Why Investors Shouldn't Fear High Stock Market Valuations: A BofA Perspective

Table of Contents

The current stock market might seem daunting. High valuations are frequently cited as a reason for investors to pull back, fueling anxieties about impending market corrections. Many headlines scream about impending doom, stoking fear among investors. However, a closer look at the situation, informed by BofA's perspective, reveals that this fear may be unwarranted. This article explores why high stock market valuations don't necessarily signal imminent doom and gloom, offering investors a more nuanced understanding of the current market landscape and providing actionable strategies to navigate it.

Understanding the Nuances of High Stock Market Valuations

The Limitations of Traditional Valuation Metrics

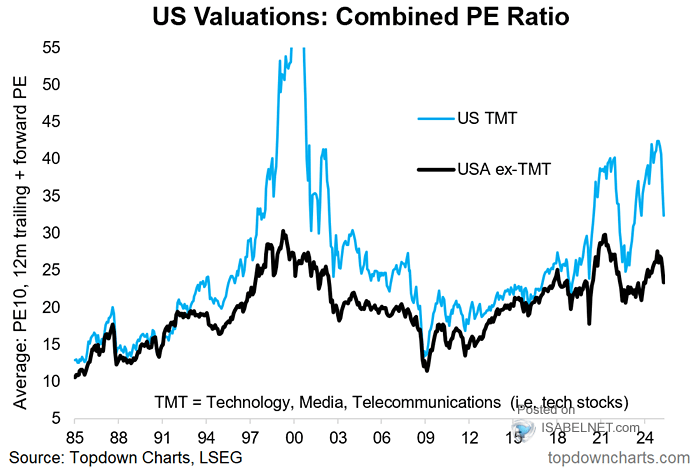

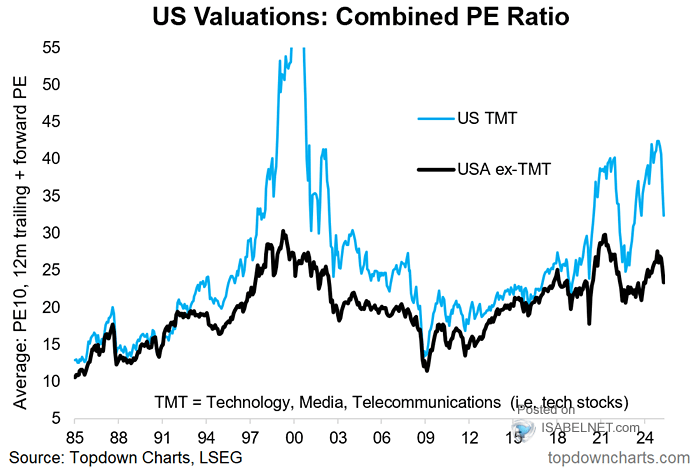

Solely relying on traditional metrics like Price-to-Earnings (P/E) ratios to assess stock market valuations can be misleading. These ratios, while useful, don't tell the whole story. Several factors can skew their interpretation.

- P/E ratios are sensitive to interest rates. Low interest rates can inflate P/E ratios, making valuations appear higher than they might be in a higher-interest-rate environment. Conversely, rising rates can compress P/E ratios.

- Growth stocks often command higher P/E ratios. Companies expected to experience significant future growth are often valued at a premium, reflecting investor confidence in their potential. This makes comparing P/E ratios across different sectors and growth stages difficult.

- Consider the company's future earnings potential. Focusing solely on current earnings ignores the potential for future growth. A high P/E ratio might be justified if a company demonstrates a strong track record of revenue and earnings growth and has significant future opportunities.

Bullet points:

- P/E ratios are sensitive to interest rates.

- Growth stocks often command higher P/E ratios.

- Consider the company's future earnings potential.

- Analyze a broader range of valuation metrics, including PEG ratios and discounted cash flow models.

The Role of Technological Innovation and Disruption

Technological advancements are a major driver of long-term economic growth. These innovations can significantly impact traditional valuation models. The rapid pace of technological disruption frequently leads to the emergence of high-growth companies with valuations that may initially seem high but reflect their disruptive potential and future market dominance.

- The tech sector's growth consistently outpaces other sectors, driving overall market valuations higher.

- Disruptive innovations can reshape industry valuations, rendering traditional metrics less reliable. Think about the impact of the internet on brick-and-mortar retail.

- Focus on identifying companies with strong intellectual property, a first-mover advantage, and a scalable business model. These qualities can justify seemingly high valuations.

Bullet points:

- Tech sector growth outpaces other sectors.

- Disruptive innovations can reshape industry valuations.

- Focus on long-term growth potential.

- Consider qualitative factors beyond financial metrics when evaluating tech companies.

BofA's Perspective on Current Market Conditions

BofA's Market Outlook and Investment Strategies

BofA's market outlook usually incorporates a comprehensive analysis of macroeconomic factors, industry trends, and company-specific data. Their recommendations often emphasize diversification and risk management strategies tailored to the prevailing market conditions. While specific strategies vary based on the current economic climate, their overall approach usually focuses on a balanced approach that considers both growth and defensive assets. It’s crucial to note that this section requires accessing and summarizing BofA's current official reports and publications. This information is dynamic and will require frequent updates.

Bullet points:

- Summary of BofA’s current market forecast (requires updating regularly based on current BofA reports).

- Suggested diversification strategies (requires updating regularly based on current BofA reports).

- Risk management recommendations from BofA (requires updating regularly based on current BofA reports).

Addressing Market Volatility and Uncertainty

Navigating market volatility requires a long-term investment horizon and a well-defined risk management strategy. Investors shouldn't be overly reactive to short-term fluctuations.

Bullet points:

- Importance of diversification across asset classes and sectors.

- Dollar-cost averaging strategy to mitigate the impact of market timing.

- Focus on long-term growth and compound returns.

- Regular portfolio rebalancing to maintain desired asset allocation.

Why Fear Might Be Unjustified

The Power of Long-Term Investing

Short-term market fluctuations are often insignificant in the context of long-term investment goals. Historical data demonstrates that markets have historically recovered from periods of high valuations, ultimately delivering positive returns over time. Patience and discipline are key to successful long-term investing.

Bullet points:

- Historical data supporting long-term market growth despite periods of high valuations. (Provide specific data and citations).

- Risk tolerance and investment time horizon are crucial factors in decision-making.

- Emotional discipline is essential to avoid impulsive reactions to market volatility.

Identifying Undervalued Opportunities Within a High-Valuation Market

Even in a market with high valuations, opportunities to identify undervalued companies exist. Thorough research and fundamental analysis are key.

Bullet points:

- Focus on companies with strong fundamentals, including robust balance sheets, consistent earnings growth, and competitive advantages.

- Identify companies with durable competitive advantages, such as strong brands, unique technologies, or efficient operations.

- Look for growth at a reasonable price (GARP) strategies to find companies with both growth potential and reasonable valuations.

Conclusion

High stock market valuations, while seemingly intimidating, don't necessarily signal impending market crashes. By understanding the nuances of valuation, considering BofA's insights (always refer to the most up-to-date BofA reports), and adopting a long-term perspective, investors can navigate these market conditions effectively. Don't let fear dictate your investment decisions. Instead, employ a strategic approach informed by thorough research and professional advice to manage risk and capitalize on opportunities within the current market. Take control of your investment strategy and learn more about how to effectively manage your portfolio in the face of high stock market valuations. Remember to regularly review your investment strategy and adjust it as needed based on evolving market conditions and your personal financial goals.

Featured Posts

-

The Implications Of Russias Military Activities For European Security

Apr 29, 2025

The Implications Of Russias Military Activities For European Security

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets The Official Purchase Guide

Apr 29, 2025

Capital Summertime Ball 2025 Tickets The Official Purchase Guide

Apr 29, 2025 -

Snow Fox Operations Update Tuesday February 11th Delays And Closings

Apr 29, 2025

Snow Fox Operations Update Tuesday February 11th Delays And Closings

Apr 29, 2025 -

Reliance Shares Significant 10 Month Gain On Earnings Announcement

Apr 29, 2025

Reliance Shares Significant 10 Month Gain On Earnings Announcement

Apr 29, 2025 -

Las Vegas Police Seek Information On Missing British Paralympian

Apr 29, 2025

Las Vegas Police Seek Information On Missing British Paralympian

Apr 29, 2025