XRP Classification As Commodity: Ripple's Settlement Talks With SEC

Table of Contents

The SEC's Case Against Ripple

The Allegation of Unregistered Security Sales

The SEC alleges that Ripple conducted unregistered sales of XRP, violating federal securities laws. Their argument hinges on the Howey Test, a legal framework used to determine whether an investment constitutes a security.

-

The Howey Test: This test considers four factors: (1) an investment of money, (2) in a common enterprise, (3) with a reasonable expectation of profits, (4) derived primarily from the efforts of others. The SEC argues that XRP satisfies all four criteria.

-

SEC's Claims Regarding Ripple's Distribution of XRP: The SEC claims Ripple distributed XRP to institutional investors and retail buyers, generating significant profits for the company while failing to register XRP as a security. They point to Ripple's direct sales and programmatic sales as evidence of this.

-

Potential Penalties for Violating Securities Laws: Violating securities laws can result in substantial financial penalties, injunctions against future sales, and even criminal charges. The potential penalties for Ripple are significant, potentially affecting the company's future and the value of XRP.

Ripple's Defense

Ripple counters that XRP is a decentralized digital asset functioning as a currency and not a security. They argue that the SEC's application of the Howey Test is flawed in this context.

-

Arguments Against the SEC's Characterization of XRP: Ripple emphasizes the decentralized nature of XRP's network and its use in numerous transactions across various exchanges worldwide. They argue that XRP's price is determined by market forces, not by Ripple's actions.

-

Decentralized Nature of XRP and Its Usage on Exchanges: Ripple highlights that XRP operates independently of Ripple's control. Its use on numerous exchanges, its function as a bridging currency, and the lack of a direct profit-sharing arrangement, are presented as evidence against the security classification.

-

Expert Testimony and Evidence: Ripple has presented expert testimony and evidence aiming to demonstrate XRP's decentralized nature and its function as a currency rather than an investment contract. This includes data on XRP's usage and market dynamics.

The Implications of XRP's Classification as a Commodity

Regulatory Impact

If XRP is classified as a commodity, it would fall under the purview of the Commodity Futures Trading Commission (CFTC) rather than the SEC. This carries significant regulatory implications.

-

Differences in Regulations Between Commodities and Securities: Commodities are subject to different regulatory frameworks than securities. The regulatory burden and compliance requirements are generally less stringent for commodities.

-

Impact on XRP Trading and Exchange Listings: A commodity classification could potentially simplify XRP's trading and listing on exchanges, as it would eliminate certain requirements imposed on securities.

-

Effect on Ripple's Business Model and Future Projects: A commodity classification could have a positive impact on Ripple's business model, streamlining operations and reducing regulatory hurdles for future projects.

Market Impact

The classification of XRP will significantly influence market sentiment and price volatility.

-

Potential Impact on XRP's Price: A commodity classification could lead to a price increase, as it might reduce regulatory uncertainty and attract more investors. However, the initial market reaction could be volatile regardless of the outcome.

-

Effect on Investor Confidence and Market Stability: A clear classification, whether commodity or security, could enhance market stability by reducing uncertainty and attracting further institutional investment. Conversely, a prolonged period of uncertainty could lead to instability.

-

Ripple Effect on Other Cryptocurrencies and the Broader Crypto Market: The outcome of the Ripple case could set a precedent for the classification of other cryptocurrencies, impacting the entire crypto market. A commodity classification could potentially lead to regulatory clarity and greater market maturity.

The Status of Settlement Talks

Current Negotiation Status

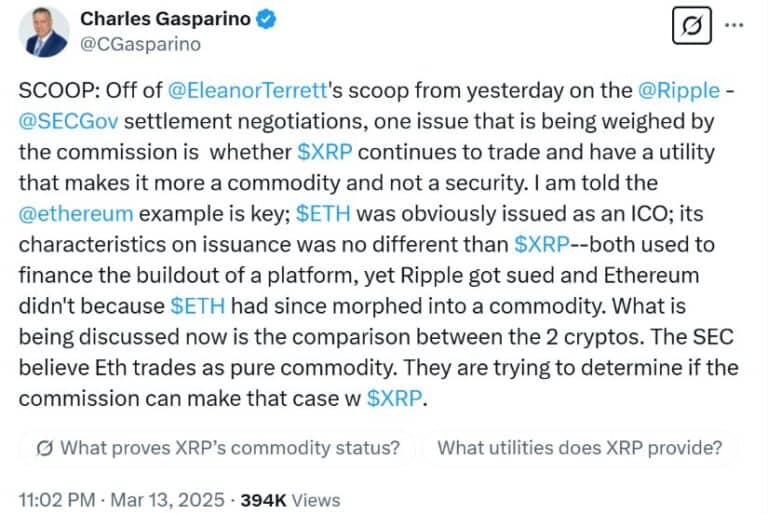

Settlement talks between Ripple and the SEC are ongoing. While details remain confidential, public statements and leaks suggest a complex negotiation process.

-

Summary of Current Status: The exact status is unclear, but both parties have expressed a willingness to explore a resolution. However, the ongoing litigation suggests that no final agreement has been reached.

-

Significant Developments or Roadblocks: The progress of the negotiations is often marked by periods of relative silence, followed by news of renewed talks or setbacks. Public statements from both sides should be carefully examined.

-

Official Statements from Ripple or the SEC: Any official communication from either party should be considered carefully, as it offers a potential glimpse into the ongoing negotiations.

Potential Outcomes

Several outcomes are possible from the settlement talks.

-

Potential Scenarios and Implications: A settlement agreement could involve Ripple paying a fine or agreeing to stricter regulatory compliance. Dismissal of the case would be a victory for Ripple. A court ruling could have significant ramifications, setting legal precedent for future crypto cases.

-

Likelihood of Each Outcome: Predicting the outcome is difficult, depending on the strength of each side’s arguments and the willingness to compromise. Analyzing the public statements and legal filings provides some insight, but it’s still uncertain.

-

Long-Term Implications: The long-term implications will be profound, influencing the regulatory environment for cryptocurrencies and the valuation of XRP and other digital assets.

Conclusion

The ongoing legal battle surrounding the XRP classification as a commodity or security and the status of Ripple's settlement talks with the SEC remains a pivotal moment for the cryptocurrency industry. The outcome will significantly impact XRP's future, the regulatory landscape for digital assets, and investor confidence. Understanding the intricacies of the case and the potential consequences of each outcome is crucial for anyone involved in or following the cryptocurrency market. Stay informed about further developments in this critical legal battle surrounding the XRP classification. Keep abreast of updates on Ripple’s settlement talks and the evolving legal definitions surrounding XRP and other digital assets.

Featured Posts

-

Aaron Judge And Paul Goldschmidt Power Yankees To Series Saving Win

May 01, 2025

Aaron Judge And Paul Goldschmidt Power Yankees To Series Saving Win

May 01, 2025 -

Jornada Nacional De Boxeo Saltillo Se Une A La Transformacion

May 01, 2025

Jornada Nacional De Boxeo Saltillo Se Une A La Transformacion

May 01, 2025 -

Historic Charlotte Barn For Sale Farmers And Foragers Ownership Opportunity

May 01, 2025

Historic Charlotte Barn For Sale Farmers And Foragers Ownership Opportunity

May 01, 2025 -

Michael Sheens 100 000 Donation Paying Off 1 Million Debt For 900 People

May 01, 2025

Michael Sheens 100 000 Donation Paying Off 1 Million Debt For 900 People

May 01, 2025 -

Miss Samoas Triumph Winning The Miss Pacific Islands 2025 Crown

May 01, 2025

Miss Samoas Triumph Winning The Miss Pacific Islands 2025 Crown

May 01, 2025