XRP Price Prediction: Whale's 20M Token Buy And Future Outlook

Table of Contents

The Whale's 20M XRP Purchase: A Deep Dive

The acquisition of 20 million XRP by a single entity—a cryptocurrency whale—is a noteworthy event that demands scrutiny. Understanding the motivation behind such a large purchase is key to predicting its impact on the XRP price. Was this a strategic long-term investment, a short-term speculative maneuver, or perhaps even an attempt at market manipulation? Let's examine the available data.

-

Timing and Motivation: The timing of the purchase is crucial. Did the whale buy during a period of low price, anticipating a future surge? Or was it a reaction to specific news or events affecting XRP? Analyzing the market conditions at the time of the purchase provides valuable context. Further research into the whale's past trading history could reveal their typical investment strategy.

-

On-Chain Data Analysis: Examining the on-chain data associated with the transaction is paramount. This includes identifying the source of the XRP, tracing the wallet's history, and analyzing any associated transactions. Blockchain explorers provide tools to track these details and shed light on the whale's intentions.

-

Impact on Liquidity and Price: A purchase of this magnitude can significantly impact XRP's liquidity. By absorbing a large portion of available XRP, the whale could potentially influence the price, creating artificial scarcity and driving demand. However, the actual effect depends on several other market factors.

-

Bullet Points:

- Exploring potential reasons for the purchase: long-term bullish outlook, short-term price speculation, accumulating for future use in the Ripple ecosystem, or a strategic play related to the ongoing SEC lawsuit.

- Analyzing the price movement of XRP: Comparing price charts before, during, and after the purchase to identify any correlation between the whale's activity and price changes.

- Examining expert opinions: Consulting analyses from cryptocurrency analysts and commentators to gain a wider perspective on the significance of the whale's action.

Current Market Sentiment and Factors Affecting XRP Price

The price of XRP is not solely dependent on whale activity; broader market conditions and regulatory landscape also significantly influence its trajectory. Understanding these factors is crucial for forming a comprehensive XRP price prediction.

-

Overall Cryptocurrency Market Conditions: The performance of Bitcoin and the overall cryptocurrency market significantly impacts altcoins like XRP. A bullish Bitcoin market often positively correlates with XRP's price, while a bearish market can negatively affect it.

-

Regulatory Landscape and the SEC Lawsuit: The ongoing legal battle between Ripple and the SEC remains a major factor. A favorable ruling could drastically boost XRP's price, while an unfavorable outcome could lead to a significant decline. This uncertainty makes accurate XRP price prediction challenging.

-

Adoption by Financial Institutions: The potential for XRP adoption by banks and financial institutions for cross-border payments is a key driver for its future growth. Increased institutional adoption could significantly boost demand and drive the price upward.

-

Bullet Points:

- Assessing Bitcoin's influence: Analyzing the historical correlation between Bitcoin's price and XRP's performance.

- Analyzing market sentiment: Evaluating overall investor sentiment (bullish or bearish) toward XRP and the broader cryptocurrency market.

- Discussing Ripple and XRP news impact: Analyzing the influence of news and announcements concerning Ripple's technology and partnerships on investor confidence.

Technical Analysis of XRP Price Charts

Technical analysis offers another tool to predict potential XRP price movements. Examining price charts and key indicators helps identify potential support and resistance levels, chart patterns, and momentum.

-

Key Technical Indicators: Moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) are commonly used indicators to assess momentum, overbought/oversold conditions, and potential trend reversals.

-

Support and Resistance Levels: Identifying key price levels where buyers and sellers tend to congregate helps predict potential price targets and reversals. Breaks above resistance levels are generally bullish, while breaks below support levels can be bearish.

-

Chart Patterns: Analyzing chart patterns like head and shoulders, double tops/bottoms, and triangles can provide insights into future price movements.

-

Bullet Points:

- Identifying key technical indicators and their current readings: Providing up-to-date readings of MAs, RSI, and MACD for XRP.

- Discussing potential price targets: Presenting possible price targets based on the identified support and resistance levels.

- Mentioning significant chart patterns: Highlighting any observed chart patterns that might indicate future price trends.

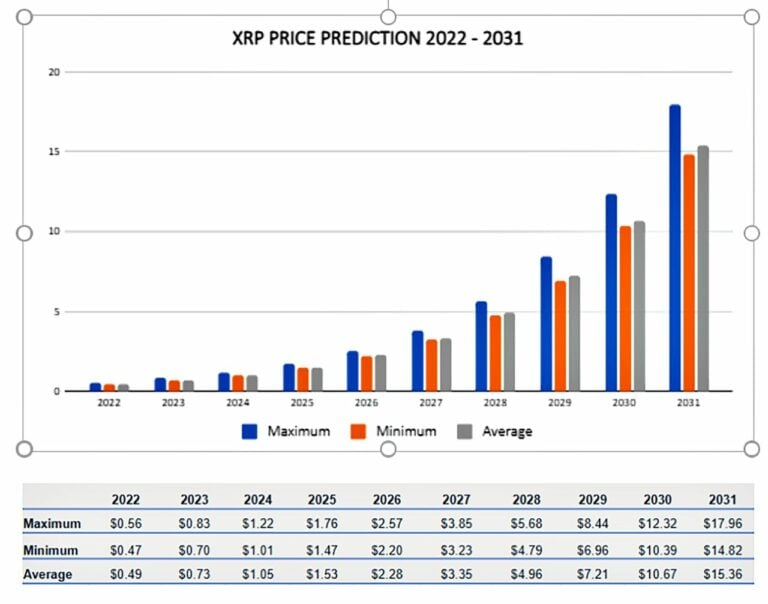

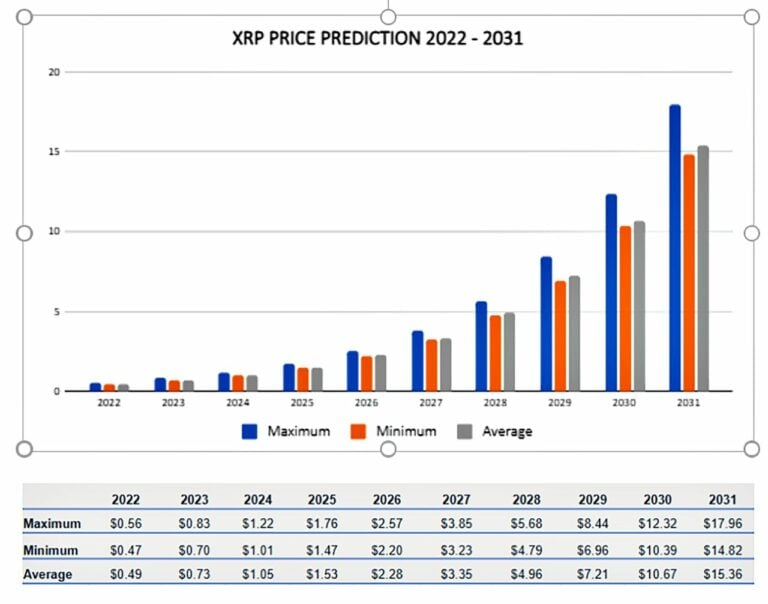

XRP Price Prediction: Expert Opinions and Forecasts

While no one can definitively predict the future price of XRP, consulting expert opinions provides valuable insights. These predictions should be considered alongside the other factors discussed above.

-

Gathering Expert Forecasts: Collecting price predictions from reputable cryptocurrency analysts and experts offers a range of perspectives and potential scenarios.

-

Highlighting Range and Assumptions: It's crucial to note the range of predictions and the underlying assumptions made by each expert. Different experts might use different methodologies and consider different factors.

-

Methodology: Understanding the methodology employed by each expert in formulating their prediction is essential for critical evaluation.

-

Bullet Points:

- Presenting short-term (1-month, 3-month) and long-term (1-year, 5-year) price predictions from various sources.

- Highlighting any consensus or divergence in expert opinions.

- Explaining the methodologies used by each expert (fundamental analysis, technical analysis, quantitative models, etc.).

Conclusion

The recent 20 million XRP purchase by a whale has undeniably created significant buzz around the cryptocurrency. While predicting the future price of XRP remains challenging due to inherent market volatility and regulatory uncertainties, analyzing the whale's activity, current market sentiment, and expert opinions provides valuable insights. Combining technical analysis with fundamental factors offers a more comprehensive approach to understanding potential future price movements. Keep monitoring the market and stay informed on all the latest news and developments to make informed decisions on your XRP investment. Remember to conduct your own thorough research before investing in any cryptocurrency, including XRP. Stay tuned for further updates on XRP price predictions and market analysis.

Featured Posts

-

Report Anthony Edwards Texts To Ayesha Howard Discuss Abortion

May 07, 2025

Report Anthony Edwards Texts To Ayesha Howard Discuss Abortion

May 07, 2025 -

2 1 1 0

May 07, 2025

2 1 1 0

May 07, 2025 -

Gears Of War Remaster Confirmed For Play Station And Xbox

May 07, 2025

Gears Of War Remaster Confirmed For Play Station And Xbox

May 07, 2025 -

Cavaliers Vs Knicks Prediction Will The Knicks Dominate At Msg

May 07, 2025

Cavaliers Vs Knicks Prediction Will The Knicks Dominate At Msg

May 07, 2025 -

Forced Sale Of Google Ad Tech Us Antitrust Ruling Implications

May 07, 2025

Forced Sale Of Google Ad Tech Us Antitrust Ruling Implications

May 07, 2025