Wealth Transfer And Succession Planning: Challenges Faced By The Super Rich

Table of Contents

Navigating Complex Tax Implications of Wealth Transfer

High net worth individuals face a unique set of tax challenges when it comes to transferring their wealth. Minimizing tax liabilities and ensuring a smooth transition requires careful planning and expert advice.

International Estate Tax Laws and Treaties

The super-rich often hold assets globally, creating a complex web of international tax laws and treaties. Understanding and navigating these complexities is critical for minimizing tax liabilities during wealth transfer. Failing to do so can result in significant financial losses.

- Double taxation treaties need careful consideration to avoid paying taxes twice on the same assets.

- The use of trusts and offshore structures requires specialized legal expertise to ensure compliance and optimize tax efficiency. Careful consideration must be given to the specific regulations of each jurisdiction involved.

- Changes in tax laws necessitate proactive planning and adaptation. Regular review and updates to your wealth transfer strategy are essential to stay ahead of evolving legislation.

Minimizing Estate Taxes and Inheritance Taxes

High net worth individuals face substantial estate and inheritance taxes. Strategic planning is essential to mitigate these costs and preserve the family's wealth for future generations. Effective strategies can significantly reduce the tax burden.

- Charitable giving can be a tax-efficient wealth transfer strategy, providing both philanthropic benefits and tax deductions.

- Utilizing life insurance policies for estate tax planning can provide a tax-advantaged way to transfer wealth and cover estate tax liabilities.

- Establishing family limited partnerships (FLPs) or limited liability companies (LLCs) can help reduce estate taxes by transferring ownership to the next generation while maintaining control over assets.

Addressing Family Dynamics and Internal Conflicts During Succession Planning

Family disputes are a common challenge in wealth transfer. Open communication and proactive planning are crucial to minimize conflict and ensure a fair distribution of assets.

Sibling Rivalry and Generational Conflicts

Disagreements over inheritance can severely damage family relationships and complicate the wealth transfer process. Preemptive measures are crucial for a smooth transition.

- The importance of clear communication and family meetings cannot be overstated. Open discussions about expectations and desires can help prevent misunderstandings.

- The role of a neutral third-party mediator or family advisor can be invaluable in facilitating difficult conversations and resolving disputes. Their expertise in family dynamics and wealth transfer can guide the process.

- Implementing legally binding succession agreements provides a clear framework for distributing assets and resolving potential conflicts. This document should address all aspects of the wealth transfer plan.

Protecting Assets from Disputes and Legal Challenges

Protecting the family's wealth from potential lawsuits and challenges is a paramount concern. Robust legal structures are necessary to safeguard assets.

- Establishing irrevocable trusts can help protect assets from creditors and lawsuits, ensuring their availability for future generations.

- Utilizing asset protection trusts in various jurisdictions can offer additional layers of protection, depending on the specific circumstances and asset location.

- Engaging experienced legal counsel specializing in wealth protection is crucial for navigating the complexities of asset protection and succession planning.

Managing and Preserving a Diverse and Extensive Asset Portfolio

The super-rich often possess a diverse portfolio of assets, requiring sophisticated management strategies for preservation and growth.

Diversification and Risk Management

Effective risk management is vital for preserving wealth. Diversification across various asset classes is key to mitigating risk.

- Professional asset management and portfolio diversification are crucial to manage risk and maximize returns. Expert advice can optimize investment strategies.

- Employing sophisticated hedging strategies can protect against market volatility and unexpected economic downturns.

- Regular portfolio reviews and adjustments ensure the strategy remains aligned with the family's long-term goals and market conditions.

Ensuring the Long-Term Sustainability of Family Wealth

Succession planning is not merely about transferring assets; it's about preserving wealth for generations. This requires a holistic approach to wealth management.

- Establishing family offices can provide centralized management of family assets and ensure continuity of wealth management practices across generations.

- Developing a family constitution outlining values, governance principles, and expectations provides a framework for future family decision-making and wealth management.

- Investing in family education and financial literacy programs empowers future generations to manage and preserve their inheritance responsibly.

Conclusion

Wealth transfer and succession planning for the super-rich present unique and complex challenges. Successfully navigating these complexities requires proactive planning, expert legal and financial advice, and a clear understanding of international tax laws, family dynamics, and asset management strategies. Failure to address these issues comprehensively can lead to significant financial losses, family disputes, and the erosion of accumulated wealth. Don't delay – secure your family's financial future by seeking professional guidance on effective wealth transfer and succession planning today. Develop a robust strategy to safeguard your legacy and ensure a smooth transition of your assets to future generations. Effective wealth transfer planning is crucial for preserving your family's legacy.

Featured Posts

-

Google Ai Smart Glasses Prototype Our Experience

May 22, 2025

Google Ai Smart Glasses Prototype Our Experience

May 22, 2025 -

Top Gbr News Grocery Savings Lucky Quarter And Doge Poll Results

May 22, 2025

Top Gbr News Grocery Savings Lucky Quarter And Doge Poll Results

May 22, 2025 -

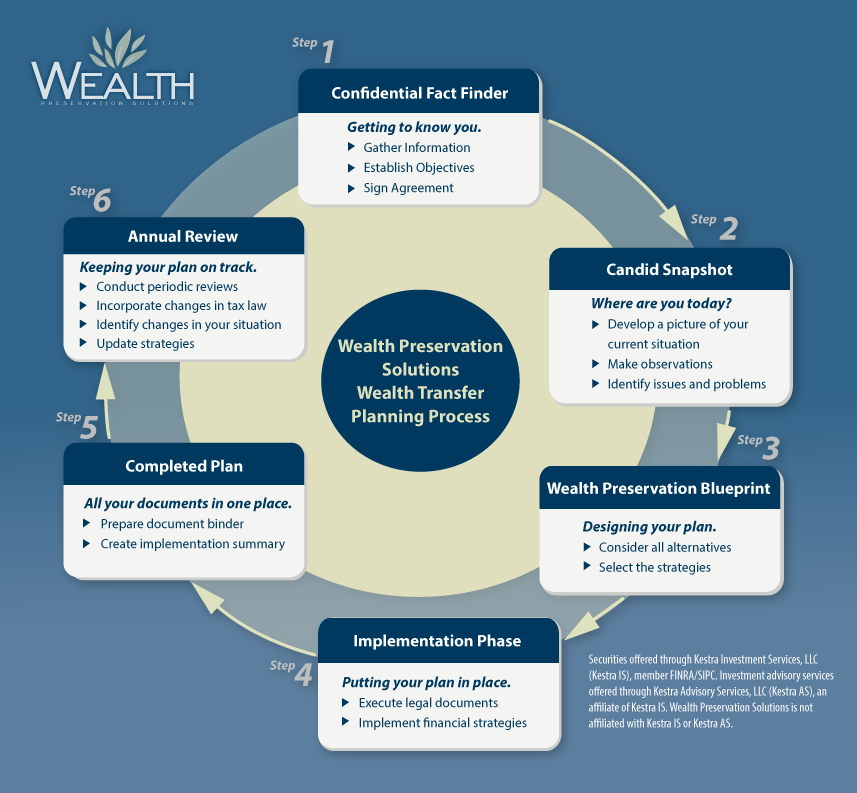

Jackson Hole Elk Feedground Cwd Confirmation And Implications

May 22, 2025

Jackson Hole Elk Feedground Cwd Confirmation And Implications

May 22, 2025 -

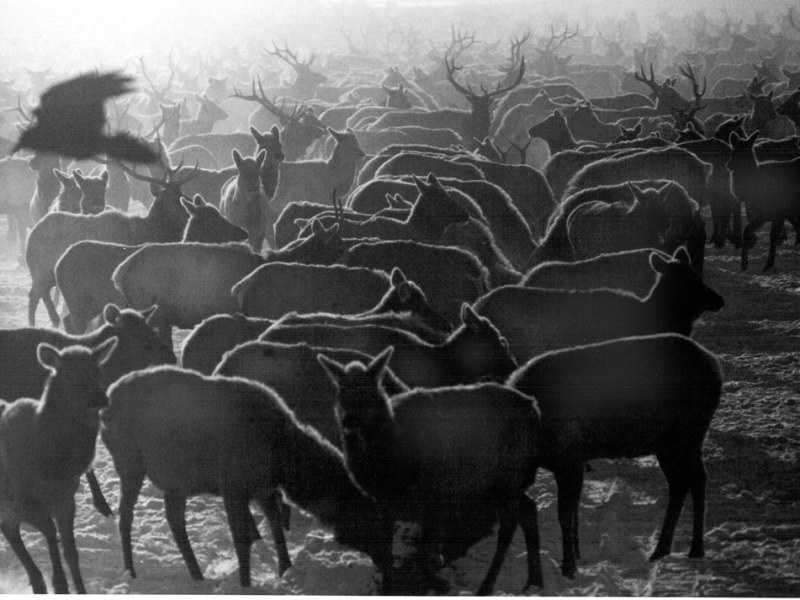

The Golden Dome Initiative Trumps Plan For A National Missile Defense

May 22, 2025

The Golden Dome Initiative Trumps Plan For A National Missile Defense

May 22, 2025 -

Delayed Appeal Ex Tory Councillors Wife And The Racist Tweet Controversy

May 22, 2025

Delayed Appeal Ex Tory Councillors Wife And The Racist Tweet Controversy

May 22, 2025