What Is The Real Safe Bet? Understanding Risk Tolerance And Investment Choices

Table of Contents

Defining Your Risk Tolerance

Before diving into specific investment strategies, it's crucial to define your risk tolerance. This refers to your comfort level with the possibility of losing money in pursuit of higher returns. Understanding your risk tolerance will guide your investment choices and help you avoid unnecessary stress and potential losses.

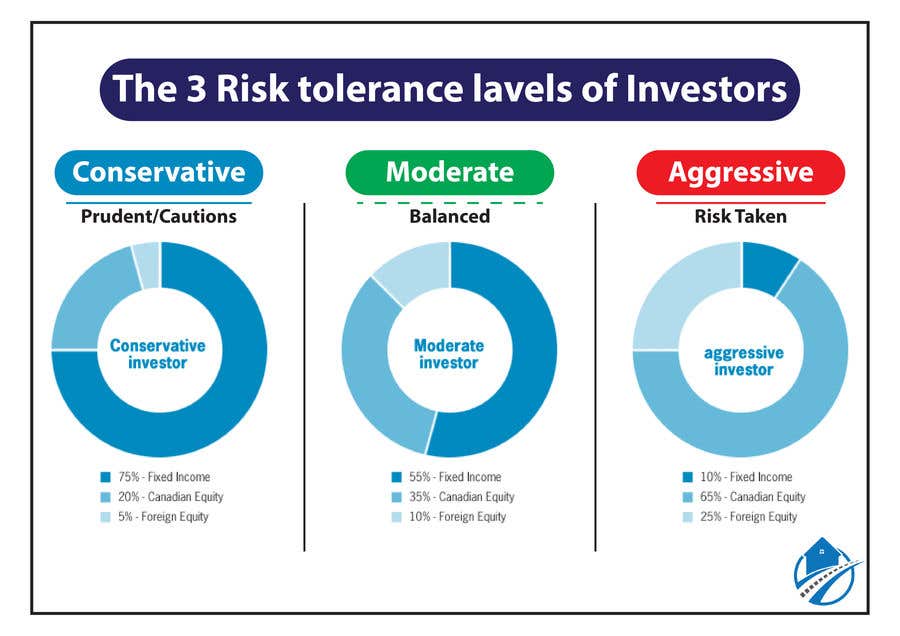

Understanding Risk Tolerance Levels

The spectrum of risk tolerance generally falls into three categories:

-

Conservative Investors: These investors prioritize capital preservation above all else. They prefer low-risk investments with minimal volatility, even if it means lower potential returns. Their focus is on maintaining their principal and avoiding significant losses.

-

Moderate Investors: Moderate investors seek a balance between risk and reward. They're willing to accept some level of risk for the potential of higher returns, but they also prioritize diversification to mitigate potential losses. They carefully weigh the potential for growth against the possibility of short-term fluctuations.

-

Aggressive Investors: Aggressive investors are comfortable with higher risk in pursuit of potentially significant returns. They're willing to tolerate greater market volatility and potential short-term losses in exchange for the possibility of substantial long-term gains.

Factors Influencing Risk Tolerance

Several factors influence your risk tolerance:

-

Age: Younger investors typically have a longer time horizon, allowing them to recover from market downturns more easily. This often translates to a higher risk tolerance. Older investors, closer to retirement, usually prefer more conservative strategies to protect their accumulated wealth.

-

Financial Goals: Short-term financial goals, such as a down payment on a house, usually require lower-risk investments. Long-term goals, like retirement, provide more flexibility to invest in higher-risk, higher-return assets.

-

Time Horizon: The longer your investment time horizon, the more risk you can generally afford to take. A longer timeframe allows your investments to ride out market fluctuations and potentially recover from losses.

-

Personal Circumstances: Factors like job security, debt levels, and overall financial health significantly impact your risk tolerance. A stable job and low debt usually allow for a higher risk tolerance.

Assessing Your Personal Risk Tolerance

Determining your risk tolerance isn't an exact science. However, several resources can help:

-

Online Risk Tolerance Questionnaires: Many financial institutions and websites offer online questionnaires to assess your risk profile. These questionnaires typically ask questions about your investment experience, financial goals, and comfort level with potential losses.

-

Financial Advisor Consultation: A qualified financial advisor can provide a personalized assessment of your risk tolerance, considering your individual circumstances and financial goals.

Investment Choices Based on Risk Tolerance

Once you've determined your risk tolerance, you can select investments that align with your comfort level and financial objectives.

Low-Risk Investments for Conservative Investors

Conservative investors typically focus on preserving capital and minimizing risk. Suitable options include:

-

Savings Accounts: Offer FDIC insurance (in the US) and easy access to funds, but typically provide low returns.

-

Certificates of Deposit (CDs): Offer a fixed interest rate for a specific term, providing higher returns than savings accounts but limiting access to your funds.

-

Money Market Accounts (MMAs): Provide higher interest rates than savings accounts with check-writing capabilities, offering a balance between liquidity and return.

-

Government Bonds: Issued by the government, these bonds are considered very low-risk, although returns might be modest.

Moderate-Risk Investments for Balanced Portfolios

Moderate investors aim for a balance between risk and return. Diversification is key:

-

Mutual Funds: Professionally managed portfolios that invest in a diversified range of assets, spreading risk across different sectors and asset classes.

-

Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges, offering greater flexibility and potentially lower fees.

-

Balanced Portfolio: A mix of stocks and bonds, often using a target-date fund that adjusts the allocation over time to become more conservative as retirement approaches.

High-Risk Investments for Aggressive Investors

Aggressive investors are willing to accept significant risk for the potential of higher returns. Options include:

-

Individual Stocks: Offer high growth potential but also carry a high risk of loss. Thorough research and due diligence are crucial.

-

Options Trading: Involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price. Highly speculative and requires advanced knowledge.

-

Alternative Investments: These include real estate, commodities, and private equity, which offer potential for high returns but typically require significant capital and specialized expertise.

Re-evaluating Your Risk Tolerance

Your risk tolerance isn't static; it can change over time due to various factors:

-

Life Changes: Major life events like marriage, having children, or changing jobs can significantly alter your financial situation and risk tolerance.

-

Market Fluctuations: Market volatility can impact your investment portfolio and potentially change your risk perception. Periodic review is crucial.

-

Professional Advice: Consulting a financial advisor is crucial for ongoing guidance and adjustments to your investment strategy as your needs and circumstances change. They can help you assess your risk tolerance and adjust your investment plan accordingly.

Conclusion

Determining the "real safe bet" is highly personal and depends entirely on your individual risk tolerance. By understanding your risk profile and aligning your investments accordingly, you can create a portfolio that meets your financial goals while managing your comfort level. Remember to regularly reassess your risk tolerance and investment strategy to ensure it remains suitable for your circumstances. Take the first step today to define your risk tolerance and discover the safe bet that's right for you. Start planning your investment strategy based on your personal risk tolerance!

Featured Posts

-

February 15th Nyt Strands Solutions Game 349

May 10, 2025

February 15th Nyt Strands Solutions Game 349

May 10, 2025 -

Nyt Crossword Solutions Strands Puzzle For April 4 2025

May 10, 2025

Nyt Crossword Solutions Strands Puzzle For April 4 2025

May 10, 2025 -

Zelenskiy Odin Na 9 Maya Pochemu Nikto Ne Priekhal

May 10, 2025

Zelenskiy Odin Na 9 Maya Pochemu Nikto Ne Priekhal

May 10, 2025 -

Transgender Experiences Under Trump Administration Policies

May 10, 2025

Transgender Experiences Under Trump Administration Policies

May 10, 2025 -

Nicolas Cage Lawsuit Update Dismissal For Ex Wife Weston Cage Still Involved

May 10, 2025

Nicolas Cage Lawsuit Update Dismissal For Ex Wife Weston Cage Still Involved

May 10, 2025