Who Will Succeed Warren Buffett? A Look At Potential Canadian Candidates

Table of Contents

Evaluating Potential Candidates: Key Traits of a Buffett Successor

Finding a successor to Warren Buffett is a monumental task. His unique blend of investment genius, business acumen, and ethical leadership is almost unparalleled. To even approach filling his shoes, a candidate must possess several key traits:

- Long-term investment vision: A deep understanding of long-term value creation, resisting short-term market pressures, and focusing on fundamental analysis is paramount. This echoes Buffett's legendary patience and long-term perspective.

- Value investing expertise: Proficiency in identifying undervalued assets, conducting thorough due diligence, and patiently waiting for market inefficiencies to correct is essential. A candidate needs to embody the core principles of value investing, a cornerstone of Buffett's success.

- Exceptional leadership: Managing a vast conglomerate like Berkshire Hathaway requires exceptional leadership skills, including talent acquisition, strategic decision-making, and fostering a positive corporate culture.

- Strong ethical compass: Buffett's reputation is built on integrity and ethical business practices. His successor must share this commitment to responsible investing and corporate governance.

- Understanding of diverse industries: Berkshire Hathaway's holdings span numerous sectors. A successful successor needs a broad understanding of various industries and the ability to identify profitable opportunities across different markets.

Bullet points summarizing essential qualities:

- Proven track record of successful value investing

- Deep understanding of financial markets and economic trends

- Exceptional leadership and management skills

- Commitment to ethical and responsible investing

- Ability to identify undervalued assets and long-term growth opportunities

Prominent Canadian Investment Leaders: A Closer Look

Canada boasts a strong pool of investment talent. While no one perfectly mirrors Buffett, several prominent figures exhibit characteristics that make them potential contenders for a Warren Buffett successor Canada role, albeit indirectly:

Mark Wiseman – A Deep Dive

Mark Wiseman, a prominent figure in Canadian finance, has a long and distinguished career. His experience at BlackRock and the Canada Pension Plan Investment Board (CPPIB) showcases his ability to manage significant assets and achieve strong returns. His investment philosophy aligns with many aspects of value investing, though perhaps with a slightly more active approach than Buffett's. While his style isn't an exact match, his leadership skills and proven track record make him a relevant figure in the discussion surrounding a potential Warren Buffett successor Canada.

Kevin O'Leary – A Deep Dive

Known for his outspoken personality on "Shark Tank," Kevin O'Leary is a successful Canadian entrepreneur and investor. His focus on due diligence and risk management aligns with value investing principles. However, his investment style, often involving more short-term plays and leveraged positions, differs significantly from Buffett's patient, long-term approach. While his business acumen is undeniable, his suitability as a Warren Buffett successor Canada is debatable due to this fundamental difference in investment philosophy.

(Note: Additional profiles of other prominent Canadian investment leaders could be included here, following the same format.)

The Challenges of Replacing an Icon: Succession Planning at Berkshire Hathaway

Replacing Warren Buffett presents immense challenges. His unique combination of investment skills, business acumen, and personal brand is hard to replicate. The scale of Berkshire Hathaway's operations further complicates the succession planning process.

Bullet points highlighting the difficulties:

- The sheer size and complexity of Berkshire Hathaway's portfolio, encompassing a vast array of businesses.

- The legendary status and reputation of Warren Buffett himself, which is deeply intertwined with the company's brand and success.

- The need for a successor who shares Buffett's vision for long-term value creation and ethical business practices.

- The possibility of internal candidates within Berkshire Hathaway itself eventually stepping up to fill the role.

Beyond the Obvious: Untapped Canadian Talent

While focusing on established figures is important, we should also consider less prominent but potentially highly capable Canadian investment professionals. The future of finance often rests on emerging talent.

Bullet points emphasizing the importance of diverse perspectives:

- Focusing on emerging talent in Canadian finance, including those working in smaller firms or with less public recognition.

- Highlighting the importance of considering diverse backgrounds and perspectives to broaden the potential pool of successors.

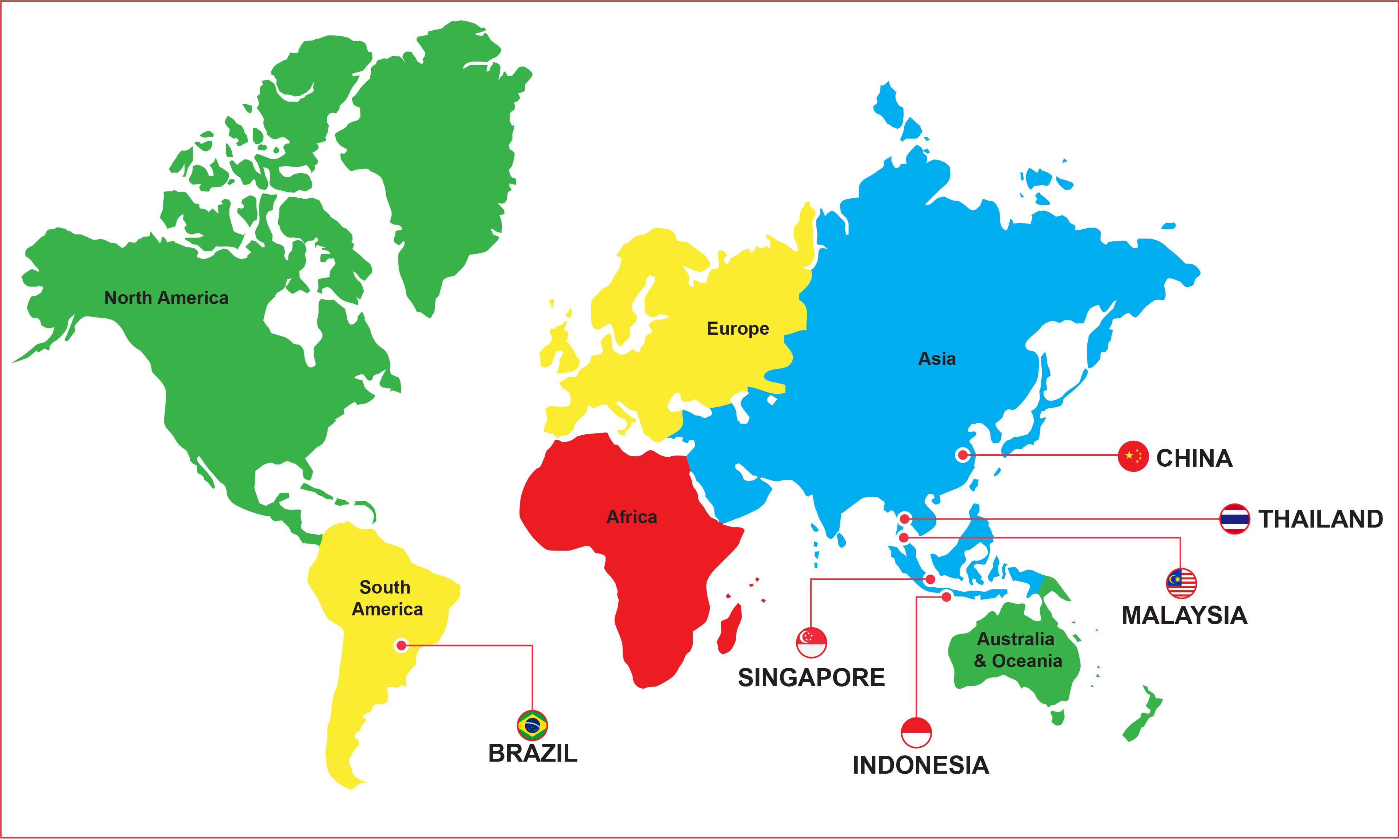

- Discussing the potential for future Canadian leaders to assume prominent roles not just in Canadian finance but in global finance as well.

Conclusion

Finding a successor to Warren Buffett is a daunting task. The sheer scale of Berkshire Hathaway, combined with Buffett's unique legacy, presents significant hurdles. While the Canadian investment landscape offers several potential candidates, each presents a unique set of strengths and weaknesses when compared to the Oracle of Omaha. The search for a Warren Buffett successor Canada presents a significant challenge, but the country boasts considerable talent in the investment world. While predicting the future is impossible, analyzing potential candidates provides valuable insight. Stay informed about developments in the Canadian investment landscape and continue to explore the potential Warren Buffett successors Canada may produce in the years to come. Further research into these individuals and other rising stars in the Canadian finance sector will be crucial in understanding the future leadership of global finance.

Featured Posts

-

Executive Orders Under Trump How Transgender People Were Affected

May 10, 2025

Executive Orders Under Trump How Transgender People Were Affected

May 10, 2025 -

Incredibly Dangerous Months Of Warnings Preceded Latest Newark Air Traffic Control Outage

May 10, 2025

Incredibly Dangerous Months Of Warnings Preceded Latest Newark Air Traffic Control Outage

May 10, 2025 -

Thailands Transgender Community A Fight For Equality In The News

May 10, 2025

Thailands Transgender Community A Fight For Equality In The News

May 10, 2025 -

Letartoztattak Egy Transznemu Not Floridaban A Noi Mosdo Hasznalataert

May 10, 2025

Letartoztattak Egy Transznemu Not Floridaban A Noi Mosdo Hasznalataert

May 10, 2025 -

Uncovering The Truth Does Us Funding Support Transgender Mouse Research

May 10, 2025

Uncovering The Truth Does Us Funding Support Transgender Mouse Research

May 10, 2025

Latest Posts

-

The Edmonton Unlimited Strategy Tech Innovation For Global Reach

May 10, 2025

The Edmonton Unlimited Strategy Tech Innovation For Global Reach

May 10, 2025 -

Growing Edmontons Tech Ecosystem The Unlimited Strategys Impact

May 10, 2025

Growing Edmontons Tech Ecosystem The Unlimited Strategys Impact

May 10, 2025 -

Edmontons Unlimited Potential A New Strategy For Global Tech Innovation

May 10, 2025

Edmontons Unlimited Potential A New Strategy For Global Tech Innovation

May 10, 2025 -

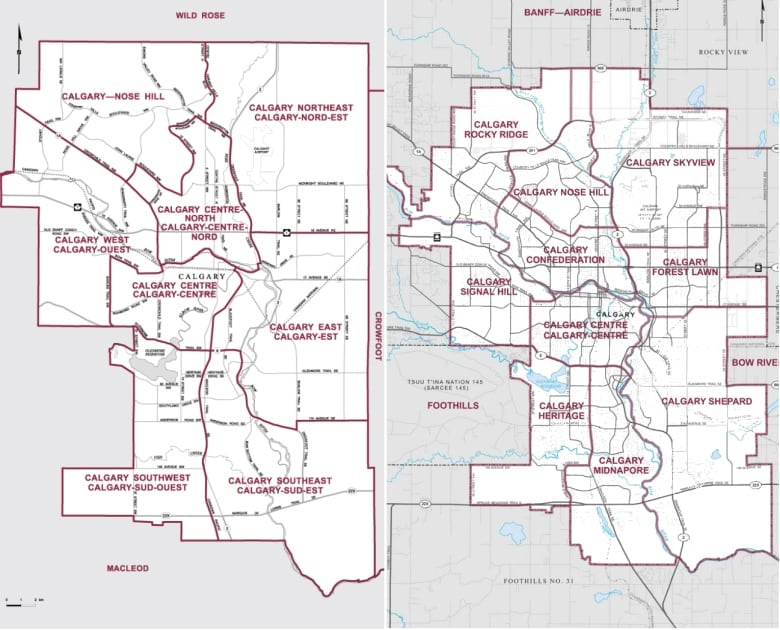

New Federal Ridings In Edmonton Implications For The Upcoming Election

May 10, 2025

New Federal Ridings In Edmonton Implications For The Upcoming Election

May 10, 2025 -

Scaling Tech And Innovation In Edmonton The Unlimited Strategy

May 10, 2025

Scaling Tech And Innovation In Edmonton The Unlimited Strategy

May 10, 2025