Will A Canadian Tire-Hudson's Bay Partnership Succeed? A Critical Analysis

Table of Contents

Synergies and Potential Benefits of a Canadian Tire-Hudson's Bay Partnership

A partnership between Canadian Tire and Hudson's Bay could unlock significant synergies, creating a retail powerhouse unlike any other in Canada.

Expanded Market Reach and Customer Base

Canadian Tire boasts a strong presence in smaller towns and cities across the country, while Hudson's Bay maintains a dominant position in urban centers. A combined entity could achieve unprecedented market reach, tapping into a significantly larger customer base.

- Increased customer base: Accessing both urban and rural demographics expands the potential customer pool dramatically.

- Access to new demographics: Combining product offerings could attract new customer segments currently underserved by either company individually.

- Potential for cross-promotion: Joint marketing campaigns and loyalty programs could leverage both brands to maximize reach and engagement.

However, careful consideration must be given to potential customer overlap. Strategic product differentiation and targeted marketing will be crucial to avoid cannibalizing sales within the existing customer base of each individual company.

Supply Chain and Logistics Optimization

Consolidating the supply chain and logistics networks of Canadian Tire and Hudson's Bay could yield substantial cost savings and efficiency gains.

- Cost reduction: Shared warehousing, transportation, and distribution infrastructure could significantly lower operational expenses.

- Improved delivery times: A streamlined supply chain could lead to faster and more reliable delivery for both online and in-store customers.

- Reduced warehousing needs: Optimizing storage and distribution could reduce the need for excess warehouse space, leading to further cost savings.

Integrating disparate systems, however, presents a major challenge. A robust IT infrastructure and a seamless transition plan are essential to avoid operational disruptions and data loss during the integration process.

Enhanced Brand Image and Customer Loyalty

The combined power of the Canadian Tire and Hudson's Bay brands could create a stronger, more appealing entity for consumers.

- Stronger brand recognition: A partnership could elevate both brands, increasing overall recognition and trust among consumers.

- Improved customer experience: Integrated loyalty programs and enhanced customer service initiatives could improve customer satisfaction and drive loyalty.

- Increased brand equity: A successful partnership could significantly increase the overall value and reputation of both brands.

The risk of brand dilution, however, exists. Maintaining the distinct identities and brand values of each company while leveraging their combined strengths will require careful management.

Challenges and Risks of a Canadian Tire-Hudson's Bay Partnership

While the potential benefits are significant, several challenges and risks could hinder the success of a Canadian Tire-Hudson's Bay partnership.

Cultural Differences and Integration Issues

Merging two distinct corporate cultures could lead to internal conflicts and integration difficulties.

- Difficulty integrating teams: Different management styles, operational processes, and organizational structures could create friction and delays.

- Potential for conflict: Clashes in company culture and values could negatively impact employee morale and productivity.

- Slower-than-expected integration: Cultural differences and integration complexities could prolong the integration process, delaying the realization of anticipated synergies.

A clearly defined integration strategy, with a focus on communication, cultural sensitivity, and a shared vision, will be crucial for success.

Regulatory Hurdles and Antitrust Concerns

The significant market share held by both companies could raise antitrust concerns from regulatory bodies.

- Potential delays: The regulatory review process could be lengthy and complex, potentially delaying or even preventing the partnership from moving forward.

- Need for regulatory approvals: Securing necessary approvals from competition authorities will be a critical step in the process.

- Potential for rejection: If regulators determine that the partnership would significantly reduce competition, it could be rejected outright.

A proactive and transparent regulatory strategy is essential to navigate the complexities of antitrust laws and ensure a smooth approval process.

Financial Risks and Return on Investment

The financial implications of the partnership, including investment costs and potential losses, must be carefully assessed.

- Investment costs: The costs associated with integration, restructuring, and marketing could be substantial.

- Potential losses: The risk of integration failures, unforeseen challenges, and market downturns could lead to financial losses.

- Return on investment (ROI) projections: A robust financial model is needed to accurately project the potential return on investment and assess the financial viability of the partnership.

A detailed financial analysis, including contingency planning for potential risks, is essential to ensure the long-term financial health of the combined entity.

Comparative Analysis of Successful and Unsuccessful Retail Partnerships

To inform our analysis, it's helpful to examine past retail partnerships. The success of mergers like [insert example of a successful retail merger, e.g., a merger of two large retailers with similar market positions] can be attributed to [mention specific reasons for success like strong integration planning, complementary product offerings, etc.]. Conversely, the failure of [insert example of an unsuccessful retail merger, e.g., a merger that failed due to cultural clashes or poor integration] highlights the importance of [mention specific reasons for failure like poor integration planning, conflicting business models, etc.]. These case studies underscore the need for careful planning, effective integration, and a clear understanding of potential risks before embarking on such a significant undertaking.

Conclusion: Will a Canadian Tire-Hudson's Bay Partnership Ultimately Succeed?

The potential for a Canadian Tire-Hudson's Bay partnership to succeed hinges on careful planning and execution. While the synergies in terms of expanded market reach, supply chain optimization, and brand enhancement are compelling, significant challenges exist related to cultural integration, regulatory hurdles, and financial risks. The success of such a venture would depend heavily on the ability to effectively manage these challenges. Based on the analysis of potential benefits and risks, along with lessons learned from past retail mergers, the likelihood of success is contingent on a meticulously crafted integration strategy, robust financial planning, and a clear understanding of the regulatory landscape. A well-executed partnership could create a dominant force in Canadian retail, but failure to address the significant challenges could result in a costly and disruptive outcome.

Continue the discussion on the potential success of the Canadian Tire-Hudson's Bay partnership by sharing your thoughts in the comments below. Let's analyze the future of this potential retail giant!

Featured Posts

-

Louanes Eurovision 2024 Entry A First Look

May 20, 2025

Louanes Eurovision 2024 Entry A First Look

May 20, 2025 -

Decouvrir L Integrale Des Romans D Agatha Christie

May 20, 2025

Decouvrir L Integrale Des Romans D Agatha Christie

May 20, 2025 -

Zachary Cunhas New Role From Us Attorney To Private Practice In Rhode Island

May 20, 2025

Zachary Cunhas New Role From Us Attorney To Private Practice In Rhode Island

May 20, 2025 -

Winter Storm And School Closings What Parents Need To Know

May 20, 2025

Winter Storm And School Closings What Parents Need To Know

May 20, 2025 -

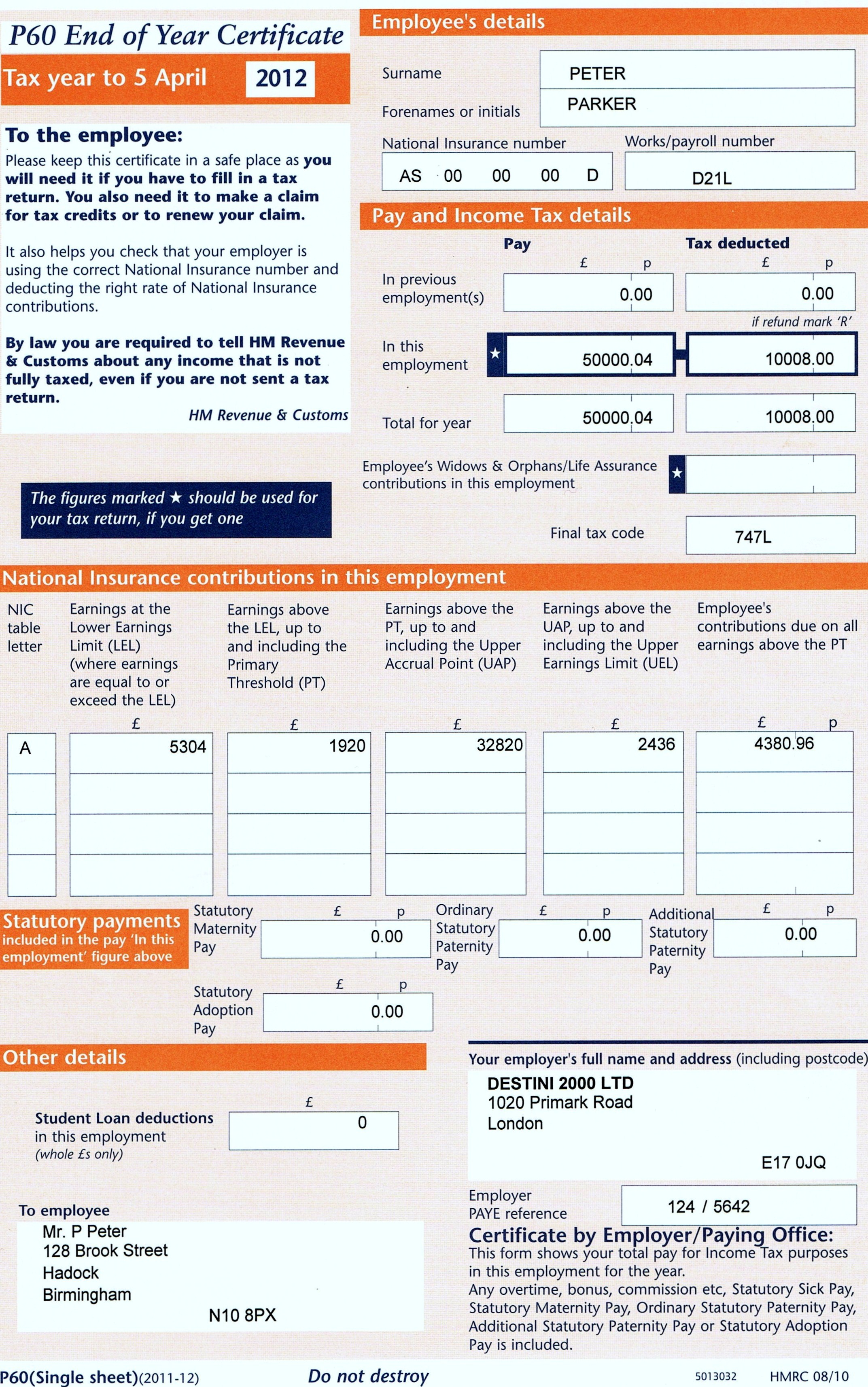

Thousands No Longer Need To File Hmrc Tax Returns Key Changes

May 20, 2025

Thousands No Longer Need To File Hmrc Tax Returns Key Changes

May 20, 2025