Why Investors Shouldn't Fear High Stock Market Valuations: BofA's Perspective

Table of Contents

BofA's Arguments Against Undervaluing the Current Market

BofA's assessment of the current market goes beyond simple price-to-earnings ratios (P/E ratios). Their analysis incorporates a broader view of economic factors and long-term growth potential, leading them to argue against a solely negative interpretation of high stock market valuations.

Strong Corporate Earnings & Profitability

BofA's analysis points to robust corporate earnings and profitability as a key justification for current market valuations. They emphasize the sustainability of these earnings, indicating that the market's valuation isn't merely speculative. Several strong sectors are driving this profitability:

- Increased margins in technology: Tech companies continue to innovate and benefit from increased efficiency, resulting in higher profit margins.

- Resilient consumer spending: Despite economic uncertainties, consumer spending remains relatively strong in several key areas, supporting the earnings of consumer goods companies.

- Growth in renewable energy: The transition to renewable energy sources is driving significant investment and creating opportunities for substantial growth and profitability within this sector.

- Strong performance in the healthcare sector: Innovation and an aging population contribute to sustained growth and profitability within this vital industry.

These factors contribute to strong overall corporate earnings, supporting BofA's view that current valuations are not necessarily unjustified. This positive sector performance and strong economic growth are significant contributors to the overall market health.

Low Interest Rates and Monetary Policy

BofA acknowledges the impact of low interest rates on stock valuations. They argue that current monetary policies, while potentially inflationary in the long term, have played a supportive role in maintaining market stability and encouraging investment. This is achieved through:

- Quantitative easing: Central banks' injection of liquidity into the market has helped to lower borrowing costs and stimulate economic activity.

- Low borrowing costs: Lower interest rates make it cheaper for companies to borrow money for investment and expansion, boosting growth and profitability.

- Stimulus measures: Government stimulus packages, while debated, have played a role in supporting businesses and consumer spending, indirectly influencing stock valuations.

These monetary policy measures, while subject to ongoing debate, have undeniably influenced investor behavior and market dynamics, contributing to the current environment. BofA emphasizes the importance of understanding the role of central bank actions in shaping the market landscape. While inflation is a concern, it is a separate discussion from market valuation itself.

Long-Term Growth Potential & Technological Advancements

BofA emphasizes the long-term growth prospects of the market, fueled by significant technological advancements. They see current valuations as reflecting not just present performance, but also the potential for substantial future growth driven by:

- Artificial Intelligence (AI): AI is revolutionizing numerous industries, from healthcare to finance, creating opportunities for significant growth and innovation.

- Cloud computing: The shift to cloud-based infrastructure is reshaping businesses and driving demand for related technologies, leading to strong growth prospects for cloud providers.

- Biotechnology: Advancements in biotechnology are leading to new treatments and cures, creating significant investment opportunities and potential for high returns.

These future trends and technological advancements underpin BofA's assessment of the market's long-term growth potential. Innovation is a key driver in their analysis, suggesting that current valuations reflect a forward-looking assessment of the market's trajectory.

Addressing Common Investor Concerns About High Valuations

While acknowledging concerns surrounding high valuations, BofA addresses common anxieties around investment strategies.

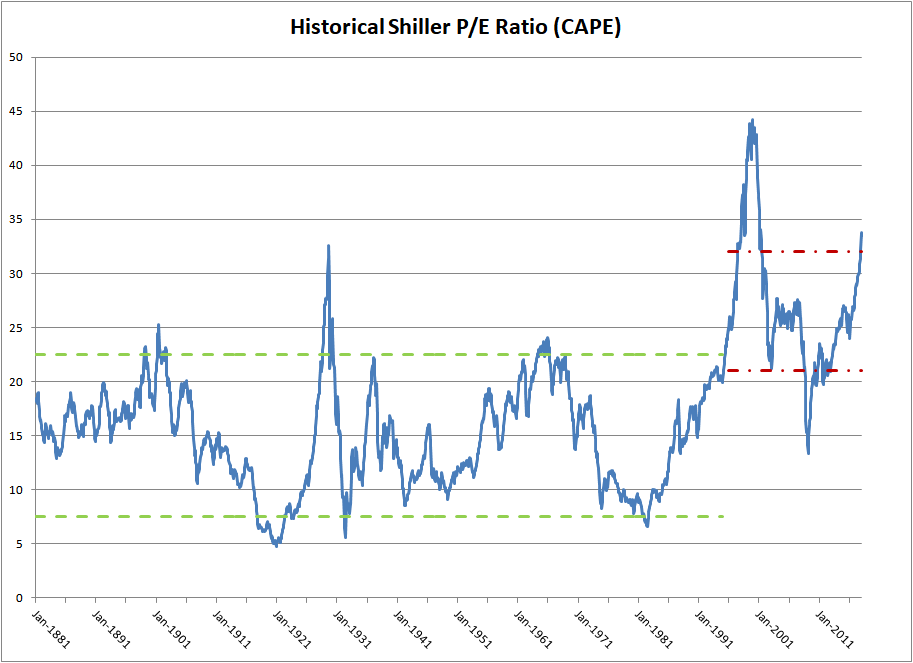

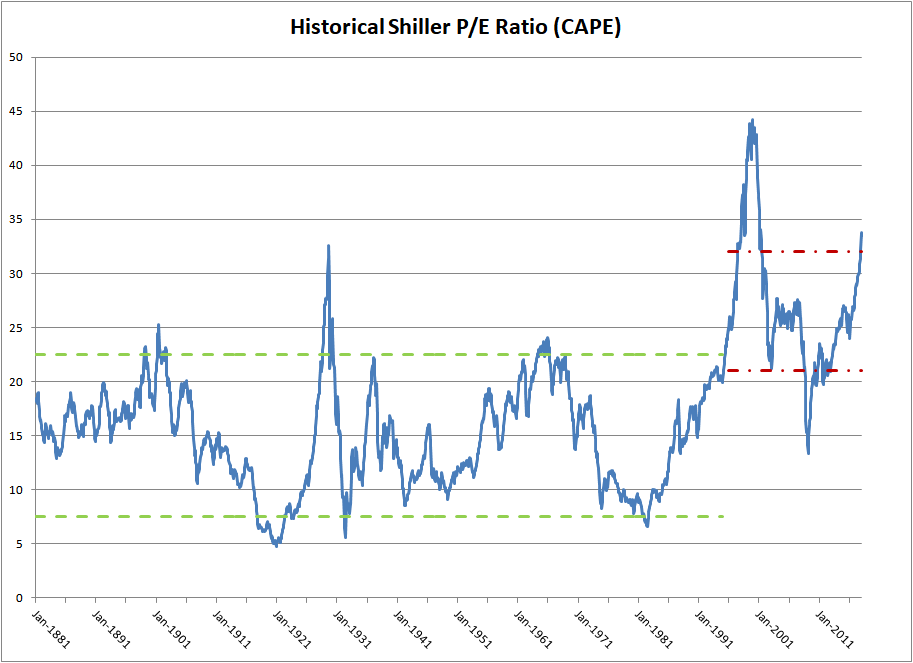

The Price-to-Earnings Ratio (P/E) and its Limitations

The P/E ratio, while a widely used valuation metric, has limitations. BofA emphasizes that relying solely on the P/E ratio to determine market valuation can be misleading. They suggest considering other factors and valuation metrics such as:

- Price-to-Sales Ratio (P/S): This ratio compares a company's stock price to its revenue, offering a broader perspective than the P/E ratio alone.

- Market capitalization: This represents the total value of a company's outstanding shares, providing a measure of its overall size and market position.

- Dividend yield: This measures the annual dividend payment relative to the stock price, offering insight into the return potential.

Using alternative valuation metrics allows for a more holistic and nuanced understanding of a company's worth, reducing over-reliance on potentially misleading indicators like the P/E ratio.

Managing Risk in a High-Valuation Environment

BofA recommends a proactive approach to risk management in the current market. This includes:

- Diversification: Spread investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to reduce the impact of any single investment underperforming.

- Portfolio management: Regularly review and adjust your investment portfolio to ensure it aligns with your risk tolerance and financial goals.

- Long-term investment horizon: Focus on long-term growth potential rather than short-term market fluctuations.

A well-defined portfolio management strategy and a long-term investment approach are crucial for mitigating risk management challenges in any market condition.

Conclusion: Overcoming Fear and Embracing Opportunities in High Stock Market Valuations

BofA's analysis suggests that fear of high stock market valuations shouldn't dictate investment decisions. Their perspective highlights strong corporate earnings, supportive monetary policy, and significant long-term growth potential driven by technological advancements. While acknowledging the importance of risk management and diversification, BofA encourages a balanced view, emphasizing the consideration of various valuation metrics and a long-term investment strategy.

Don't let fear of high stock market valuations paralyze your investment strategy. Learn more about BofA's insights and develop a well-informed approach to navigate the current market. Click here to access BofA's latest market analysis.

Featured Posts

-

Ftc Investigation Into Open Ais Chat Gpt What It Means

Apr 22, 2025

Ftc Investigation Into Open Ais Chat Gpt What It Means

Apr 22, 2025 -

88 Year Old Pope Francis Dies Following Pneumonia Illness

Apr 22, 2025

88 Year Old Pope Francis Dies Following Pneumonia Illness

Apr 22, 2025 -

Chainalysis Expands With Ai Acquisition Of Alterya

Apr 22, 2025

Chainalysis Expands With Ai Acquisition Of Alterya

Apr 22, 2025 -

Trump Administrations 1 Billion Funding Threat To Harvard

Apr 22, 2025

Trump Administrations 1 Billion Funding Threat To Harvard

Apr 22, 2025 -

In Depth Razer Blade 16 2025 Review Ultra Performance Ultra Price Tag

Apr 22, 2025

In Depth Razer Blade 16 2025 Review Ultra Performance Ultra Price Tag

Apr 22, 2025