Why Did Novo Nordisk's Ozempic Lose Market Share In Weight Loss?

Table of Contents

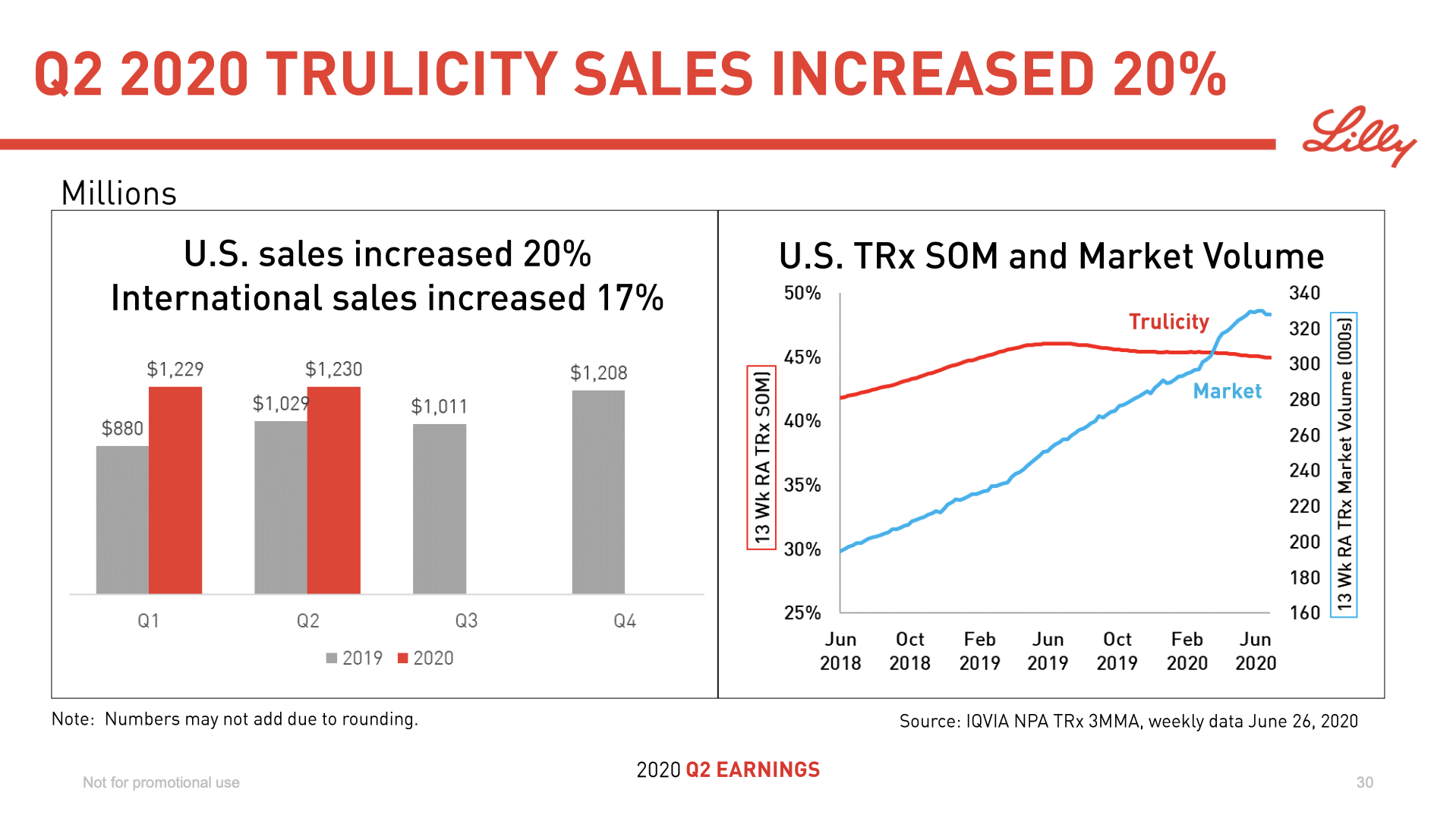

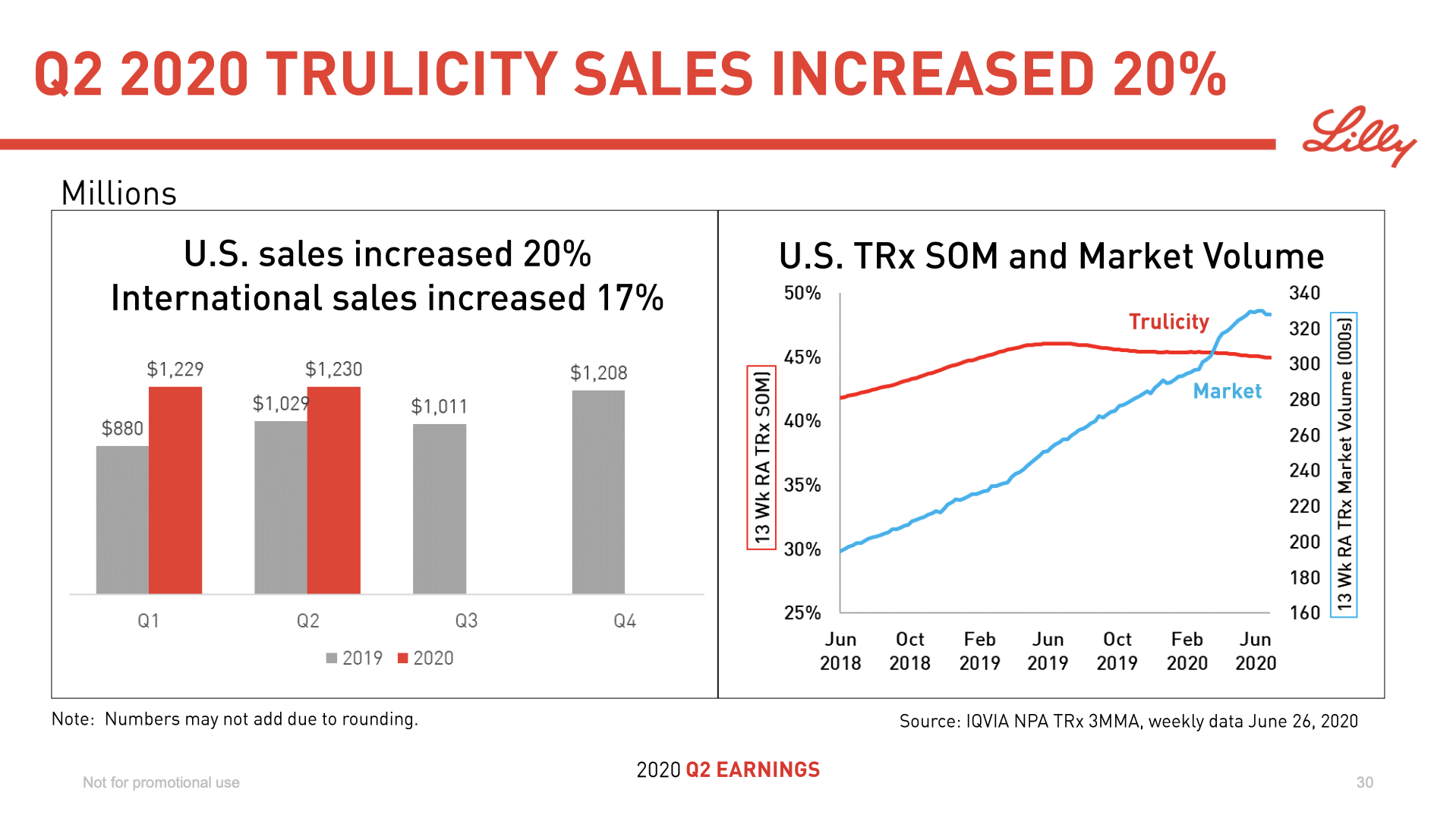

Increased Competition in the GLP-1 Receptor Agonist Market

The GLP-1 receptor agonist market has exploded in recent years, significantly impacting Ozempic's market share weight loss. This fierce competition stems from several key developments.

The Rise of Wegovy and Other Semaglutide-Based Medications

The emergence of Wegovy, also a semaglutide-based medication, has been a major factor.

- Higher Dosage and Efficacy: Wegovy, with its higher dosage of semaglutide, has been marketed as offering superior weight loss efficacy compared to Ozempic, influencing consumer choices and directly impacting Ozempic market share weight loss.

- Competitor Drugs and Marketing: Other competing GLP-1 receptor agonists, each with their own unique marketing strategies, have also carved out significant market niches. These include Mounjaro (tirzepatide) and others, all vying for a piece of the lucrative weight-loss market. The aggressive marketing campaigns of these competitors have impacted Ozempic's visibility and market position.

- Brand Recognition and Marketing: While Ozempic initially benefited from strong brand recognition, the influx of new competitors with targeted marketing efforts has diluted this advantage, contributing to the shift in Ozempic market share weight loss.

The Impact of Biosimilars and Generics

The future holds another potential challenge: the entry of biosimilars and generic versions of semaglutide.

- Lower Prices and Consumer Choice: The lower prices associated with biosimilars could significantly alter the market landscape, potentially driving consumers towards more affordable alternatives and further impacting Ozempic's market share.

- Timeline and Market Penetration: The timing of biosimilar approvals and their subsequent market penetration remain uncertain, but their eventual arrival is likely to intensify the competitive pressure on Ozempic and other brand-name GLP-1 agonists.

Challenges Related to Access and Affordability

Access to Ozempic, even amidst its initial popularity, hasn't been universally easy. Two major factors contributed to this accessibility problem.

High Costs and Insurance Coverage Issues

The high cost of Ozempic presents a significant barrier for many patients.

- Out-of-Pocket Expenses: The substantial out-of-pocket expenses for patients without adequate insurance coverage have restricted access and influenced market share weight loss.

- Pharmaceutical Pricing and Insurance Negotiations: The complex negotiations between pharmaceutical companies and insurance providers further complicate matters, leaving many patients struggling to afford Ozempic.

Supply Chain Issues and Availability

Reports of supply chain disruptions and shortages have also impacted Ozempic's availability.

- Limited Supply and Market Share: These supply issues have undoubtedly contributed to a decrease in Ozempic's market share, as patients unable to obtain the medication may turn to alternative treatments.

- Novo Nordisk's Response: Novo Nordisk has implemented strategies to address these supply chain challenges; however, the impact of these efforts on regaining lost market share remains to be seen.

Shifting Market Perceptions and Patient Preferences

Beyond the competitive landscape and access issues, shifts in perceptions and patient preferences have also played a role.

Safety Concerns and Side Effects

Reports of side effects associated with Ozempic have impacted consumer confidence.

- Side Effect Frequency and Media Coverage: While side effects are common with many medications, media coverage of specific side effects associated with Ozempic may have negatively influenced patient perceptions and consequently the Ozempic market share weight loss.

- Patient Perception and Trust: This has impacted consumer trust and contributed to some patients seeking alternative treatments.

Changing Treatment Guidelines and Recommendations

Changes in medical guidelines and recommendations can impact prescribing habits.

- Alternative Weight Loss Treatments: Updated guidelines might emphasize lifestyle changes or other weight loss treatments, leading physicians to prescribe alternative options.

- Impact on Prescribing Habits: This shift in medical recommendations directly affects the demand for Ozempic, thus impacting the Ozempic market share weight loss.

Conclusion

Ozempic's decline in weight loss market share is a multifaceted issue. Increased competition from other GLP-1 receptor agonists, particularly Wegovy, along with access challenges stemming from high costs and supply chain issues, have played a significant role. Furthermore, evolving patient perceptions regarding safety and changing treatment guidelines have all contributed to the shift in market dynamics. Understanding the factors influencing Ozempic's market share in weight loss is crucial for both consumers and healthcare professionals. Continue your research into GLP-1 receptor agonists and other weight loss treatments to make informed decisions.

Featured Posts

-

Last 16 Bound Raducanus Powerful Performance In Miami

May 30, 2025

Last 16 Bound Raducanus Powerful Performance In Miami

May 30, 2025 -

Des Moines Public Schools Temporarily Suspends Central Campus Agriscience Program

May 30, 2025

Des Moines Public Schools Temporarily Suspends Central Campus Agriscience Program

May 30, 2025 -

Marvel To Sinner Post Credits Scenes Worth Watching

May 30, 2025

Marvel To Sinner Post Credits Scenes Worth Watching

May 30, 2025 -

Citizen Scientists Uncover Clues Within Whidbey Clams

May 30, 2025

Citizen Scientists Uncover Clues Within Whidbey Clams

May 30, 2025 -

Bts V And Jungkooks Post Military Physiques Fan Reactions To Viral Gym Photos

May 30, 2025

Bts V And Jungkooks Post Military Physiques Fan Reactions To Viral Gym Photos

May 30, 2025