Why Current Stock Market Valuations Are Not A Red Flag: A BofA Analysis

Table of Contents

BofA's Methodology and Data Sources

BofA's analysis of stock market valuations employs a multifaceted approach, drawing on a range of metrics and data sources to provide a comprehensive assessment. Their methodology goes beyond simple price-to-earnings (P/E) ratios, incorporating a broader range of valuation metrics to paint a more complete picture.

-

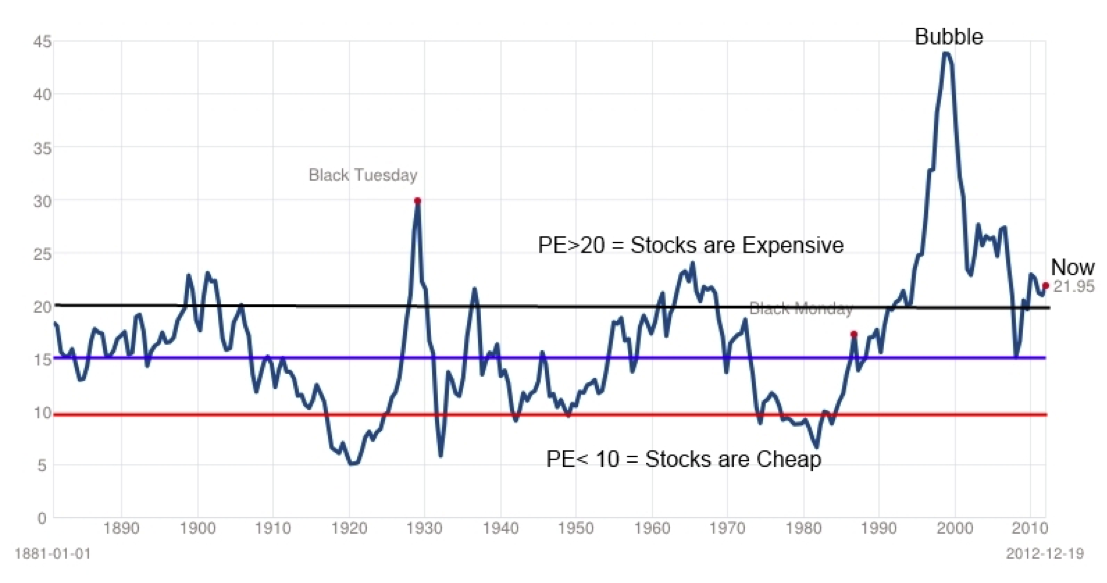

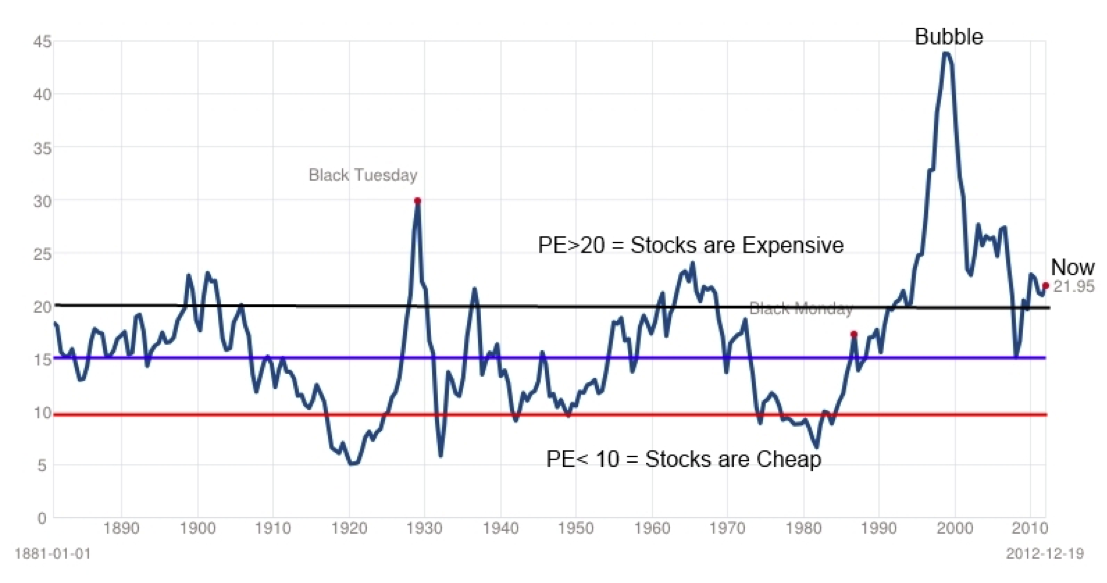

Metrics Used: BofA utilizes a combination of forward P/E ratios (estimating earnings over the next 12 months), cyclically adjusted price-to-earnings (CAPE) ratios (adjusting for economic cycles), and price-to-sales ratios to gauge valuations across various sectors and market indices. They also incorporate discounted cash flow (DCF) models for a more in-depth, long-term valuation assessment of individual companies.

-

Data Sources: The analysis relies heavily on company-reported financial statements, ensuring accuracy and transparency. Furthermore, BofA incorporates macroeconomic indicators such as interest rates, inflation data, and GDP growth projections to provide context for their valuation assessments. They draw upon extensive proprietary databases and publicly available information to ensure a robust and well-rounded analysis.

-

Specifics of the Analysis: BofA's analysis typically encompasses major market indices like the S&P 500, as well as sector-specific analyses, allowing for granular insights into the valuation landscape. They often highlight specific sectors showing strong growth potential, counterbalancing concerns about overall market valuation levels. A unique aspect of their methodology is the incorporation of qualitative factors alongside quantitative data, providing a more holistic understanding of the market.

Factors Justifying Current Valuations

BofA's analysis identifies several key factors that help justify the current, seemingly high, stock market valuations. These factors, when considered in conjunction, paint a picture that is far less alarming than headlines might suggest.

-

Strong Corporate Earnings Growth: Many companies have exceeded earnings expectations, demonstrating robust profitability and underlying strength in the economy. This is reflected in the strong revenue growth reported across various sectors. For example, the technology sector has shown impressive earnings growth fueled by the ongoing digital transformation.

-

Low Interest Rates: Persistently low interest rates make borrowing cheaper for businesses and consumers, fostering investment and economic expansion. Lower interest rates also decrease the discount rate used in DCF models, leading to higher present values and, consequently, higher valuations.

-

Technological Innovation: Continuous technological advancements are driving productivity growth and creating new opportunities for businesses. This innovation fuels future growth prospects, supporting higher valuations for companies positioned to capitalize on these trends. The rise of AI and its application across various industries is a prime example of this driver.

-

Positive Economic Outlook (Supported by Indicators): While uncertainties always exist, BofA's analysis often incorporates positive economic indicators such as employment figures and consumer spending, suggesting a healthy economic backdrop that justifies the current market valuations. Sustained GDP growth, albeit at a potentially slower pace than previous years, helps support this positive outlook.

Addressing Common Valuation Concerns

While BofA's analysis suggests current stock market valuations are not overly alarming, it acknowledges common investor concerns. Addressing these concerns directly is crucial for a balanced perspective.

-

Refuting Bubble Arguments: BofA typically counters bubble arguments by highlighting the underlying strength of the economy and the sustained, albeit potentially slower, growth in corporate earnings. They use historical data to contextualize current valuations, demonstrating that they are not unprecedented relative to other periods of economic expansion.

-

Addressing Sector-Specific Overvaluation Concerns: The analysis typically breaks down valuations by sector, acknowledging that some sectors might be more richly valued than others. However, BofA counters concerns by demonstrating the specific growth drivers and future potential of these sectors, suggesting that higher valuations are justified in some instances.

-

Distinguishing Justified High Valuations from Unsustainable Bubbles: BofA's analysis emphasizes the importance of differentiating between high valuations driven by strong fundamentals (earnings growth, innovation) and unsustainable bubbles driven by speculation and irrational exuberance. Their comprehensive approach allows them to make these crucial distinctions.

BofA's Investment Recommendations Based on the Analysis

Based on their valuation analysis, BofA often provides sector-specific investment recommendations and an overall market outlook. These recommendations are directly linked to the key findings outlined above.

-

Recommended Sectors: Historically, BofA's recommendations have often included sectors positioned to benefit from technological innovation and long-term economic growth, such as technology and healthcare.

-

Investment Strategies: The investment strategies recommended may vary depending on the market conditions and specific findings of the analysis. However, a balanced approach that considers both growth and value investing is often suggested.

-

Risk Assessment and Mitigation: BofA emphasizes the importance of risk management, suggesting diversification strategies and appropriate risk tolerance levels for individual investors. Their recommendations are never presented as guaranteed returns but rather as informed investment approaches based on their analysis.

Conclusion: Why Current Stock Market Valuations Are Not a Red Flag: Key Takeaways and Call to Action

In summary, BofA's analysis suggests that while current stock market valuations may seem high, they are not necessarily a red flag signaling an imminent crash. Strong corporate earnings growth, low interest rates, technological innovation, and a generally positive economic outlook (supported by various key economic indicators) all contribute to a more nuanced understanding of the current market landscape. The analysis highlights the importance of distinguishing between justified high valuations based on strong fundamentals and unsustainable bubbles driven by speculation.

Don't let fear of high stock market valuations cloud your judgment. Review BofA's comprehensive analysis (link to BofA's report, if available) to make informed decisions about your investment portfolio and understand why current stock market valuations are not necessarily a cause for concern. A deeper understanding of the factors influencing these valuations can lead to a more robust and successful investment strategy. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

The Untold Story Of A U S Nuclear Base Beneath Greenlands Ice

May 16, 2025

The Untold Story Of A U S Nuclear Base Beneath Greenlands Ice

May 16, 2025 -

Official Dodgers Add Inf Hyeseong Kim To Mlb Roster

May 16, 2025

Official Dodgers Add Inf Hyeseong Kim To Mlb Roster

May 16, 2025 -

Find Affordable Boston Celtics Finals Gear Under 20

May 16, 2025

Find Affordable Boston Celtics Finals Gear Under 20

May 16, 2025 -

Israel Strikes Hamas Leader Mohammed Sinwar In Gaza

May 16, 2025

Israel Strikes Hamas Leader Mohammed Sinwar In Gaza

May 16, 2025 -

Foot Locker Inc Announces New Global Headquarters In St Pete

May 16, 2025

Foot Locker Inc Announces New Global Headquarters In St Pete

May 16, 2025