Will A Resurgent Wall Street Undermine The DAX's Strong Performance?

Table of Contents

The Current State of the DAX

Recent DAX Performance and Key Drivers

The DAX has experienced significant growth in recent months, fueled by several key factors. This strong DAX performance is not an isolated incident, but rather a reflection of a robust German economy.

- Strong German Export Performance: German manufacturing and exports have shown resilience, contributing significantly to economic growth and boosting DAX companies' profits. Exports to key markets like China and the US have been relatively healthy despite global uncertainties.

- Resilient Industrial Sector: The German industrial sector, a major component of the DAX, has shown surprising strength, overcoming supply chain challenges more effectively than anticipated. Companies like Siemens and Volkswagen have reported positive earnings, driving DAX index growth.

- Positive Consumer Spending: Consumer confidence in Germany, though fluctuating, remains relatively high, supporting domestic demand and bolstering the performance of consumer-related companies within the DAX.

This positive DAX performance, however, is not without its vulnerabilities.

Potential Vulnerabilities of the DAX

Despite the current strength of the DAX, several factors could pose significant downside risks.

- High Inflation and Interest Rate Hikes: Persistent inflation in Germany and subsequent interest rate hikes by the European Central Bank could dampen economic growth and negatively affect corporate profits, potentially impacting DAX performance.

- Geopolitical Uncertainties: The ongoing war in Ukraine and its global ramifications, including energy price volatility, pose a substantial risk to the German and, subsequently, the DAX's stability.

- Global Supply Chain Disruptions: While Germany has shown resilience, lingering supply chain issues could still disrupt production and negatively impact the performance of DAX companies reliant on global supply chains.

The Resurgence of Wall Street

Factors Contributing to Wall Street's Recovery

Recent indicators suggest a potential Wall Street rebound, driven by several factors.

- Easing Inflationary Pressures: While inflation remains a concern, signs of easing inflationary pressures in the US are boosting investor confidence and driving up stock prices.

- Strong Corporate Earnings: Many US corporations have reported better-than-expected earnings, fueling optimism about future growth and strengthening the overall market sentiment.

- Improved Consumer Sentiment: Increased consumer spending and improved consumer confidence in the US are positive indicators for future economic growth and consequently, Wall Street performance.

This potential Wall Street recovery has significant implications for global markets, including the DAX.

Global Economic Interdependence and its Impact

The interconnected nature of global markets means that a strong Wall Street could significantly impact the DAX through several channels.

- Investor Sentiment: Positive sentiment on Wall Street can spill over into other global markets, potentially attracting investors to the DAX and driving up its value. However, the opposite is also true; negative sentiment could lead to capital flight.

- Capital Flows: Investors often diversify their portfolios across different markets. A strong Wall Street could divert investment capital away from the DAX if US assets become more attractive.

- Currency Fluctuations: The relative strength of the US dollar against the Euro can impact the attractiveness of German assets to international investors, potentially influencing the DAX's performance.

Analyzing the Potential for Undermining

Scenario Analysis

Several scenarios could unfold regarding the relationship between Wall Street's resurgence and the DAX's performance.

- Scenario 1: Strong Wall Street, Strong DAX: Both markets could experience robust growth, driven by global economic recovery and positive investor sentiment. This scenario would be beneficial for investors in both markets.

- Scenario 2: Strong Wall Street, Weaker DAX: A strong Wall Street might draw investment away from the DAX, potentially leading to a slowdown in its growth or even a decline, especially if other headwinds impacting the German economy materialize. This scenario would necessitate a more cautious approach for DAX investors.

- Scenario 3: Weak Wall Street, Weak DAX: A simultaneous weakening of both markets, possibly due to a global economic downturn, would negatively impact investors in both the US and German markets.

Expert Opinions and Forecasts

Financial experts offer varied forecasts. Some believe that a strong Wall Street won't necessarily undermine the DAX, highlighting the resilience of the German economy and its distinct growth drivers. Others caution that capital flows and investor sentiment could shift, negatively impacting the DAX's performance. Close monitoring of economic indicators, including inflation, interest rates and geopolitical events, is crucial for accurate prediction.

Conclusion

The potential impact of a resurgent Wall Street on the DAX's strong performance is complex and uncertain. While the German economy exhibits strength, vulnerabilities remain. A strong Wall Street could potentially divert investment capital, impacting the DAX, but a decoupling is also possible, depending on numerous factors. Understanding the intricacies of this relationship is crucial for investors. To make informed decisions, continue monitoring market trends, analyzing economic indicators, and conducting thorough research before making any investment decisions related to the DAX and Wall Street. Understanding the DAX's performance in relation to Wall Street requires continuous vigilance and a nuanced understanding of global economic dynamics.

Featured Posts

-

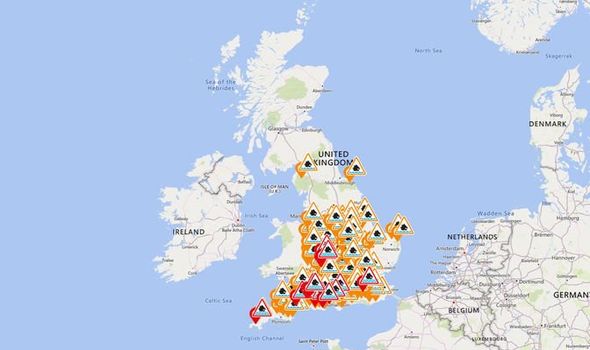

Flood Alerts Explained Understanding Flood Warnings And Taking Action

May 25, 2025

Flood Alerts Explained Understanding Flood Warnings And Taking Action

May 25, 2025 -

Nvidias Rtx 5060 A Critical Look At The Performance And Marketing

May 25, 2025

Nvidias Rtx 5060 A Critical Look At The Performance And Marketing

May 25, 2025 -

Alastthmarat Fy Daks 30 Thlyl Adae Almwshr Bed Tjawz Dhrwt Mars

May 25, 2025

Alastthmarat Fy Daks 30 Thlyl Adae Almwshr Bed Tjawz Dhrwt Mars

May 25, 2025 -

Amsterdam Stock Exchange Falls 2 On Trumps New Tariffs

May 25, 2025

Amsterdam Stock Exchange Falls 2 On Trumps New Tariffs

May 25, 2025 -

Buy And Hold Investing The Long Games Gut Wrenching Reality

May 25, 2025

Buy And Hold Investing The Long Games Gut Wrenching Reality

May 25, 2025