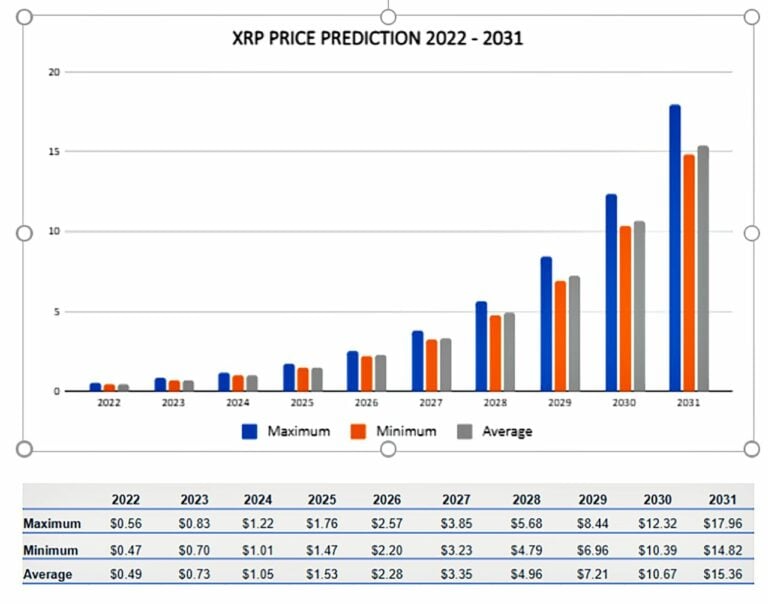

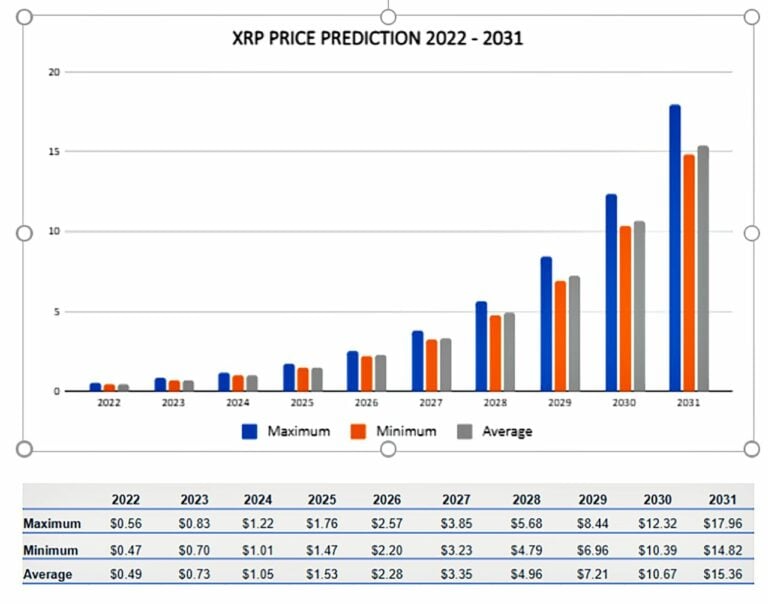

XRP Price Prediction: Analyzing The Post-SEC Lawsuit Market Outlook

Table of Contents

The Impact of the SEC Lawsuit on XRP Price

The SEC lawsuit against Ripple significantly impacted XRP's price and market perception. The outcome of this legal battle will be a major determinant of XRP's future price movement.

The Ruling and its Implications

The SEC lawsuit against Ripple could have several outcomes: Ripple could win outright, achieve a partial victory, or lose completely. Each outcome carries drastically different implications for XRP's price and the broader cryptocurrency regulatory landscape.

-

Ripple Wins: A complete victory for Ripple would likely trigger a significant surge in XRP's price. Increased investor confidence and the potential removal of regulatory uncertainty could lead to substantial price appreciation and increased trading volume. This would likely be considered a positive catalyst for long-term stability.

-

Partial Victory: A partial victory, perhaps involving a settlement or a ruling that clarifies certain aspects of XRP's regulatory status, might result in a moderate price increase. However, lingering regulatory uncertainty could limit the price surge. The short-term volatility would likely still be significant.

-

Ripple Loses: A complete loss for Ripple could severely depress XRP's price. The immediate aftermath might involve substantial short-term volatility. The long-term impact would depend on the specifics of the ruling and the market's response. Regulatory clarity, or lack thereof, would significantly affect the long-term outlook.

-

Bullet points:

- Short-term volatility is almost certain regardless of the outcome.

- Long-term stability depends heavily on the ruling's clarity and market reaction.

- Regulatory uncertainty remains a significant factor affecting XRP's price.

Market Sentiment and Investor Confidence

Investor sentiment towards XRP has fluctuated dramatically since the lawsuit began. Negative news and FUD (Fear, Uncertainty, and Doubt) have often led to price drops, while positive developments, such as favorable court rulings or announcements of new partnerships, can trigger price increases.

-

Social media plays a crucial role in shaping investor perception, with both positive and negative narratives influencing trading decisions. News coverage, both mainstream and specialized crypto news outlets, significantly influences market sentiment.

-

Delistings from certain exchanges initially negatively impacted XRP's price and availability. However, relistings on major exchanges have helped to restore some liquidity and potentially increase trading volume.

-

Bullet points:

- FUD significantly impacts XRP price.

- Positive news, such as successful legal developments or increased adoption, fuels price growth.

- Institutional investment plays a major role in long-term price stability.

Technical Analysis of XRP Price

Technical analysis provides another perspective on XRP's potential price movements. By examining historical price charts and using various indicators, we can identify potential price trends.

Chart Patterns and Indicators

Analyzing XRP's historical price charts reveals key support and resistance levels. Technical indicators such as moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can help predict future price movements.

-

Support and resistance levels are crucial in predicting potential price reversals or breakouts.

-

Moving averages help identify trends, while RSI and MACD can signal overbought or oversold conditions, potentially suggesting price corrections or continuations.

-

Breakout scenarios – where the price breaks through significant resistance levels – could indicate a significant price increase.

-

Bullet points:

- Price trends identified through moving averages are key indicators.

- Volume analysis can confirm trend strength.

- Support and resistance levels highlight potential price reversal points.

On-Chain Metrics and Network Activity

Analyzing on-chain data offers valuable insights into XRP's network health and adoption. Metrics like transaction volume, active addresses, and developer activity can provide a more nuanced picture than price alone.

-

High transaction volume and a rising number of active addresses generally indicate increased network activity and potentially higher demand for XRP.

-

Developer activity is a measure of network development and innovation, indirectly signaling long-term potential.

-

The correlation between on-chain metrics and price movements isn't always direct, but these metrics provide context and may foreshadow future price movements.

-

Bullet points:

- Transaction volume reflects the network's usage and demand.

- The number of active users demonstrates network growth.

- Developer activity is a key indicator of long-term sustainability.

Factors Beyond the Lawsuit Influencing XRP Price

While the SEC lawsuit is a dominant factor, other aspects influence XRP's price.

Adoption and Utility

XRP's utility as a cross-border payment solution is a significant driver of its potential growth. Wider adoption by financial institutions and increased usage on RippleNet could fuel price appreciation.

-

RippleNet's expansion into new markets and partnerships with financial institutions are key factors influencing XRP adoption.

-

Real-world use cases demonstrate XRP's practical applications and value proposition.

-

Increased usage naturally leads to higher demand and, potentially, increased price.

-

Bullet points:

- RippleNet expansion directly increases XRP’s usage.

- Partnerships with major financial institutions bolster credibility and adoption.

- Real-world use cases demonstrate the practicality and value of XRP.

The Broader Cryptocurrency Market

XRP's price is also influenced by the overall cryptocurrency market and Bitcoin's performance.

-

Bitcoin's dominance in the crypto market often dictates the direction of altcoins like XRP.

-

The concept of “altcoin season” – periods where altcoins outperform Bitcoin – can also impact XRP's price.

-

Macroeconomic factors, such as inflation and interest rates, affect the overall investment climate and influence investor sentiment towards cryptocurrencies, including XRP.

-

Bullet points:

- Bitcoin's price directly influences XRP's price.

- Altcoin season can trigger periods of significant XRP price increases.

- Macroeconomic factors influence the overall crypto market and investor sentiment.

Conclusion

Predicting the exact XRP price is inherently challenging. The outcome of the SEC lawsuit, market sentiment, technical analysis, adoption rate, and the broader crypto market all play crucial roles. While a precise XRP price prediction is impossible, understanding these factors is vital for informed investment decisions.

Conduct thorough research and consider your risk tolerance before investing in XRP. Stay informed about the latest developments surrounding the SEC lawsuit and market trends to make the most accurate XRP price prediction for your portfolio. Continue to monitor this evolving situation and consult with a financial advisor for personalized guidance. Remember that any XRP price prediction requires careful consideration of multiple interwoven factors.

Featured Posts

-

Investing In Xrp Ripple In 2024 A Price Analysis Below 3

May 02, 2025

Investing In Xrp Ripple In 2024 A Price Analysis Below 3

May 02, 2025 -

Harry Potter Actors Dramatic Change Leaves Fans Speechless

May 02, 2025

Harry Potter Actors Dramatic Change Leaves Fans Speechless

May 02, 2025 -

Loyle Carner 3 Arena Show Tickets On Sale Now

May 02, 2025

Loyle Carner 3 Arena Show Tickets On Sale Now

May 02, 2025 -

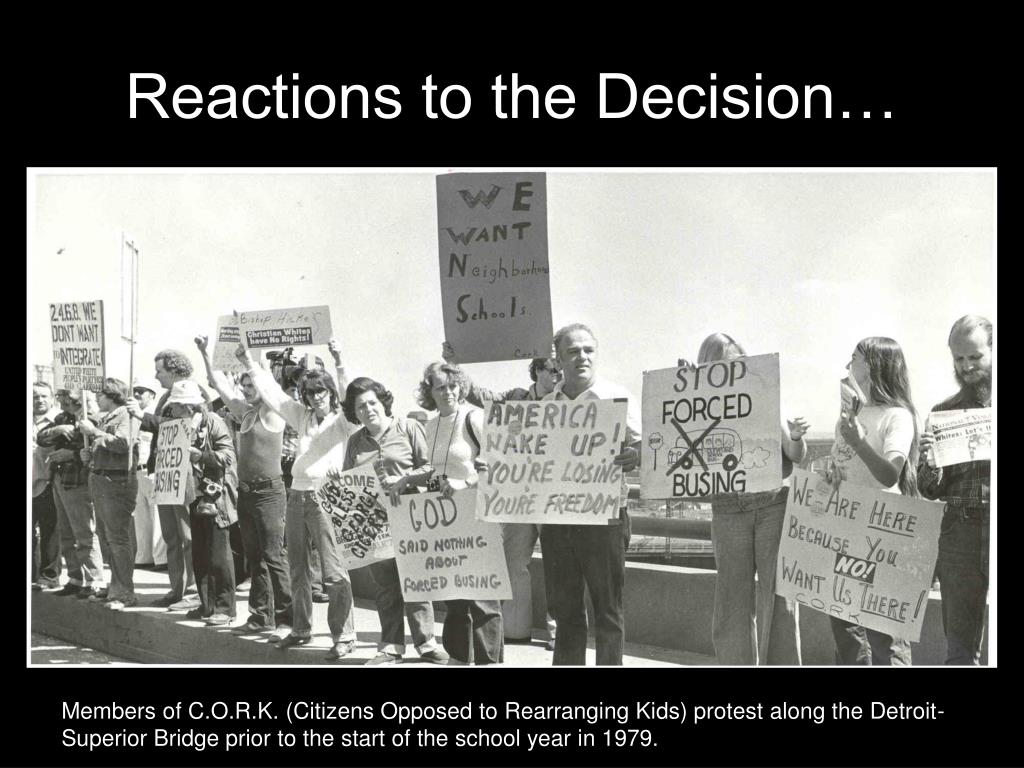

Justice Departments Decision More School Desegregation Orders At Risk

May 02, 2025

Justice Departments Decision More School Desegregation Orders At Risk

May 02, 2025 -

Hl Stkwn Hdhh Mwasfat Blay Styshn 6

May 02, 2025

Hl Stkwn Hdhh Mwasfat Blay Styshn 6

May 02, 2025