XRP Price Prediction: Boom Or Bust After SEC Lawsuit Drop? Analysis And Forecast

Table of Contents

The Ripple vs. SEC Lawsuit: A Retrospective and its Implications

The Ripple vs. SEC lawsuit dominated headlines for years, casting a pall over XRP's price and adoption. The SEC alleged that Ripple's sale of XRP constituted an unregistered securities offering. The protracted legal battle finally concluded with a partial victory for Ripple, significantly impacting XRP's future. The judge ruled that programmatic sales of XRP did not constitute securities, while institutional sales were deemed to be unregistered securities.

- Key arguments presented by both sides: The SEC argued XRP was an unregistered security, while Ripple contended it was a currency.

- Judge's key findings and their significance: The ruling provided some clarity, but the ambiguity around certain XRP sales remains a concern.

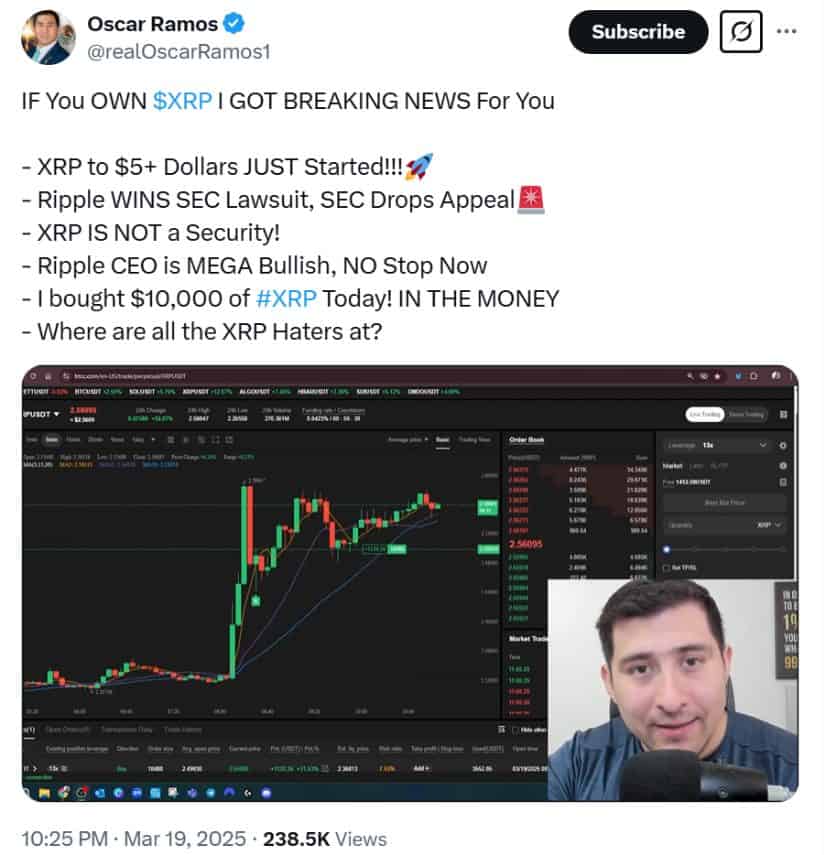

- Impact on investor confidence: The outcome boosted investor confidence, leading to a surge in XRP's price in the short term.

- Potential future legal challenges: While a win for Ripple, the possibility of further legal challenges remains, influencing future XRP price predictions.

Factors Influencing Future XRP Price

Several factors will significantly influence XRP's future price. Understanding these factors is crucial for any accurate XRP price prediction.

Market Sentiment and Adoption

Market sentiment towards XRP is crucial for its price. Positive news, such as increased institutional adoption and growing retail investor interest, can drive prices upward. Conversely, negative news or regulatory uncertainty can lead to price declines.

- Social media sentiment analysis: Monitoring social media trends helps gauge public opinion on XRP.

- Trading volume and market capitalization trends: These metrics provide insights into market demand and overall market value.

- Impact of on-chain activity: Increased on-chain activity suggests growing usage and adoption, potentially influencing price. Partnerships and collaborations with other companies can also significantly impact XRP's price.

Technological Advancements and Ripple's Roadmap

Ripple's ongoing development efforts and innovations within the XRP Ledger directly impact XRP's utility and, consequently, its price. Improvements in transaction speed, scalability, and new features all contribute to the overall appeal of the cryptocurrency.

- Details on Ripple's new products and services: Ripple's continued development of its products and services strengthens the XRP ecosystem.

- Improvements in transaction speed and scalability: Faster and more efficient transactions make XRP more attractive for payments.

- Comparison to competitor cryptocurrencies: XRP's competitive advantage in speed and energy efficiency influences its position in the market.

Regulatory Landscape and Global Adoption

The regulatory landscape for cryptocurrencies remains fluid and significantly impacts XRP's price. Regulatory clarity in different jurisdictions is essential for widespread adoption. Uncertainty, however, fuels price volatility.

- Regulatory developments in key markets (e.g., US, EU, Asia): Positive regulatory developments in major markets can boost XRP's price.

- Potential for future regulation affecting XRP: Any new regulations could either benefit or hinder XRP's growth.

- Impact of regulatory changes on adoption rates: Clear and favorable regulations can drive greater adoption and price appreciation.

XRP Price Prediction Models and Forecasts

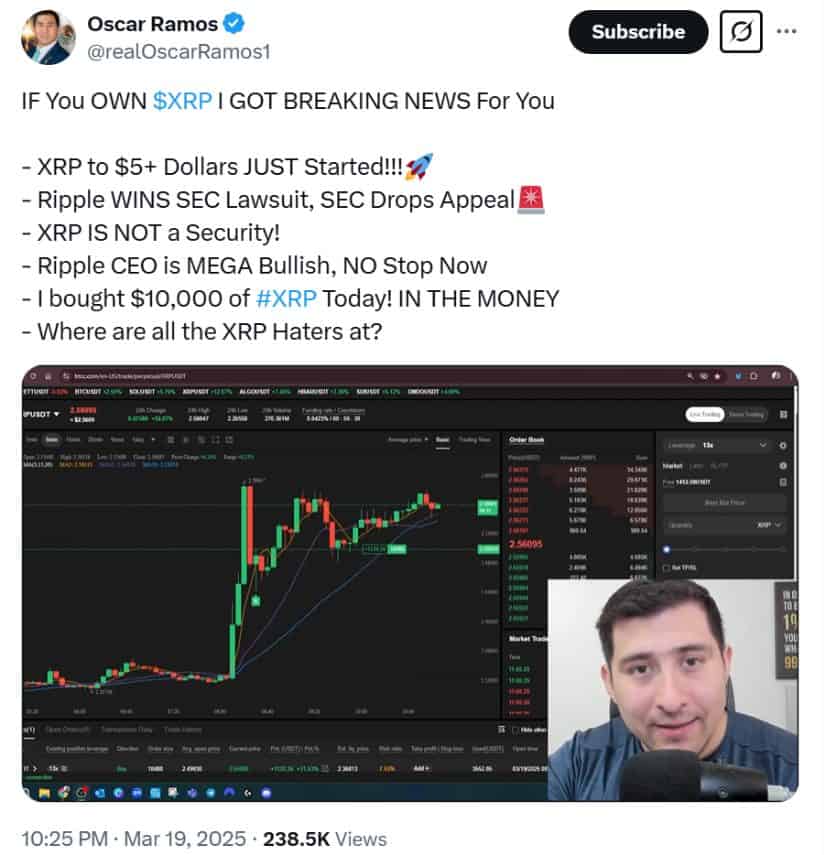

Predicting XRP's future price is inherently challenging. Various models exist, including technical analysis (chart patterns, indicators) and fundamental analysis (market cap, adoption rates). However, all models have limitations.

- Short-term price targets (e.g., 6 months, 1 year): Short-term predictions are highly speculative, influenced by short-term market fluctuations.

- Long-term price projections (e.g., 5 years): Long-term predictions are even more uncertain, depending on many factors outlined above.

- Factors influencing the various price scenarios: Bullish scenarios depend on widespread adoption, technological advancements, and positive regulatory developments. Bearish scenarios involve negative regulatory changes, lack of adoption, or increased competition.

Conclusion: XRP Price Prediction: A Cautious Outlook

This XRP price prediction analysis highlights the complexity of forecasting cryptocurrency prices. While the resolution of the SEC lawsuit is positive, numerous factors – market sentiment, technological advancements, and the regulatory landscape – will significantly impact XRP's future price. Both bullish and bearish scenarios are possible.

While this XRP price prediction offers insights, remember to conduct your own thorough research before investing. The cryptocurrency market is inherently risky. Stay informed about the latest developments, understand the potential risks, and make informed decisions based on your own risk tolerance. Consider diversifying your portfolio and only invest what you can afford to lose. Remember that any XRP price prediction is just an estimate, and the actual price could differ significantly.

Featured Posts

-

Kripto Lider Kripto Para Duenyasinin Yeni Yuekselen Yildizi Neden Bu Kadar Popueler

May 08, 2025

Kripto Lider Kripto Para Duenyasinin Yeni Yuekselen Yildizi Neden Bu Kadar Popueler

May 08, 2025 -

Inter Milan Midfielder Zielinski Sidelined By Calf Injury Weeks Out

May 08, 2025

Inter Milan Midfielder Zielinski Sidelined By Calf Injury Weeks Out

May 08, 2025 -

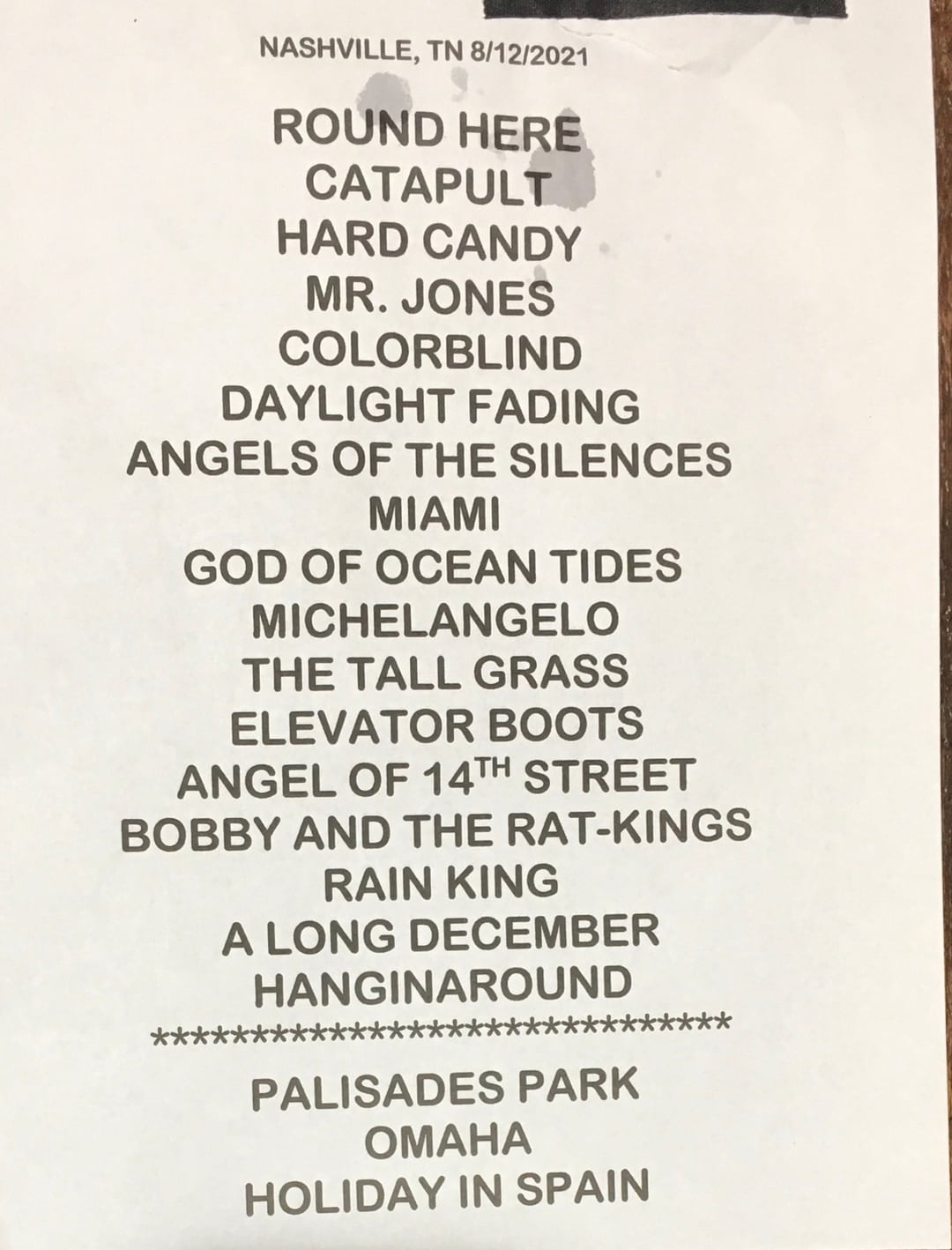

Counting Crows 2025 Setlist Predictions What To Expect On Tour

May 08, 2025

Counting Crows 2025 Setlist Predictions What To Expect On Tour

May 08, 2025 -

Arsenal Psg Macin Yayinlandigi Kanal Ve Saat Bilgisi

May 08, 2025

Arsenal Psg Macin Yayinlandigi Kanal Ve Saat Bilgisi

May 08, 2025 -

Mlb Insiders Deliver Harsh Assessment Of Angels Farm System

May 08, 2025

Mlb Insiders Deliver Harsh Assessment Of Angels Farm System

May 08, 2025