Why Did D-Wave Quantum (QBTS) Stock Crash On Monday? A Detailed Analysis

Table of Contents

Market Sentiment and Broader Tech Stock Downturn

The decline in QBTS stock wasn't isolated; it mirrored a broader negative sentiment sweeping the tech sector. Understanding this context is crucial to analyzing the D-Wave Quantum stock crash.

The Impact of the Overall Market

The recent downturn in the tech sector is multifaceted. Several factors contributed to the negative market sentiment:

- Rising Interest Rates: The Federal Reserve's ongoing interest rate hikes aim to curb inflation, but this also increases borrowing costs for companies, impacting growth and valuations, particularly for high-growth tech stocks.

- Inflationary Pressures: Persistent inflation erodes purchasing power and investor confidence, leading to a flight to safety and away from riskier investments like QBTS.

- Increased Investor Risk Aversion: Uncertainty in the global economy has led investors to become more risk-averse, favoring safer investments and selling off more volatile assets. The NASDAQ Composite, a key tech index, has seen significant drops recently, reflecting this broader trend. This negative market sentiment disproportionately affects speculative high-growth stocks like QBTS, which rely heavily on future potential rather than current profitability.

Investor Expectations and the Quantum Computing Hype Cycle

The quantum computing industry, while promising, is still in its nascent stages. Early hype surrounding the potential of quantum annealing and other quantum computing technologies might have led to an overvaluation of QBTS stock.

- Long-Term Development: Quantum computing is a long-term play. The technology requires significant research and development before it reaches widespread commercial viability. This gap between current capabilities and overly optimistic market expectations likely contributed to the correction.

- Competitor Activity: News and advancements from competitors like IBM, Google, and IonQ, while positive for the quantum computing industry as a whole, could also have influenced investor perceptions of D-Wave Quantum's competitive position and market share. Any perceived loss of momentum relative to competitors could trigger selling pressure.

D-Wave Quantum-Specific Factors

Beyond the broader market trends, several D-Wave Quantum-specific factors might have contributed to the stock crash.

Lack of Recent Positive News or Financial Results

The absence of positive news or strong financial results can significantly impact investor confidence. Analyzing recent company announcements is crucial:

- Earnings Calls and Financial Reports: Did D-Wave Quantum release any recent earnings reports or hold any earnings calls that revealed disappointing results or missed targets? Negative financial forecasts or a lack of clear path to profitability could trigger selling.

- Partnerships and Product Launches: Significant partnerships or new product launches can boost investor confidence. The absence of such announcements, especially compared to competitors, could have contributed to the negative sentiment.

Analysis of Company Performance and Future Outlook

A thorough assessment of D-Wave Quantum's current financial situation and long-term prospects is necessary:

- Revenue Streams and Customer Base: How diversified are D-Wave Quantum's revenue streams? A dependence on a limited number of customers or a lack of substantial revenue growth could concern investors.

- Competitive Landscape: The quantum computing industry is fiercely competitive. D-Wave Quantum’s position relative to competitors, their technological advancements, and their market share are crucial factors for investors.

- Path to Profitability: Investors are keen to see a viable path to profitability. Any uncertainty or delays in achieving profitability could fuel negative sentiment.

Short-Selling Activity and Institutional Investor Moves

The stock market is influenced by various actors. Analyzing institutional and short-selling activity is important:

- Short-Selling: A sudden increase in short-selling activity – betting on a price decline – can accelerate a downward trend. Data on short interest could provide valuable insights.

- Institutional Investor Trades: Large institutional investors' decisions to sell off their holdings can significantly impact a stock's price. News about major institutional investors divesting from QBTS could have amplified the drop.

External Factors Influencing QBTS Stock

External factors unrelated to D-Wave Quantum's specific performance can also impact its stock price.

Geopolitical Events and Economic Uncertainty

Global economic uncertainty and geopolitical events can create a ripple effect, influencing investor sentiment towards riskier assets.

- Global Economic Anxiety: Periods of global economic instability often trigger a sell-off in riskier assets, as investors seek safer havens.

- Geopolitical Instability: Major geopolitical events can also impact investor confidence, leading to increased market volatility.

Competition in the Quantum Computing Industry

The quantum computing sector is rapidly evolving, with several companies vying for market dominance.

- Competitor Advancements: Significant breakthroughs or announcements from competitors can shift investor focus and perceptions of D-Wave Quantum's competitive position.

- Market Share and Growth Prospects: The competitive landscape directly affects D-Wave Quantum's market share and overall growth potential, influencing investor confidence.

Conclusion

The D-Wave Quantum (QBTS) stock crash on Monday resulted from a complex interplay of factors. The broader tech market downturn, driven by rising interest rates, inflation concerns, and investor risk aversion, created a negative backdrop. Simultaneously, D-Wave Quantum-specific factors, such as a lack of recent positive news, questions regarding the company's financial performance and path to profitability, and potentially increased short-selling activity, all contributed to the significant price decline. External factors, including broader economic uncertainty and competition within the burgeoning quantum computing industry, further exacerbated the situation.

While the recent D-Wave Quantum (QBTS) stock drop is concerning, understanding the underlying causes is crucial for making informed investment decisions. Continue to monitor D-Wave Quantum's progress, analyzing future announcements and market conditions to assess its long-term potential. Stay informed about developments in the quantum computing sector to make educated decisions regarding D-Wave Quantum (QBTS) and other quantum computing investments.

Featured Posts

-

Is The Peppa Pig Theme Park In Texas Worth Visiting A Review

May 21, 2025

Is The Peppa Pig Theme Park In Texas Worth Visiting A Review

May 21, 2025 -

Filmska Adaptacija Popularne Reddit Price Sydney Sweeney U Glavnoj Ulozi

May 21, 2025

Filmska Adaptacija Popularne Reddit Price Sydney Sweeney U Glavnoj Ulozi

May 21, 2025 -

Tory Councillors Wife Jailed For Hotel Fire Tweet Appeal Pending

May 21, 2025

Tory Councillors Wife Jailed For Hotel Fire Tweet Appeal Pending

May 21, 2025 -

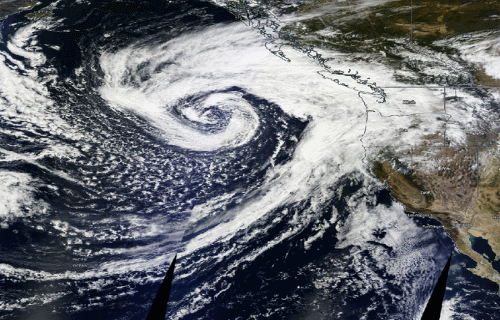

Fast Moving Storms How To Prepare For High Winds

May 21, 2025

Fast Moving Storms How To Prepare For High Winds

May 21, 2025 -

Mainz Stuns Rb Leipzig Burkardt And Amiri Lead The Charge

May 21, 2025

Mainz Stuns Rb Leipzig Burkardt And Amiri Lead The Charge

May 21, 2025