Why Did CoreWeave (CRWV) Stock Price Increase On Wednesday?

Table of Contents

Positive Financial News and Earnings Reports

CoreWeave's stock price increase on Wednesday was likely significantly influenced by positive financial news and strong earnings reports. Let's break down the key contributing factors:

Strong Q[Quarter] Earnings Beat Expectations

- Exceeded Revenue Projections: CoreWeave likely announced revenue significantly higher than analysts' predictions. For example, they might have reported a 50% year-over-year growth, exceeding the projected 40%. (Note: Replace with actual numbers if available from the official report).

- Strong Growth in Key Metrics: The report likely showcased strong growth in several key performance indicators (KPIs). These could include:

- A substantial increase in customer acquisition, showcasing strong market demand for their services.

- High data center utilization rates, indicating efficient resource management and high demand.

- Improved margins, indicating increased profitability.

- Access the Official Report: For detailed information and exact figures, refer to the official CoreWeave earnings report [insert link to report here].

Upbeat Future Guidance

CoreWeave’s management likely provided optimistic guidance for upcoming quarters. This positive outlook signals confidence in future growth and profitability. Key aspects contributing to the positive guidance could include:

- New Contracts and Partnerships: Securing significant new contracts with major clients in the AI and cloud computing sectors would bolster investor confidence.

- Expansion Plans: Announcements of new data center expansions or investments in infrastructure would demonstrate commitment to scaling operations to meet growing demand. This could involve expanding to new geographic regions or increasing processing power.

Industry-Wide Tailwinds Boosting CRWV

The overall positive sentiment in the cloud computing and AI sectors also played a crucial role in the CoreWeave (CRWV) stock price surge.

The Growing Demand for AI and Cloud Computing

The current technological landscape is experiencing exponential growth in the demand for AI and cloud computing resources. This is driven by several factors:

- Increased AI Adoption: Businesses across various industries are increasingly relying on AI for tasks such as data analysis, automation, and machine learning. This requires significant cloud infrastructure.

- CoreWeave's Specialized Infrastructure: CoreWeave specializes in providing high-performance computing resources tailored to the demanding needs of AI workloads, placing them in a strong position to benefit from this growth.

- Competitive Landscape: While CoreWeave faces competition from established players like AWS, Azure, and Google Cloud, its specialized focus on AI infrastructure provides a niche advantage.

Strategic Partnerships and Investments

Strategic partnerships and investments can significantly impact a company's stock price. For CoreWeave, such developments could include:

- Technology Collaborations: Partnerships with leading AI software providers or hardware manufacturers enhance their offerings and broaden their reach.

- Investment Rounds: Successful fundraising rounds demonstrate investor confidence and provide resources for expansion and innovation. (Link to press releases announcing partnerships or investments should be included here).

Market Sentiment and Investor Confidence

Positive market sentiment and investor confidence are essential drivers of stock price movements.

Positive Analyst Ratings and Upgrades

Upgrades from financial analysts significantly influence investor perception. For example:

- Price Target Increases: Analysts may have raised their price targets for CRWV stock based on the strong performance and positive outlook.

- Buy Ratings: Positive ratings from reputable analysts encourage buying, increasing demand and driving up the price. (Include specific examples of analyst ratings and price targets here).

- Tech Sector Sentiment: A generally positive sentiment towards the technology sector also benefits companies like CoreWeave.

Increased Trading Volume and Short Covering

Increased trading volume can be a strong indicator of market interest.

- High Trading Activity: A sharp increase in CRWV trading volume on Wednesday suggests strong buying pressure.

- Short Covering: Investors who had bet against CoreWeave (short selling) might have covered their positions, buying shares to limit potential losses, further contributing to the price increase. (Charts or graphs illustrating trading volume would be beneficial here).

Conclusion

The CoreWeave (CRWV) stock price increase on Wednesday can be attributed to a combination of factors, including strong financial performance, positive industry trends, and a boost in investor confidence. Strong earnings, positive future guidance, and the growing demand for AI and cloud computing all contributed to this surge. Furthermore, positive analyst sentiment and potential short covering played a significant role.

Call to Action: Understanding the reasons behind CoreWeave's (CRWV) stock price movements is crucial for informed investment decisions. Stay updated on the latest news and analysis concerning CoreWeave and other key players in the cloud computing and AI infrastructure markets. Continue to research CoreWeave (CRWV) to make well-informed decisions about your investment strategy. Remember to conduct thorough due diligence before making any investment decisions.

Featured Posts

-

Senat S Sh A Ta Lindsi Grem Posilennya Tisku Na Rosiyu Cherez Sanktsiyi

May 22, 2025

Senat S Sh A Ta Lindsi Grem Posilennya Tisku Na Rosiyu Cherez Sanktsiyi

May 22, 2025 -

Cong Dung Cua Hai Lo Vuong Nho Tren Dau Noi Usb

May 22, 2025

Cong Dung Cua Hai Lo Vuong Nho Tren Dau Noi Usb

May 22, 2025 -

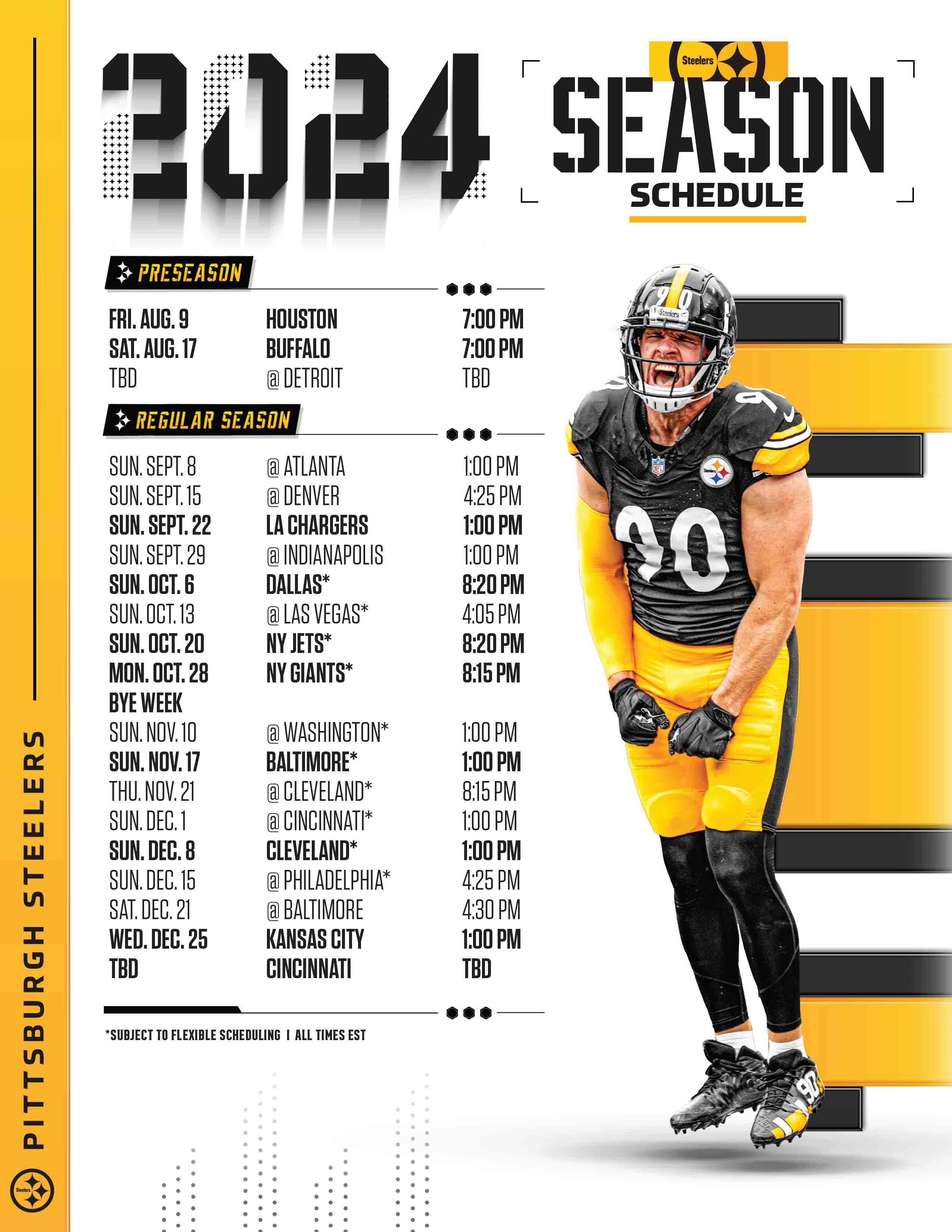

Projected Pittsburgh Steelers Schedule For 2025

May 22, 2025

Projected Pittsburgh Steelers Schedule For 2025

May 22, 2025 -

Arne Slot Was Liverpool Lucky Against Psg Goalkeeper Debate Reignited

May 22, 2025

Arne Slot Was Liverpool Lucky Against Psg Goalkeeper Debate Reignited

May 22, 2025 -

Aex Abn Amro Wint Terrein Na Publicatie Kwartaalcijfers

May 22, 2025

Aex Abn Amro Wint Terrein Na Publicatie Kwartaalcijfers

May 22, 2025