XRP Price Recovery: Derivatives Market Slows Momentum

Table of Contents

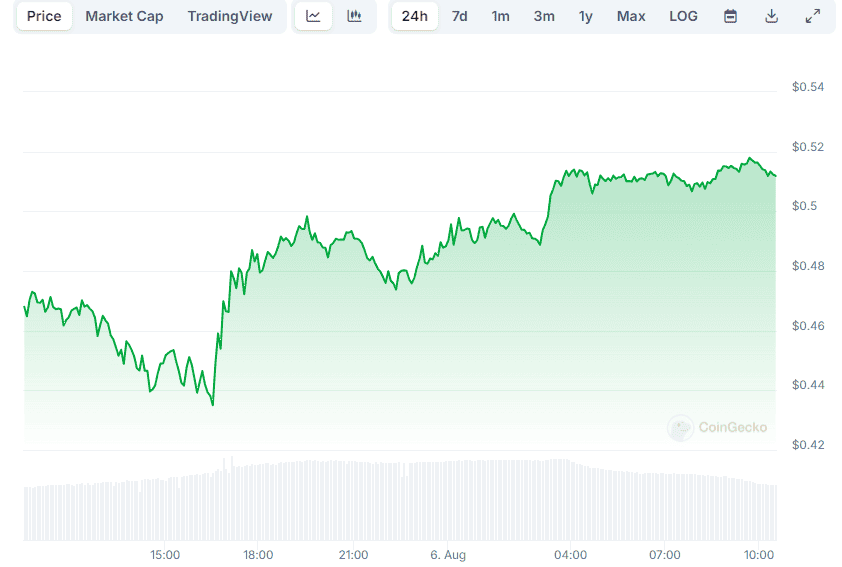

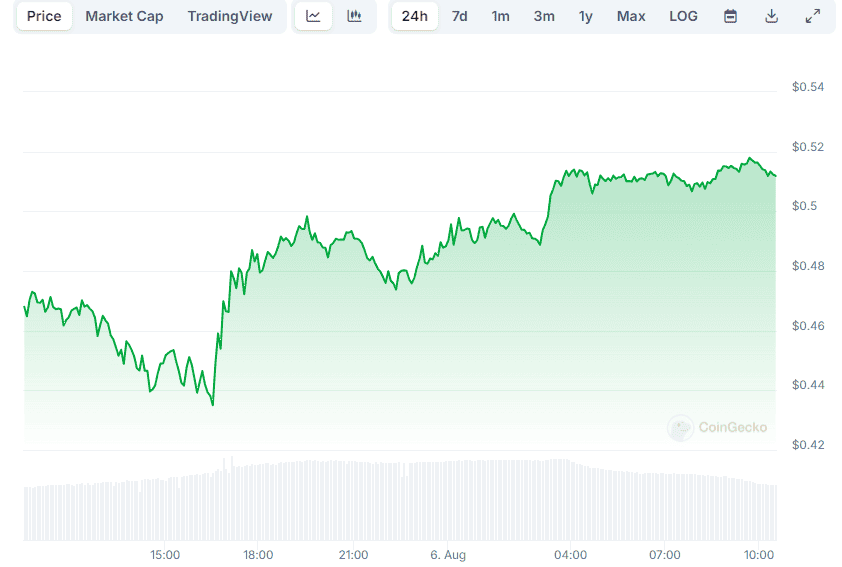

Signs of XRP Price Recovery

While the overall crypto market faces challenges, XRP exhibits certain positive trends hinting at a potential price recovery.

Increased Trading Volume

The recent increase in XRP trading volume across major exchanges is a significant indicator of growing interest. This surge in activity suggests that more investors are actively buying and selling XRP, potentially driving price increases through increased demand.

- Binance: Reports show a notable rise in XRP trading volume on Binance in the last quarter. [Link to Binance data or reputable news source]

- Coinbase: Similar increases have been observed on Coinbase, suggesting widespread interest across various platforms. [Link to Coinbase data or reputable news source]

- Kraken: Kraken has also reported increased XRP trading activity. [Link to Kraken data or reputable news source]

Increased volume, especially when coupled with positive price action, is a strong signal that the market is becoming more bullish on XRP's prospects.

Positive Social Sentiment

Social media chatter and online forums dedicated to XRP have shown a marked increase in positive sentiment. This is often a leading indicator of price movements. The community seems optimistic about Ripple's ongoing legal battles and future technological developments.

- Increased mentions of positive news on Twitter and Reddit. [Link to relevant social media trends analysis]

- Engagement from key influencers in the crypto space who are expressing bullish views on XRP. [mention specific influencers if possible with links to their posts]

- Growing discussions about the potential benefits of XRP's technology within the broader fintech space.

Positive social sentiment suggests growing confidence and anticipation, both critical for sustaining an XRP price recovery.

Technological Developments

Ripple's continued development of XRP's underlying technology and its expansion into new partnerships are bolstering investor confidence. These advancements signal a commitment to long-term growth and utility, which can significantly impact price appreciation.

- Improvements to XRP Ledger's transaction speed and scalability. [Link to relevant technical documentation or news articles]

- New partnerships with financial institutions integrating XRP into their payment systems. [Link to relevant announcements or press releases]

- Development of new use cases for XRP beyond cross-border payments. [Link to details about new use cases]

These technological advancements directly contribute to the utility and value proposition of XRP, attracting further investment and potentially fostering an XRP price recovery.

Derivatives Market Slowdown and its Impact

Despite the positive signals, the slowing momentum in the derivatives market presents a counterpoint to the optimistic narrative.

Reduced Open Interest

Open interest, which represents the total number of outstanding contracts in the derivatives market, has shown a noticeable decrease recently. This decline indicates reduced speculative activity and potentially less pressure on XRP's price.

- Data showing a decrease in open interest for XRP futures contracts. [Include chart or graph if possible, cite source]

- This reduction suggests less leveraged trading, which can lead to decreased volatility in the short term.

A decline in open interest can signal a decrease in overall market speculation, potentially resulting in less dramatic price swings.

Lower Trading Volume in Derivatives

Compared to the spot market, the trading volume in the XRP derivatives market has also decreased. This suggests a shift away from speculative trading and towards a more fundamental approach to XRP investment.

- Data comparing the volume in the spot and derivatives markets for XRP. [Include chart or graph if possible, cite source]

- This difference might suggest that investors are focusing more on the long-term potential of XRP rather than short-term gains through leveraged trading.

This shift in trading behavior might imply a period of consolidation before any significant price movement.

Implications for Price Volatility

The slowdown in the derivatives market may signal a decrease in future XRP price volatility. Reduced speculative activity generally results in calmer price movements.

- Explanation of how derivatives trading amplifies price volatility.

- Analysis of potential scenarios: a more stable price range or a prolonged period of consolidation.

While reduced volatility can be beneficial for long-term investors, it can also indicate a lack of significant bullish momentum.

Analyzing the Overall Market Sentiment towards XRP

A comprehensive assessment of XRP's price prospects requires considering broader market factors beyond just trading volume and derivatives activity.

Institutional Investment

While institutional adoption has been slower for XRP compared to some other cryptocurrencies, there are ongoing efforts and potential for future institutional involvement.

- Mention any reports of significant investments or partnerships from institutional investors. [Provide links to supporting evidence]

- Analyze the potential impact on long-term price stability and growth.

Increased institutional adoption could provide significant price support and stability in the long run.

Regulatory Uncertainty

The ongoing legal battles surrounding Ripple and XRP create uncertainty that can affect the price. Clarity in regulatory landscapes is crucial for investor confidence.

- Summary of significant legal developments and their potential implications for the market. [Provide links to news sources]

- Discussion on how increased regulatory clarity (or lack thereof) could affect investor confidence and price.

Regulatory clarity or unfavorable rulings could significantly impact the price, either positively or negatively.

Competition from other Cryptocurrencies

The cryptocurrency market is highly competitive. The success of XRP depends on its ability to differentiate itself from competitors.

- Mention key competing cryptocurrencies and their market performance.

- Discuss how competition could influence XRP's price recovery trajectory.

Competition from other cryptocurrencies with similar functionalities will continue to put pressure on XRP's price.

Conclusion: XRP Price Recovery - A Cautious Outlook

While increased trading volume, positive social sentiment, and technological advancements suggest an XRP price recovery is possible, the slowdown in the derivatives market indicates a potential moderation of price momentum. Therefore, it's crucial to maintain a balanced perspective. The regulatory landscape and competition from other cryptocurrencies remain significant factors influencing XRP’s future. To make informed decisions, it's vital to continuously track XRP price recovery, monitor XRP price trends, and learn more about XRP’s price fluctuations. Stay informed about the latest developments, conduct thorough research, and consider all factors before investing in XRP.

Featured Posts

-

Warriors Vs Rockets How Crucial Is Home Court Advantage

May 07, 2025

Warriors Vs Rockets How Crucial Is Home Court Advantage

May 07, 2025 -

Steelers Decide On Star Wide Receivers Future

May 07, 2025

Steelers Decide On Star Wide Receivers Future

May 07, 2025 -

Jan 6th Falsehoods Ray Epps Defamation Case Against Fox News Explained

May 07, 2025

Jan 6th Falsehoods Ray Epps Defamation Case Against Fox News Explained

May 07, 2025 -

The Minnesota Timberwolves Season Hinges On Chris Finchs Strategic Choices

May 07, 2025

The Minnesota Timberwolves Season Hinges On Chris Finchs Strategic Choices

May 07, 2025 -

Family Drama Zendayas Sister Speaks Out

May 07, 2025

Family Drama Zendayas Sister Speaks Out

May 07, 2025