Why The Fed Remains Cautious On Interest Rate Cuts

Table of Contents

Persistent Inflationary Pressures

Bringing inflation down to the Fed's target of 2% continues to be a significant challenge. Core inflation, which excludes volatile food and energy prices, remains stubbornly high, indicating underlying inflationary pressures within the economy. This persistent inflation is a major reason why the Fed is hesitant to implement interest rate cuts.

- Core inflation remains stubbornly high: Despite recent decreases, core inflation remains significantly above the Fed's target, suggesting that price increases are not merely transitory. This necessitates a continued cautious approach to monetary policy.

- Wage growth continues to outpace productivity increases: Strong wage growth, while positive for workers, contributes to inflationary pressures if it outstrips productivity improvements. This wage-price spiral is a concern for the Fed.

- Supply chain disruptions are still impacting prices of goods and services: Although supply chain issues have eased somewhat, lingering disruptions continue to contribute to higher prices for various goods and services. The full impact of these disruptions is still unfolding.

- The impact of the Russia-Ukraine conflict on global energy prices: The war in Ukraine continues to exert upward pressure on energy prices, impacting inflation globally and complicating the Fed's efforts to control inflation. This geopolitical instability adds another layer of complexity to the inflation challenge.

The Fed's commitment to price stability is a primary mandate. The current inflation rate, as measured by metrics like the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) index, remains a key factor influencing the Fed's decisions regarding monetary policy, including interest rate cuts.

Robust Labor Market Conditions

The strength of the US labor market is another factor contributing to the Fed's cautious stance on interest rate cuts. Low unemployment rates and robust job growth indicate a healthy economy, but also pose a risk of overheating.

- Job growth remains strong despite economic slowdown fears: The continued strong job growth, while positive, could exacerbate inflationary pressures if it leads to increased demand for goods and services without a corresponding increase in supply.

- Unemployment rates at historic lows: The historically low unemployment rate suggests a tight labor market, contributing to wage growth and inflationary pressures.

- Wage growth contributing to inflationary pressures: As mentioned above, rapid wage growth, while beneficial for workers, can fuel a wage-price spiral if not accompanied by increased productivity.

- The potential for a wage-price spiral: The combination of strong wage growth and persistent inflation creates a risk of a wage-price spiral, where rising wages lead to higher prices, further fueling wage demands, and creating a self-perpetuating cycle of inflation.

This robust labor market makes the Fed hesitant to stimulate the economy further through interest rate cuts, as such actions could risk overheating and exacerbating inflation.

Geopolitical Uncertainty and Global Economic Risks

Global events significantly impact the US economy and the Fed's decision-making process. The current geopolitical landscape adds another layer of uncertainty.

- The ongoing war in Ukraine and its impact on energy prices and global supply chains: The war in Ukraine continues to disrupt global energy markets and supply chains, creating uncertainty and impacting inflation globally.

- Concerns about global economic slowdown and recessionary risks: The risk of a global economic slowdown or recession adds complexity to the Fed's considerations. A global downturn could impact the US economy and necessitate a different monetary policy response.

- Potential for further financial market volatility: Geopolitical uncertainty and economic instability contribute to the potential for further financial market volatility, making the Fed cautious about implementing interest rate cuts that could amplify these risks.

These uncertainties make the Fed cautious about implementing interest rate cuts, as such a move could have unpredictable and potentially negative consequences in a volatile global environment.

The Risk of Premature Rate Cuts

Lowering interest rates prematurely carries significant risks.

- Risk of reigniting inflation: Premature interest rate cuts could reignite inflation, undoing the progress made in bringing inflation down. This would necessitate further interest rate hikes in the future, creating economic instability.

- Potential for asset bubbles: Lower interest rates can inflate asset prices, creating the potential for asset bubbles that could burst, leading to financial instability.

- Weakening of the dollar: Interest rate cuts can weaken the dollar, making imports more expensive and potentially fueling inflation further.

The importance of a measured approach to monetary policy cannot be overstated. The Fed's cautious approach aims to avoid these negative consequences and maintain economic and financial stability.

Conclusion

The Federal Reserve's reluctance to implement interest rate cuts stems from a complex interplay of factors, including persistent inflationary pressures, a robust labor market, and considerable geopolitical uncertainty. The risks associated with premature easing of monetary policy outweigh the potential benefits at this juncture. The Fed's primary focus remains on bringing inflation down to its 2% target while maintaining a stable and healthy economy.

Understanding the reasons behind the Fed's cautious approach to interest rate cuts is crucial for investors and businesses alike. Stay informed about the latest economic indicators and the Fed's policy announcements to navigate the current economic climate effectively. Continuously monitor updates on interest rate cuts and their potential impact on your financial planning. This proactive approach will allow you to make informed decisions and adapt your strategies as the situation evolves.

Featured Posts

-

Solve Nyt Strands Hints And Answers For Wednesday April 9 Game 402

May 09, 2025

Solve Nyt Strands Hints And Answers For Wednesday April 9 Game 402

May 09, 2025 -

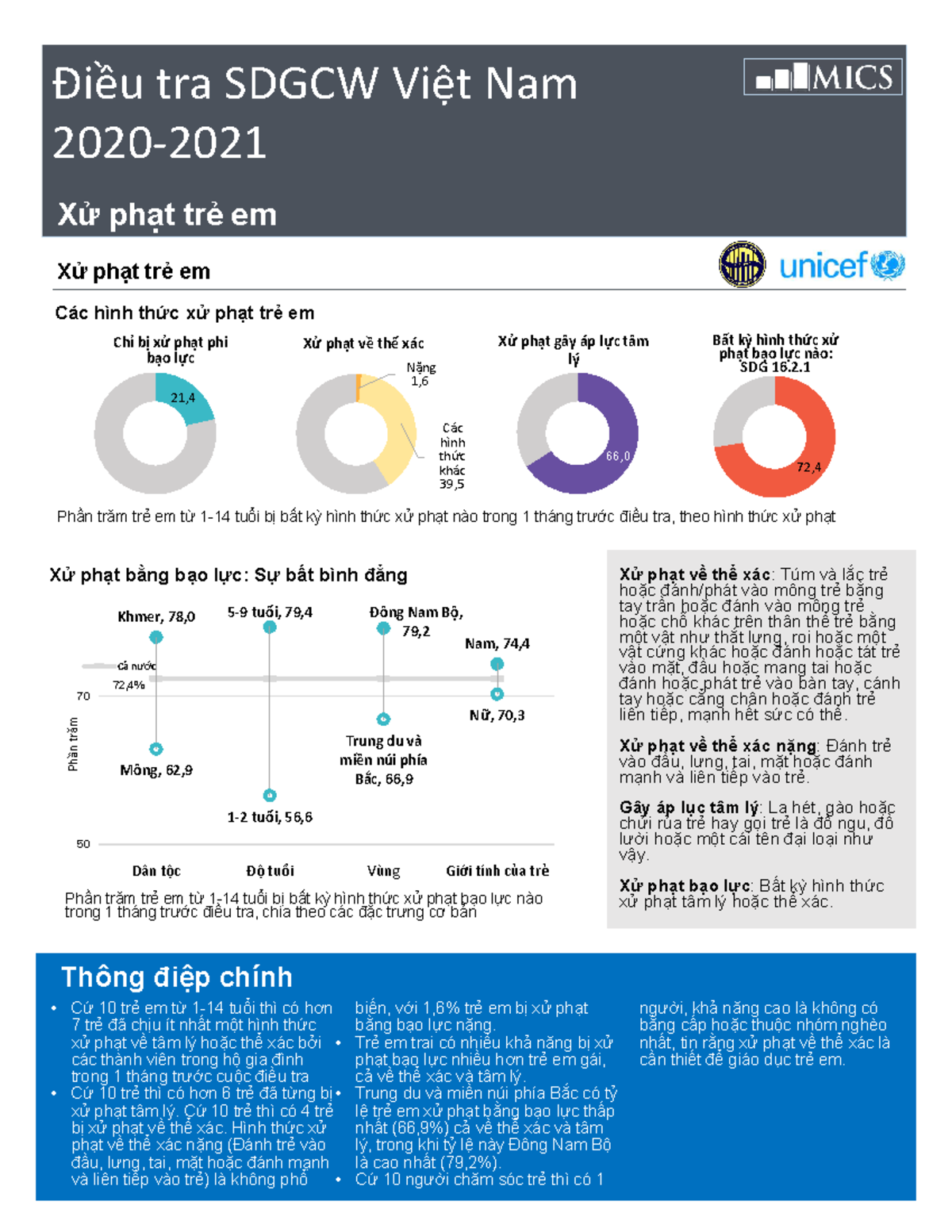

Kiem Tra Va Xu Ly Nghiem Cac Truong Hop Bao Hanh Tre Em O Co So Giu Tre Tu Nhan

May 09, 2025

Kiem Tra Va Xu Ly Nghiem Cac Truong Hop Bao Hanh Tre Em O Co So Giu Tre Tu Nhan

May 09, 2025 -

Uk Visa Application Process Changes Nationality Specifics

May 09, 2025

Uk Visa Application Process Changes Nationality Specifics

May 09, 2025 -

Nhl 2024 25 Season Key Storylines To Follow

May 09, 2025

Nhl 2024 25 Season Key Storylines To Follow

May 09, 2025 -

His Rise From Wolves Rejection To European Footballing Glory

May 09, 2025

His Rise From Wolves Rejection To European Footballing Glory

May 09, 2025