Will Trump's Policies Push Bitcoin (BTC) Above $100,000? A Price Prediction Analysis

Table of Contents

Trump's Economic Policies and their Potential Impact on Bitcoin

Fiscal Policy and Inflation

A Trump administration is often associated with increased government spending and potential tax cuts. Such fiscal policies could lead to significant inflationary pressures. Historically, periods of high inflation have driven investors towards alternative assets like Bitcoin, seen by some as a hedge against inflation. This is because Bitcoin's supply is capped at 21 million coins, making it a potentially deflationary asset in contrast to an inflating fiat currency.

- Increased Government Spending: A substantial increase in government spending could significantly boost the money supply, potentially leading to a devaluation of the dollar and increased inflation.

- Inflationary Hedge: Investors seeking to protect their purchasing power might flock to Bitcoin, driving up demand and, consequently, its price.

- Example: During periods of high inflation in history, alternative assets such as gold have typically seen increased demand. Bitcoin could follow a similar trajectory.

Regulatory Uncertainty and Bitcoin

Trump's stance on cryptocurrency regulation remains uncertain. Increased regulatory clarity could boost institutional investment, while conversely, unpredictable regulations could deter institutional participation. The effects of his potential policies could range from encouraging growth to creating significant uncertainty within the cryptocurrency market.

- Regulatory Clarity: Clear and favorable regulations could attract large institutional investors, pushing Bitcoin's price higher.

- Regulatory Uncertainty: Conversely, a lack of clarity or stringent regulations could discourage investment and hinder Bitcoin's price growth.

- Institutional Adoption: The level of regulatory scrutiny directly influences institutional adoption rates, which significantly impact market capitalization.

Geopolitical Instability and Safe-Haven Assets

A Trump presidency might be characterized by increased geopolitical instability. In times of uncertainty, investors often seek safe-haven assets. Bitcoin, due to its decentralized nature and independence from traditional financial systems, has shown potential to act as a safe-haven asset during periods of global turmoil.

- Geopolitical Risk Premium: Increased geopolitical uncertainty often results in a "risk premium" on assets perceived as safe, potentially benefiting Bitcoin.

- Flight to Safety: Investors may move their assets out of traditional markets and into Bitcoin as a hedge against potential political and economic instability.

- Historical Precedents: Past periods of geopolitical tension have, in some cases, correlated with increases in Bitcoin's price, suggesting a potential safe-haven characteristic.

Factors Beyond Trump's Policies Affecting Bitcoin's Price

Technological Advancements

Bitcoin's price is also significantly influenced by technological advancements within its ecosystem. Upgrades improving scalability, security, and transaction speeds are critical for mass adoption. The development and implementation of layer-2 solutions are particularly crucial for improving the efficiency of the network.

- Bitcoin Upgrades: Successful protocol upgrades that enhance efficiency and security can boost investor confidence and drive price appreciation.

- Scaling Solutions: Layer-2 solutions, like the Lightning Network, aim to address scalability issues and increase transaction speeds, making Bitcoin more practical for everyday use.

- Technological Adoption: Widespread adoption of Bitcoin-related technologies is a crucial factor in long-term price appreciation.

Market Sentiment and Adoption

Market sentiment, driven by social media trends, mainstream media coverage, and general investor confidence, plays a massive role in Bitcoin's price volatility. Increased adoption by both retail and institutional investors further fuels price fluctuations.

- Market Sentiment: Positive news and widespread adoption can significantly boost investor confidence and drive price appreciation. Negative sentiment can have the opposite effect.

- Institutional Investors: Large institutional investments can lead to significant price increases due to their high capital inflows.

- Retail Investors: Growing participation from retail investors also impacts demand and subsequently price.

Macroeconomic Factors

Global macroeconomic factors, such as interest rates, inflation rates, and overall economic growth, also influence Bitcoin's price. These wider economic trends can impact investor risk appetite and capital allocation.

- Interest Rates: Rising interest rates can draw investment away from riskier assets like Bitcoin into more stable options.

- Global Economic Growth: Strong global economic growth can boost risk appetite, potentially leading to higher Bitcoin prices.

- Market Cycles: Bitcoin, like other assets, is subject to market cycles influenced by macroeconomic factors.

Conclusion: Predicting Bitcoin's Future Under Potential Trump Policies

Predicting Bitcoin's price with certainty is impossible. However, analyzing the potential influence of Trump's policies on factors like inflation, regulation, and geopolitical stability provides valuable insights. While a return of Trump's economic policies might create inflationary pressures potentially driving investors towards Bitcoin as an inflation hedge, regulatory uncertainty and increased geopolitical risk are countervailing factors. Technological advancements, market sentiment, and global macroeconomic conditions will all play critical roles in shaping Bitcoin's future price regardless of any particular political climate. Conduct thorough research and carefully assess your risk tolerance before investing in Bitcoin. While the path to $100,000 Bitcoin remains uncertain, understanding the potential impact of Trump's policies is crucial for any investor navigating this volatile market. Stay informed about Bitcoin price predictions and the evolving economic landscape to make informed investment decisions.

Featured Posts

-

Googles Response To Dojs Antitrust Lawsuit Concerns Over User Trust

May 08, 2025

Googles Response To Dojs Antitrust Lawsuit Concerns Over User Trust

May 08, 2025 -

Unprecedented Action Indias Deepest Military Strike On Pakistan Cnn

May 08, 2025

Unprecedented Action Indias Deepest Military Strike On Pakistan Cnn

May 08, 2025 -

Lahwr Ky 10 Myn Se 5 Ahtsab Edaltyn Khtm Mqdmat Ka Kya Hwga

May 08, 2025

Lahwr Ky 10 Myn Se 5 Ahtsab Edaltyn Khtm Mqdmat Ka Kya Hwga

May 08, 2025 -

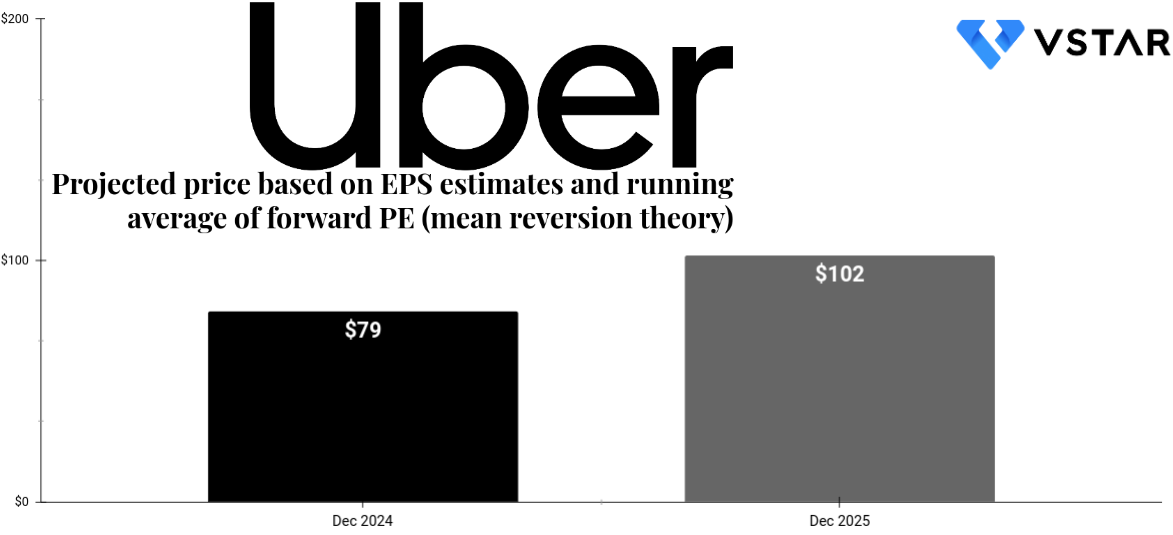

Will Ubers Self Driving Cars Drive Stock Prices Higher

May 08, 2025

Will Ubers Self Driving Cars Drive Stock Prices Higher

May 08, 2025 -

Coming Soon The European Digital Identity Wallet A Comprehensive Guide

May 08, 2025

Coming Soon The European Digital Identity Wallet A Comprehensive Guide

May 08, 2025