Why Did Canadian Tire Buy Hudson's Bay? Understanding The Merger

Table of Contents

Strategic Expansion and Diversification for Canadian Tire

The acquisition of Hudson's Bay represents a bold move for Canadian Tire, allowing for significant expansion beyond its traditional automotive parts, hardware, and sporting goods core business. This strategic acquisition allows Canadian Tire to diversify its revenue streams and tap into new market segments. The "Canadian Tire and Hudson's Bay merger" offers several key advantages:

- Access to a High-End Customer Base: Hudson's Bay caters to a more affluent clientele than Canadian Tire's typical customer base. This opens doors to new luxury goods markets and allows Canadian Tire to expand its brand reach into a previously untapped demographic.

- Retail Diversification: The merger reduces Canadian Tire's dependence on the automotive and hardware sectors, which can be cyclical. This "retail diversification" strategy mitigates risk and provides greater stability during economic downturns.

- Synergy and Brand Integration: The potential for synergy between the two brands is substantial. Integrating their supply chains, marketing efforts, and customer loyalty programs could lead to significant operational efficiencies.

This strategic move demonstrates Canadian Tire's ambition to become a dominant player in the broader "Canadian retail market," embracing a more diversified approach to retail business.

Real Estate Value: A Key Driver in the Canadian Tire Hudson's Bay Deal

A significant driver behind the "Canadian Tire buying Hudson's Bay" deal is the immense value of Hudson's Bay's prime real estate portfolio. This "real estate investment" aspect is crucial to understanding the long-term strategy. The prime commercial real estate holdings in major Canadian cities represent a substantial asset with significant potential for future growth.

- Redevelopment and Rental Income: Canadian Tire can redevelop Hudson's Bay's existing properties, potentially increasing rental income significantly. This provides a robust and consistent revenue stream beyond retail sales.

- Mixed-Use Developments: The opportunity to integrate Canadian Tire's retail offerings into mixed-use developments on Hudson's Bay's land is particularly appealing. This could create synergistic retail environments and enhance overall property values.

- Long-Term Investment Strategy: The "property development" potential offers a long-term investment strategy focused on real estate appreciation, providing a stable foundation for future growth and profitability. This makes the "Canadian Tire and Hudson's Bay merger" a sound long-term investment.

Synergies and Operational Efficiency in the Post-Merger Landscape

The "Canadian Tire and Hudson's Bay merger" presents significant opportunities for operational efficiency and synergy. By combining operations, both companies can leverage shared resources and streamline processes.

- Cost Savings: Combined logistics and distribution networks could lead to substantial cost savings through reduced transportation costs and optimized inventory management.

- Supply Chain Management: Streamlining the supply chain will enhance efficiency and responsiveness to market demands, improving overall profitability.

- Enhanced Marketing Reach: Combining marketing expertise and customer databases can create more targeted and effective marketing campaigns, increasing brand awareness and customer engagement. The "synergy benefits" from this integration are considerable.

Challenges and Potential Risks of the Canadian Tire Hudson's Bay Merger

While the potential benefits of the "Canadian Tire and Hudson's Bay merger" are substantial, several challenges and risks need careful consideration.

- Integration Difficulties: Merging two distinct retail brands with different customer bases, product offerings, and operational structures will be complex and potentially challenging. "Merger integration" requires careful planning and execution.

- Brand Dilution: There's a risk of brand dilution if the integration isn't handled effectively. Careful consideration must be given to maintaining the distinct identities of both brands while leveraging their respective strengths.

- Regulatory Hurdles and Antitrust Concerns: The merger may face scrutiny from regulatory bodies concerning potential antitrust issues. Navigating these "antitrust regulations" successfully will be crucial.

The Future of the Canadian Tire and Hudson's Bay Merger

The "Canadian Tire and Hudson's Bay merger" is driven by a strategic vision of expansion, a lucrative real estate investment, and the potential for substantial synergies. While risks exist, particularly regarding "merger integration" and brand management, the potential rewards are significant. Successfully navigating the challenges will be crucial for realizing the full potential of this ambitious retail venture. The long-term success of this combined retail giant remains to be seen.

What are your thoughts on the future of this combined retail giant? Do you think this merger will be successful? Share your predictions on the "Canadian Tire and Hudson's Bay merger" in the comments below!

Featured Posts

-

Jannik Sinners Italian Open Outlook Following Doping Ban Announcement

May 28, 2025

Jannik Sinners Italian Open Outlook Following Doping Ban Announcement

May 28, 2025 -

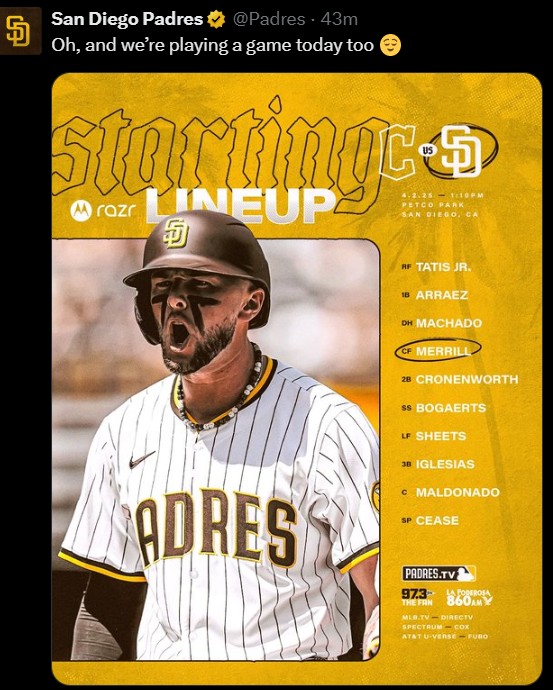

Nl West 2024 Dodgers And Padres Unbeaten Start

May 28, 2025

Nl West 2024 Dodgers And Padres Unbeaten Start

May 28, 2025 -

Car Dealerships Renew Pushback Against Electric Vehicle Regulations

May 28, 2025

Car Dealerships Renew Pushback Against Electric Vehicle Regulations

May 28, 2025 -

Cuaca Hari Ini And Besok Di Kalimantan Timur Ikn Balikpapan Samarinda

May 28, 2025

Cuaca Hari Ini And Besok Di Kalimantan Timur Ikn Balikpapan Samarinda

May 28, 2025 -

Chainalysis And Alterya Merge A New Era In Blockchain Technology

May 28, 2025

Chainalysis And Alterya Merge A New Era In Blockchain Technology

May 28, 2025