Will Bitcoin Soar 1,500% In 5 Years? Analyzing The Investment Outlook

Table of Contents

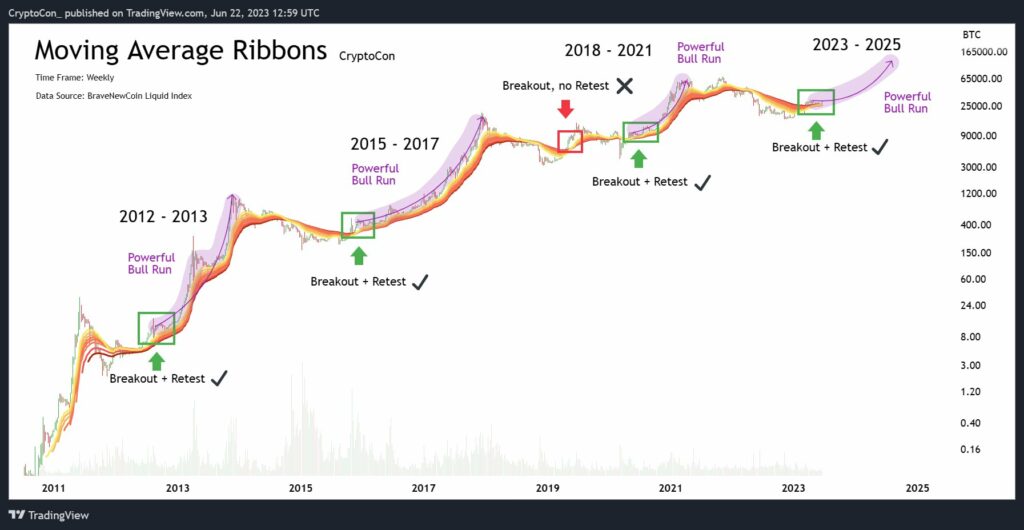

Factors Suggesting Potential for Significant Bitcoin Growth

Several factors suggest that Bitcoin could experience substantial growth in the coming years. Understanding these factors is crucial for any Bitcoin investment strategy.

Increasing Institutional Adoption

The growing interest from institutional investors is a significant catalyst for Bitcoin's price appreciation. Large corporations and financial institutions are increasingly recognizing Bitcoin's potential as a store of value and a diversifying asset.

- Examples: MicroStrategy's significant Bitcoin holdings, Tesla's acceptance of Bitcoin as payment (albeit temporarily suspended), and the growing number of publicly traded companies adding Bitcoin to their balance sheets demonstrate the shift in institutional sentiment.

- Impact: Institutional adoption brings greater price stability and increases market capitalization, making Bitcoin a more attractive investment for a wider range of investors. This influx of capital into the Bitcoin market can drive substantial price increases. Keywords: Institutional Bitcoin investment, corporate Bitcoin adoption, Bitcoin market cap.

Technological Advancements and Network Upgrades

Bitcoin's underlying technology, the blockchain, is constantly evolving. Improvements in scalability and efficiency are key drivers of future growth.

- Scalability Solutions: The Lightning Network, a second-layer payment protocol, significantly improves transaction speed and reduces fees, addressing a key limitation of the original Bitcoin network.

- Upcoming Upgrades: Ongoing development and upgrades to the Bitcoin protocol aim to enhance its functionality and security, further solidifying its position as a leading cryptocurrency. Keywords: Bitcoin technology, blockchain scalability, Lightning Network, Bitcoin upgrades.

Growing Global Demand and Scarcity

Bitcoin's inherent scarcity, with a fixed supply of only 21 million coins, is a major factor driving demand.

- Limited Supply: This fixed supply acts as a hedge against inflation, making Bitcoin an attractive alternative to traditional fiat currencies, especially in countries with volatile economies.

- Emerging Markets: Growing adoption in emerging markets and developing countries, where inflation is often high, fuels the demand for Bitcoin as a store of value and a means of exchange. Keywords: Bitcoin supply, Bitcoin demand, Bitcoin scarcity, Bitcoin inflation hedge.

Challenges and Risks Hindering Bitcoin's Potential Growth

Despite the bullish factors, several challenges and risks could hinder Bitcoin's growth trajectory. A realistic Bitcoin price prediction must acknowledge these potential obstacles.

Regulatory Uncertainty and Government Intervention

The regulatory landscape for cryptocurrencies varies significantly across different countries. Government policies and regulations can significantly impact Bitcoin's price and adoption.

- Varying Regulations: Some countries have embraced cryptocurrencies, while others have implemented strict regulations or outright bans. This regulatory uncertainty creates volatility and can impact investor confidence.

- Potential Impact: Changes in government policy, such as increased taxation or stricter regulations, could negatively affect Bitcoin's price. Keywords: Bitcoin regulation, cryptocurrency regulation, government Bitcoin policy.

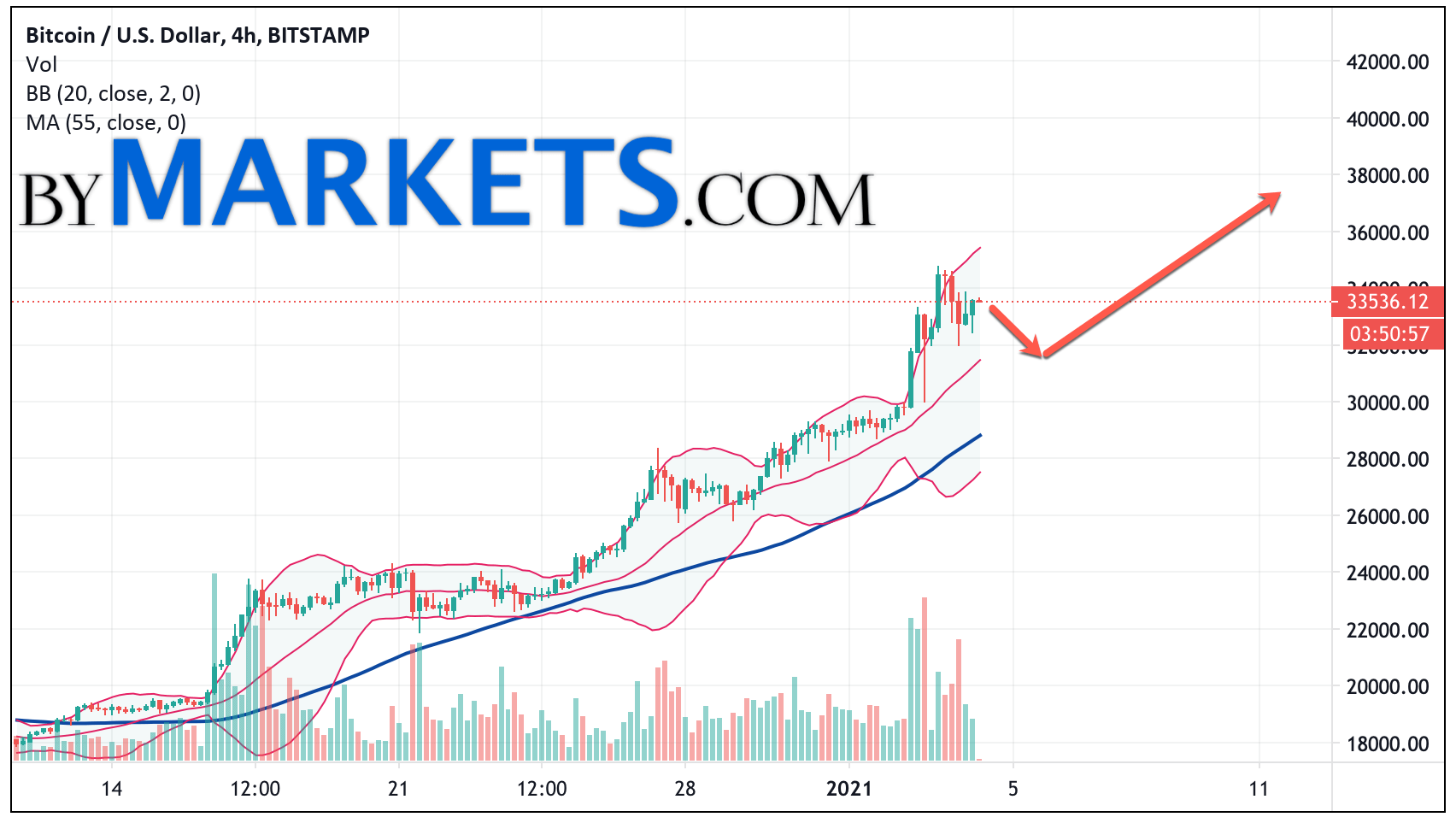

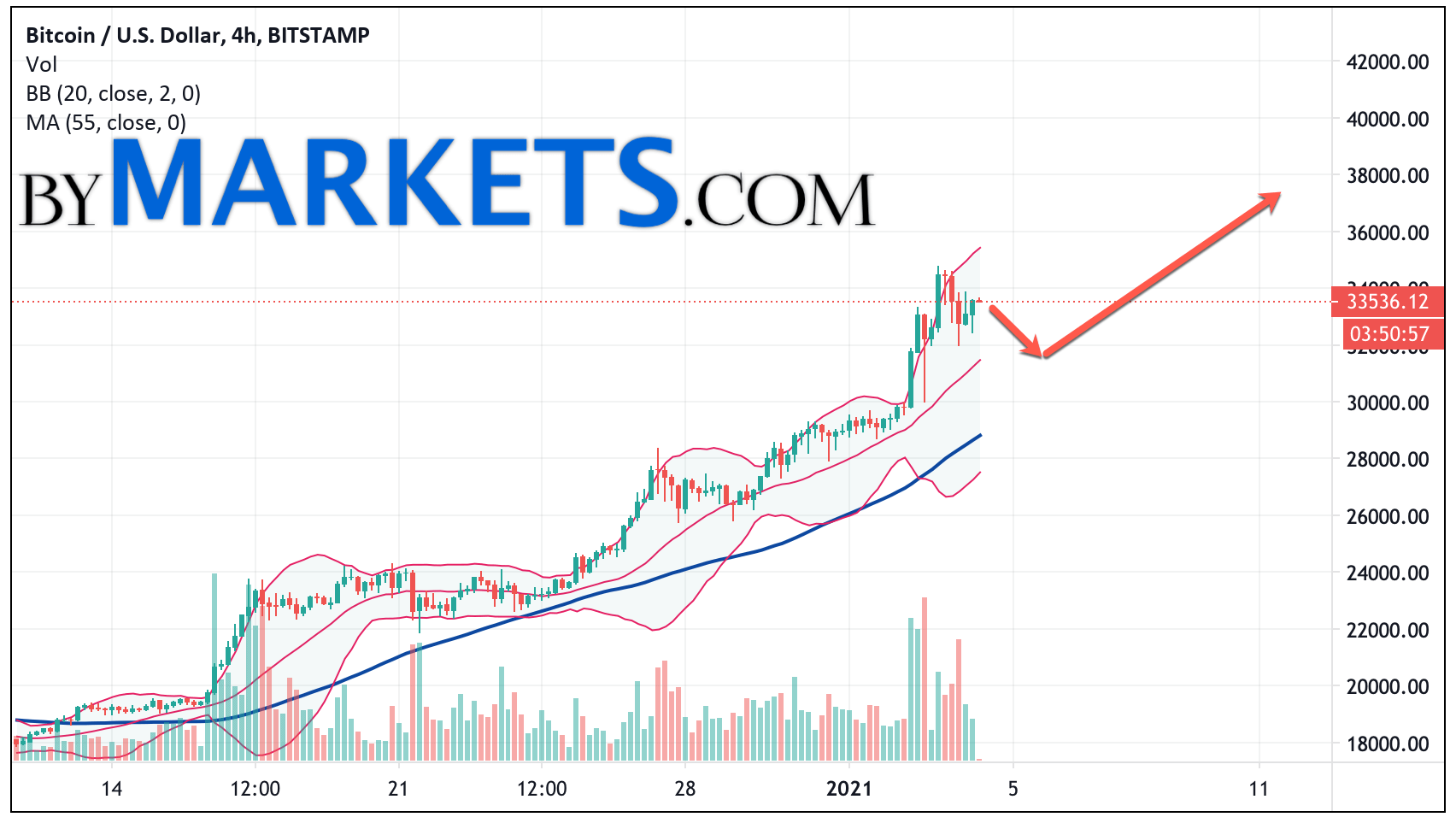

Market Volatility and Price Fluctuations

Bitcoin is known for its high volatility. Its price can fluctuate dramatically in short periods due to various factors.

- Contributing Factors: News events, market sentiment, and even social media trends can significantly influence Bitcoin's price.

- Investment Risks: The inherent volatility makes Bitcoin a high-risk investment, and significant price drops are possible. Keywords: Bitcoin volatility, cryptocurrency market volatility, Bitcoin price prediction risks.

Competition from Alternative Cryptocurrencies

The cryptocurrency market is not limited to Bitcoin. The emergence of alternative cryptocurrencies (altcoins) presents competition.

- Altcoin Competition: Many altcoins offer features and functionalities that differentiate them from Bitcoin.

- Impact on Dominance: The success of competing cryptocurrencies could potentially dilute Bitcoin's market share and impact its price. Keywords: Bitcoin competitors, altcoins, cryptocurrency competition.

Conclusion: Weighing the Possibilities: Can Bitcoin Reach a 1500% Increase?

Predicting Bitcoin's price with certainty is impossible. While factors like institutional adoption, technological advancements, and scarcity suggest potential for significant growth, regulatory uncertainty, market volatility, and competition present substantial risks. A 1500% surge in five years is a bold prediction, and achieving it would require a confluence of positive factors and overcoming significant challenges. A balanced Bitcoin investment strategy requires acknowledging both the potential rewards and the inherent risks. Learn more about the potential of Bitcoin investment and its risks before making any decisions. Is a 1500% Bitcoin surge realistic for you?

Featured Posts

-

Grayscale Xrp Etf Filing And Sec Action Impact On Xrp Price Outperforming Bitcoin And Top Cryptos

May 08, 2025

Grayscale Xrp Etf Filing And Sec Action Impact On Xrp Price Outperforming Bitcoin And Top Cryptos

May 08, 2025 -

The Hunger Games Directors New Stephen King Horror Movie 2025 Release Date

May 08, 2025

The Hunger Games Directors New Stephen King Horror Movie 2025 Release Date

May 08, 2025 -

Dwp Letter Missing Potential 6 828 Benefit Loss

May 08, 2025

Dwp Letter Missing Potential 6 828 Benefit Loss

May 08, 2025 -

Investing In 2025 Micro Strategy Stock Vs Bitcoin A Detailed Analysis

May 08, 2025

Investing In 2025 Micro Strategy Stock Vs Bitcoin A Detailed Analysis

May 08, 2025 -

Bitcoin Rebound Is This The Start Of A New Bull Run

May 08, 2025

Bitcoin Rebound Is This The Start Of A New Bull Run

May 08, 2025