Weihong Liu: The Billionaire Behind The Hudson's Bay Lease Purchases

Table of Contents

Weihong Liu's Business Empire and Investment Strategy

Weihong Liu is a prominent figure in international finance and real estate, known for his shrewd investment strategies and long-term vision. While details about his personal life remain relatively private, his business activities speak volumes about his approach to wealth creation. His investment philosophy centers on identifying undervalued assets with significant growth potential, particularly within the real estate sector. He focuses on acquiring large-scale properties, leveraging his financial resources to secure advantageous lease terms and long-term value appreciation.

- Key companies and investments: While the precise details of all his holdings are not publicly available, Weihong Liu's investments span various sectors, with a heavy emphasis on real estate, both domestically and internationally. His companies often participate in joint ventures and partnerships, maximizing opportunities and mitigating risk.

- Risk assessment and due diligence: Liu's success is attributed to his meticulous approach to due diligence. His team conducts extensive market research, financial modeling, and legal analysis before committing to any significant transaction. This rigorous process minimizes risk and optimizes returns.

- History of successful large-scale property deals: Liu has a proven track record of securing and developing lucrative real estate assets. His portfolio includes a diverse range of properties, demonstrating his ability to identify and capitalize on opportunities across various market segments.

The Hudson's Bay Lease Purchases: A Detailed Analysis

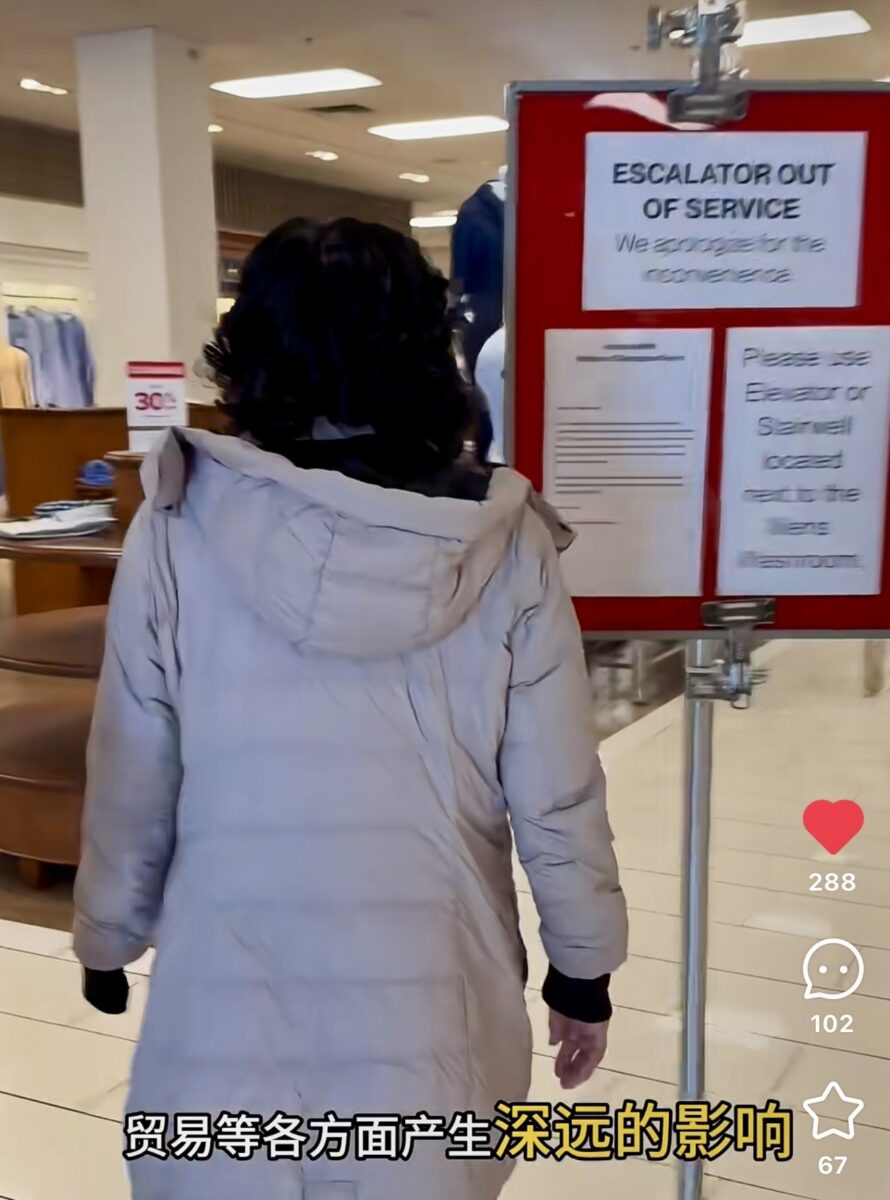

Weihong Liu, through his various investment vehicles, has been significantly involved in acquiring long-term leases on numerous Hudson's Bay properties across Canada. These purchases represent a substantial investment in the Canadian retail market. While exact figures are often kept confidential due to the nature of private real estate transactions, the scale of the acquisitions is undeniable.

- Timeline of significant acquisitions: The acquisitions have occurred over a period of several years, strategically timed to leverage market conditions and maximize returns. Specific dates and values often remain undisclosed, maintaining a degree of privacy around these sensitive financial transactions.

- Breakdown of property types acquired: The properties acquired include a mix of prime retail spaces, strategically located in major urban centers across the country. Some acquisitions may also encompass office spaces or other ancillary commercial real estate associated with Hudson's Bay locations.

- Potential impact on the Hudson's Bay Company's future: These lease purchases could significantly impact Hudson's Bay's long-term strategy, potentially providing them with the capital to invest in other initiatives or restructure their operations. The deal's overall effect remains to be seen, as it unfolds over time.

Impact on the Canadian Retail Sector

Weihong Liu's substantial investments in Hudson's Bay properties have ripple effects throughout the Canadian retail sector. His actions reflect a broader trend of investment in prime commercial real estate, shaping the dynamics of the industry.

- Shifting dynamics within the retail landscape: These purchases highlight the ongoing evolution of the retail sector, with investors seeking long-term value in established properties despite the challenges of e-commerce. This signifies a belief in the enduring relevance of physical retail spaces in key urban areas.

- Potential job creation or displacement: While the direct impact on employment is complex, the lease purchases could lead to both job creation and potential displacement, depending on how Hudson's Bay adapts to the changed circumstances. Redevelopment of acquired spaces may create new job opportunities.

- Long-term effects on urban development: The long-term lease agreements influence urban planning and development. These investments could lead to renovations, revitalization projects, and shifts in the overall commercial landscape of various Canadian cities.

The Future of Weihong Liu's Real Estate Portfolio

Predicting the future investments of a shrewd investor like Weihong Liu is inherently speculative, but based on his past performance, several trends can be observed. His focus on strategic real estate acquisitions, particularly in prime locations with significant long-term potential, will likely continue.

- Potential targets for future investments: His future investments might target similarly situated properties in major Canadian cities or potentially expand into other sectors of the commercial real estate market, such as logistics or industrial properties.

- Predicted growth of his real estate portfolio: Given his history, it is highly probable that his real estate portfolio will continue to grow substantially in the coming years, both in terms of value and geographical reach.

- Assessment of risks and opportunities: While the inherent risks in real estate investments remain, Liu's demonstrated ability to identify and mitigate risk suggests he will continue to pursue opportunities that offer substantial long-term returns.

Conclusion

Weihong Liu's strategic lease purchases of Hudson's Bay properties represent a significant investment in the Canadian real estate market, impacting the retail sector and shaping urban landscapes. His keen investment strategy, focused on long-term value and due diligence, has positioned him as a major player in the Canadian economy. The consequences of these acquisitions will be felt for years to come. Learn more about the fascinating world of Weihong Liu's investments and the influence he wields on the Canadian real estate market. Stay informed about future developments by following our updates on billionaire investor activities and Hudson's Bay lease purchases.

Featured Posts

-

Koeln Entscheidung Zur Venloer Strasse Als Einbahnstrasse

May 29, 2025

Koeln Entscheidung Zur Venloer Strasse Als Einbahnstrasse

May 29, 2025 -

The Ultimate Drive Movies And Tv Guide For Great Entertainment

May 29, 2025

The Ultimate Drive Movies And Tv Guide For Great Entertainment

May 29, 2025 -

Mickey Rourke Controversy Aj Odudus Official Statement On Celebrity Big Brother Incident

May 29, 2025

Mickey Rourke Controversy Aj Odudus Official Statement On Celebrity Big Brother Incident

May 29, 2025 -

Msyrt Alastqlal Njahat Wthdyat

May 29, 2025

Msyrt Alastqlal Njahat Wthdyat

May 29, 2025 -

Pokemon Tcg Game Stop Imposes One Per Customer Buying Restriction

May 29, 2025

Pokemon Tcg Game Stop Imposes One Per Customer Buying Restriction

May 29, 2025