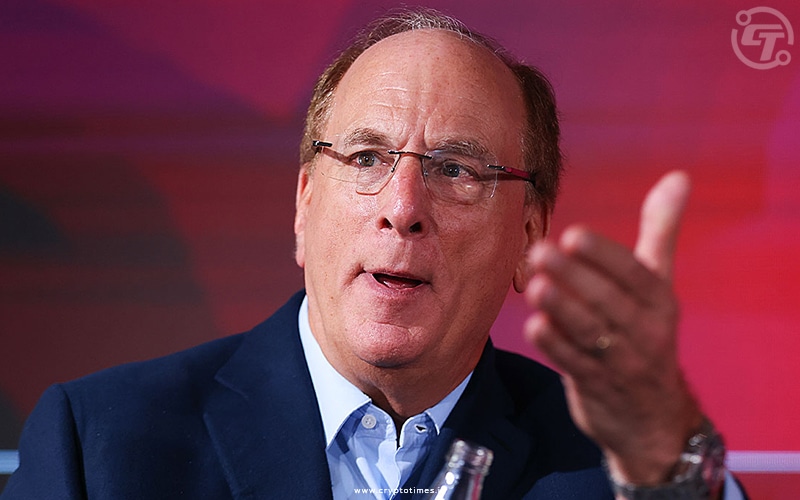

XRP Price On The Rise: Grayscale's ETF Application Under SEC Scrutiny

Table of Contents

Grayscale's ETF Application and its Implications for the Crypto Market

Grayscale's application for a spot Bitcoin ETF is a watershed moment for the cryptocurrency industry. Its approval would represent a significant victory for crypto proponents, potentially paving the way for increased institutional investment and mainstream adoption. The implications are far-reaching, affecting not only Bitcoin but also the entire crypto market, including XRP.

However, the path to approval is fraught with challenges. The SEC has expressed concerns about market manipulation and price volatility, leading to numerous rejections of similar applications in the past. Grayscale's legal battle highlights the regulatory hurdles facing cryptocurrencies and the ongoing debate surrounding their classification as securities.

- Spot Bitcoin ETF vs. Futures-Based ETF: A spot Bitcoin ETF would directly track the price of Bitcoin, unlike futures-based ETFs which track Bitcoin futures contracts. This distinction is crucial because a spot ETF is seen as more transparent and directly linked to the underlying asset.

- SEC Concerns: The SEC's primary concern centers around the potential for market manipulation in the spot Bitcoin market, citing its relatively smaller size and susceptibility to price volatility compared to established financial markets.

- The Competitive Landscape: Several other companies are vying for SEC approval for their Bitcoin ETFs, intensifying the competition and creating a dynamic environment where the outcome of Grayscale's application could significantly influence the strategies and market positioning of its rivals.

The Correlation Between XRP Price and the SEC's Decision

While not directly linked, there's a demonstrable correlation between XRP's price and regulatory developments affecting the broader crypto market. A favorable ruling on Grayscale's application could create a positive sentiment ripple effect, boosting investor confidence and driving increased trading volume for XRP. This is because a successful spot Bitcoin ETF application would signal a greater acceptance of cryptocurrencies by regulatory bodies, potentially easing concerns surrounding XRP and its regulatory uncertainty.

- Recent XRP Price Fluctuations: Charts clearly show a recent uptick in XRP's price, coinciding with heightened anticipation surrounding the Grayscale case.

- Analyst Predictions: Many analysts believe a positive outcome for Grayscale could significantly boost XRP's price, pointing to a potential increase in trading volume and institutional investment.

- Ripple's Ongoing Legal Battle: The ongoing Ripple vs. SEC lawsuit continues to cast a shadow over XRP. However, a positive ruling in the Grayscale case could indirectly benefit Ripple by improving overall market sentiment towards cryptocurrencies.

Understanding the Ripple vs. SEC Lawsuit and its Influence on XRP

The Ripple lawsuit, centered on the classification of XRP as a security, has profoundly impacted XRP's price. While the Grayscale case focuses on Bitcoin, a positive outcome could create a more favorable regulatory environment, potentially influencing the Ripple case's outcome and positively impacting XRP's price. Conversely, a negative outcome in the Grayscale case could negatively impact market sentiment and further depress XRP's price.

- Key Arguments in the Ripple Case: The SEC argues that XRP was sold as an unregistered security, while Ripple contends that XRP is a decentralized digital asset, not subject to the same regulations.

- Implications of a Court Ruling: The Ripple case's outcome will significantly shape the regulatory landscape for cryptocurrencies, potentially setting precedents for future cases and directly influencing the future trajectory of XRP's price.

- Historical Impact on XRP Price: The Ripple lawsuit has undeniably caused significant price volatility for XRP. A positive resolution would likely lead to a price surge.

Analyzing Market Sentiment and Investor Behavior

Market sentiment significantly influences XRP's price. Positive news and social media discussions often contribute to price increases, while negative news or regulatory uncertainty can lead to price drops. Analyzing XRP's trading volume and market capitalization alongside other cryptocurrencies provides valuable insights into investor behavior and market trends.

- Price Performance Graphs: Visual representations comparing XRP's price movements to other major cryptocurrencies offer a clearer understanding of its relative performance and market dynamics.

- Trading Volume and Market Capitalization Data: Tracking these metrics provides a quantitative assessment of investor activity and market confidence in XRP.

Conclusion: Navigating the XRP Price Rise and Future Outlook

The correlation between Grayscale's ETF application and the XRP price is undeniable, though indirect. A positive outcome in the Grayscale case could significantly boost investor confidence, impacting not only Bitcoin but also other cryptocurrencies, including XRP. However, navigating the crypto market requires caution, and investors should remain aware of the inherent risks and regulatory uncertainty. The Ripple lawsuit continues to play a significant role, and the SEC's decisions will shape the future of the crypto landscape.

Stay informed on the latest developments regarding XRP price and the Grayscale ETF application to make educated investment decisions. Conduct thorough research and consider consulting with a financial advisor before making any investment choices. The future of XRP, and the cryptocurrency market as a whole, depends on regulatory clarity and continued innovation.

Featured Posts

-

El Betis Una Historia Forjada En Verde

May 08, 2025

El Betis Una Historia Forjada En Verde

May 08, 2025 -

Re Examining The Thunder Bulls Offseason Trade A Look At The Actual Events

May 08, 2025

Re Examining The Thunder Bulls Offseason Trade A Look At The Actual Events

May 08, 2025 -

Uber Stock A Comprehensive Investment Analysis

May 08, 2025

Uber Stock A Comprehensive Investment Analysis

May 08, 2025 -

Analyzing The 67 Million Ethereum Liquidation Predicting Future Trends

May 08, 2025

Analyzing The 67 Million Ethereum Liquidation Predicting Future Trends

May 08, 2025 -

Neymar Podria Volver A La Seleccion Brasilena Prelista Para Partido Contra Argentina

May 08, 2025

Neymar Podria Volver A La Seleccion Brasilena Prelista Para Partido Contra Argentina

May 08, 2025