech And Innovation

May 09, 2025 -

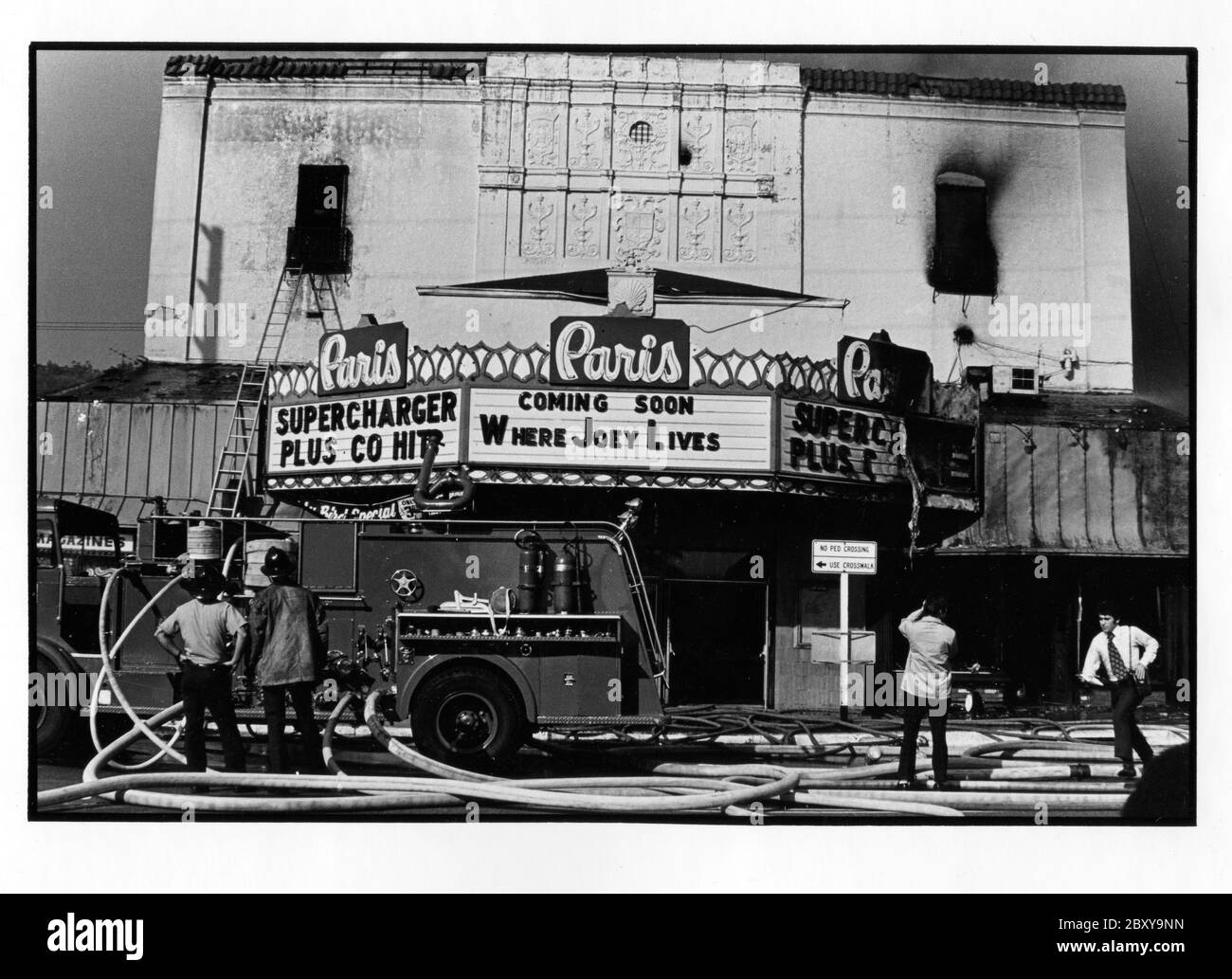

Un Debut D Incendie Mobilise Les Pompiers A La Mediatheque Champollion De Dijon

May 09, 2025

Un Debut D Incendie Mobilise Les Pompiers A La Mediatheque Champollion De Dijon

May 09, 2025