Why BCE Inc. Reduced Its Dividend: A Detailed Analysis For Investors

Table of Contents

BCE Inc.'s Financial Performance and Debt Levels

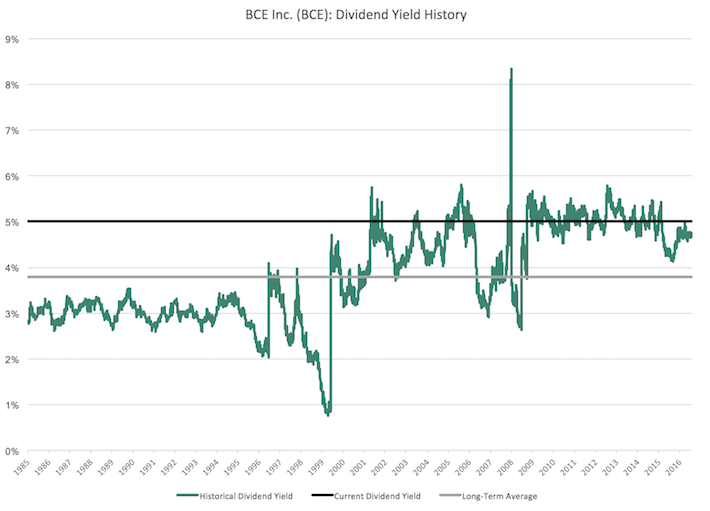

Understanding BCE Inc.'s financial position is crucial to comprehending the dividend reduction. A thorough examination of its recent financial statements reveals a complex picture. While BCE Inc. remains a profitable company, several key metrics highlight potential constraints on its dividend payout capacity.

-

High Debt-to-Equity Ratio: BCE Inc.'s debt-to-equity ratio has [Insert Specific Number and Percentage] in recent quarters, exceeding industry averages [Insert Industry Average and Source]. This indicates a relatively high level of financial leverage.

-

Impact of Interest Rate Hikes: Rising interest rates significantly increase the cost of servicing BCE Inc.'s debt, reducing the free cash flow available for dividend payments and share buybacks. The increased interest expense directly impacts the company's profitability and ability to maintain its previous dividend.

-

Declining Free Cash Flow: Free cash flow, a critical metric for dividend sustainability, has shown [Insert Trend - e.g., a downward trend or specific numbers] in recent periods. This suggests a reduced capacity to support the previous dividend payout. A comparison to previous years and industry benchmarks will provide valuable context.

Increased Capital Expenditures and Investment in Infrastructure

BCE Inc.'s substantial investments in infrastructure upgrades are a major factor influencing its decision. The company is heavily committed to expanding its 5G network and fiber optic capabilities, requiring significant capital expenditure (CAPEX).

-

5G Network Rollout: The ambitious rollout of BCE Inc.'s 5G network involves substantial upfront costs for equipment, infrastructure deployment, and network optimization. [Insert estimated costs or ranges].

-

Fiber Optic Expansion: The expansion of its fiber optic network, crucial for providing high-speed internet access, also represents a considerable financial commitment. This long-term investment is expected to significantly enhance BCE's competitive positioning, but it strains short-term profitability and impacts the ability to sustain a high dividend payout.

-

Long-Term Growth Strategy: While these investments might negatively impact short-term dividends, they are crucial for BCE Inc.'s long-term growth and competitiveness in the evolving telecom market. They are positioning the company for future revenue growth and market dominance.

Competitive Landscape and Market Challenges

The Canadian telecom industry is fiercely competitive, with several major players vying for market share. BCE Inc. faces considerable challenges, including intense competition on pricing and regulatory pressures.

-

Intense Competition: Competitors such as [List Key Competitors] are aggressively vying for market share, putting pressure on BCE Inc.'s pricing strategies and profitability.

-

Regulatory Scrutiny: The Canadian telecommunications industry operates under a complex regulatory environment. Regulatory changes and potential fines could significantly impact BCE Inc.'s profitability and available funds for dividends.

-

Pricing Pressures: The competitive landscape compels BCE Inc. to maintain competitive pricing, which can squeeze profit margins and affect the company's ability to maintain its dividend at previous levels.

Management's Rationale and Future Outlook

BCE Inc.'s management has clearly stated its reasons for the dividend reduction [Insert direct quotes from press releases or investor presentations]. These statements emphasize the need to prioritize investments in infrastructure to ensure long-term competitiveness and growth.

-

Prioritizing Long-Term Growth: Management likely views the reduced dividend as a necessary strategic move to ensure the company's long-term financial health and sustainable growth.

-

Future Free Cash Flow Projections: [Insert projections, if available, and their source]. These projections should shed light on the expected timeline for restoring or increasing the dividend in the future. They will clarify how the company plans to balance infrastructure investment with shareholder returns.

-

Reinvestment for Future Dividends: Management aims to reinvest the funds previously allocated to dividends to strengthen the company's foundation, which is envisioned to lead to higher dividend payouts in the long run.

Conclusion: Understanding BCE Inc.'s Dividend Reduction and its Implications

The BCE Inc. dividend reduction is a complex issue stemming from a confluence of factors. High debt levels, significant capital expenditures for infrastructure upgrades, intense competition, and regulatory pressures all contributed to the decision. While the short-term impact on investors is negative, the long-term implications could be positive if the investments yield the anticipated returns. Understanding BCE's financial health and its strategic rationale behind the dividend reduction is paramount for investors evaluating their holdings and future investment decisions. Conduct further research, consult with your financial advisor, and make informed decisions regarding your investment in BCE Inc. stock, considering the updated BCE dividend policy and the BCE stock dividend implications for your portfolio and your overall BCE investor outlook.

Featured Posts

-

Conor Mc Gregors Recent Fox News Appearances A Comprehensive Overview

May 12, 2025

Conor Mc Gregors Recent Fox News Appearances A Comprehensive Overview

May 12, 2025 -

Could Happy Gilmore 2 Reignite Sandlers Comedy Career

May 12, 2025

Could Happy Gilmore 2 Reignite Sandlers Comedy Career

May 12, 2025 -

Ufc 315 Shevchenko Vs Fiorot Expert Predictions And Betting Analysis

May 12, 2025

Ufc 315 Shevchenko Vs Fiorot Expert Predictions And Betting Analysis

May 12, 2025 -

Appeals Court Upholds Ruling Against Trump In Alien Enemies Act Case

May 12, 2025

Appeals Court Upholds Ruling Against Trump In Alien Enemies Act Case

May 12, 2025 -

Bayern Munichs Home Win Mullers Farewell And Championship Celebration

May 12, 2025

Bayern Munichs Home Win Mullers Farewell And Championship Celebration

May 12, 2025