XRP Price Surge: Impact Of ProShares' Upcoming ETF Launch

Table of Contents

H2: The Anticipation Factor: How ETF Approvals Fuel Crypto Price Increases

The approval of an exchange-traded fund (ETF) for a cryptocurrency often acts as a significant catalyst for price increases. This surge isn't solely driven by the ETF itself but by the broader market psychology surrounding it. The anticipation of an ETF approval generates a ripple effect throughout the crypto market.

- Increased institutional investment interest: ETFs provide a regulated and accessible entry point for institutional investors, who often manage vast sums of capital. The prospect of institutional involvement significantly boosts confidence and drives demand.

- Enhanced market liquidity and trading volume: ETFs increase trading volume by making the asset more accessible to a wider range of investors. This heightened liquidity reduces price volatility in the long run.

- Reduced regulatory uncertainty (depending on the specific ETF approval): A successful ETF listing often implies a degree of regulatory acceptance, reducing uncertainty and attracting more risk-averse investors.

- Positive media coverage and increased public awareness: ETF approvals often generate considerable media attention, increasing public awareness and potentially attracting retail investors. This heightened visibility further contributes to price appreciation. The resulting increase in XRP market cap is usually a significant component.

H2: ProShares' Track Record and its Significance for XRP

ProShares is a well-established player in the ETF market, known for its experience and expertise in launching successful exchange-traded products. Their potential entry into the XRP ETF space holds significant implications for XRP's price.

- ProShares' established presence in the ETF market: Their existing track record lends credibility to any XRP ETF they might launch, boosting investor confidence.

- The potential for increased accessibility to XRP for institutional investors: ProShares' ETF would provide institutional investors with a regulated and convenient method of gaining exposure to XRP, potentially leading to a significant influx of capital.

- The implications for XRP's market capitalization and trading volume: A successful ProShares XRP ETF would likely lead to a substantial increase in XRP's market capitalization and trading volume, further driving price appreciation.

- Comparison to other successful crypto ETF launches (if any): Analyzing the performance of other successful crypto ETFs can offer valuable insights into the potential impact of a ProShares XRP ETF. Studying past ETF approval trends and the resulting XRP price action provides additional information.

H2: Analyzing Ripple's Legal Battle and its Influence on XRP's Price

The ongoing Ripple vs. SEC lawsuit casts a significant shadow over the potential for an XRP ETF approval. The outcome of this litigation will undoubtedly influence XRP's price trajectory.

- Positive impact of a favorable court ruling on XRP's price: A ruling in favor of Ripple could significantly reduce regulatory uncertainty, potentially paving the way for widespread XRP ETF approvals and a substantial price surge.

- Potential negative impact of an unfavorable ruling on XRP's price: An unfavorable ruling could severely dampen investor enthusiasm, potentially leading to a significant price drop.

- The SEC's position on XRP and its implications for ETF approval: The SEC's stance on XRP is a critical factor in determining the likelihood of ETF approval. Any future SEC actions will impact the XRP price and the market's overall sentiment.

- Expert opinions and market sentiment analysis regarding the lawsuit's outcome: Monitoring expert opinions and market sentiment regarding the lawsuit provides valuable insights into the potential price movements.

H2: Potential Risks and Cautions Regarding XRP Investment

Investing in cryptocurrencies, including XRP, inherently involves significant risks. It’s crucial to understand these risks before making any investment decisions.

- High volatility of cryptocurrency investments: The cryptocurrency market is known for its extreme price volatility. XRP’s price can fluctuate dramatically in short periods, potentially leading to substantial losses.

- The importance of risk management strategies: Employing effective risk management strategies, such as diversification and position sizing, is crucial for mitigating potential losses.

- The need for thorough due diligence before investing in XRP: Before investing, conduct thorough research and understand the fundamentals of XRP and the risks involved.

- Alternative investment options to consider: Diversification is key. Don't put all your eggs in one basket; explore other investment options to balance your portfolio.

H2: The Future of XRP: Post-ETF Launch Predictions

Predicting the future price of any cryptocurrency is inherently speculative. However, a successful ProShares XRP ETF launch could significantly alter XRP’s trajectory.

- Potential price increase scenarios: A successful launch could trigger a significant price increase, potentially surpassing previous highs, depending on the overall market sentiment and adoption rate.

- Potential market adoption scenarios: Increased accessibility through an ETF could lead to wider market adoption, particularly by institutional investors.

- Factors influencing future XRP price (e.g., adoption by exchanges, regulatory clarity): Factors such as exchange listings, regulatory clarity, and technological advancements will all continue to influence XRP's price.

- Long-term outlook for XRP in the cryptocurrency market: The long-term outlook for XRP remains uncertain but hinges heavily on its ability to gain wider adoption and navigate regulatory hurdles.

3. Conclusion:

The potential launch of a ProShares XRP ETF has the potential to significantly impact the XRP price surge. While the anticipation is high, it’s vital to remember the inherent risks associated with cryptocurrency investments. The outcome of the Ripple vs. SEC lawsuit, along with broader market conditions, will play a crucial role in shaping XRP's future. Understanding these factors and conducting thorough due diligence is paramount before making any investment decisions. Stay informed about the latest developments surrounding the XRP price surge and potential ETF launch, and remember to conduct thorough research before investing. Learn more about XRP investing strategies today!

Featured Posts

-

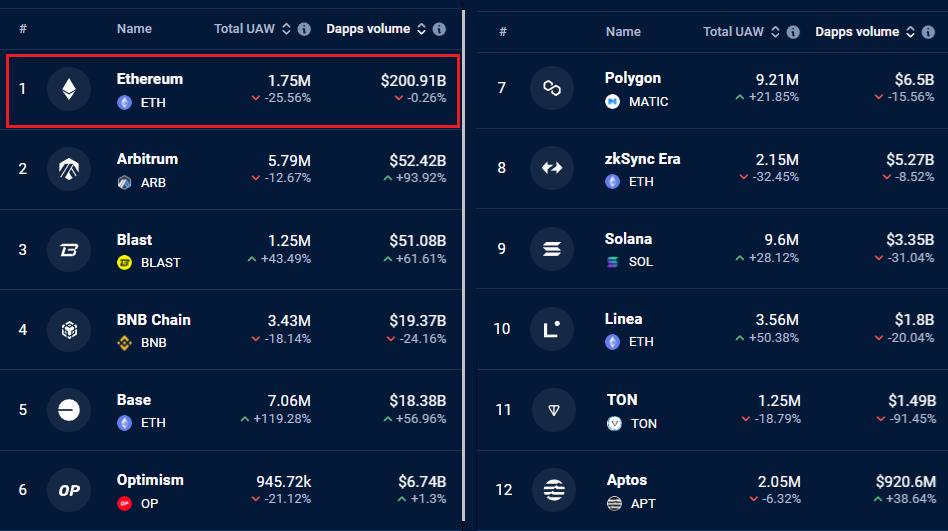

Recent Ethereum Price Action Hints Of An Impending Rally

May 08, 2025

Recent Ethereum Price Action Hints Of An Impending Rally

May 08, 2025 -

Instituto De Cordoba El Estado De Salud De Central En El Gigante De Arroyito

May 08, 2025

Instituto De Cordoba El Estado De Salud De Central En El Gigante De Arroyito

May 08, 2025 -

Colin Cowherd And Jayson Tatum A History Of Disagreement

May 08, 2025

Colin Cowherd And Jayson Tatum A History Of Disagreement

May 08, 2025 -

Celtics Vs Nets Latest Injury Report And Tatums Game Time Decision

May 08, 2025

Celtics Vs Nets Latest Injury Report And Tatums Game Time Decision

May 08, 2025 -

2025 Investment Strategy Weighing Micro Strategy Stock Against Bitcoin

May 08, 2025

2025 Investment Strategy Weighing Micro Strategy Stock Against Bitcoin

May 08, 2025