Where To Invest: Mapping The Country's Fastest-Growing Business Areas

Table of Contents

Analyzing Key Economic Indicators for Investment Decisions

Before diving into specific sectors and locations, understanding key economic indicators is crucial for identifying promising investment opportunities. Analyzing these indicators provides a macro-level perspective on the overall health and direction of the economy, helping you pinpoint areas ripe for growth. This involves examining several factors to gauge the economic vitality of different regions.

- Focus on regions with consistently high GDP growth rates. A steadily increasing Gross Domestic Product (GDP) signals a healthy and expanding economy, creating favorable conditions for investment. You can find this data from sources like [link to government statistics website].

- Look for areas with low unemployment and a strong workforce. A robust workforce is essential for business growth. Low unemployment rates indicate a healthy labor market, making it easier for businesses to find and retain skilled employees. Check for regional unemployment data at [link to labor statistics website].

- Consider the impact of inflation on investment returns. High inflation can erode the purchasing power of your returns, so understanding inflation trends in different regions is essential for accurate investment appraisal. Consult the [link to central bank inflation reports] for up-to-date information.

- Assess consumer spending patterns to identify strong demand sectors. Analyzing consumer confidence indices and spending habits can highlight areas with robust demand, indicating potential for high returns in related industries. Look at reports from [link to consumer research organizations].

High-Growth Sectors: Identifying Promising Industries

Several industries are currently experiencing significant growth and offer compelling investment opportunities. Careful analysis of these sectors can reveal promising avenues for capital allocation.

- Renewable energy: The global shift towards sustainable energy sources is driving explosive growth in solar, wind, and other green technologies. Government incentives and subsidies in many regions further enhance the attractiveness of this sector. Look for investment opportunities in companies involved in [specific technologies within renewable energy, e.g., solar panel manufacturing, wind turbine installation].

- Technology: The technology sector continues to be a powerhouse of innovation and growth, with software development, artificial intelligence (AI), and cybersecurity leading the charge. Consider investing in companies developing cutting-edge technologies or providing essential IT services.

- Healthcare: An aging population and advancements in medical technology are fueling the growth of the healthcare sector. Opportunities abound in areas like pharmaceuticals, medical devices, and healthcare IT.

- E-commerce: The booming online retail market presents significant investment opportunities in logistics, delivery services, and e-commerce platforms. The rise of mobile commerce further amplifies this growth.

- Sustainable Agriculture: Growing concerns about climate change and food security are driving demand for eco-friendly food production methods. Investing in sustainable farming practices and technologies offers both financial and environmental benefits.

Geographic Hotspots: Regional Variations in Business Growth

Business growth isn't uniform across the country. Certain regions and cities are experiencing disproportionately high rates of economic expansion, creating attractive investment hotspots. (Note: The following examples are illustrative and should be replaced with specific regions and cities relevant to the target country).

- Region/City A (e.g., Silicon Valley equivalent): This region is a thriving tech hub, attracting significant investment and creating numerous high-paying jobs. The concentration of tech companies, universities, and research institutions makes it a particularly attractive investment destination.

- Region/City B (e.g., a major manufacturing center): Government investment in infrastructure and improvements in transportation networks have propelled the growth of this manufacturing center. The availability of a skilled workforce and access to key markets make it a strategic location for investment.

- Region/City C (e.g., a rapidly developing coastal city): This region benefits from a strategic location, attracting investment in tourism, real estate, and related industries. While presenting significant opportunities, it also faces challenges related to infrastructure development and environmental sustainability.

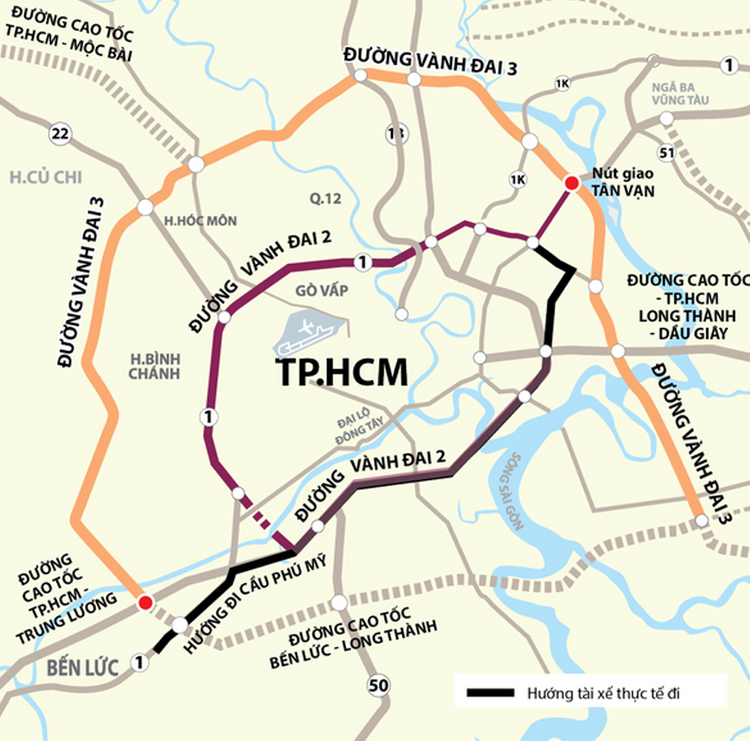

[Include a map visualizing regional economic activity and growth rates here]

Mitigating Risks and Conducting Due Diligence

Before making any investment decisions, conducting thorough due diligence is paramount. A well-defined risk management strategy can significantly improve your chances of success.

- Conduct thorough market research: Understand industry dynamics, competition, and potential market disruptions before investing.

- Assess the political and regulatory environment: Political stability and a predictable regulatory framework are crucial for successful investments.

- Evaluate the financial health and stability of potential investment targets: Analyze financial statements, assess management quality, and understand the company's debt levels.

- Develop a diversified investment portfolio: Diversification reduces the impact of potential losses from any single investment.

Conclusion

Identifying the country’s fastest-growing business areas requires a careful analysis of economic indicators, high-growth sectors, and regional variations. By conducting thorough due diligence and mitigating risks, investors can maximize their returns and participate in the nation's economic expansion. Start your journey towards lucrative investment opportunities today. Explore the fastest-growing business areas and make informed decisions to secure your financial future. Learn more about successful investment strategies by [link to relevant resources or further reading].

Featured Posts

-

Focus Sur Les Novelistes A L Espace Julien Avant Le Hellfest

May 22, 2025

Focus Sur Les Novelistes A L Espace Julien Avant Le Hellfest

May 22, 2025 -

Interstate 83 Traffic Delays Due To Produce Hauling Truck Accident

May 22, 2025

Interstate 83 Traffic Delays Due To Produce Hauling Truck Accident

May 22, 2025 -

Understanding Jim Cramers Opinion On Core Weave Crwv And Its Open Ai Ties

May 22, 2025

Understanding Jim Cramers Opinion On Core Weave Crwv And Its Open Ai Ties

May 22, 2025 -

Xay Dung Ket Noi Tp Hcm Long An 7 Vi Tri Chien Luoc

May 22, 2025

Xay Dung Ket Noi Tp Hcm Long An 7 Vi Tri Chien Luoc

May 22, 2025 -

Participating In The Wtt Aimscaps Approach And Outcomes

May 22, 2025

Participating In The Wtt Aimscaps Approach And Outcomes

May 22, 2025