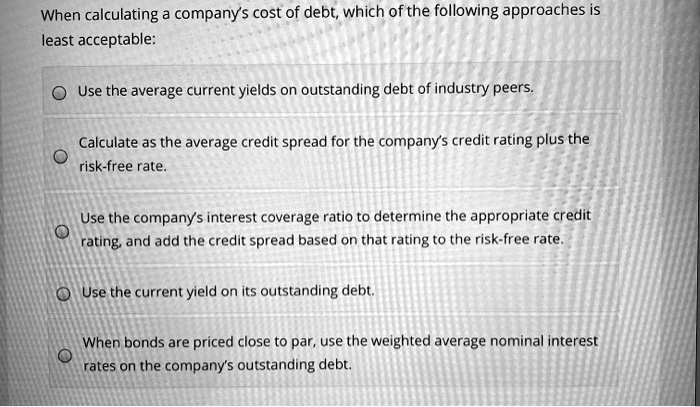

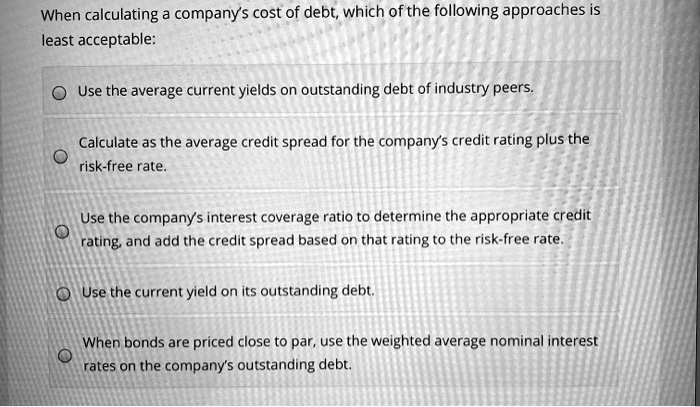

X Corp Financial Report: Assessing The Impact Of Recent Debt Financing

Table of Contents

Analysis of X Corp's Debt Structure Post-Financing

The X Corp financial report reveals a significantly altered debt structure following the recent financing. Analyzing this new structure is key to understanding the potential risks and rewards.

Types of Debt Incurred:

The X Corp financial report details the following types of debt incurred:

- Corporate Bonds: X Corp issued $500 million in 10-year bonds with a 5% coupon rate. These bonds represent a significant portion of the new debt.

- Term Loans: A further $200 million was secured through term loans from a syndicate of banks, carrying an interest rate of 4.5% and maturing in 7 years.

- Bridge Loan: A short-term bridge loan of $100 million was also utilized, pending the issuance of long-term debt. This loan carries a higher interest rate of 6%.

The total debt amount of $800 million represents a substantial increase in X Corp's leverage. Comparing this to previous years, where X Corp's debt-to-equity ratio stood at 0.5, the new ratio is projected to reach 0.8, indicating a higher level of financial risk. Key financial ratios, such as the debt-to-equity ratio and the interest coverage ratio (the latter showing the company's ability to meet its interest payments), need close monitoring.

Credit Rating Implications:

Following the debt financing, Moody's, S&P, and Fitch all reviewed X Corp's credit rating. While maintaining an investment-grade rating, a slight downgrade from AA- to A+ was observed by two of the agencies. This downgrade reflects the increased debt burden. The potential impact of this lower rating is an increase in X Corp's future borrowing costs, making future financing more expensive. Careful monitoring of these credit ratings is crucial for assessing the ongoing financial health of X Corp.

Impact on X Corp's Financial Performance

The X Corp financial report allows for an analysis of the debt financing's impact on the company's financial performance, both in the short and long term.

Short-Term Effects:

The immediate impact includes:

- A slight decrease in earnings per share (EPS) due to increased interest expense.

- No significant change in revenue in the short term.

- A reduction in profitability margins due to higher interest payments.

- The cash flow statement shows a decrease in free cash flow, but this is expected to improve as the bridge loan is repaid. Liquidity should not be a major concern in the short term.

Long-Term Effects and Projections:

The long-term effects depend greatly on how X Corp utilizes the debt financing proceeds. The X Corp financial report projects:

- Potential for significant growth through investments in new technologies and expansion into new markets. This is the primary benefit of the debt financing.

- Increased financial leverage, increasing the risk of default if future revenues are lower than expected.

- The company's projections also include plans for debt reduction within the next five years.

Careful evaluation of these projections is crucial to fully understand the long-term impacts of the financial decisions made.

Investor Sentiment and Market Reaction

The market reaction to the X Corp debt financing announcement is a crucial element in assessing the overall success of the strategy.

Stock Price Performance:

The X Corp stock price initially dipped slightly following the announcement. However, after the company elaborated on its strategic plans for using the funds, the stock price largely recovered, indicating positive investor sentiment towards the potential long-term benefits. Charts and graphs depicting this stock price movement provide further insight.

Analyst Ratings and Recommendations:

Following the release of the X Corp financial report, analyst opinions varied. While some analysts expressed concerns about the increased debt burden, others remained positive, highlighting the growth opportunities created by the financing. Many analysts maintained their "buy" or "hold" ratings, reflecting a relatively optimistic outlook, but close monitoring of analyst opinions is recommended. [Links to analyst reports could be inserted here].

Conclusion: Key Takeaways and Call to Action

The X Corp financial report reveals a complex picture following the recent debt financing. While the increased debt burden presents a risk, the potential for long-term growth and expansion offers significant upside. Careful analysis of the debt structure, credit rating implications, and the impact on financial performance is crucial. Understanding the X Corp financial report's details is vital for accurately gauging the risks and potential benefits of this financial strategy. Stay updated on the evolving financial landscape of X Corp by regularly checking for new financial reports and analyzing the long-term implications of this debt financing. Continuous monitoring of the X Corp financial report and related news is vital for investors seeking to make informed decisions.

Featured Posts

-

Chat Gpt Developer Open Ai Under Federal Trade Commission Investigation

Apr 29, 2025

Chat Gpt Developer Open Ai Under Federal Trade Commission Investigation

Apr 29, 2025 -

Louisville Representative Accuses Usps Of Hiding Mail Delay Information

Apr 29, 2025

Louisville Representative Accuses Usps Of Hiding Mail Delay Information

Apr 29, 2025 -

911 Cayenne

Apr 29, 2025

911 Cayenne

Apr 29, 2025 -

Jeff Goldblum On Altering The Flys Ending His Reasons Revealed

Apr 29, 2025

Jeff Goldblum On Altering The Flys Ending His Reasons Revealed

Apr 29, 2025 -

Ryan Reynolds Celebrates Wrexham Afcs Historic Promotion To The Football League

Apr 29, 2025

Ryan Reynolds Celebrates Wrexham Afcs Historic Promotion To The Football League

Apr 29, 2025