Where To Invest: A Map Of The Country's Promising Business Locations

Table of Contents

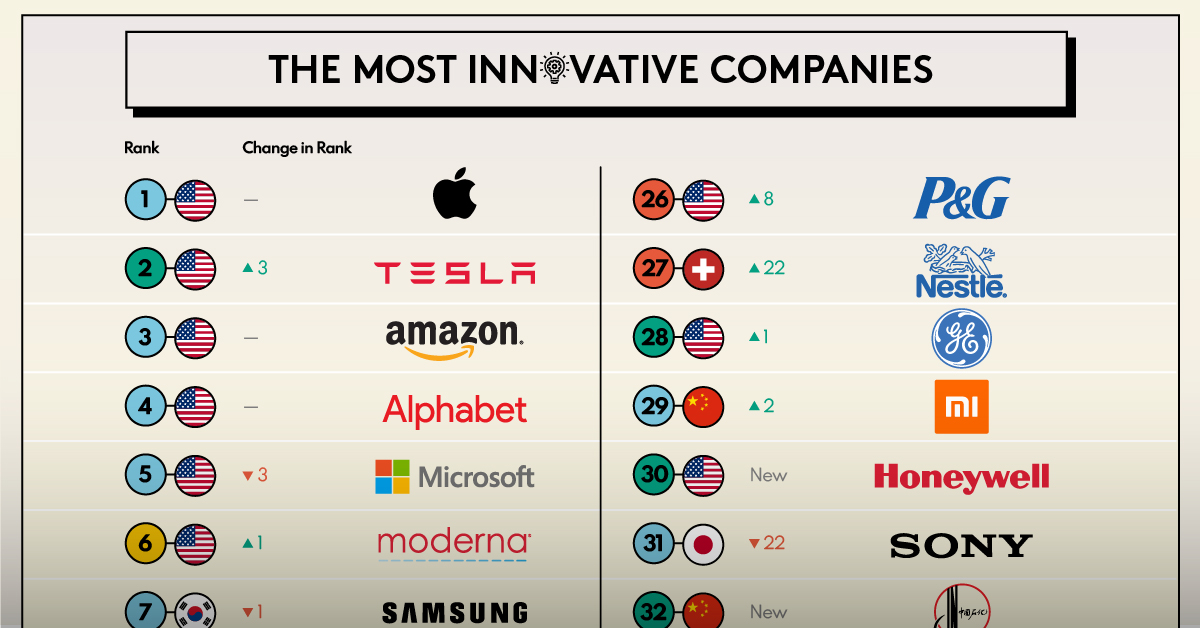

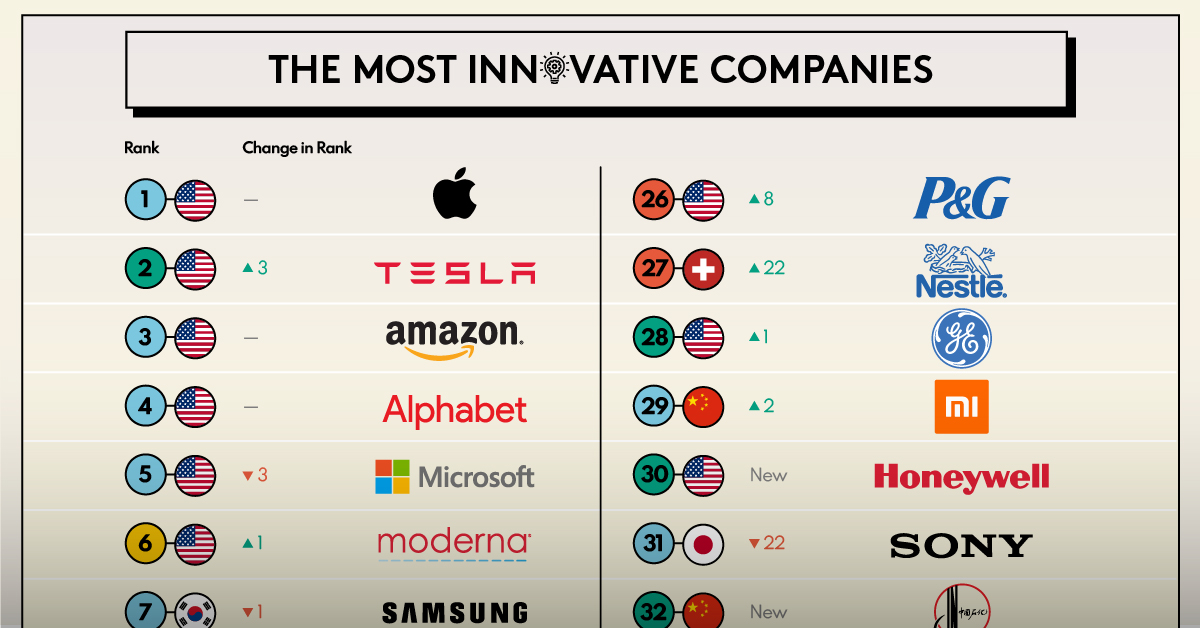

Tech Hubs: Thriving Ecosystems for Innovation

The technology sector is a dynamic engine of economic growth, and investing in thriving tech hubs offers significant potential. These areas boast a concentration of talent, resources, and funding opportunities that are hard to match elsewhere.

Silicon Valley (California): The Gold Standard

Silicon Valley remains the gold standard for tech investment. Its established ecosystem attracts top talent and substantial venture capital funding.

- Booming tech sector with established venture capital networks: A vast network of venture capitalists provides ample funding opportunities for startups and established tech companies.

- High concentration of skilled workers and specialized talent: Access to a deep pool of engineers, designers, and other specialized professionals is crucial for innovation.

- Access to cutting-edge infrastructure and resources: State-of-the-art infrastructure, research facilities, and collaborative spaces support technological advancements.

- High cost of living, a potential drawback: The high cost of living in Silicon Valley can impact profitability and employee retention.

Emerging Tech Centers (Austin, Texas; Seattle, Washington; Raleigh-Durham, North Carolina): Affordable Alternatives

While Silicon Valley dominates, several emerging tech centers offer attractive alternatives with lower costs and equally promising growth potential.

- Rapidly growing tech scenes with lower operational costs: These locations offer a more affordable environment for startups and businesses looking to expand.

- Attractive tax incentives for startups and tech companies: Many states offer tax breaks and other incentives to attract tech investments.

- Strong universities producing a steady stream of graduates: Proximity to leading universities provides a constant supply of skilled graduates.

- Potential for higher risk but potentially higher reward: Investing in emerging tech hubs carries more risk, but the potential for higher returns is significant.

Manufacturing Powerhouses: Capitalizing on Industrial Growth

The manufacturing sector is experiencing a resurgence, driven by reshoring and nearshoring initiatives. Investing in manufacturing powerhouses can offer substantial returns.

Manufacturing Belts (Midwest States): Established Infrastructure

Traditional manufacturing hubs in the Midwest boast established infrastructure and a skilled workforce.

- Well-established manufacturing infrastructure and supply chains: Decades of manufacturing activity have created robust supply chains and infrastructure.

- Skilled labor force with experience in various industries: A large pool of experienced workers reduces training costs and accelerates production.

- Access to key transportation networks and logistics: Efficient transportation networks are crucial for the timely delivery of goods.

- Potential for competition from established businesses: Competition from established players can make it challenging for new entrants.

Reshoring and Nearshoring Opportunities (Various Locations): New Growth Areas

The trend of companies relocating manufacturing back to the country (reshoring) or to nearby countries (nearshoring) creates new investment opportunities.

- Growing trend of companies relocating manufacturing back to the country: This trend is driven by factors such as rising labor costs overseas and supply chain disruptions.

- Government incentives to attract manufacturing investments: Many states and municipalities offer attractive tax breaks and other incentives to attract manufacturers.

- Opportunities to create new jobs and stimulate local economies: Manufacturing investments stimulate local economies by creating jobs and boosting demand for goods and services.

- Need for investment in modernizing infrastructure in some areas: Some areas require investments in infrastructure upgrades to support modern manufacturing operations.

Real Estate Hotspots: High-Yield Investment Opportunities

Real estate remains a popular investment vehicle, offering the potential for both rental income and capital appreciation.

Major Metropolitan Areas (New York City, Los Angeles, Chicago): Consistent Growth

Major metropolitan areas typically offer consistent growth due to high population density and strong rental demand.

- High population density and strong rental demand: High demand keeps rental rates high and provides a steady stream of income.

- Potential for appreciation in property value over time: Property values in major cities tend to appreciate over time.

- Access to amenities and infrastructure: Residents have access to a wide range of amenities and well-developed infrastructure.

- High competition and potentially higher purchase prices: High demand leads to high prices and increased competition among buyers.

Up-and-Coming Urban Centers (Nashville, Austin, Denver): Hidden Gems

Smaller, rapidly growing urban centers present opportunities for higher returns but also carry higher risk.

- Rapidly growing populations and increasing property values: Rapid population growth drives up property values.

- Opportunities for greater return on investment compared to established markets: These markets often offer greater potential for appreciation than established markets.

- Potential for higher risk due to market volatility: Smaller markets are more susceptible to market fluctuations.

- Need to research local market conditions carefully: Thorough due diligence is essential to assess the risk and reward of investing in these areas.

Conclusion

Identifying the best promising business locations requires careful consideration of various factors, including economic trends, infrastructure, labor markets, and government policies. This guide has highlighted some of the country's most attractive investment opportunities across diverse sectors. By understanding the strengths and weaknesses of each location, you can make well-informed decisions that align with your investment goals. Remember to conduct thorough due diligence before committing your capital. Begin your search for promising business locations today and unlock your investment potential!

Featured Posts

-

Memorial Day Weekend Wwe Wrestle Mania 41 Golden Belts And Ticket Sales

May 23, 2025

Memorial Day Weekend Wwe Wrestle Mania 41 Golden Belts And Ticket Sales

May 23, 2025 -

Sylhet Test Zimbabwes Triumph Ends Away Win Drought

May 23, 2025

Sylhet Test Zimbabwes Triumph Ends Away Win Drought

May 23, 2025 -

Essen Der Unerwartete Eis Trend In Nordrhein Westfalen

May 23, 2025

Essen Der Unerwartete Eis Trend In Nordrhein Westfalen

May 23, 2025 -

Ramaphosas Calm Response Alternative Actions In The White House Ambush

May 23, 2025

Ramaphosas Calm Response Alternative Actions In The White House Ambush

May 23, 2025 -

Freddie Flintoffs Life After His Horror Crash Ptsd Recovery And New Beginnings

May 23, 2025

Freddie Flintoffs Life After His Horror Crash Ptsd Recovery And New Beginnings

May 23, 2025