Will Internal GOP Divisions Sink Trump's Tax Plan?

Table of Contents

Factionalism Within the Republican Party

The Republican Party, far from being a monolithic entity, is fractured along ideological lines, creating significant hurdles for Trump's tax plan. This internal struggle significantly impacts the legislative process and the plan's ultimate fate.

The Conservative vs. Moderate Divide

A deep ideological chasm separates the conservative and moderate wings of the GOP, leading to significant disagreements on the specifics of Trump's tax plan. These differences extend to the scope of tax cuts, the distribution of benefits, and the potential long-term economic consequences.

- Corporate Tax Rates: Conservatives push for drastic cuts, while moderates advocate for more moderate reductions to avoid excessive deficits.

- Individual Tax Brackets: Disputes exist regarding the extent of cuts for high-income earners versus lower and middle-income individuals.

- Estate Tax Repeal: While conservatives champion a complete repeal, moderates express concerns about the revenue loss and its impact on the national debt.

Prominent figures like Senator Ted Cruz, representing the conservative faction, advocate for aggressive tax cuts, while others, such as Senator Susan Collins, express caution, emphasizing fiscal responsibility. These diverging viewpoints create intense negotiation challenges, delaying the process and potentially weakening the final legislation.

The Freedom Caucus' Influence

The House Freedom Caucus, a powerful bloc of conservative Republicans, holds significant sway in Congress. Their history of opposing Republican leadership on various issues presents a major obstacle to the smooth passage of Trump's tax plan.

- Past Opposition: The Freedom Caucus has previously blocked or significantly altered legislation, demonstrating their capacity to influence the legislative agenda.

- Potential Demands: They are likely to demand further tax cuts targeted at specific interests, potentially creating internal conflicts and delays.

- Consequences of Opposition: Their opposition could lead to a weakened bill, its complete failure, or force compromises that significantly alter the original proposal.

Economic Concerns and Opposition

Beyond internal GOP divisions, economic realities pose significant challenges to Trump's tax plan. Concerns about escalating budget deficits and the disproportionate benefits for the wealthy fuel opposition, both within and outside the Republican Party.

Projected Budget Deficits and National Debt

Trump's tax plan is projected to substantially increase the national debt. This fuels opposition from fiscally conservative Republicans and creates an opening for bipartisan criticism.

- CBO Projections: The Congressional Budget Office's projections highlight a significant increase in the national debt under the plan, potentially exceeding trillions of dollars over the next decade.

- Fiscal Conservative Concerns: Many within the GOP, prioritizing fiscal responsibility, express deep reservations about the long-term economic consequences.

- Bipartisan Opposition: The potential for a massive increase in the national debt could attract bipartisan opposition, jeopardizing the plan's passage.

Concerns about Tax Cuts Benefiting the Wealthy

Critics argue that the tax plan disproportionately benefits high-income earners and large corporations at the expense of the middle class.

- Statistical Evidence: Analysis reveals that a significant portion of the tax cuts will accrue to the wealthiest Americans, exacerbating income inequality.

- Internal Republican Criticism: Some Republicans have publicly voiced concerns about this inequality, further fueling internal divisions.

- Political Ramifications: This perceived unfairness could damage the GOP's image and alienate moderate voters, creating significant political repercussions.

The Role of Lobbying and Special Interests

The influence of lobbying and special interest groups further complicates the situation, creating internal conflicts and potential roadblocks for Trump's tax plan.

Influence of Corporate Lobbyists

Powerful corporate lobbyists have actively shaped the tax plan, potentially creating conflicts within the GOP.

- Corporate Interests: Large corporations have pushed for specific provisions benefiting their industries, such as lower corporate tax rates and loopholes.

- Internal Conflicts: These provisions may clash with the interests of other factions within the GOP, creating internal divisions.

Competing Interests Within the GOP

Different factions within the GOP represent conflicting interests, making consensus building even more challenging.

- Small Business vs. Large Corporations: Small business owners might oppose provisions favoring large corporations, creating internal friction.

- Potential for Failure: These competing interests could ultimately prevent the passage of a unified tax plan.

Conclusion: Will Internal GOP Divisions Sink Trump's Tax Plan?

The passage of Trump's tax plan faces significant headwinds from within the Republican Party. Deep ideological divisions, economic concerns, and the influence of lobbying groups all threaten to derail the proposed reforms. While the President might secure passage through various compromises, the final legislation will likely differ significantly from the original proposal. The ultimate success or failure will depend on the President's ability to navigate these internal conflicts and forge a compromise acceptable to enough factions within the GOP. The future of Trump's tax policy remains uncertain. Engage in the conversation! Leave your comments below and share this article to continue the discussion on Trump's tax reform and the GOP's challenges. Let's explore the future of Trump's tax policy together.

Featured Posts

-

Wtt Contender Chennai 2025 Kamals Farewell Suravajjulas Victory

May 22, 2025

Wtt Contender Chennai 2025 Kamals Farewell Suravajjulas Victory

May 22, 2025 -

Ronaldo I Kho Lund Imitatsi A Na Slav Eto I Reaktsi Ata Na Cr 7

May 22, 2025

Ronaldo I Kho Lund Imitatsi A Na Slav Eto I Reaktsi Ata Na Cr 7

May 22, 2025 -

Ln Finale Khrvatska Zagubi Od Shpani A Po Seri A Penali

May 22, 2025

Ln Finale Khrvatska Zagubi Od Shpani A Po Seri A Penali

May 22, 2025 -

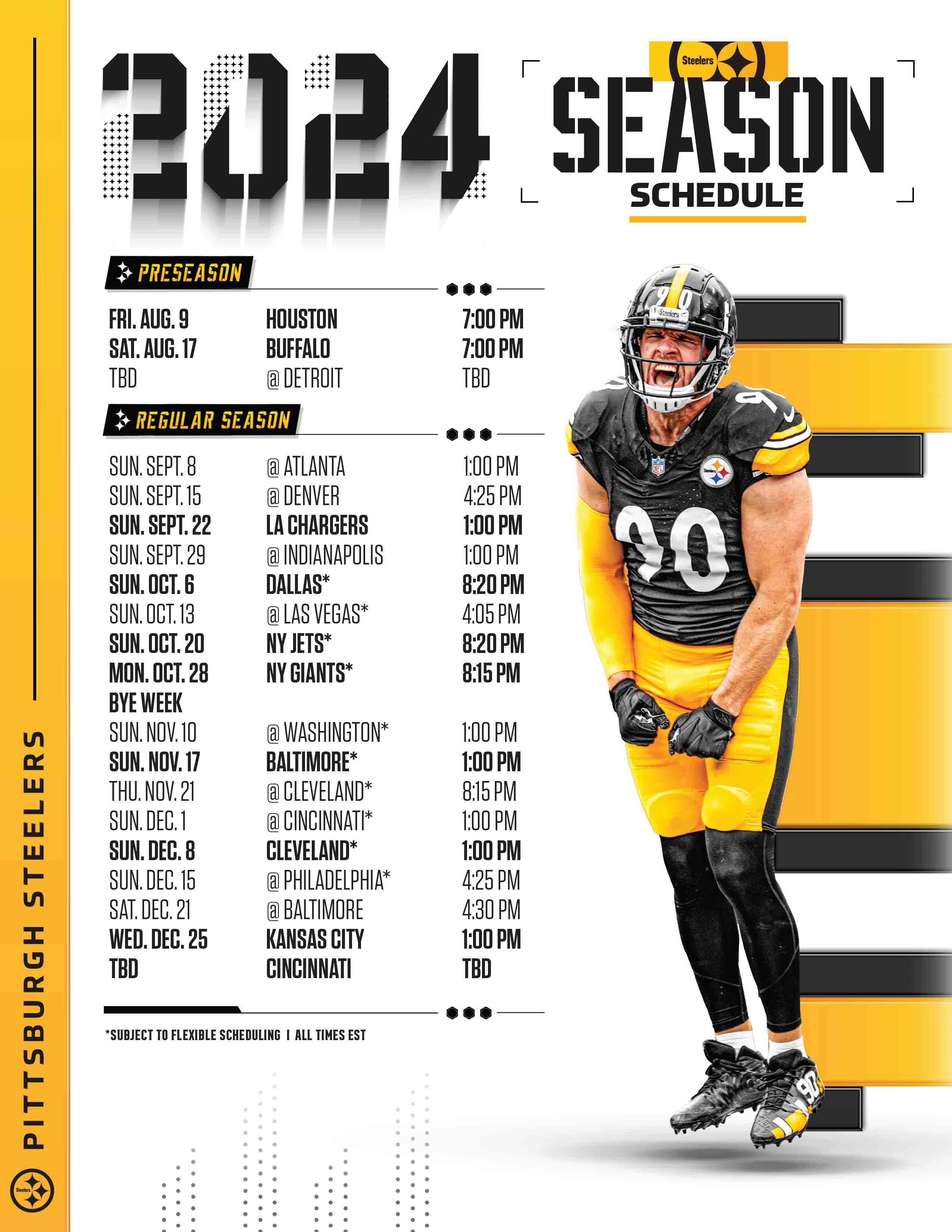

Projected Pittsburgh Steelers Schedule For 2025

May 22, 2025

Projected Pittsburgh Steelers Schedule For 2025

May 22, 2025 -

Partido Mexico Vs Panama Fecha Hora Y Canales De Transmision

May 22, 2025

Partido Mexico Vs Panama Fecha Hora Y Canales De Transmision

May 22, 2025