XRP Explained: How Does It Work And What Is Its Value?

Table of Contents

Understanding XRP's Functionality

XRP, created by Ripple Labs, is a cryptocurrency designed to facilitate seamless and cost-effective cross-border transactions. Unlike Bitcoin or Ethereum, which primarily focus on decentralized applications or store-of-value functions, XRP's core strength lies in its efficiency as a bridge currency.

XRP as a Bridge Currency

XRP acts as a bridge between different currencies, allowing for quick and inexpensive transfers across borders. This is achieved by converting one currency into XRP, then transferring it across borders before converting it back to the desired currency at the destination.

- Reduced Transaction Fees: XRP transactions significantly lower the fees associated with traditional international money transfers, saving both individuals and businesses substantial amounts.

- Increased Transaction Speed: XRP transactions are processed considerably faster than traditional banking systems, often completing within seconds or minutes.

- International Payments Made Easy: XRP simplifies international payments, bypassing the complexities and delays often associated with conventional methods. This is particularly beneficial for businesses operating across multiple countries.

RippleNet and its Ecosystem

XRP operates within RippleNet, a global network of financial institutions leveraging blockchain technology for efficient payments. RippleNet isn't just about currency exchange; it offers a suite of solutions for banks and payment providers.

- Partnerships with Financial Institutions: Ripple has established partnerships with numerous banks and financial institutions worldwide, integrating XRP into their payment systems.

- Impact on the Global Financial System: RippleNet is reshaping the global financial system by providing a faster, cheaper, and more transparent alternative to traditional cross-border payments.

- Benefits for Banks and Payment Providers: RippleNet offers banks and payment providers enhanced efficiency, reduced operational costs, and access to a wider global market. This leads to increased revenue and improved customer satisfaction.

XRP's Consensus Mechanism

XRP utilizes a unique consensus mechanism, distinct from Bitcoin's Proof-of-Work and Ethereum's Proof-of-Stake. While a detailed technical explanation is beyond the scope of this article, it's important to note its efficiency.

- Energy Efficiency: XRP's consensus mechanism is significantly more energy-efficient than Proof-of-Work systems, reducing its environmental impact.

- Scalability: The system is designed for scalability, enabling it to handle a large volume of transactions without compromising speed or efficiency.

- Transaction Confirmation: Transactions are confirmed rapidly, ensuring quick and reliable payments.

Factors Affecting XRP's Value

Several factors influence XRP's price, mirroring the dynamics of other cryptocurrencies, but with unique considerations.

Market Demand and Supply

Like any asset, XRP's price is governed by the laws of supply and demand. Increased adoption and positive market sentiment drive demand, pushing prices upward. Conversely, negative news or reduced adoption can lead to price drops.

- Adoption Rates: Wider adoption by financial institutions and businesses significantly impacts XRP's value.

- Regulatory Changes: Regulatory decisions and legal challenges can influence market sentiment and, consequently, XRP's price.

- Media Coverage: Positive or negative media coverage can significantly affect investor sentiment and price volatility.

- Overall Market Sentiment: The broader cryptocurrency market's performance influences XRP's price, as investors often react to overall market trends.

Ripple's Partnerships and Developments

Ripple's partnerships and technological advancements play a crucial role in shaping XRP's future. Successful partnerships drive adoption, boosting confidence and price. However, legal battles, like the ongoing SEC lawsuit, can negatively affect market sentiment.

- Ripple Partnerships: New partnerships with major financial institutions signal increased adoption and potential for growth.

- Regulatory Landscape: Navigating the complex regulatory environment is crucial for Ripple and XRP's long-term success. The SEC lawsuit's outcome will significantly impact investor confidence.

- Technological Innovation: Ongoing development and improvements to RippleNet and XRP technology enhances its appeal and strengthens its position in the market.

Adoption by Financial Institutions

The adoption of XRP by banks and other financial institutions is pivotal to its long-term success and price appreciation. Increased institutional adoption signals market validation and strengthens XRP's position as a viable solution for cross-border payments.

- Successful Case Studies: Successful implementations of XRP within financial institutions serve as strong case studies, encouraging further adoption.

- Banking Integration: Seamless integration with existing banking systems is essential for widespread adoption.

- Institutional Investors: Attracting investment from institutional investors further legitimizes XRP and fuels price appreciation.

Conclusion

XRP's functionality as a bridge currency within the RippleNet ecosystem, combined with its efficiency and potential for widespread adoption by financial institutions, positions it uniquely within the cryptocurrency market. While its value is subject to market forces, including regulatory developments and overall market sentiment, understanding its core functionality and the factors influencing its price is crucial. Learn more about XRP and its potential to revolutionize global finance.

Featured Posts

-

Australian Rugby Under Scrutiny Phippss Assessment Of Dominance

May 01, 2025

Australian Rugby Under Scrutiny Phippss Assessment Of Dominance

May 01, 2025 -

Analyzing Remember Mondays Uk Eurovision Entry A Response To Online Hate

May 01, 2025

Analyzing Remember Mondays Uk Eurovision Entry A Response To Online Hate

May 01, 2025 -

Royals Fall To Guardians In Extra Innings Thriller

May 01, 2025

Royals Fall To Guardians In Extra Innings Thriller

May 01, 2025 -

Bartlett Fire Leaves Two Structures As Total Losses Under Red Flag Warning

May 01, 2025

Bartlett Fire Leaves Two Structures As Total Losses Under Red Flag Warning

May 01, 2025 -

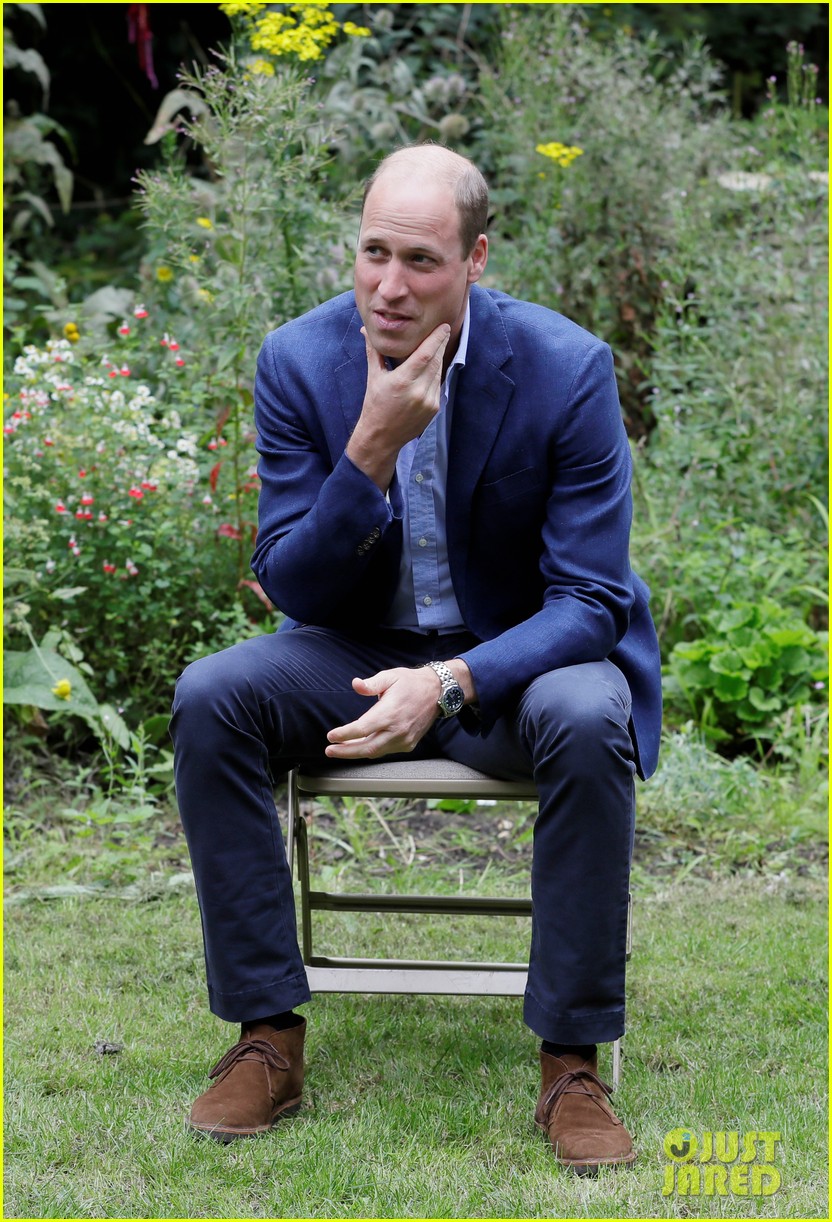

Royal Support For Homeless Cause Prince Williams Scottish Engagement

May 01, 2025

Royal Support For Homeless Cause Prince Williams Scottish Engagement

May 01, 2025