Where To Invest: Mapping The Country's Top Business Locations

Table of Contents

Economic Powerhouses: Thriving Metropolitan Areas

Major cities often represent the most attractive best business locations due to their robust economies and established infrastructure. These metropolitan areas typically boast high GDP growth, significant job creation, and a diverse economy, making them attractive for a wide range of business investments. Investing in commercial real estate within these business hubs often yields significant returns.

- Analysis of key economic indicators: We'll look at metrics like GDP growth rate, unemployment rates, and per capita income to assess the economic health of each city. For example, City A might show a consistent 4% GDP growth over the last five years, while City B displays fluctuating growth but a lower unemployment rate. This data provides a crucial foundation for making informed investment decisions.

- Examples of successful businesses: Case studies of thriving businesses in these locations highlight the supportive environment and market opportunities. This could include established corporations, fast-growing startups, and successful small businesses, showcasing various profitable business locations within the city.

- Cost of doing business: While these areas offer great opportunities, the cost of doing business – including rent, salaries, and taxes – can be significantly higher. A careful cost-benefit analysis is crucial to understanding the true profitability of these top investment destinations.

- Specific industries: Certain cities excel in specific sectors. For example, City C might be a prominent center for technology, while City D is known for its strong financial services industry. Understanding these industry strengths can help investors target their investment strategies.

Emerging Markets: Untapped Potential and Growth Opportunities

Beyond the established metropolitan areas, emerging markets offer exciting business investment opportunities. These regions, often fueled by government initiatives or infrastructure improvements, present significant growth potential, although with higher inherent risk. Investing in these high-growth regions can lead to substantial returns, but requires a more thorough risk assessment.

- Identification of key cities and regions: We will identify cities and regions showing particularly strong growth trajectories, considering factors such as infrastructure development and government investment in regional development. These up-and-coming cities often offer lucrative incentives for businesses.

- Government incentives and support: Many governments offer attractive incentives—such as tax breaks, grants, and subsidized land—to encourage business investment in these emerging markets. Understanding these incentives is crucial for maximizing investment returns.

- Risks and opportunities: While the potential rewards are high, investing in emerging markets carries higher risks. Challenges might include underdeveloped infrastructure, less-skilled labor pools, and potentially volatile political climates. A thorough due diligence process is crucial.

- Successful businesses in these areas: Case studies of companies that have successfully established themselves in these regions illustrate the strategies required for navigating the specific challenges and capitalizing on the opportunities.

Specialized Hubs: Niche Industries and Targeted Investments

Some areas develop into specialized hubs, attracting businesses within a particular sector. These specialized hubs, whether technology hubs (Silicon Valley-style clusters) or agricultural regions, offer unique advantages for businesses operating within their niche. Investing in these sector-specific areas demands a detailed understanding of the specific industry landscape.

- Examples of specialized hubs: We will examine examples such as technology hubs known for software development, agricultural regions specializing in a specific crop, or manufacturing centers focused on a particular industry. These niche industries present focused investment opportunities.

- Advantages and disadvantages: Concentrating in a specialized hub provides access to a concentrated pool of talent and resources, but also increases competition. Understanding this trade-off is critical for investment decisions.

- Successful companies in specialized areas: Studying companies that have thrived in these sector-specific investment zones illuminates best practices and helps investors understand the specific requirements for success.

- Factors contributing to their success: The success of these companies is often tied to factors like access to specialized talent, proximity to suppliers, and a strong regulatory environment.

Factors to Consider When Choosing a Location

Beyond economic indicators, several other factors influence investment decisions. Thorough location analysis is crucial for assessing the overall viability of a location for your business.

- Accessibility and transportation infrastructure: Efficient transportation networks are crucial for logistics and distribution.

- Availability of skilled labor and talent: Access to a skilled workforce is essential for business operations.

- Cost of living and operating expenses: These costs significantly impact profitability and employee attraction.

- Regulatory environment and legal considerations: Understanding local regulations and legal frameworks is essential for compliance and risk mitigation.

- Market demand and competition: Analyzing market demand and competitive landscape helps assess the viability of the business. This stage of due diligence is absolutely critical.

Conclusion

Choosing where to invest requires careful consideration of diverse factors. This article highlights the numerous opportunities across various regions and sectors, from established economic powerhouses to promising emerging markets and specialized hubs. Remember, thorough market research and strategic investment strategy are paramount. A robust business plan that accounts for all the factors discussed is essential for success.

Ready to make informed decisions about where to invest your capital? Explore these top business locations and find the perfect fit for your business goals. Begin your journey to discovering the best business locations in the country today! Start your research on profitable business locations now!

Featured Posts

-

Bianca Censoris Nearly Nude Outfit Another Bold Appearance

May 28, 2025

Bianca Censoris Nearly Nude Outfit Another Bold Appearance

May 28, 2025 -

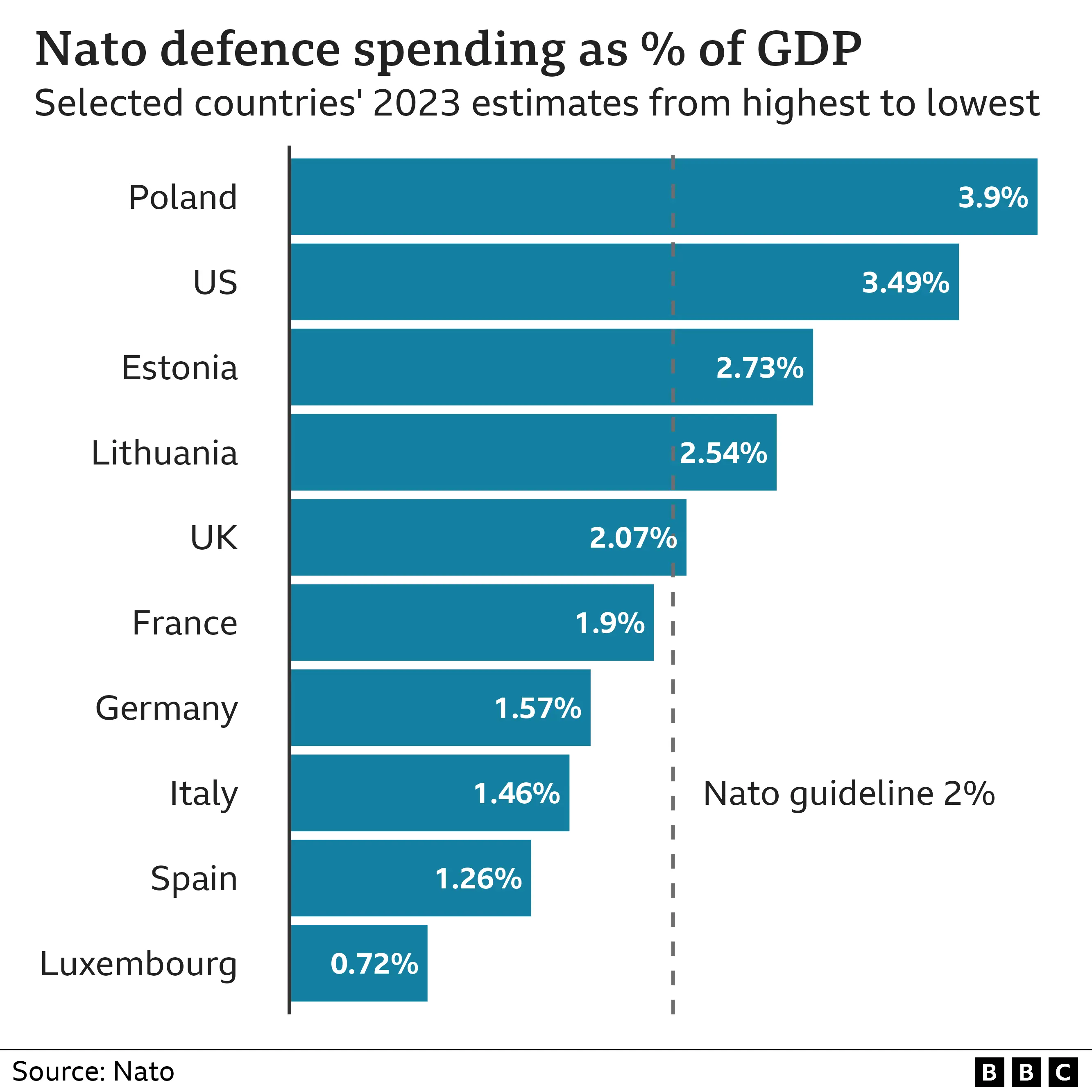

Natos 2 Spending Target Ruttes Assessment Of Member Progress

May 28, 2025

Natos 2 Spending Target Ruttes Assessment Of Member Progress

May 28, 2025 -

Huge Lottery Prize Unclaimed Winning Ticket Sold Location Revealed

May 28, 2025

Huge Lottery Prize Unclaimed Winning Ticket Sold Location Revealed

May 28, 2025 -

German Insider Rayan Cherki Update

May 28, 2025

German Insider Rayan Cherki Update

May 28, 2025 -

Unclaimed 1 Million National Lottery Prize Six Week Warning Issued

May 28, 2025

Unclaimed 1 Million National Lottery Prize Six Week Warning Issued

May 28, 2025