Weak Q1 Results Send Kering Shares Down 6%

Table of Contents

Disappointing Sales Figures Across Key Brands

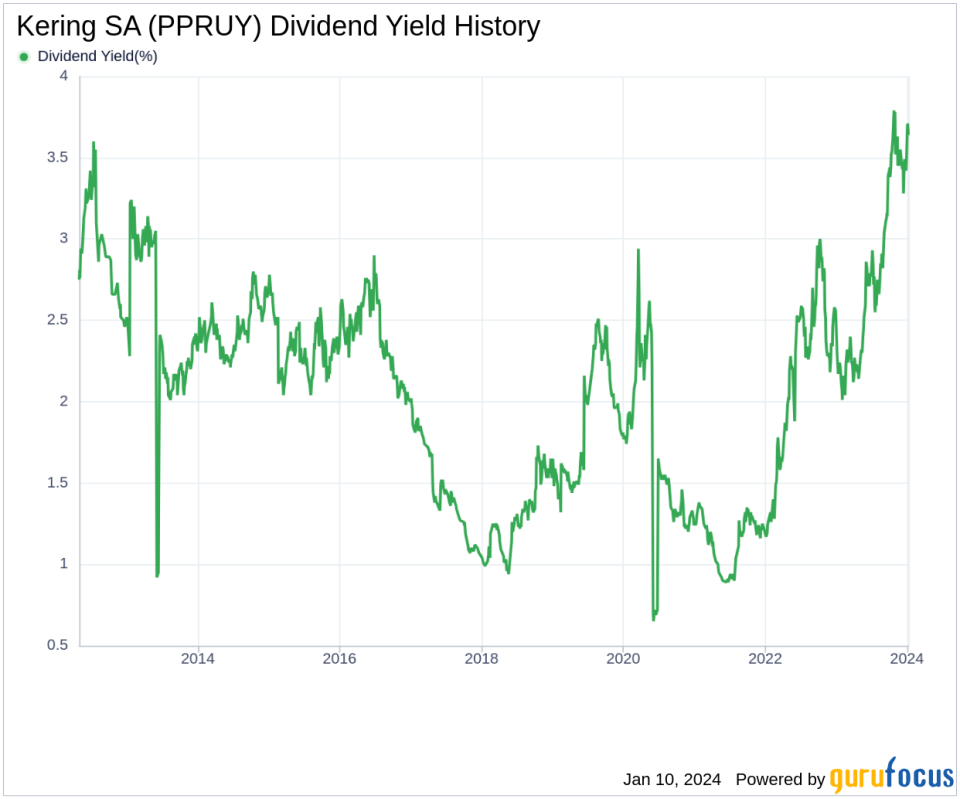

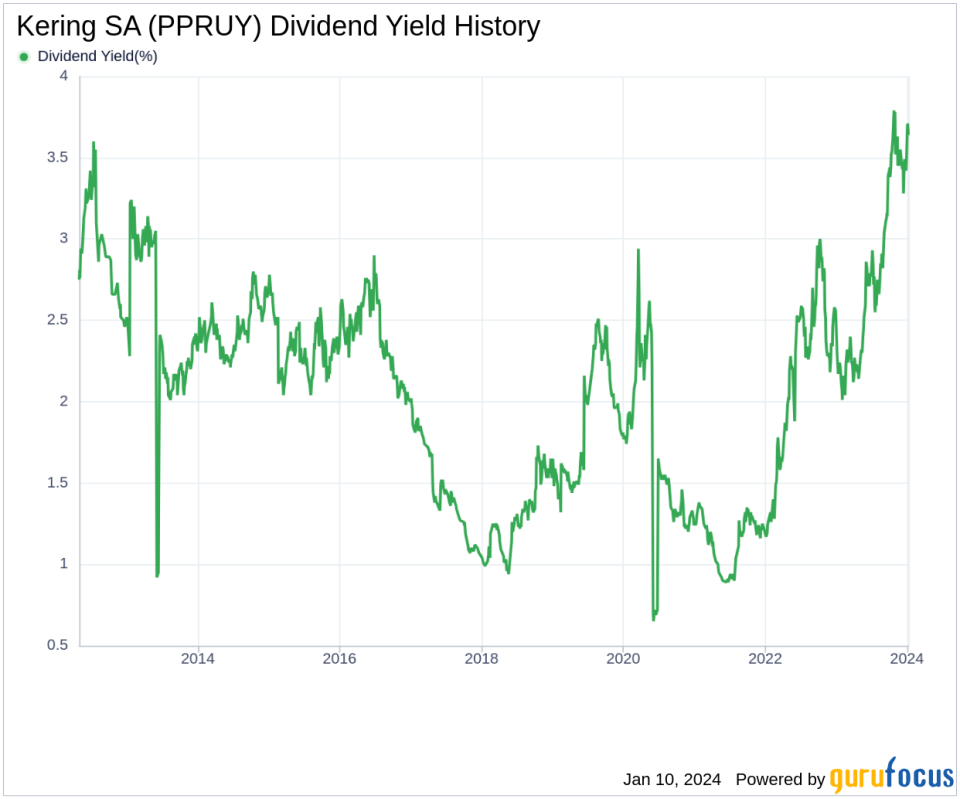

Kering's Q1 2024 results revealed underwhelming sales figures across its key brands, significantly impacting its overall financial performance and causing the sharp decline in its share price. The luxury brand sales figures fell short of analyst expectations, raising questions about the future trajectory of the company.

-

Gucci sales: Kering's flagship brand, Gucci, reported slower-than-expected sales growth. This underperformance can be attributed to several factors, including a softening demand in the crucial Chinese market due to lingering effects of the pandemic and reduced tourist spending in major European capitals. Specific data regarding the percentage decline in Gucci's Q1 sales compared to Q1 2023 is still being analyzed and is expected to be released soon. The brand's dependence on key geographic regions is making it more vulnerable to external economic factors.

-

Saint Laurent performance: Yves Saint Laurent (YSL), another key contributor to Kering's revenue, also underperformed, with revenue growth significantly below analyst predictions. While precise figures are yet to be officially confirmed, early reports suggest a considerable shortfall compared to projected growth rates. This further points towards a broader struggle in the luxury goods sector.

-

Bottega Veneta sales: Other brands within the Kering portfolio, such as Bottega Veneta, also experienced slower-than-anticipated growth. While Bottega Veneta has been undergoing a brand repositioning, the results suggest that this strategy hasn't yet translated into the anticipated sales boost. Further analysis is needed to determine the specific causes of underperformance.

Impact of Macroeconomic Factors on Luxury Consumption

The disappointing Q1 results for Kering are not isolated incidents but rather reflect a broader trend impacting the luxury market. Several macroeconomic factors are contributing to the decreased consumer spending in the high-end sector.

-

Economic slowdown: A global economic slowdown, characterized by high inflation and interest rates, is directly impacting consumer spending. Consumers are becoming more cautious about discretionary spending, leading to reduced demand for luxury goods.

-

Geopolitical uncertainty: Geopolitical instability, including the ongoing war in Ukraine and rising tensions in other parts of the world, also plays a role in creating uncertainty among consumers, further impacting their willingness to spend on luxury items.

-

Changes in tourist spending: Significant shifts in tourist spending patterns, particularly in key luxury markets like Europe and Asia, have had a substantial impact on sales. Reduced travel and tourism due to both economic uncertainty and lingering pandemic effects contribute significantly to this decline.

Kering's Strategic Response and Future Outlook

In response to the weak Q1 results, Kering is expected to implement several strategic adjustments to revitalize its brand portfolio and regain investor confidence. The company's ability to adapt to the current macroeconomic climate will be crucial in determining its future performance and market share.

-

Cost-cutting measures: Kering is likely to explore cost-cutting measures across different departments to improve profitability and efficiency. This might include streamlining operations, optimizing supply chains, and potentially re-evaluating marketing budgets.

-

Brand repositioning initiatives: Specific brands may undergo further repositioning initiatives to appeal to a broader customer base or target emerging markets. These initiatives could involve innovative marketing campaigns, new product launches, and a renewed focus on sustainable practices.

-

Luxury market recovery: The outlook for the luxury market remains uncertain. Kering's ability to navigate these challenges and capitalize on potential recovery will significantly shape its future performance. The success of its strategic response and the recovery of overall consumer confidence will be key factors in determining the company's long-term outlook. Analyst forecasts vary, with some predicting a market recovery in the later half of 2024, while others remain more cautious.

Conclusion

Kering's disappointing Q1 results, marked by a 6% share price drop, highlight the significant challenges facing the luxury goods sector amidst a challenging macroeconomic environment. Weak performances across key brands like Gucci and Saint Laurent underscore the urgent need for strategic adjustments. The impact of factors like rising inflation, economic uncertainty, and shifting tourism patterns cannot be overstated.

Call to Action: Stay informed on the evolving situation surrounding Kering's performance and the wider luxury goods market. Monitor future announcements regarding Kering's Q2 results and strategic initiatives to understand the long-term implications of these weak Q1 results for investors. Follow our updates for further analysis on Kering's financial performance and the luxury market's trajectory. Understanding the intricacies of Kering’s Q1 results and the potential recovery is crucial for all investors tracking the luxury goods market.

Featured Posts

-

Jenson Fw 22 Extended Everything You Need To Know

May 25, 2025

Jenson Fw 22 Extended Everything You Need To Know

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf How Nav Impacts Your Investment

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf How Nav Impacts Your Investment

May 25, 2025 -

Escape To The Country Balancing Rural Life And Modern Amenities

May 25, 2025

Escape To The Country Balancing Rural Life And Modern Amenities

May 25, 2025 -

Reliving The Glory Jenson Button And His 2009 Brawn Gp Car

May 25, 2025

Reliving The Glory Jenson Button And His 2009 Brawn Gp Car

May 25, 2025 -

Najvise Milionera Penzionera Zivi U Ovom Gradu

May 25, 2025

Najvise Milionera Penzionera Zivi U Ovom Gradu

May 25, 2025