Why Current Stock Market Valuations Are Not A Cause For Alarm (According To BofA)

Table of Contents

BofA's Rationale: Focusing on Long-Term Growth Potential

BofA's market analysis emphasizes the importance of looking beyond short-term stock price fluctuations and focusing on long-term earnings growth. Their investment strategy prioritizes the underlying strength of companies and their potential for sustained growth, even amidst current market volatility.

- BofA's analysts emphasize the importance of focusing on long-term earnings growth rather than short-term price fluctuations. Instead of reacting to daily market swings, they advise investors to assess the fundamental health and future prospects of individual companies. This long-term view mitigates the impact of short-term market corrections.

- They highlight strong corporate earnings projections, suggesting sustained growth potential despite current valuation levels. Many sectors show strong projected earnings growth, supporting BofA's assertion that current valuations are sustainable. This is a key argument against the narrative of imminent market collapse.

- BofA cites specific sectors demonstrating robust earnings growth to support their claims. For instance, technology companies focused on cloud computing and artificial intelligence continue to show impressive growth trajectories, justifying relatively high valuations.

- They detail their methodology for projecting future earnings and assessing valuation multiples. BofA uses sophisticated models incorporating various economic indicators and industry-specific factors to forecast earnings and assess whether market multiples reflect realistic expectations.

- They argue that current valuations are justified by anticipated future earnings growth. This is the core of BofA's argument: current stock prices, even with high price-to-earnings ratios (P/E), are supported by the expectation of future growth in earnings.

Addressing Concerns about High Price-to-Earnings Ratios (P/E)

A common concern among investors is the elevated price-to-earnings ratio (P/E) of many stocks. The P/E ratio is a valuation metric that compares a company's stock price to its earnings per share. High P/E ratios often signal that a stock is expensive relative to its earnings.

- Explains what P/E ratios are and how they are used to assess valuations. The P/E ratio is a crucial tool for evaluating whether a stock is overvalued or undervalued. It compares the current market price to the company's earnings, giving an indication of how much investors are willing to pay for each dollar of earnings.

- Acknowledges that high P/E ratios are a common concern among investors. BofA recognizes the validity of this concern and addresses it directly in their analysis. However, they don't view high P/E ratios as an automatic red flag.

- BofA counters this concern by emphasizing the influence of low interest rates on valuation multiples. Low interest rates make borrowing cheaper, which can support higher stock valuations. When interest rates are low, investors are willing to pay more for future earnings.

- They point to historical data demonstrating that high P/E ratios haven't always been followed by significant market corrections. Historical data reveals instances where high P/E ratios persisted without leading to immediate market crashes. This underscores the importance of looking beyond simplistic metrics.

- They differentiate between sectors with high P/E ratios and those with more reasonable multiples. BofA recognizes that P/E ratios vary significantly across sectors. Some high-growth sectors may naturally command higher P/E multiples than more mature industries.

The Role of Interest Rates in Stock Market Valuations

Interest rates play a crucial role in shaping stock market valuations. There's an inverse relationship between interest rates and stock valuations.

- Explains the inverse relationship between interest rates and stock valuations. Lower interest rates generally lead to higher stock valuations because they reduce the discount rate used to calculate the present value of future earnings. Conversely, higher interest rates tend to depress stock valuations.

- Details how low interest rates can support higher valuation multiples. When interest rates are low, investors are less inclined to invest in bonds, which offer lower yields, and more inclined to invest in stocks, driving up prices and valuation multiples.

- BofA’s perspective on the current and future interest rate environment. BofA's analysis considers the current interest rate environment and its projected trajectory, factoring this crucial element into their valuation assessments.

- Impact of low interest rates on the attractiveness of equities relative to bonds. Low interest rates increase the relative attractiveness of equities compared to bonds, which influences stock prices and market valuations.

Considering Macroeconomic Factors and Their Impact

Macroeconomic factors, such as economic growth, inflation, and geopolitical risks, significantly influence stock market valuations.

- Addresses potential macroeconomic risks and their impact on the stock market. BofA's analysis accounts for various macroeconomic risks, including potential recessions and inflationary pressures.

- Explains how BofA's analysis incorporates these factors into their valuation assessments. Their models include variables reflecting economic growth, inflation expectations, and geopolitical uncertainty, ensuring a comprehensive view of the market.

- BofA's view on inflation and its potential effects on stock valuations. BofA examines the current inflation rate and its potential impact on corporate earnings and profit margins, ultimately influencing their valuation assessments.

- Their assessment of the likelihood of a recession and its impact on corporate earnings. They assess the probability of a recession and its potential consequences for corporate earnings and stock prices.

- How geopolitical risks are factored into their analysis. Geopolitical uncertainties, such as trade wars or international conflicts, are incorporated into their models to assess their potential impact on market valuations.

Conclusion

Bank of America's comprehensive analysis suggests that while current stock market valuations may seem high based on certain metrics like P/E ratios, the long-term growth potential of numerous companies justifies these levels. By considering long-term earnings growth, the impact of interest rates, and potential macroeconomic risks, BofA provides a balanced and reasoned perspective. Their analysis suggests that current valuations aren't necessarily a cause for immediate alarm, especially for investors with a long-term horizon.

Call to Action: Understand the nuances of current stock market valuations. Don't let short-term market fluctuations or sensationalized headlines dictate your investment strategy. Learn more about BofA's insights and develop a well-informed approach to investing. Consider consulting with a financial advisor to tailor an investment strategy that aligns with your specific financial goals and risk tolerance before making any investment decisions.

Featured Posts

-

Decouvrez Le Festival De La Camargue A Port Saint Louis Du Rhone

May 31, 2025

Decouvrez Le Festival De La Camargue A Port Saint Louis Du Rhone

May 31, 2025 -

La Rental Market Exploited After Fires Report Highlights Price Gouging

May 31, 2025

La Rental Market Exploited After Fires Report Highlights Price Gouging

May 31, 2025 -

Stock Market Summary Dow S And P 500 Data For May 30

May 31, 2025

Stock Market Summary Dow S And P 500 Data For May 30

May 31, 2025 -

Comprehensive April Outlook Update Latest Information

May 31, 2025

Comprehensive April Outlook Update Latest Information

May 31, 2025 -

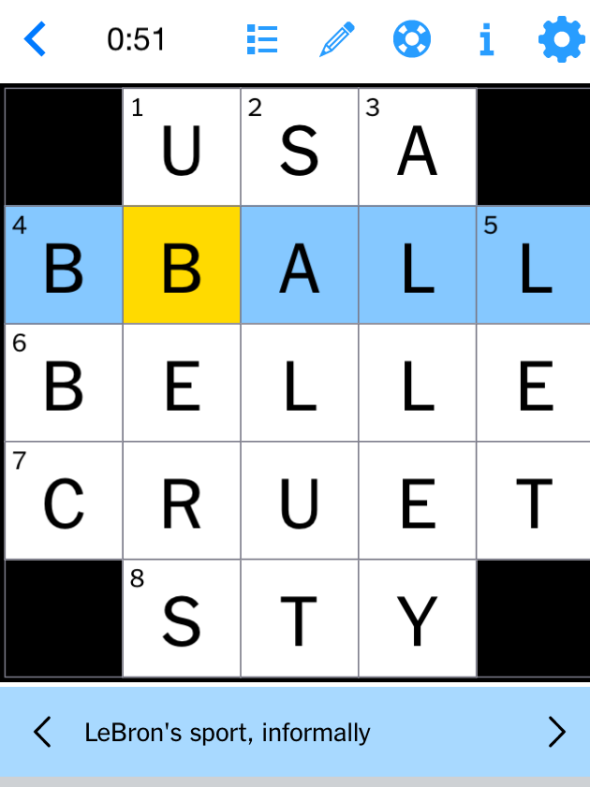

Todays Nyt Mini Crossword Answers March 18 2025

May 31, 2025

Todays Nyt Mini Crossword Answers March 18 2025

May 31, 2025