XRP ETF Approval Could Unleash $800 Million In Week 1 Inflows

Table of Contents

The Projected $800 Million Influx: A Deep Dive

The prediction of an $800 million influx within the first week of XRP ETF approval stems from several reputable analyst reports. For example, a recent study by [Insert Analyst Firm Name and Link to Report] utilized a proprietary model considering historical ETF launch data, projected retail and institutional demand, and XRP's current market capitalization. Their methodology suggests a significant surge in buying pressure immediately following SEC approval. This figure isn't pulled from thin air; it's a calculated estimate based on sophisticated market analysis.

Contributing factors to this projected influx include:

- Increased Institutional Investment: Pension funds, hedge funds, and other large institutional investors often shy away from direct cryptocurrency investment due to regulatory complexities and custodial challenges. An XRP ETF provides a regulated and easily accessible entry point, potentially unlocking vast sums of institutional capital.

- Retail Investor Participation: ETFs democratize investment. The ease of access through brokerage accounts will attract a wave of retail investors who previously found direct XRP investment too complicated or risky. This increased participation will significantly boost trading volume.

- Reduced Regulatory Uncertainty: SEC approval of an XRP ETF would signal a degree of regulatory acceptance, significantly reducing investor uncertainty. This newfound confidence is a major driver of increased investment.

[Insert Chart/Graph here illustrating projected inflow and its potential impact on XRP price. Clearly label axes and source data.]

Impact on XRP Price and Volatility

While the potential for a significant price increase following XRP ETF approval is substantial, it's crucial to acknowledge the potential for subsequent price correction. The initial surge will likely be followed by a period of consolidation as the market absorbs the influx of new capital.

Potential volatility factors include:

- Short-Term Price Spikes Followed by Potential Consolidation: We can expect dramatic price movements in the short term, followed by a period of stabilization as the market adjusts to the increased liquidity.

- Increased Trading Volume Leading to Higher Price Fluctuations: Higher trading volume inherently increases price volatility as buying and selling pressure fluctuate.

- Potential for Manipulation in the Short-Term, Followed by a More Stable Market: Short-term price manipulation is always a risk in highly liquid markets. However, as the market matures post-ETF approval, this risk should diminish.

Analyzing historical data on other ETF approvals (e.g., Bitcoin ETFs in Canada) reveals a similar pattern: initial price spikes followed by periods of consolidation and increased overall trading volume.

The Ripple Effect on the Crypto Market

The approval of an XRP ETF will have far-reaching consequences for the cryptocurrency market as a whole. It's not just about XRP; this event holds significant implications for the broader crypto landscape.

Potential ripple effects include:

- Increased Overall Market Capitalization of Cryptocurrencies: A successful XRP ETF could inspire confidence in other crypto assets, leading to a general market-wide increase in capitalization.

- Increased Institutional Interest in Other Crypto Assets: The success of an XRP ETF could pave the way for increased institutional investment in other cryptocurrencies, driving further market growth.

- Potential for Regulatory Changes Impacting Other Cryptocurrencies: The SEC's decision regarding XRP will set a precedent, potentially influencing future regulatory decisions on other crypto assets.

This could also lead to increased competition among other cryptocurrencies as they strive to attract investment in the wake of the XRP ETF's success.

XRP ETF Approval and Regulatory Landscape

The current regulatory environment surrounding XRP is complex, heavily influenced by the ongoing SEC lawsuit against Ripple Labs. The SEC's decision on XRP ETF approval will be a pivotal moment, setting a precedent for future ETF applications and significantly impacting investor confidence.

A positive decision would signal a more favorable regulatory stance towards XRP and potentially other cryptocurrencies, boosting investor confidence and unlocking further market growth. Conversely, a negative decision could have a chilling effect on the entire crypto market. Regulatory clarity is paramount for sustained growth and attracting long-term investment.

Conclusion: The Future of XRP and ETF Approvals

The potential $800 million influx within the first week of XRP ETF approval represents a significant catalyst for the cryptocurrency market. This influx will likely impact XRP's price, increasing volatility in the short term before stabilizing. The broader implications are significant, potentially setting a precedent for other cryptocurrencies and driving further institutional investment. The SEC's decision is, therefore, a landmark moment.

Call to Action: Stay informed about the latest developments regarding XRP ETF approval. Follow reputable news sources for updates and insights into the potential impact of this landmark decision on your investment strategy. Understanding the potential of XRP ETF approval is crucial for navigating the evolving cryptocurrency landscape. Learn more about XRP ETF investment strategies and how to prepare for the potential market changes.

Featured Posts

-

Analize Kodel Nba Lyderiai Pralaimejo Su Duobeles Dalyvavimu

May 07, 2025

Analize Kodel Nba Lyderiai Pralaimejo Su Duobeles Dalyvavimu

May 07, 2025 -

The Future Of George Pickens With The Pittsburgh Steelers Expert Insight

May 07, 2025

The Future Of George Pickens With The Pittsburgh Steelers Expert Insight

May 07, 2025 -

Royal Air Marocs Continued Commitment To The Ouagadougou Pan African Film Festival

May 07, 2025

Royal Air Marocs Continued Commitment To The Ouagadougou Pan African Film Festival

May 07, 2025 -

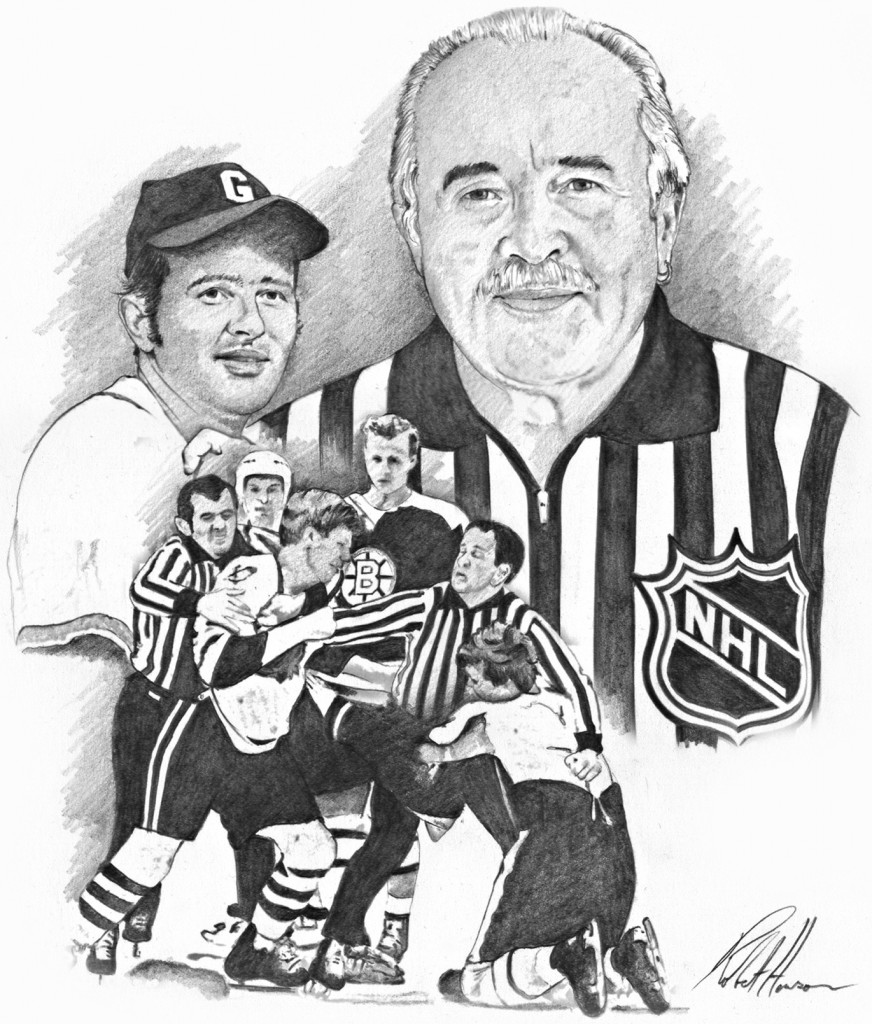

Apple Watches And Nhl Officials A New Era In Officiating

May 07, 2025

Apple Watches And Nhl Officials A New Era In Officiating

May 07, 2025 -

Tigers Vs Mariners Prediction Picks And Odds For Todays Mlb Game

May 07, 2025

Tigers Vs Mariners Prediction Picks And Odds For Todays Mlb Game

May 07, 2025