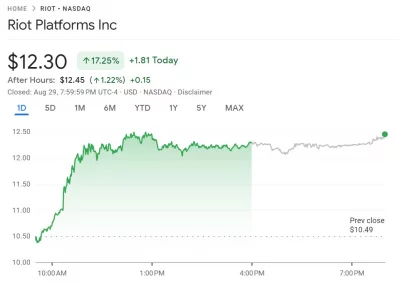

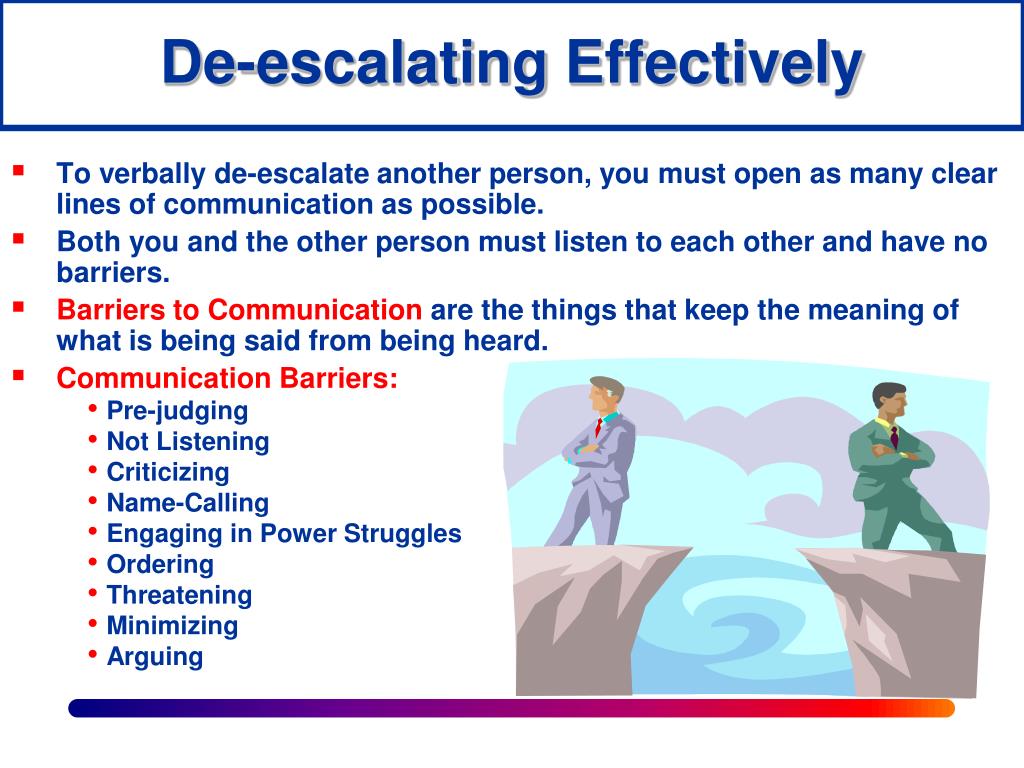

What's Driving The Recent Volatility In Riot Platforms (RIOT) Stock?

Table of Contents

The Impact of Bitcoin (BTC) Price Fluctuations on RIOT

Riot Platforms' fortunes are inextricably linked to the price of Bitcoin (BTC). This correlation directly impacts the company's profitability and, consequently, its stock price. The volatility in RIOT stock price swings is often a direct reflection of the inherent volatility of Bitcoin itself.

- Higher Bitcoin prices lead to increased mining profitability for RIOT. When Bitcoin's value rises, the revenue generated from mining increases, boosting RIOT's bottom line and attracting investor interest.

- Lower Bitcoin prices reduce profitability, impacting RIOT's revenue and stock value. Conversely, a decline in Bitcoin's price directly translates to lower mining revenues, potentially impacting RIOT's financial performance and leading to decreased investor confidence.

- The inherent volatility of Bitcoin and its cascading effect on RIOT. Bitcoin's notoriously volatile nature means RIOT's stock price can experience significant swings even with relatively small changes in the cryptocurrency's value. This creates a high-risk, high-reward scenario for investors.

- Bitcoin's price prediction and its implication for RIOT. Predicting Bitcoin's price is notoriously difficult. However, any significant price movement, whether positive or negative, will directly affect the profitability and stock price of RIOT. Market analysts' predictions concerning Bitcoin should be considered when assessing RIOT’s future performance.

[Insert chart/graph illustrating the correlation between BTC and RIOT stock prices here]

Energy Costs and Their Influence on RIOT's Operations

Energy costs represent a significant operational expense for cryptocurrency mining companies like Riot Platforms. Fluctuations in energy prices directly impact RIOT's profitability and overall financial health, adding another layer to the volatility in RIOT.

- Fluctuating energy prices directly affect RIOT's operating expenses. Increases in energy costs can significantly reduce profit margins, impacting the company's ability to generate revenue and potentially affecting investor sentiment.

- The impact of renewable energy adoption on RIOT's cost structure. RIOT's commitment to using renewable energy sources can help mitigate the risk associated with volatile energy prices, offering a degree of stability in its operating costs. However, the initial investment in renewable energy infrastructure can represent a substantial cost.

- Geographical factors influencing energy costs and their effect on RIOT's profitability. The location of RIOT's mining facilities plays a crucial role in determining energy costs. Regions with lower energy prices can provide a competitive advantage, impacting profitability and stock price.

- Potential strategies RIOT employs to mitigate energy cost volatility. Hedging strategies, long-term energy contracts, and diversification of energy sources are some ways RIOT can try to reduce the impact of energy price fluctuations on its operations.

[Insert data on energy prices and their impact on RIOT's financial performance here]

Regulatory Uncertainty and its Effect on RIOT Stock

The cryptocurrency mining industry, including RIOT, operates within a landscape of evolving regulations. This regulatory uncertainty contributes significantly to the volatility of RIOT stock.

- The influence of government policies and potential changes in regulations on the industry. Changes in government regulations regarding cryptocurrency mining can dramatically affect the operational environment for RIOT, impacting its ability to operate and potentially influencing investor confidence.

- The impact of environmental regulations on RIOT's operations. Growing concerns about the environmental impact of cryptocurrency mining could lead to stricter regulations, potentially affecting RIOT's operations and profitability.

- Any legal challenges faced by RIOT or the cryptocurrency mining industry as a whole. Legal challenges and lawsuits can create uncertainty and negatively impact investor sentiment, leading to price volatility.

- Regulatory uncertainty creates volatility in the RIOT stock price. The unpredictable nature of regulations in the cryptocurrency space creates an inherently risky environment, leading to significant price swings in RIOT's stock.

[Reference specific regulatory developments and their influence on RIOT’s market position here]

Market Sentiment and Investor Behavior

Beyond fundamental factors, market sentiment and investor behavior play a substantial role in shaping RIOT's stock price. This adds another layer of complexity to understanding the volatility in RIOT.

- The impact of broader market trends on RIOT's performance. Overall market conditions, including economic downturns or bullish periods, can influence investor appetite for risky assets like RIOT stock.

- The influence of news and media coverage on investor perceptions. Positive or negative news coverage can significantly impact investor sentiment, leading to price fluctuations.

- The role of short-selling and other speculative trading activities. Short-selling and other speculative trading strategies can exacerbate price volatility, especially in a market as volatile as the cryptocurrency mining sector.

- The impact of social media sentiment on RIOT stock. Social media sentiment can significantly impact investor perception and trading decisions, contributing to price fluctuations.

[Include data on trading volume and investor sentiment indicators here]

Conclusion: Navigating the Volatility of Riot Platforms (RIOT) Stock

Understanding the volatility of Riot Platforms (RIOT) stock requires considering the interconnectedness of several key factors: Bitcoin price fluctuations, energy costs, regulatory uncertainty, and market sentiment. These factors combine to create a highly dynamic and unpredictable investment environment. The price swings in RIOT are often a direct reflection of these interacting forces. Therefore, thorough research is imperative before making any investment decisions related to RIOT. Stay informed about the factors impacting RIOT stock price swings and consider consulting with a financial advisor before investing. For further reading, explore reputable financial news sources and company filings to gain a deeper understanding of the cryptocurrency mining sector and Riot Platforms’ performance. Understanding the volatility of Riot Platforms (RIOT) stock is crucial for informed investment decisions.

Featured Posts

-

Fortnite Update 34 21 Server Downtime New Features And Bug Fixes

May 03, 2025

Fortnite Update 34 21 Server Downtime New Features And Bug Fixes

May 03, 2025 -

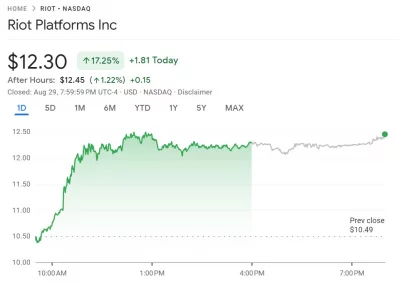

Indias Justice Plea A Response To Rubios De Escalation Call

May 03, 2025

Indias Justice Plea A Response To Rubios De Escalation Call

May 03, 2025 -

Riot Platforms Nasdaq Riot Stock Dip Analysis And Outlook

May 03, 2025

Riot Platforms Nasdaq Riot Stock Dip Analysis And Outlook

May 03, 2025 -

The Future Of Reform Uk Five Challenges Facing Nigel Farage

May 03, 2025

The Future Of Reform Uk Five Challenges Facing Nigel Farage

May 03, 2025 -

Increased Chinese Naval Activity Off Sydney Coast What Does It Mean For Australia

May 03, 2025

Increased Chinese Naval Activity Off Sydney Coast What Does It Mean For Australia

May 03, 2025