XRP News: SEC Commodity Classification - Regulatory Uncertainty And Debate

Table of Contents

The SEC's Case Against Ripple and its Impact on XRP

The SEC's lawsuit against Ripple Labs, the company behind XRP, alleges that XRP is an unregistered security. This claim rests heavily on the application of the Howey Test, a legal framework used to determine whether an investment contract constitutes a security. The Howey Test considers four factors:

- Investment of money: Did investors contribute funds with the expectation of profit?

- Common enterprise: Was there a common investment scheme or undertaking?

- Expectation of profits: Did investors anticipate profits primarily from the efforts of others?

- Efforts of others: Were profits derived largely from the efforts of the promoter or a third party?

The SEC argues that XRP satisfies all four prongs of the Howey Test, primarily citing Ripple's sales and distribution of XRP to generate profits. The ongoing legal proceedings involve extensive discovery, witness testimony, and legal arguments, impacting XRP's price significantly. Market volatility has been directly linked to the developments in the case. Expert legal opinions are divided, with some supporting the SEC's stance and others arguing for XRP's classification as a commodity or currency. The timeline for a final verdict remains uncertain, further fueling market uncertainty.

Arguments for and Against XRP as a Commodity

The debate surrounding XRP's classification centers on whether it functions as a security or a commodity. Arguments for its classification as a commodity emphasize its decentralized nature and utility within the XRP Ledger:

- Decentralized nature: Unlike securities issued by a central entity, XRP's distribution is largely decentralized.

- Utility on the XRP Ledger: XRP facilitates fast and low-cost transactions on the XRP Ledger, a functional aspect independent of Ripple's actions.

- Use in DeFi: XRP's integration within decentralized finance (DeFi) protocols further supports its utility as a transactional asset.

Conversely, the SEC contends that Ripple's actions, including its strategic sales of XRP, created a centralized control that aligns with the characteristics of a security. They argue that the expectation of profit derived primarily from Ripple's efforts, making XRP an investment contract under the Howey Test. This conflict highlights the complexities in applying traditional securities laws to the novel characteristics of cryptocurrencies. The outcome will have significant implications for future regulatory frameworks for cryptocurrencies and the development of decentralized finance.

The Broader Implications for the Cryptocurrency Market

The SEC's stance on XRP has far-reaching implications for the entire cryptocurrency market. Regulatory clarity is crucial for fostering investor confidence and encouraging innovation. The outcome of this case could set a precedent for how other cryptocurrencies are regulated, potentially influencing the classification of Bitcoin, Ethereum, and other altcoins.

- Regulatory Uncertainty: The lack of clear regulatory frameworks creates uncertainty, impacting investor confidence and market stability.

- Investor Protection: A well-defined regulatory landscape is vital for protecting investors from fraud and manipulation within the cryptocurrency market.

- Future Legal Challenges: This case could spark further legal challenges and regulatory scrutiny for other crypto projects, impacting the development and adoption of blockchain technology.

Navigating the Regulatory Uncertainty: Advice for XRP Investors

Given the ongoing regulatory uncertainty surrounding XRP, investors should adopt a cautious and informed approach:

- Risk Management: Investing in XRP carries significant risk due to the ongoing legal battle. Diversification of investments is crucial to mitigate potential losses.

- Due Diligence: Before investing in any cryptocurrency, including XRP, conduct thorough research and due diligence to understand the associated risks.

- Regulatory Compliance: Stay updated on all developments in the XRP case and broader cryptocurrency regulations to ensure compliance with applicable laws.

- Financial Advice: Consult with a qualified financial advisor before making any investment decisions to assess your risk tolerance and investment goals.

Conclusion

The SEC's classification of XRP as a security remains a significant development with far-reaching consequences for the cryptocurrency market. The ongoing legal battle between Ripple and the SEC underscores the need for clearer regulatory frameworks and highlights the inherent risks associated with investing in cryptocurrencies. Understanding the arguments surrounding XRP's classification, the potential outcomes of the lawsuit, and the broader implications for the crypto ecosystem is crucial for both investors and industry stakeholders. Stay informed about the latest developments in the XRP news and the ongoing SEC commodity classification debate. Conduct thorough research and consult with financial advisors before making any investment decisions related to XRP or other cryptocurrencies. Understanding the regulatory landscape is critical to navigating the evolving world of digital assets.

Featured Posts

-

Dzien Zwierzat Bezdomnych 4 Kwietnia Jak Wesprzec Schroniska

May 01, 2025

Dzien Zwierzat Bezdomnych 4 Kwietnia Jak Wesprzec Schroniska

May 01, 2025 -

Viral Cat Posts Spark Concern Among Kashmirs Cat Owners

May 01, 2025

Viral Cat Posts Spark Concern Among Kashmirs Cat Owners

May 01, 2025 -

Addressing Canadas Key Economic Issues A Mandate For The Next Prime Minister

May 01, 2025

Addressing Canadas Key Economic Issues A Mandate For The Next Prime Minister

May 01, 2025 -

Johnstons Speedy Goal Propels Stars To Victory Against Avalanche In Game 4

May 01, 2025

Johnstons Speedy Goal Propels Stars To Victory Against Avalanche In Game 4

May 01, 2025 -

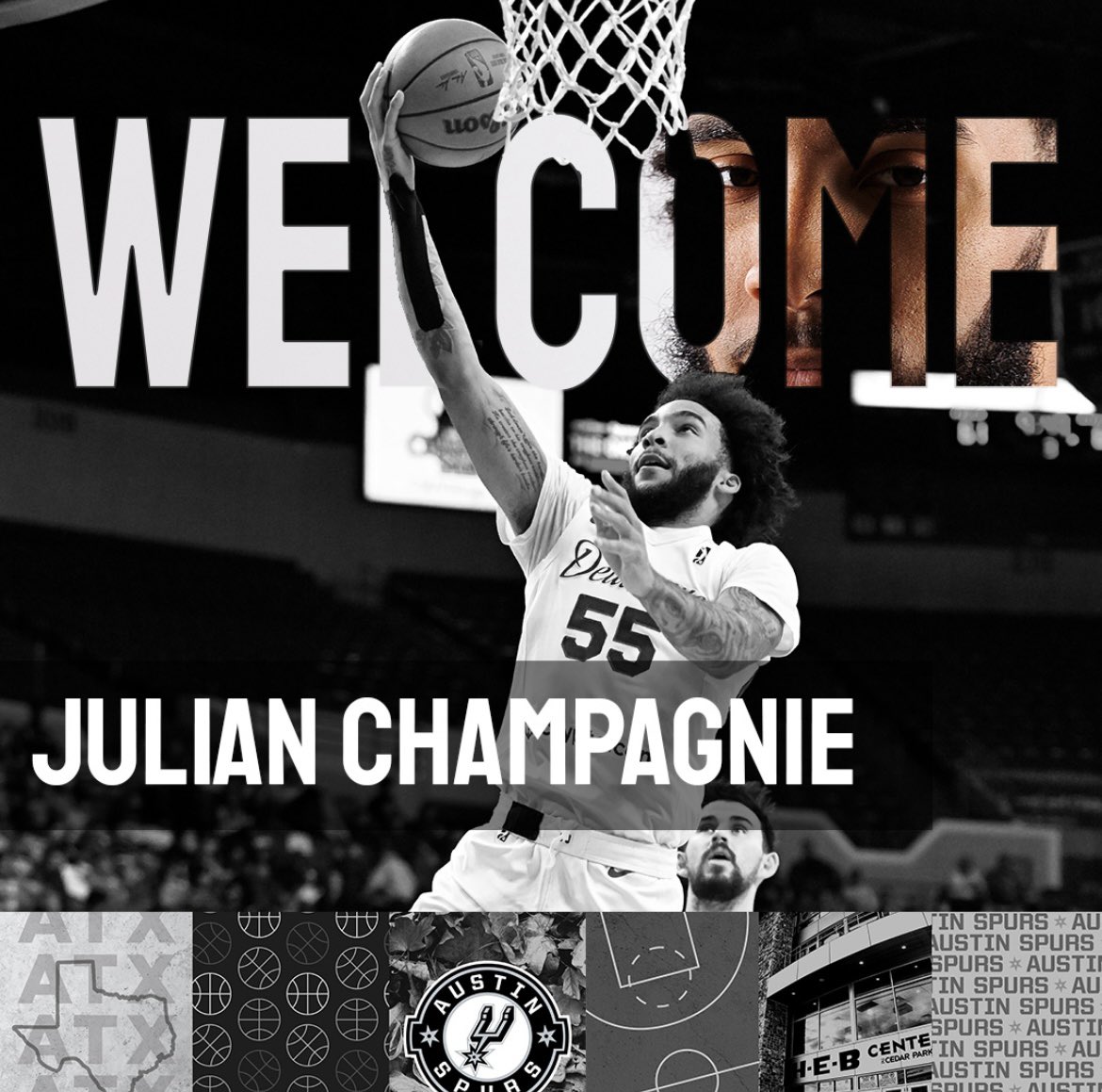

Analyzing The Game Attendance Of Paul Barnes And Champagnie For The San Antonio Spurs

May 01, 2025

Analyzing The Game Attendance Of Paul Barnes And Champagnie For The San Antonio Spurs

May 01, 2025