XRP Price Surge: Outperforming Bitcoin And Other Cryptocurrencies Post-Grayscale ETF Filing

Table of Contents

The Ripple Effect: How Grayscale's ETF Filing Impacts XRP

The Grayscale Bitcoin ETF filing, while not directly involving XRP, has had a significant indirect impact on its price. This influence stems from the overall improvement in market sentiment and the potential for wider regulatory acceptance of cryptocurrencies.

Indirect Correlation and Market Sentiment

The Grayscale filing injected a wave of positive sentiment into the broader cryptocurrency market. This positive sentiment, often referred to as the "Grayscale effect," spilled over to other altcoins, including XRP, leading to increased buying pressure.

- Increased institutional investor interest: The pursuit of a Bitcoin ETF by a major player like Grayscale signals growing institutional interest in the cryptocurrency space, indirectly benefiting other crypto assets like XRP.

- Reduced regulatory uncertainty (though still present): While regulatory uncertainty remains a significant factor in the crypto market, the Grayscale filing suggests a potential shift towards greater regulatory acceptance, which boosts investor confidence across the board.

- A potential domino effect: A successful Grayscale Bitcoin ETF could pave the way for approvals of other cryptocurrency ETFs, including potential XRP ETFs in the future. This anticipation contributes to the positive sentiment surrounding XRP.

Ripple's Ongoing Legal Battle and its Influence

Despite the ongoing legal battle between Ripple and the SEC, the market seems to be discounting some of the negative impacts, potentially anticipating a favorable outcome.

- Growing confidence in Ripple's legal defense: Recent developments in the Ripple case have fueled speculation about a potential positive resolution, boosting investor confidence in XRP.

- Speculation regarding a potential settlement or favorable ruling: Market participants are increasingly speculating about a potential settlement or a favorable court ruling for Ripple, which could significantly drive up XRP's price.

- Increased adoption of XRP despite regulatory uncertainty: The continued use and adoption of XRP in various payment systems and cross-border transactions demonstrate its resilience despite the legal uncertainty.

Technical Analysis: Chart Patterns and Price Drivers

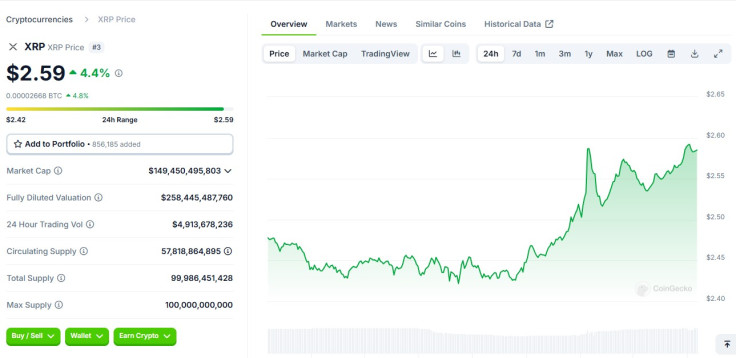

Analyzing XRP's price charts reveals strong buying pressure and increased trading volume, supporting the recent surge.

Breakout Patterns and Trading Volume

Recent chart patterns, such as significant breakouts above key resistance levels and sustained high trading volume, indicate a strong bullish momentum for XRP. (Note: Specific chart examples would be included here with appropriate attribution to the charting platform used. For example, a screenshot showing a clear breakout pattern on a reputable exchange's chart.)

- Key support and resistance levels: Identifying and tracking these levels helps understand potential price targets and areas of consolidation.

- Candlestick patterns: Analyzing candlestick patterns like bullish engulfing patterns or hammer formations provides further insights into the price momentum.

- Trading volume surges: Significant increases in trading volume alongside price increases confirm the strength of the bullish trend.

On-Chain Metrics: Analyzing Network Activity

Examining on-chain data provides further evidence of increased demand for XRP.

- Increased transaction volume: A surge in XRP transaction volume indicates heightened activity and usage of the XRP Ledger.

- Growth in active addresses: An increase in the number of unique addresses interacting with the XRP Ledger signifies a growing user base.

- Analysis of XRP’s utility: XRP's use cases in payment systems and remittances contribute to the underlying demand and drive adoption.

Future Outlook: Predicting the Trajectory of XRP's Price

While the recent surge is impressive, the future trajectory of XRP's price remains subject to various factors.

Potential Catalysts for Further Growth

Several potential catalysts could further propel XRP's price upward.

- Positive developments in the Ripple-SEC lawsuit: A favorable outcome in the lawsuit could significantly reduce uncertainty and attract substantial investment.

- Increased partnerships and integrations: Expansion of XRP's partnerships and integrations with businesses and financial institutions could drive increased adoption and utility.

- Potential listings on major cryptocurrency exchanges: Additional listings on major exchanges would increase XRP's liquidity and accessibility, potentially boosting its price.

Risks and Challenges

Despite the positive outlook, several risks and challenges remain.

- Potential negative consequences of an unfavorable Ripple ruling: An unfavorable court decision could negatively impact XRP's price and market sentiment.

- Market corrections and price drops: The cryptocurrency market is inherently volatile, and XRP is susceptible to sudden price corrections.

- Regulatory uncertainty: Ongoing regulatory uncertainty remains a significant risk factor for all cryptocurrencies, including XRP.

Conclusion

The recent XRP price surge, fueled by market sentiment, technical indicators, and speculation surrounding the Ripple lawsuit, highlights the dynamic nature of the cryptocurrency market. While the Grayscale ETF filing indirectly contributed to the overall positive sentiment boosting XRP, the future of XRP's price remains dependent on various factors including the Ripple-SEC case resolution and broader regulatory developments. Investors considering XRP should carefully assess the risks involved in cryptocurrency investments. Stay informed about the latest XRP price news and the Ripple lawsuit to make well-informed decisions. Conduct thorough due diligence before investing in XRP or any other cryptocurrency.

Featured Posts

-

Why Reliability And Trust Are Crucial In Todays Crypto News Landscape

May 08, 2025

Why Reliability And Trust Are Crucial In Todays Crypto News Landscape

May 08, 2025 -

Jayson Tatum Takes The Heat Tnt Announcers Hilarious Abc Promo For Lakers Celtics Game

May 08, 2025

Jayson Tatum Takes The Heat Tnt Announcers Hilarious Abc Promo For Lakers Celtics Game

May 08, 2025 -

Cowherds Persistent Attacks On Jayson Tatum Analysis And Reaction

May 08, 2025

Cowherds Persistent Attacks On Jayson Tatum Analysis And Reaction

May 08, 2025 -

Lotto Plus 1 And Lotto Plus 2 Check The Winning Numbers Now

May 08, 2025

Lotto Plus 1 And Lotto Plus 2 Check The Winning Numbers Now

May 08, 2025 -

Sec Acknowledges Grayscale Xrp Etf Filing Xrp Price Outperforms Bitcoin And Other Crypto Assets

May 08, 2025

Sec Acknowledges Grayscale Xrp Etf Filing Xrp Price Outperforms Bitcoin And Other Crypto Assets

May 08, 2025