WestJet Stake Sale: Onex Realizes Full Return On Investment

Table of Contents

Onex's Investment in WestJet: A Timeline and Strategy

Onex's journey with WestJet began in [Insert Year] when it acquired a significant stake in the airline. [Insert Percentage]% ownership represented a substantial investment of [Insert Amount]. Onex's strategy wasn't simply passive ownership; it involved actively shaping WestJet's trajectory. Their approach focused on several key areas:

- Operational Efficiency: Onex implemented measures to streamline WestJet's operations, focusing on cost reduction and enhancing productivity. This involved analyzing routes, optimizing fleet management, and improving customer service processes.

- Strategic Expansion: Under Onex's guidance, WestJet explored strategic expansion opportunities, both domestically and internationally, aiming to increase market share and revenue streams. This involved careful route planning and potential acquisitions or partnerships.

- Brand Enhancement: Onex likely invested in marketing and branding initiatives to solidify WestJet's position in the competitive airline market.

Key Milestones:

- [Year]: Initial investment in WestJet.

- [Year]: Implementation of cost-saving measures.

- [Year]: Expansion into new markets/routes.

- [Year]: [Mention any significant events like acquisitions or mergers].

- [Year]: [Mention any major operational changes].

WestJet's Financial Performance Under Onex Ownership

During Onex's ownership, WestJet demonstrated considerable financial strength. While facing challenges like fluctuating fuel prices and the significant impact of the COVID-19 pandemic, WestJet's performance showcased resilience and growth under Onex's strategic direction.

- Revenue Growth: [Insert data on revenue growth percentage over the period]. This demonstrates the success of expansion strategies and operational efficiency improvements.

- Profitability: [Insert data on net income and EBITDA, demonstrating profitability trends]. This highlights the financial returns achieved during Onex’s tenure.

- Passenger Numbers: [Insert data showing passenger numbers and growth]. This reflects the success of the airline’s market strategy and expansion.

- Market Share: [Insert data showcasing WestJet's market share trends]. This illustrates the successful competition within the Canadian airline market.

Onex's strategic interventions, including operational improvements and expansion plans, played a crucial role in facilitating this positive financial performance, laying the groundwork for the successful WestJet stake sale.

The WestJet Stake Sale: Details and Implications

The WestJet stake sale was finalized on [Insert Date], with [Insert Buyer] acquiring Onex's shares for [Insert Sale Price]. This transaction represents a complete return on Onex's initial investment, marking a substantial success for the private equity firm.

- Onex's ROI: A detailed calculation showing how Onex achieved a full return on its initial investment should be included here. This could include a simple calculation or a more sophisticated analysis considering time value of money.

Implications:

- For Onex: This successful exit demonstrates Onex's expertise in identifying and developing undervalued assets within the airline sector, bolstering their reputation and enhancing their future investment prospects.

- For WestJet: The change in ownership could bring new strategic directions, investment opportunities, and potentially influence future growth strategies for the airline.

Industry Analysis: Private Equity in the Airline Sector

Private equity firms are increasingly active players in the airline industry, seeking opportunities to restructure, optimize, and ultimately generate high returns on investment. This sector presents unique challenges and opportunities.

- Current Trends: The industry shows an increase in private equity involvement for restructuring struggling airlines, unlocking growth potential, and capitalizing on consolidation opportunities within the sector.

- Future Prospects: Future investment is likely to focus on airlines demonstrating strong growth potential and resilient business models, particularly in regions showing strong growth in air travel.

- Examples: [Mention other successful or unsuccessful examples of private equity investment in airlines, providing brief details and outcomes].

Conclusion: WestJet Stake Sale: A Case Study in Successful Private Equity Investment

The WestJet stake sale serves as a compelling example of successful private equity investment in the airline sector. Onex's strategic interventions, coupled with WestJet's operational improvements and resilience, resulted in a complete return on investment. This case study highlights the potential for significant returns through proactive management and strategic decision-making within a challenging yet dynamic industry. To learn more about successful private equity investments, delve deeper into case studies of airline industry investments or explore further analysis of the WestJet investment, utilize keywords like "successful private equity investments," "airline industry investment," or "WestJet investment analysis."

Featured Posts

-

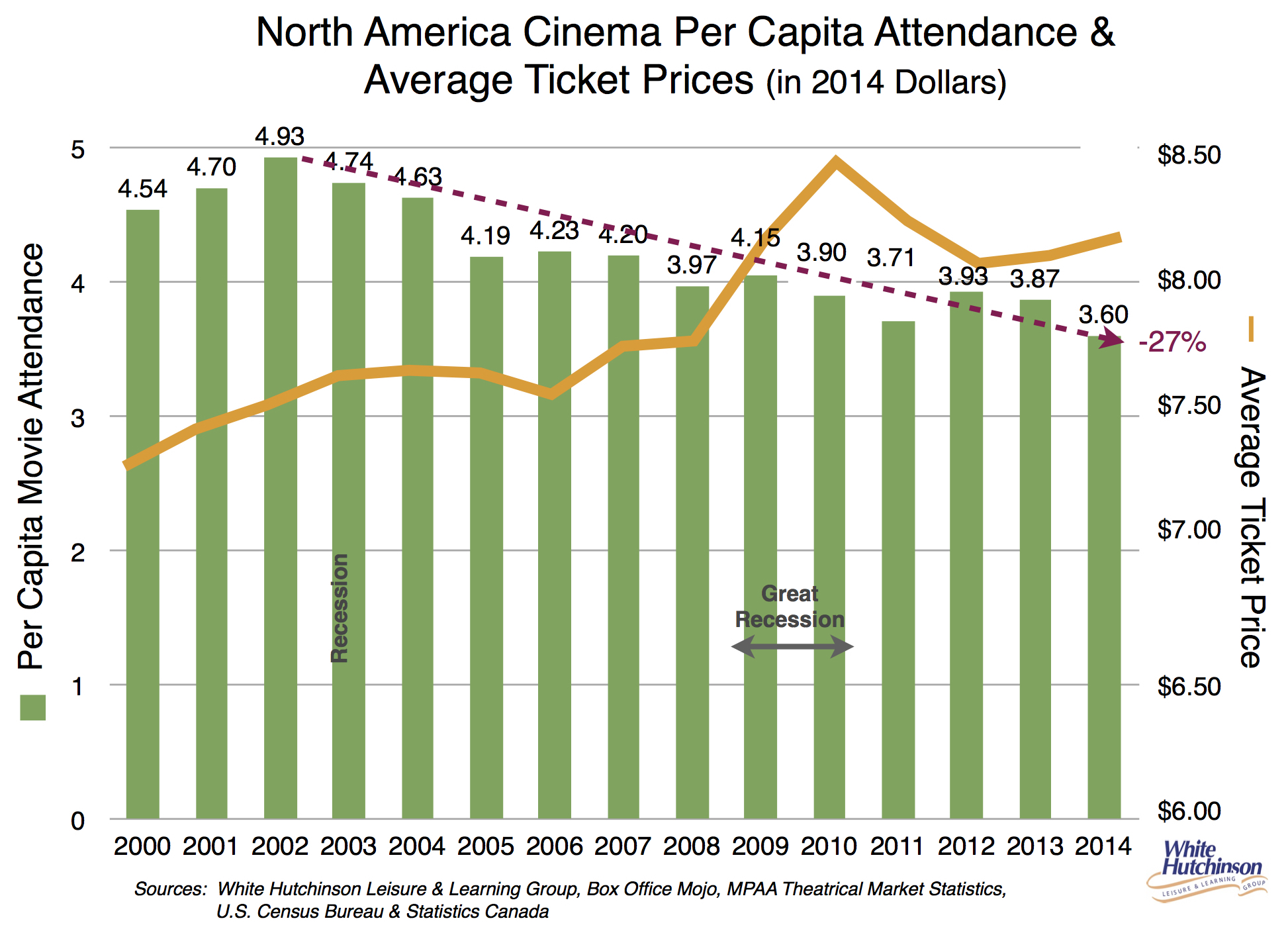

Cineplex Q1 Results Show Attendance Decline Leading To Financial Loss

May 12, 2025

Cineplex Q1 Results Show Attendance Decline Leading To Financial Loss

May 12, 2025 -

Ufc 315 Can Fiorot Overcome Shevchenkos Retirement Challenge

May 12, 2025

Ufc 315 Can Fiorot Overcome Shevchenkos Retirement Challenge

May 12, 2025 -

Tam Krwz Ke Jwtwn Pr Pawn Rkhne Waly Mdah Awr Adakar Ka Hyran Kn Rdeml

May 12, 2025

Tam Krwz Ke Jwtwn Pr Pawn Rkhne Waly Mdah Awr Adakar Ka Hyran Kn Rdeml

May 12, 2025 -

Zware Nederlaag Voor Kompany Een Vernederende Ervaring

May 12, 2025

Zware Nederlaag Voor Kompany Een Vernederende Ervaring

May 12, 2025 -

Mls Flytt Foer Thomas Mueller Fakta Och Spekulationer

May 12, 2025

Mls Flytt Foer Thomas Mueller Fakta Och Spekulationer

May 12, 2025