Will Palantir Be A Trillion-Dollar Company By 2030? An In-Depth Analysis

Table of Contents

Palantir's Current Market Position and Financial Performance

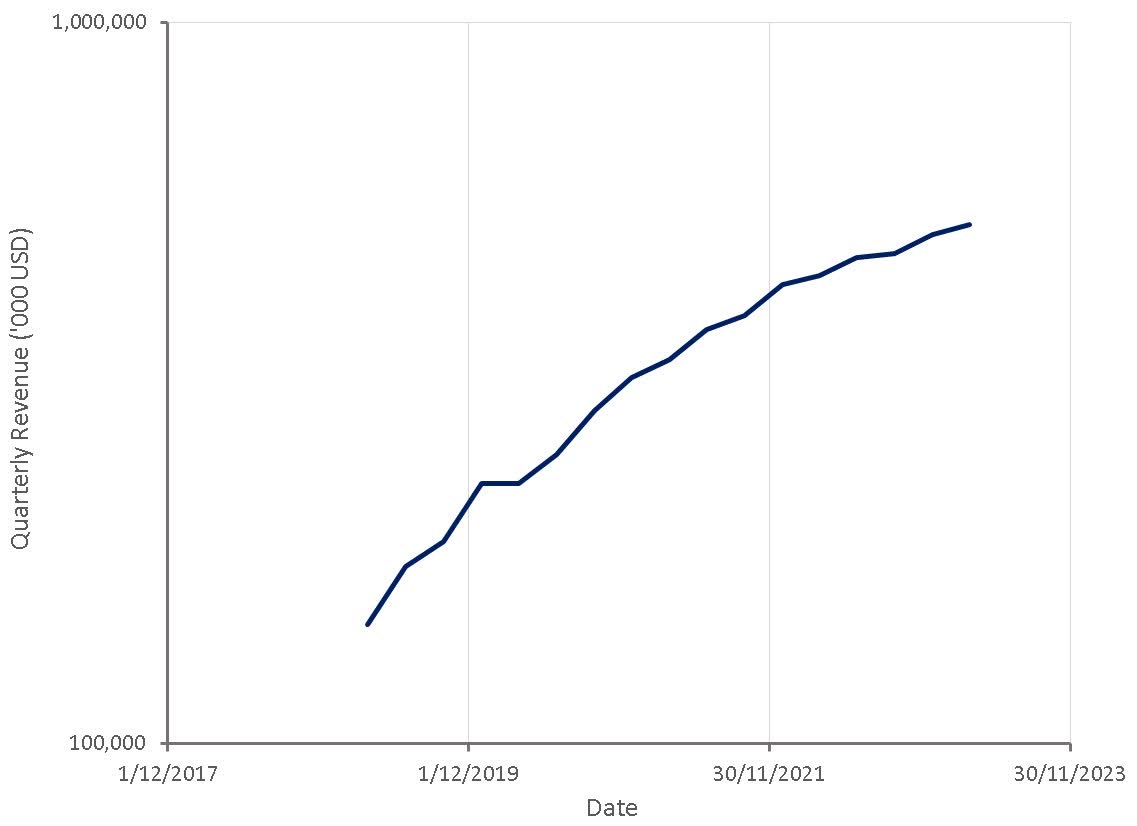

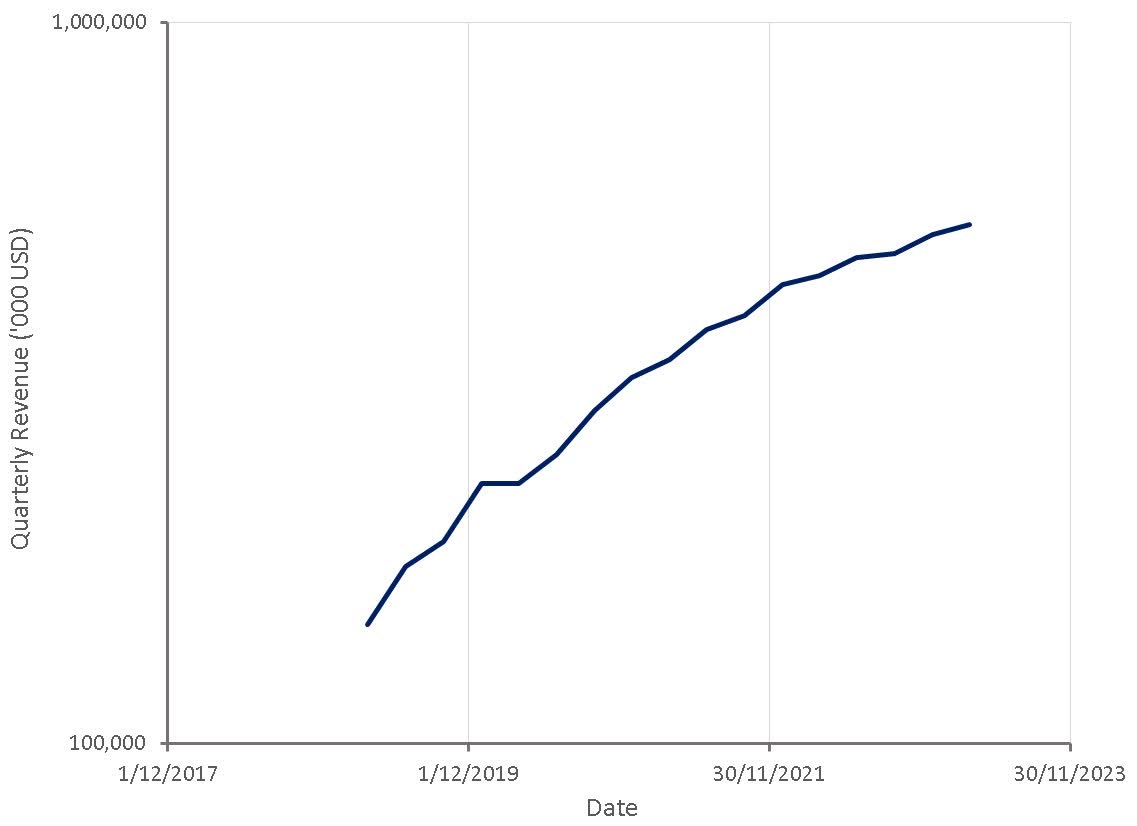

Understanding Palantir's current standing is crucial to assessing its potential for future growth and its chances of becoming a Palantir trillion-dollar company. Currently, Palantir’s market capitalization fluctuates, and its revenue growth trajectory is a key factor in determining its long-term prospects.

Analyzing key financial metrics reveals a mixed picture. While revenue has shown consistent year-over-year growth, profitability remains a challenge, and debt levels need careful consideration.

- Current Market Cap and Year-over-Year Growth: While the market cap is dynamic, tracking its performance against projected revenue growth will provide a clearer picture of investor sentiment and market valuation.

- Analysis of Revenue Streams (Government vs. Commercial): Palantir's revenue is derived from both government and commercial contracts. Understanding the proportion and growth trajectory of each segment is vital in assessing future revenue stability and diversification.

- Profitability Trends and Projections: Examining profit margins and projected profitability is crucial for assessing the long-term sustainability of its business model. Achieving a trillion-dollar valuation requires sustained and substantial profitability.

- Debt Levels and their Potential Impact: High debt levels could hinder Palantir's ability to invest in future growth and innovation, potentially impacting its path towards a Palantir trillion-dollar company valuation.

Growth Drivers and Opportunities for Palantir

Several factors could propel Palantir towards its ambitious goal. The increasing demand for sophisticated data analytics, fueled by the rise of artificial intelligence (AI) and machine learning, creates significant opportunities. Government contracts, particularly in national security and intelligence, form a substantial part of its revenue, and continued government spending in this area could significantly boost Palantir’s growth.

- Expansion into New Sectors (e.g., healthcare, finance): Diversification beyond its core government and defense markets is essential for reducing risk and driving substantial revenue growth. Successful expansion into sectors like healthcare and finance could significantly contribute to a Palantir trillion-dollar company trajectory.

- Technological Advancements and Product Innovation: Continuous innovation in its data analytics platforms and AI capabilities will be crucial to maintaining a competitive edge and attracting new clients.

- Strategic Partnerships and Acquisitions: Collaborations and acquisitions could accelerate Palantir’s expansion into new markets and enhance its technological capabilities, furthering its potential to become a Palantir trillion-dollar company.

- Government Spending on Data Analytics and National Security: Continued high government spending on data analytics and national security remains a key driver of Palantir's growth, but this is subject to economic and political shifts.

Challenges and Risks Facing Palantir

Despite the potential, several challenges could impede Palantir's progress. Intense competition from established tech giants and innovative startups is a significant hurdle. Concerns around data privacy and regulatory compliance also pose a considerable risk.

- Competition from Established Tech Giants and Startups: Competition from companies like Microsoft, Google, and Amazon, along with agile startups, presents a constant threat to Palantir's market share.

- Data Privacy Regulations and Compliance Risks: Stringent data privacy regulations, such as GDPR and CCPA, demand significant compliance efforts, potentially impacting Palantir’s operational efficiency and growth.

- Economic Uncertainty and its Impact on Government Spending: Economic downturns could lead to reduced government spending, significantly impacting Palantir's revenue, especially its reliance on government contracts.

- Dependence on Large Government Contracts: Over-reliance on large government contracts poses a risk, as these contracts can be subject to delays, cancellations, or changes in government priorities.

Valuation and Path to a Trillion-Dollar Market Cap

Achieving a trillion-dollar market cap requires extraordinary growth. Comparing Palantir's valuation to similar companies in the data analytics and software sectors provides some context, but it's vital to consider the unique nature of Palantir’s business model and its dependence on government contracts.

- Comparison of Palantir's Valuation to Competitors: Benchmarking Palantir against its peers provides a relative valuation, but direct comparisons can be misleading given the unique characteristics of Palantir's business.

- Projected Revenue Growth and Market Share: Sustained, significant revenue growth and substantial market share gains are essential to justify a trillion-dollar valuation.

- Analysis of Different Valuation Models: Employing various valuation models, such as discounted cash flow analysis, provides different perspectives and insights into Palantir's potential future value.

- Probability Assessment of Reaching a Trillion-Dollar Valuation by 2030: Given the current market conditions, growth projections, and inherent risks, assessing the probability of achieving a trillion-dollar valuation by 2030 is a complex exercise with no definitive answer.

Conclusion: Will Palantir Achieve a Trillion-Dollar Valuation?

Whether Palantir will achieve a trillion-dollar valuation by 2030 remains a highly speculative question. While the company possesses significant potential fueled by growth drivers like increasing demand for data analytics and continued government investment, significant challenges related to competition, regulatory compliance, and economic uncertainty need careful consideration. The path to a Palantir trillion-dollar company is fraught with both opportunity and risk. Achieving this ambitious goal necessitates sustained, high-growth trajectories across various market segments while mitigating risks effectively.

What do you think? Will Palantir be a trillion-dollar company by 2030? Share your thoughts in the comments below!

Featured Posts

-

Dakota Dzhonson Sredi Laureatov Zolotoy Maliny Analiz Provalnykh Filmov Goda

May 09, 2025

Dakota Dzhonson Sredi Laureatov Zolotoy Maliny Analiz Provalnykh Filmov Goda

May 09, 2025 -

Large Scale Alaska Protest Targets Doge And Trump Administration Initiatives

May 09, 2025

Large Scale Alaska Protest Targets Doge And Trump Administration Initiatives

May 09, 2025 -

Pogoda Perm I Permskiy Kray Konets Aprelya 2025 Prognoz

May 09, 2025

Pogoda Perm I Permskiy Kray Konets Aprelya 2025 Prognoz

May 09, 2025 -

Clarification Politique Elisabeth Borne Envisage La Fusion De Renaissance Et Du Modem

May 09, 2025

Clarification Politique Elisabeth Borne Envisage La Fusion De Renaissance Et Du Modem

May 09, 2025 -

Elizabeth City Road Fatal Accident Two Pedestrians Killed

May 09, 2025

Elizabeth City Road Fatal Accident Two Pedestrians Killed

May 09, 2025