Why Is Gold Reaching Record Highs Amidst Trade Disputes?

Table of Contents

Gold as a Safe Haven Asset During Economic Uncertainty

Gold has long been recognized as a safe haven asset, a preferred investment during times of economic turmoil. Understanding why investors flock to gold during periods of market volatility is key to understanding the current surge in prices.

Understanding Safe Haven Assets

Safe haven assets are characterized by several key features:

- Low correlation with other assets: Their prices don't typically move in tandem with stocks or bonds, offering diversification benefits during market downturns.

- Stability and reliability: They are considered relatively stable and less susceptible to dramatic price swings.

- High liquidity: They can be easily bought and sold without significant price impact.

Other examples of safe haven assets include US Treasury bonds and the Swiss Franc. However, gold's unique appeal lies in its tangible nature and historical role as a store of value.

Trade Disputes and Market Volatility

Escalating trade disputes, such as the ongoing US-China trade war, inject significant uncertainty into the global economy. This uncertainty manifests as:

- Market volatility: Stock markets react negatively to trade war headlines, leading to increased volatility and investor anxiety.

- Investor sentiment: Fear and uncertainty drive investors to seek the safety of assets like gold, pushing prices higher.

- Sectoral impact: Specific sectors, like manufacturing and technology, are disproportionately affected by trade wars, further fueling the flight to safety. The resulting economic slowdown contributes to the demand for gold as a hedge against potential losses.

Weakening Global Currency and Gold's Value

The relationship between the US dollar and gold prices is inversely correlated. A weakening dollar typically leads to higher gold prices, and vice versa.

The Inverse Relationship Between the Dollar and Gold

When the dollar weakens, gold becomes more affordable for investors holding other currencies, increasing demand. This is because gold is priced in US dollars, so a weaker dollar means that the same amount of another currency can buy more gold.

- Currency devaluation impact: Devaluation of a major currency can significantly influence the gold price expressed in that currency, even if the dollar price remains relatively stable. For example, a weakening Euro will make gold more expensive for European investors, but cheaper for those using dollars.

- Currency fluctuations: Recent fluctuations in major currencies, driven partly by trade tensions, have contributed to the increased demand for gold.

Impact of Monetary Policy on Gold Prices

Central bank actions also play a significant role. Loose monetary policies, such as interest rate cuts and quantitative easing, can lead to:

- Inflation: Increased money supply can lead to inflation, eroding the purchasing power of fiat currencies. Gold, as a tangible asset, serves as a hedge against inflation.

- Further monetary easing: The expectation of further monetary easing to stimulate economic growth can further boost gold prices, as investors anticipate potential inflationary pressures.

Increased Investor Demand for Gold

The surge in gold prices is also fueled by a significant increase in investor demand.

Shifting Investment Strategies

Investors are increasingly shifting their portfolios towards gold as a defensive investment:

- Institutional and central bank demand: Central banks around the world are accumulating gold reserves, signaling confidence in gold as a safe haven asset. Similarly, institutional investors are increasing their gold holdings.

- Gold ETFs: The popularity of gold exchange-traded funds (ETFs) has made it easier for investors to gain exposure to gold, contributing to increased demand.

Geopolitical Risks and Gold Investment

Geopolitical instability and uncertainty are further driving demand for gold:

- Geopolitical events: Events such as political tensions, conflicts, and uncertainty surrounding global trade agreements fuel investor anxiety, leading to a surge in demand for gold as a safe haven.

- Hedge against political risk: Gold's historical role as a store of value and a hedge against political risk makes it an attractive asset during times of heightened geopolitical uncertainty.

Conclusion

Gold reaching record highs amidst trade disputes is a direct consequence of multiple factors. The role of gold as a safe haven asset during times of economic uncertainty, the impact of a weakening dollar and fluctuating currencies, and the increased investor demand driven by both economic and geopolitical factors all contribute to the current upward trend. The ongoing trade disputes are creating significant market volatility and uncertainty, pushing investors towards the perceived safety and stability of gold. Understanding why gold is reaching record highs amidst trade disputes is crucial for informed investment decisions. Learn more about gold investment strategies and stay updated on the latest market trends.

Featured Posts

-

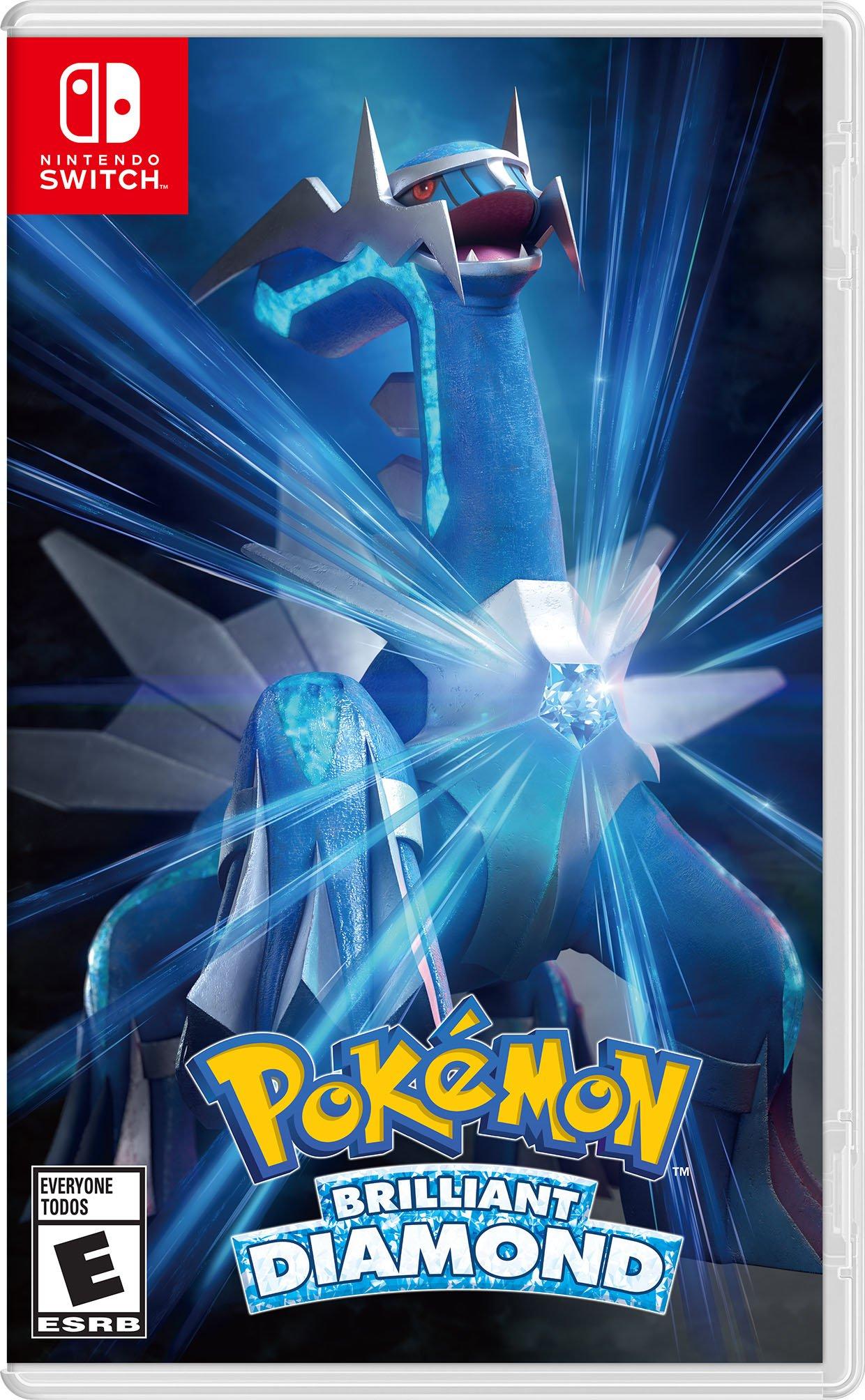

Nintendo Switch 2 Game Stop Preorder Success Story

Apr 26, 2025

Nintendo Switch 2 Game Stop Preorder Success Story

Apr 26, 2025 -

People Betting On La Wildfires A Sign Of Shifting Societal Values

Apr 26, 2025

People Betting On La Wildfires A Sign Of Shifting Societal Values

Apr 26, 2025 -

King Day 2024 Mixed Public Response To Holiday Observance

Apr 26, 2025

King Day 2024 Mixed Public Response To Holiday Observance

Apr 26, 2025 -

Oscars After Party Nepotism Reign And The Public Backlash

Apr 26, 2025

Oscars After Party Nepotism Reign And The Public Backlash

Apr 26, 2025 -

Trumps Stance On Ukraines Nato Membership A Deep Dive

Apr 26, 2025

Trumps Stance On Ukraines Nato Membership A Deep Dive

Apr 26, 2025