XRP Price Prediction: Impact Of Ripple's Reduced $50M SEC Settlement

Table of Contents

Ripple's Reduced SEC Settlement: A Detailed Look

The reduced $50 million settlement between Ripple and the SEC significantly differs from the SEC's initial claims. Instead of a full admission of guilt and classification of XRP as a security, the settlement allows Ripple to continue operations without facing further legal challenges related to the SEC's allegations.

- Key Aspects of the Agreement: The settlement involved no admission of wrongdoing by Ripple. The SEC dropped its claims against Ripple executives Brad Garlinghouse and Chris Larsen. Ripple agreed to pay the $50 million penalty without admitting or denying the allegations.

- Legal Implications and Securities Classification Uncertainty: While the settlement doesn't definitively classify XRP as a non-security, it removes the significant legal uncertainty that had previously plagued the cryptocurrency. This is a major positive for investor confidence.

- Impact on Investor Confidence and Market Sentiment: The reduced settlement has the potential to significantly boost investor confidence. The removal of a major legal hurdle allows Ripple to focus on growth and development, fostering a more positive market sentiment. However, some lingering uncertainty may remain, potentially impacting short-term price volatility.

Factors Influencing XRP Price After the Settlement

Several factors will influence XRP's price following the Ripple SEC settlement. Let's analyze the key elements:

Market Sentiment and Speculation

The settlement news has already influenced trader sentiment. The reduced settlement is largely perceived as positive, creating a bullish sentiment among many XRP investors.

- Potential Bullish Reactions: Increased trading volume, price appreciation, higher investor confidence, and renewed interest from institutional investors.

- Potential Bearish Reactions: Some investors may remain hesitant due to lingering regulatory concerns or the perception that the settlement is not a complete victory. Negative news coverage could also trigger bearish sentiment.

- Social media and news coverage play a crucial role in shaping public opinion and influencing short-term price fluctuations.

Technical Analysis of XRP's Chart

Analyzing XRP's price chart using technical indicators can provide insights into potential future price movements.

- Support and Resistance Levels: Identifying key support and resistance levels on the chart can help predict potential price reversals or breakouts.

- Technical Indicators: Monitoring indicators like moving averages (e.g., 50-day, 200-day) and the Relative Strength Index (RSI) can reveal potential overbought or oversold conditions.

- Trading Volume: Changes in trading volume after the settlement can indicate the strength of the price movement, offering further insights into market sentiment. Increased volume alongside price increases often signals stronger bullish momentum.

Adoption and Utility of XRP

The ongoing adoption and utility of XRP in the payment industry are crucial factors affecting its price.

- Increased Demand: Ripple's continued development of its RippleNet payment network and partnerships with financial institutions could lead to increased demand for XRP.

- Real-world Applications: The use of XRP in cross-border payments and other financial transactions contributes to its real-world utility and enhances its value proposition. Increased usage directly translates into greater demand.

XRP Price Prediction Scenarios

Based on the factors discussed, here are possible scenarios for XRP's price:

Bullish Scenario

A bullish scenario envisions a significant price increase due to increased institutional investment, widespread adoption, and positive market sentiment fueled by the settlement.

- Contributing Factors: A surge in institutional investments, successful partnerships, increased regulatory clarity, and positive media coverage.

- Potential Price Target Range: A significant price increase above previous all-time highs is possible in this scenario.

Bearish Scenario

A bearish scenario sees XRP's price remaining relatively stagnant or decreasing.

- Contributing Factors: Lingering regulatory uncertainty, increased competition from other cryptocurrencies, and negative market sentiment.

- Potential Price Target Range: The price might consolidate around current levels or even experience a temporary decline.

Neutral Scenario

A neutral scenario suggests moderate price fluctuations with no significant upward or downward trends.

- Contributing Factors: Market consolidation, balancing bullish and bearish pressures, and the continued development of XRP's utility.

- Potential Price Target Range: A range-bound movement within a defined price channel.

XRP Price Prediction: A Final Assessment

The Ripple SEC settlement significantly reduces the uncertainty surrounding XRP, potentially impacting its price positively. However, several factors, including market sentiment, technical analysis, and adoption, will continue to influence its future trajectory. We've explored bullish, bearish, and neutral scenarios, each with its own set of contributing factors and potential price targets. Remember, cryptocurrency investments are inherently risky. Conduct thorough research and consider your personal risk tolerance before investing in XRP.

Stay tuned for further updates on XRP price prediction and continue to conduct your own thorough research before investing. Remember, this is not financial advice.

Featured Posts

-

Fortnite Leak Suggests Lara Crofts Speedy Return

May 02, 2025

Fortnite Leak Suggests Lara Crofts Speedy Return

May 02, 2025 -

Fortnite Down Checking Server Status And Update 34 20 Patch Notes

May 02, 2025

Fortnite Down Checking Server Status And Update 34 20 Patch Notes

May 02, 2025 -

London Fashion Week Kate And Lila Mosss Stunning Matching Black Dresses

May 02, 2025

London Fashion Week Kate And Lila Mosss Stunning Matching Black Dresses

May 02, 2025 -

Tesla Rejects Report Of Elon Musks Impending Removal

May 02, 2025

Tesla Rejects Report Of Elon Musks Impending Removal

May 02, 2025 -

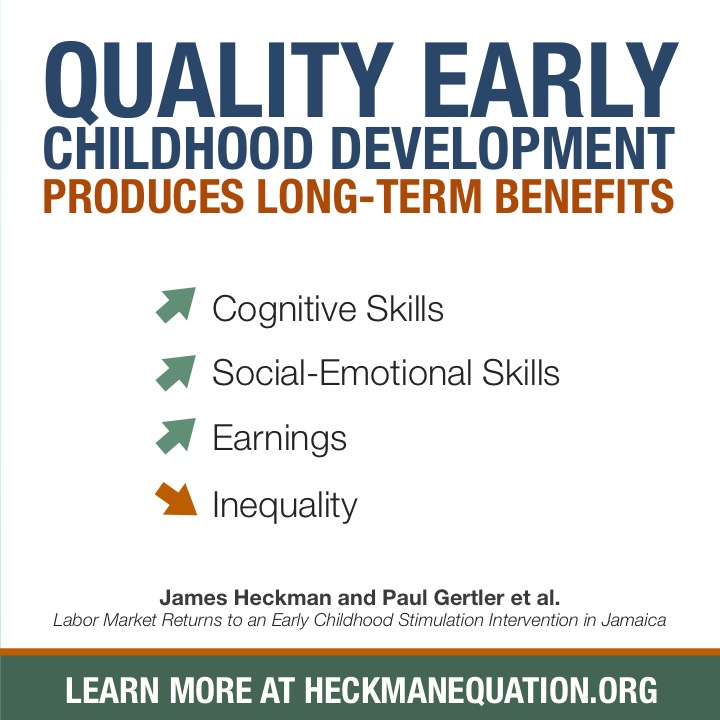

Early Childhood Investment Long Term Benefits For Mental Health

May 02, 2025

Early Childhood Investment Long Term Benefits For Mental Health

May 02, 2025