Which Cryptocurrency Could Outperform During A Trade War?

Table of Contents

Decentralized Cryptocurrencies as Safe Havens

Decentralized cryptocurrencies offer a unique proposition during times of global economic strife, particularly trade wars. Their inherent structure provides a potential hedge against the risks associated with traditional financial systems.

Reduced Reliance on Geopolitical Factors

Unlike fiat currencies, which are intrinsically tied to the economic and political stability of specific nations, decentralized cryptocurrencies operate independently of geopolitical influences.

- Bitcoin's Decentralized Nature: Bitcoin, the pioneer cryptocurrency, is a prime example. Its decentralized nature, governed by a global network of nodes rather than a central authority, makes it resilient to government control and manipulation. This inherent resilience can be a significant advantage during trade wars, where national currencies and financial systems can be significantly impacted.

- Resistance to Government Control: The absence of a central point of control makes Bitcoin and other decentralized cryptocurrencies less susceptible to sanctions, capital controls, or other regulatory measures often implemented during trade conflicts. This characteristic enhances their appeal as a safe haven asset.

- Historical Performance During Uncertainty: While past performance is not indicative of future results, Bitcoin's historical performance during periods of economic uncertainty offers a compelling case study. Its value has often shown resilience, sometimes even increasing, during times of geopolitical turmoil. This suggests a potential flight to safety towards decentralized assets.

Increased Demand During Uncertainty

Periods of trade war uncertainty often trigger a "flight to safety," where investors move their capital from riskier assets to those perceived as more secure. Decentralized cryptocurrencies could benefit significantly from this behavior.

- Flight to Safety: Investors seeking shelter from the storm might increasingly view decentralized cryptocurrencies as a relatively safer alternative to volatile stocks, bonds, and national currencies. The perceived stability, compared to traditional markets deeply impacted by trade wars, could drive increased demand.

- Scarcity and Limited Supply: The inherent scarcity of many cryptocurrencies, especially Bitcoin with its fixed supply of 21 million coins, contributes to their perceived value and potential for price appreciation during times of uncertainty. This limited supply acts as a powerful counterbalance to potential market fluctuations.

Cryptocurrencies with Utility and Real-World Applications

Beyond decentralization, the practical applications of certain cryptocurrencies could enhance their performance during trade wars. These use cases offer additional reasons for investors to seek them out.

Stablecoins and their Role

Stablecoins, pegged to fiat currencies or other assets, provide a unique perspective. Their relative stability compared to volatile cryptocurrencies makes them an attractive option during periods of uncertainty.

- USDT and USDC Examples: Stablecoins such as Tether (USDT) and USD Coin (USDC), pegged to the US dollar, aim to maintain a stable value, minimizing the volatility associated with other cryptocurrencies. This stability can be appealing to investors seeking to avoid the risks inherent in more volatile assets.

- Facilitating Cross-Border Transactions: Stablecoins can potentially play a crucial role in facilitating cross-border transactions, bypassing some of the restrictions imposed during trade wars. Their use could become increasingly important as traditional payment systems face disruptions.

Privacy Coins and Circumventing Sanctions

Privacy-focused cryptocurrencies, designed to enhance transaction anonymity, might also see increased use during trade wars. However, this comes with important caveats.

- Circumventing Trade Restrictions: The ability of privacy coins like Monero (XMR) or Zcash (ZEC) to obscure transaction details could make them attractive to those seeking to circumvent trade restrictions or sanctions. It's important to note, however, that this use case raises significant ethical and legal concerns.

- Ethical and Regulatory Implications: The use of privacy coins to evade sanctions or engage in illicit activities is a significant concern. Regulations surrounding their use are likely to evolve and tighten in response to such activities. Investors should be fully aware of the potential legal ramifications before considering such investments.

Market Sentiment and Investor Behavior

Market sentiment plays a pivotal role in shaping cryptocurrency prices, and trade wars significantly influence this sentiment.

Fear, Uncertainty, and Doubt (FUD)

Trade wars often amplify "fear, uncertainty, and doubt" (FUD), potentially leading to a sell-off across various asset classes, including cryptocurrencies.

- Risk-Off Sentiment: A risk-off sentiment, where investors withdraw from riskier investments, could negatively impact even the most promising cryptocurrencies. The overall market downturn can overshadow the unique qualities of individual coins.

- Relative Risk Perception: However, some cryptocurrencies might be perceived as less risky than others during such times. For example, decentralized and established cryptocurrencies with a proven track record might withstand the storm better than newer, less-established projects.

Predicting Market Trends

Predicting the cryptocurrency market's response to trade wars is challenging due to the market's inherent volatility and the complex interplay of factors.

- Diversification and Due Diligence: It's crucial to diversify your cryptocurrency portfolio, spreading investments across different projects to minimize risk. Thorough research and due diligence are essential before investing in any cryptocurrency.

- No Guarantees: No cryptocurrency guarantees success during a trade war. Understanding the unique attributes of different assets and maintaining a balanced, diversified portfolio is paramount to managing risk effectively.

Conclusion

While no single cryptocurrency offers a foolproof guarantee of outperformance during a trade war, certain characteristics might increase their resilience. Decentralized cryptocurrencies like Bitcoin could act as safe havens, while stablecoins might offer transactional stability. However, the impact of overall market sentiment cannot be overstated. Thorough research, careful risk assessment, and diversification are key to navigating the complex landscape of cryptocurrencies during periods of global economic uncertainty. Before investing, carefully research which cryptocurrency could outperform during a trade war to best align your investment strategy with your risk tolerance.

Featured Posts

-

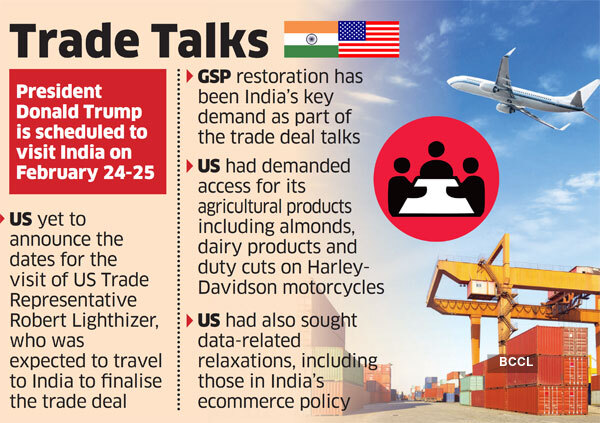

Upcoming India Us Talks Focus On Bilateral Trade Deal

May 09, 2025

Upcoming India Us Talks Focus On Bilateral Trade Deal

May 09, 2025 -

The Whats App Spyware Case Metas 168 Million Defeat And Ongoing Challenges

May 09, 2025

The Whats App Spyware Case Metas 168 Million Defeat And Ongoing Challenges

May 09, 2025 -

He Morgan Brother And High Potential Investigating Davids True Identity

May 09, 2025

He Morgan Brother And High Potential Investigating Davids True Identity

May 09, 2025 -

Trump Appoints Casey Means A Leader In The Maha Movement As Surgeon General

May 09, 2025

Trump Appoints Casey Means A Leader In The Maha Movement As Surgeon General

May 09, 2025 -

Nyt Strands Hints And Answers Friday March 14 Game 376

May 09, 2025

Nyt Strands Hints And Answers Friday March 14 Game 376

May 09, 2025