Will The Bank Of Canada Cut Rates Again? Tariff Impacts And Economic Forecasts

Table of Contents

The Impact of Tariffs on the Canadian Economy

Tariffs, particularly those stemming from the US-China trade war and other trade disputes, have significantly impacted the Canadian economy. Understanding their influence is crucial to predicting the Bank of Canada's next move regarding interest rates.

Trade Wars and Reduced Exports

The imposition of tariffs has led to a noticeable decline in Canadian exports, especially to the US, a key trading partner. This reduction in export revenue has dampened economic growth and created uncertainty for businesses.

- Lumber: The ongoing dispute over softwood lumber exports has significantly impacted Canadian lumber producers, leading to job losses and reduced output.

- Agriculture: Tariffs on Canadian agricultural products have hurt farmers and processors, impacting both domestic and export markets.

- Automotive: Disruptions in the automotive supply chain due to tariffs have affected production and employment in the Canadian automotive sector.

Quantitative data illustrating the decline in exports across these and other sectors is readily available from Statistics Canada and further highlights the negative impact of these trade wars on Canadian economic health and influences whether the Bank of Canada will cut rates again.

Supply Chain Disruptions and Inflation

Tariffs don't just affect exports; they also disrupt supply chains and increase costs for businesses and consumers. This leads to inflationary pressures and can stifle investment.

- Increased Import Costs: Tariffs increase the price of imported goods, impacting everything from raw materials to finished products. This directly contributes to higher consumer prices.

- Consumer Spending: As prices rise, consumers may reduce spending, impacting overall economic demand and potentially leading to slower GDP growth. This is a key consideration in the Bank of Canada's decision-making process regarding interest rates.

- Business Investment: Increased uncertainty and higher costs can lead to businesses postponing or cancelling investment projects, further hindering economic growth. This reluctance to invest is directly linked to the potential for future Bank of Canada interest rate cuts.

Analyzing Recent Economic Forecasts for Canada

Several reputable sources provide economic forecasts for Canada. Analyzing these forecasts, while recognizing their inherent limitations, helps us gauge the likelihood of further interest rate cuts.

GDP Growth Projections

The International Monetary Fund (IMF), the Conference Board of Canada, and other organizations offer varying GDP growth projections for Canada. These variations reflect different assumptions about key economic factors, including the impact of tariffs, global growth, and consumer confidence.

- Discrepancies in Forecasts: Differences in forecasts often stem from different assumptions about the severity and duration of trade disputes, the strength of consumer spending, and the overall global economic environment. Understanding the basis of these discrepancies helps in assessing the plausibility of each projection.

- Impact on BOC Decision: Lower-than-expected GDP growth projections could increase the likelihood of the Bank of Canada cutting interest rates to stimulate economic activity. The Bank of Canada closely monitors these projections when deciding on monetary policy, including whether the Bank of Canada will cut rates again.

Job Market Trends and Unemployment Rates

The Canadian job market provides important clues about the health of the economy and the need for potential interest rate adjustments.

- Unemployment Rate: The current unemployment rate is a key indicator. A rising unemployment rate often signals a weakening economy, increasing pressure on the Bank of Canada to lower interest rates.

- Sector-Specific Trends: Analyzing job growth and decline in specific sectors helps provide a clearer picture of economic health. Sectors heavily impacted by tariffs will show different trends than others.

- Relationship to Interest Rates: Low unemployment generally reduces the pressure for interest rate cuts, while rising unemployment increases it. This correlation is central to the Bank of Canada's policy decisions.

Factors Influencing the Bank of Canada's Decision

Several factors influence the Bank of Canada's decision on whether to cut interest rates further.

Inflation Targets and Monetary Policy

The Bank of Canada has an inflation target, typically around 2%. Current inflation rates compared to this target heavily influence monetary policy decisions.

- Current Inflation Rate: If inflation is below the target, the Bank of Canada might consider lowering interest rates to stimulate economic activity and boost inflation. Conversely, higher-than-target inflation might lead to rate hikes.

- Inflation Target Relationship to Interest Rates: The Bank of Canada's primary mandate is to maintain price stability, and its interest rate decisions directly impact inflation.

- Bank of Canada Mandate: Understanding the Bank of Canada's mandate and its focus on price stability is essential when analyzing interest rate decisions.

Global Economic Uncertainty

Global economic factors significantly influence the Bank of Canada's outlook and its policy decisions.

- Brexit Impact: Uncertainty surrounding Brexit has created ripples across global markets, impacting Canadian exports and investor confidence.

- US-China Trade Tensions: The ongoing trade dispute between the US and China creates significant uncertainty in the global economy, affecting Canada indirectly.

- Global Recession Risk: The potential for a global recession is a crucial factor considered by the Bank of Canada when assessing the need for potential interest rate adjustments. This is especially true considering whether the Bank of Canada will cut rates again.

Conclusion

The decision of whether the Bank of Canada will cut rates again is complex, influenced by various interconnected factors. While the impact of tariffs on exports and supply chains has created economic headwinds, the current state of the job market, GDP growth projections, and global economic uncertainty all play a significant role. The Bank of Canada's inflation target and its mandate for price stability remain central to their decision-making process.

Stay informed about crucial economic developments and the Bank of Canada's policy decisions by regularly checking our website for updates on the Bank of Canada interest rate cuts. Understanding the potential for future rate changes is vital for both businesses and individuals planning their financial strategies. Continue to follow our analysis on whether the Bank of Canada will cut rates again.

Featured Posts

-

A 1 Iou The Unpaid Tom Cruise Role For Tom Hanks

May 12, 2025

A 1 Iou The Unpaid Tom Cruise Role For Tom Hanks

May 12, 2025 -

Ranking Washington Dcs Power Elite The 500 Of 2025

May 12, 2025

Ranking Washington Dcs Power Elite The 500 Of 2025

May 12, 2025 -

Indy Car 2025 The 5 Drivers Facing Elimination On Bump Day

May 12, 2025

Indy Car 2025 The 5 Drivers Facing Elimination On Bump Day

May 12, 2025 -

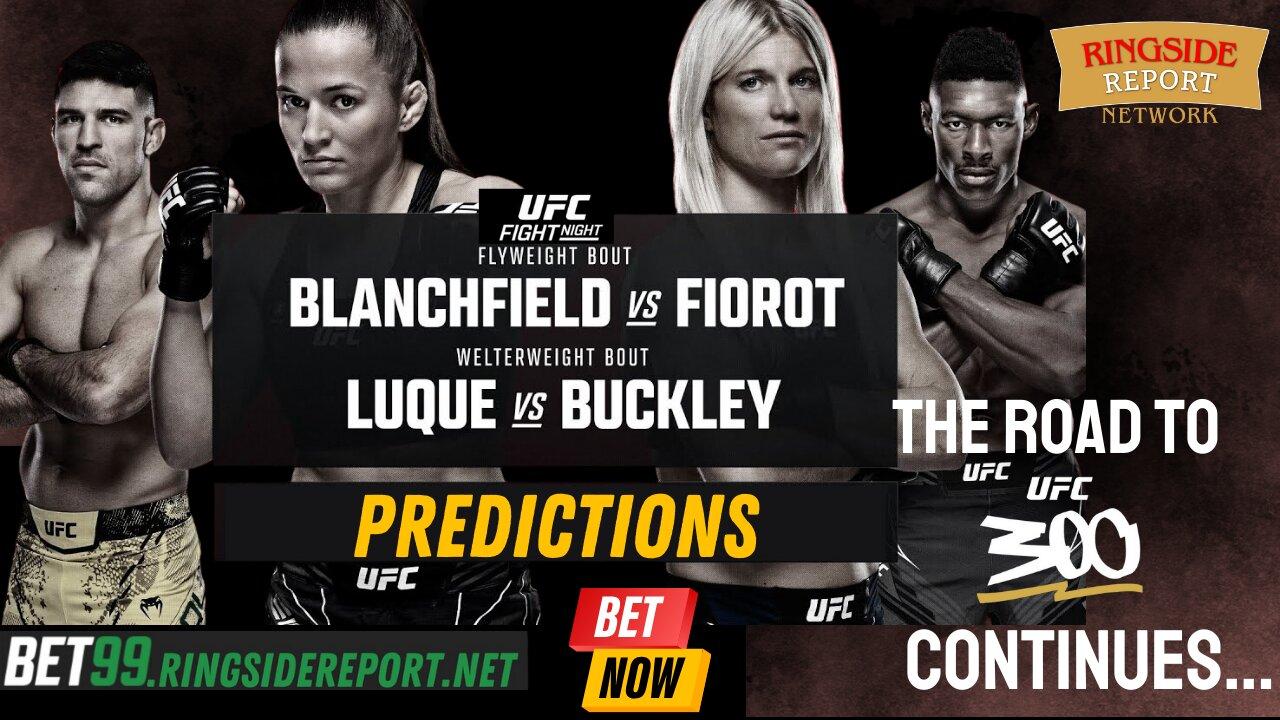

Shevchenko Vs Fiorot Champions Dismissive Remarks Fuel Ufc Rivalry

May 12, 2025

Shevchenko Vs Fiorot Champions Dismissive Remarks Fuel Ufc Rivalry

May 12, 2025 -

Jean Luc Delarue Le Temoignage Peu Amene D Antoine Dulery

May 12, 2025

Jean Luc Delarue Le Temoignage Peu Amene D Antoine Dulery

May 12, 2025