XRP ETFs: Potential For $800M In Week 1 Inflows Upon Approval

Table of Contents

The cryptocurrency market is buzzing with anticipation regarding the potential approval of XRP Exchange Traded Funds (ETFs). Industry analysts predict a staggering $800 million could flow into XRP ETFs within the first week of approval, representing a significant catalyst for XRP price appreciation and broader market adoption. This article delves into the potential implications of XRP ETF approval, exploring the factors driving this predicted surge and outlining the opportunities and risks for investors.

The Catalyst: SEC Approval and its Market Impact

The primary catalyst for the projected $800 million influx is the potential approval of XRP ETFs by the Securities and Exchange Commission (SEC). Currently, regulatory uncertainty surrounding XRP has hindered significant institutional investment. However, SEC approval would dramatically alter this landscape.

Regulatory Uncertainty Resolved

- Increased institutional investor confidence: SEC approval would signal a significant reduction in regulatory risk, encouraging large financial institutions to allocate capital to XRP. This influx of institutional money is a major factor contributing to the predicted $800 million inflow.

- Reduced risk perception for large financial institutions: Many institutional investors have previously hesitated to invest in XRP due to the regulatory ambiguity. An SEC-approved ETF would mitigate these concerns, opening doors to substantial investment.

- Opening access to a wider investor base: ETFs provide a more accessible and regulated entry point for retail investors who might otherwise be hesitant to invest directly in cryptocurrencies.

Increased Liquidity and Trading Volume

The listing of XRP ETFs on major exchanges will dramatically increase liquidity and trading volume for XRP. This is crucial for price stability and attracting further investment.

- Simplified access for retail investors: ETFs allow investors to buy and sell XRP through their brokerage accounts, simplifying the process and removing the need for complex cryptocurrency exchange accounts.

- Creation of a more efficient market: ETFs create a more transparent and regulated market for XRP, leading to improved price discovery and reduced volatility compared to the often-volatile cryptocurrency exchanges.

- Potential for price discovery and stabilization: Increased trading volume driven by ETFs can lead to more accurate pricing and potentially stabilize the price of XRP, making it a more attractive investment for risk-averse investors.

The $800 Million Projection: Methodology and Assumptions

The $800 million projection is based on a combination of factors and assumptions:

- Market demand analysis: Analysts have examined the existing demand for XRP and projected potential investment based on ETF accessibility.

- Comparison to other successful ETF launches: The projected inflow is partially based on the success of other cryptocurrency ETF launches, scaling the results to the expected demand for an XRP ETF.

- Conservative estimates based on potential investor interest: The $800 million figure represents a relatively conservative estimate, considering the potential for even greater investor interest once regulatory hurdles are cleared.

Investment Opportunities and Strategies with XRP ETFs

XRP ETFs offer exciting investment opportunities, but it is crucial to approach them with a sound strategy and awareness of the risks.

Diversification Benefits

XRP ETFs offer diversification benefits within a broader crypto portfolio or even a traditional investment portfolio.

- Reduced risk compared to direct XRP holdings: Investing in an XRP ETF mitigates some of the risks associated with holding XRP directly, such as security breaches on exchanges.

- Exposure to a different asset class: XRP offers exposure to a different asset class than traditional stocks and bonds, providing diversification benefits for a balanced portfolio.

- Potential for higher returns: While riskier than traditional investments, XRP, and subsequently XRP ETFs, hold the potential for significantly higher returns.

Trading Strategies

Several trading strategies can be applied to XRP ETFs, but each carries different risk levels.

- Buy-and-hold strategy: A long-term approach focusing on holding the ETF for an extended period, suitable for investors with a long-term horizon.

- Swing trading: A short-to-medium-term strategy that aims to capitalize on price fluctuations over several days or weeks.

- Day trading: A high-risk, high-reward strategy that involves buying and selling the ETF within the same trading day. Warning: Day trading requires significant experience and carries substantial risk.

Risk Management Considerations

Investing in XRP ETFs, like any investment, involves risks:

- Market volatility: Cryptocurrency markets are known for their volatility, and XRP is no exception. Price fluctuations can be substantial.

- Regulatory changes: Future regulatory changes could impact the price and availability of XRP ETFs.

- Underlying XRP price fluctuations: The value of the ETF is directly tied to the price of XRP, so any negative price movement in XRP will affect the ETF's value.

The Broader Impact on the XRP Ecosystem

The approval of XRP ETFs could significantly impact the broader XRP ecosystem.

Increased Adoption and Utility

- Greater integration into mainstream finance: ETF approval would represent a significant step towards integrating XRP into the mainstream financial system.

- Potential for increased use in payment systems: Increased adoption could lead to wider usage of XRP in cross-border payments and other financial transactions.

- Expansion of XRP's technological applications: The increased visibility and adoption of XRP could spur innovation and expansion of its technological applications.

Competition and Market Dynamics

The success of XRP ETFs could significantly influence the cryptocurrency market landscape:

- Attracting other cryptocurrencies to pursue ETF listings: The success of an XRP ETF could encourage other cryptocurrencies to seek similar listings, increasing competition and overall market liquidity.

- Potential for increased market capitalization for the entire crypto sector: The increased institutional interest and mainstream adoption resulting from XRP ETFs could positively influence the market capitalization of the entire cryptocurrency sector.

- Shifting investor sentiment and market trends: The approval and success of XRP ETFs could significantly shift investor sentiment and overall market trends within the crypto space.

Conclusion

The potential approval of XRP ETFs presents a compelling investment opportunity, potentially drawing substantial inflows like the projected $800 million in the first week. The elimination of regulatory uncertainty, increased liquidity, and simplified access for investors are all key factors driving this anticipated surge. While potential benefits are significant, it's crucial to understand and manage the inherent risks associated with cryptocurrency investments. Before investing in XRP ETFs or any other crypto asset, conduct thorough research and consult with a financial advisor. Stay informed about developments regarding XRP ETF approval and navigate the exciting future of XRP investment strategically. Learn more about the potential of XRP ETFs and prepare for the potential market shift.

Featured Posts

-

Tuesday April 15 2025 Daily Lotto Results

May 08, 2025

Tuesday April 15 2025 Daily Lotto Results

May 08, 2025 -

Former Uber Ceo Travis Kalanick Regrets Abandoning Specific Project Decision

May 08, 2025

Former Uber Ceo Travis Kalanick Regrets Abandoning Specific Project Decision

May 08, 2025 -

Experience The Best Ps 5 Pro Enhanced Exclusives

May 08, 2025

Experience The Best Ps 5 Pro Enhanced Exclusives

May 08, 2025 -

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1

May 08, 2025

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1

May 08, 2025 -

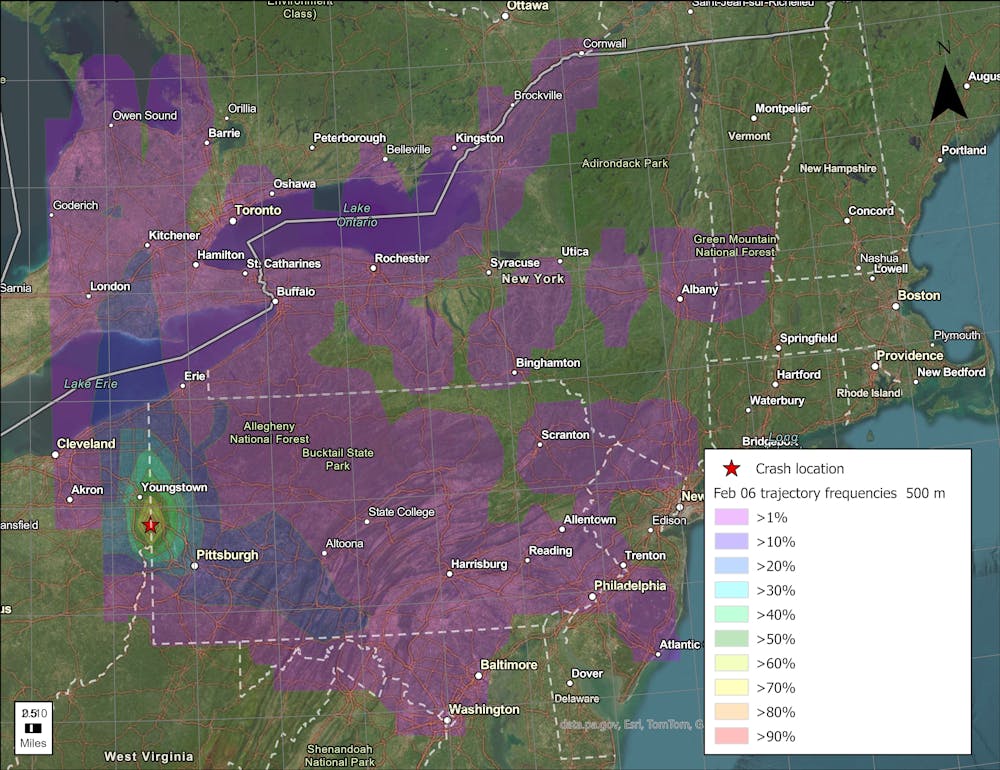

Investigation Into Lingering Toxic Chemicals In Buildings After Ohio Train Derailment

May 08, 2025

Investigation Into Lingering Toxic Chemicals In Buildings After Ohio Train Derailment

May 08, 2025